Word to the Wise: Taking a comprehensive approach to A&D – land, production, liabilities, and emissions

February 1, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Last week, our Word to the Wise covered the emerging role for emissions data in acquisitions and divestitures. As ESG investing, carbon reduction targets, liabilities, and government regulations have risen in prominence, it has become important for companies to incorporate a comprehensive methodology throughout all levels of their organization.

The changing landscape has necessitated a change in the responsibilities of an A&D team. It’s not enough to know the potential land value and production history of an acquisition target. Teams now need to consider how the closure commitments and costs of an asset will affect their company’s liability obligations, and closure budgets. As emissions reduction-related commitments continue to grow in prominence, the same will be true of emissions data and the need for a more complete approach to A&D.

High level scoping

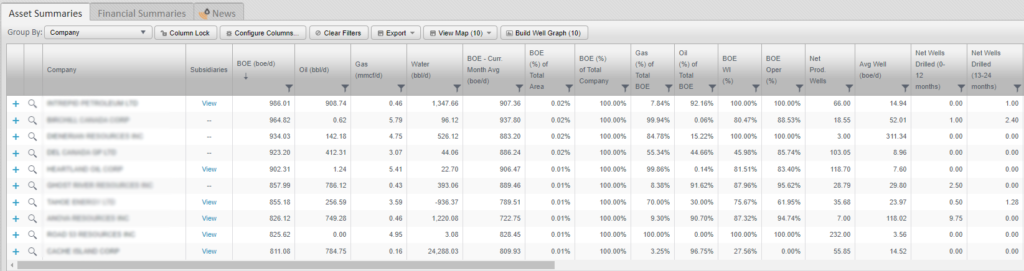

A typical first step when researching opportunities is to do a high-level search based on the criteria and scope set by a company’s corporate goals. This could involve either searching a core area for assets that meet these criteria or researching a list of companies to see which best fits. Criteria at this level of scoping can include data such as production rate, working interest, average well rates, undeveloped land, expiring license, partners, producing zone, to name but a few.

Traditionally, this type of scoping involves either relying on the quality of data for publicly marketed opportunities or sifting through government data which can be time consuming and show an inaccurate overall picture.

Production profile

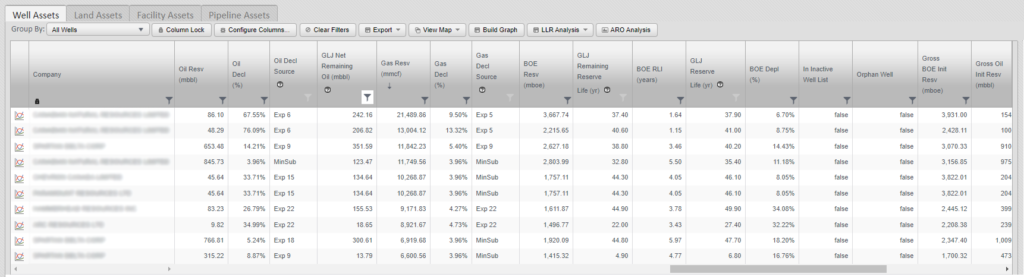

After scoping out a group of opportunities into one that best fits a company’s criteria, the next step is to dig into the assets within an opportunity and examine their production profile. What do the declines look like? Are these long-life reserves? Does the type of production match your operational profile (e.g., zones, wet or dry gas, heavy oil, SAGD, etc.)?

Most companies will dig through government data to get a picture of working interest and then export to an economics and decline software package for further evaluation. Getting to a well list is key, which then will need to be broken down and analyzed in more detail to determine fit. If the user has access to reliable working interest data, it will save time through the process when estimating value.

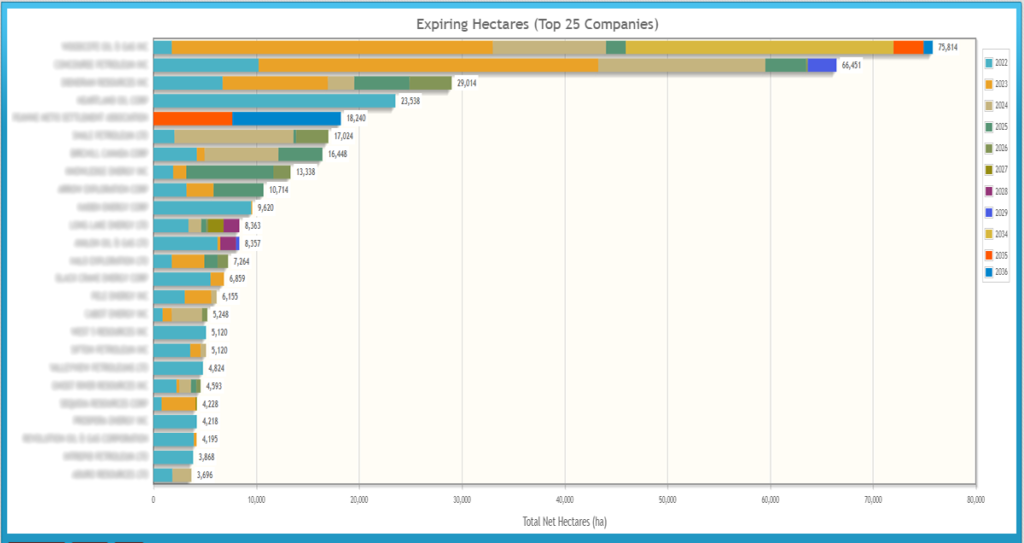

Land data

Land is an important piece to the puzzle, and it is vital to understand the area before making any final purchase decisions. Buyers tend to have expertise on land in their core areas, but when looking at non-core areas that are part of a corporate acquisition, they need the ability to quickly get a sense for land expiries, recent land sale prices, and upside potential.

