Word to the Wise: As Ps change to Es, petroleum producers drive energy’s sustainable approach to A&D

November 29, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Word to the Wise in your inbox, subscribe here.

The oil and gas industry is undergoing an evolution. In the face of pressure from governments, investors, and public relations, the industry is adopting an ESG approach throughout all levels of its organizations. You can see this shift in all the professional associations rebranding themselves to move from Petroleum to Energy, a signal to the world that our industry provides a vital service and is positioning itself to continue to do so well into the future.

Corporations have responded to this shift by creating ESG and sustainability teams, which drive organizational changes to better position the company for future investment. As a concept, ESG has been around for several decades in the form of socially responsible investing, but recently it’s become an even greater concern for both our industry and the investing community at large.

For this new commitment in our industry to succeed, it must extend past sustainability teams to all parts of an operation. This includes A&D teams, where every deal, large or small, should factor in ESG considerations. Today’s A&D professionals must focus on accretive growth strategies, smart divesting, and on larger and longer-term corporate responsibilities.

How do the closure commitments and costs of an asset affect their company’s liability obligations and closure budgets? What is the material impact on the overall corporate emissions intensity of an acquisition or a divestment? How will a transaction affect their investor standing, credit facilities, social governance, or long-term intensity targets?

A sustainable approach to A&D examines, but is not exclusive to:

- The potential debts of an asset, to either rule out potential assets or find opportunities your organization is positioned to absorb.

- Corporate cultural fit from a social and governance perspective – including diversity and inclusion, partnerships with first nations, community engagement, etc.

- Post transaction GHG intensity, gas conservation rates of potential acquisitions

- Potential emissions mitigation strategies, existing technologies, and infrastructure

- Regulatory and tax implications

While a sustainable approach is becoming a necessary component to meet the evolving demands of our industry, getting usable, over-the-fence sustainability data isn’t easy. Over the fence LLR numbers are no longer available from the Regulator, and only provide part of the picture necessary in the new regulatory environment.

For emissions, over-the-fence GHG data is difficult to find, let alone amalgamate – particularly when you’re dealing with groups of assets rather than a corporate acquisition. The go-to is usually Sustainability Reports, which are only available for public companies that choose to report and are often a year or more out of date.

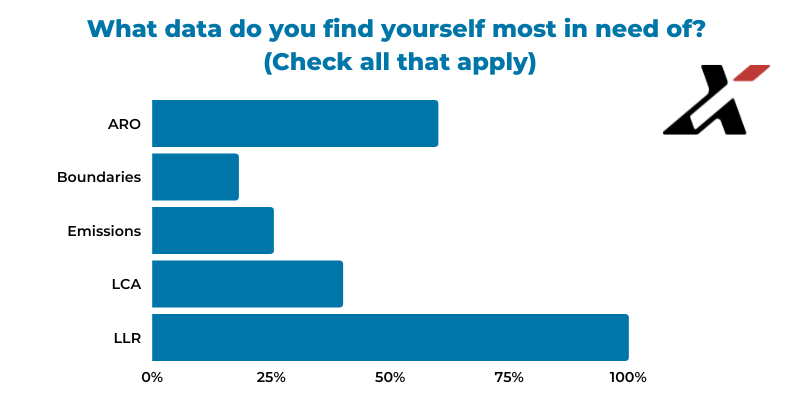

Despite these challenges, sustainability scoping is increasingly important to those in the A&D space. In a recent webinar for landmen, we asked the audience what new data they need to do their assessments. Liability data in the form of LLR, ARO, and LCA were the most common responses, but emissions data is fourth on the list and rising.

This need will only increase as external pressures for sustainable operations increase. A&D teams can’t afford to work at cross purposes of the overall corporate goals when it comes to ESG targets. The data necessary may be difficult to find, but to meet the challenges of an evolving sector, producers must train and invest in this sustainable approach to A&D.

At XI Technologies, we believe in arming A&D teams with the data they need, without having to search through a data room to get it. That’s why we’ve expanded our AssetSuite of solutions to include ARO, LLR, LCA, and Emissions data to provide the most complete listing of company data in the WCSB. As a result, A&D teams are better equipped to meet their company’s sustainability requirements. To find out more about how these tools can aid your strategic acquisition identification and evaluation, visit our website or contact us for a demo.