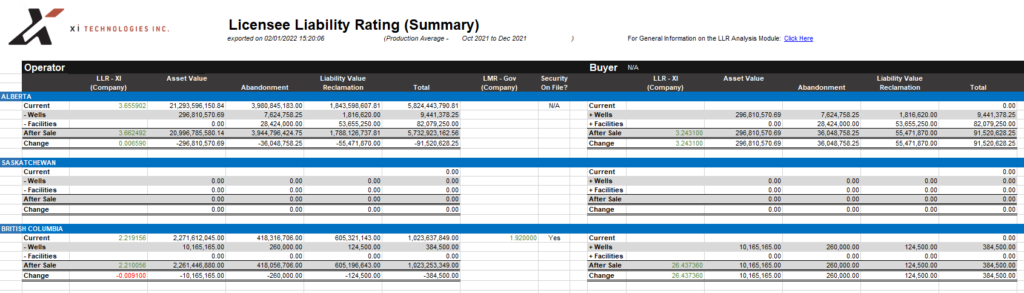

Liability data

These first two buckets make up the traditional way of doing A&D: find opportunities and evaluate how they will fit with current operations and increase profitability. The evolution of A&D scoping has been to examine potential debts of an asset, to either rule out potential assets or find opportunities your organization is positioned to absorb, and how they will impact your closure commitments. This is where liability data comes in.

To scope liability data the various provincial Licensee Liability Rating (LLR) was useful in early-stage analysis. When it was publicly available it was a quick, easy-to-understand measure to weed out lower quality licensees. Calculating these numbers manually using the AER’s cost calculations still provide a company a leg up when doing this early pre data room assessments. It is especially important when looking at multiple packages.

As an over-the-fence tool, LLR has become opaque as the Government regulations change. However, when searching listed assets, sellers will often give the LLR associated with an asset, providing a needed glimpse. Alternatively, some cost models still provide users LLR calculations based on the Regulator cost models.

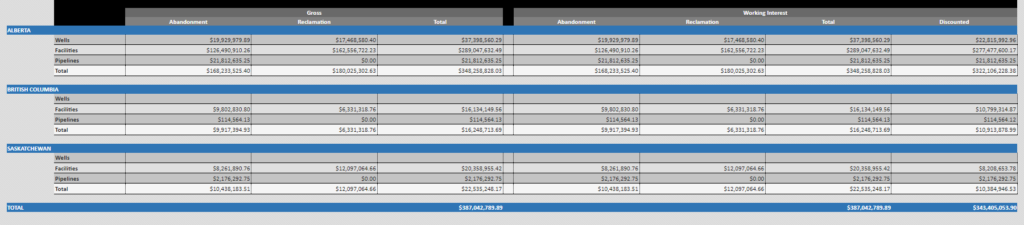

For a deeper look at liabilities, more detailed closure cost data is required (a truer picture of ARO). LLR is useful for quick assessments, but deep-diving into scoping an opportunity means the missing components in the calculation matter even more; working interest percentages, discounting, and inaccurate costing for sour gas, aging wells, and reclamation (and remediation), for example. That’s when you need more detailed and robust ARO calculations, plus a consistent cost model that lets you compare apples to apples for various assets at the company or license level.

Emissions data

Land, production, and liabilities is the modern workflow for today’s A&D. Into this picture has come a new element: emissions. Companies looking to be proactive in addressing their emissions must ensure that the assets they acquire do not materially alter their emissions standards. To do this, they need to consider proforma emissions scenarios of potential acquisitions, and consider factors such as:

- Gas volumes and GHG CO2 ton equivalents for Fuel, Flare and Vent

- GHG intensity effects

- Gas conservation rates

- Regulatory commitments

Pulling this data can be difficult, and often requires combing through annual sustainability reports from companies that choose to share them. For privately held companies, this process is next to impossible. For emissions scoping to truly become a part of a comprehensive approach to A&D, users need easy access to emissions data for both private and public companies. Data intelligence must be neutral and sourced from the ground up for fair evaluations, not merely provided in the way that the companies choose to self-report. At XI Technologies, we believe in arming A&D teams with the data they need, without having to search through a data room to get it. That’s why we’ve expanded our AssetSuite of solutions to include the most complete listing of company data in the WCSB, with the land and production data users have come to expect and now with ARO, LLR, and Emissions data they’ve grown to need. To find out more about how these tools can aide your strategic acquisition identification and evaluation, visit our website our contact us for a demo.