Word to the Wise: Open Asset Evaluation for May 2020

May 5, 2020

Succeeding in oil and gas M&A comes down to how well and how quickly you can analyze potential opportunities. Once a month, XI Technologies will apply its evaluation tools to a currently available asset to give readers a sense of the opportunities available and how they can be evaluated for A&D purposes.

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

For this month, XI will examine the bankruptcy sale of Direct Oil & Gas Inc. On March 24, 2020, MNP Ltd. was appointed as the Trustee of the bankrupt estate of Direct Oil & Gas Inc. MNP Ltd. then engaged Sayer Energy Advisors to assist it with a sale for cash of Direct’s oil and natural gas property. The Company’s assets are located in the northern part of the Peace River Arch region of Alberta and are what we will evaluate in this article.

Potential Buyers

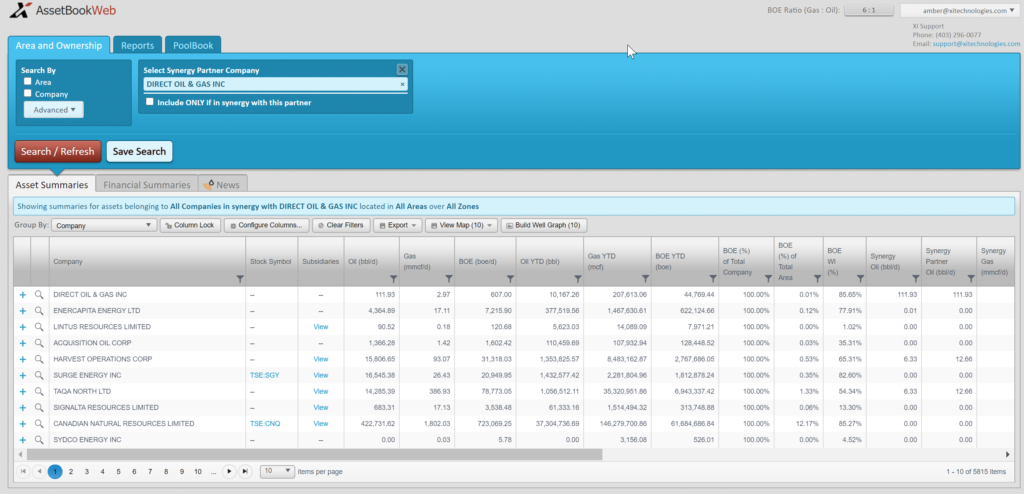

An important thing to do when evaluating an acquisition is to look at who the most likely bidders for the asset would be. The first thing to check for is whether the properties have any working interest partners who might be looking to increase their share of the asset by running a Synergy Report.

Click here to download a synergy spreadsheet report.

The next best thing to do for this information is to look at what other companies are operating in the area, as they may be looking to increase their imprint in the area to benefit from economies of scale. Contact XI to see this report.

Asset Liabilities

One of the most important parts of A&D research these days is to look at the liabilities carried by the asset. Using the Alberta Government’s LLR algorithm, XI calculates the LLR on this Company to be 1.10 with a net deemed asset value of $17,105,858 and deemed liabilities of $15,538,482. Click here to download our LLR spreadsheet.

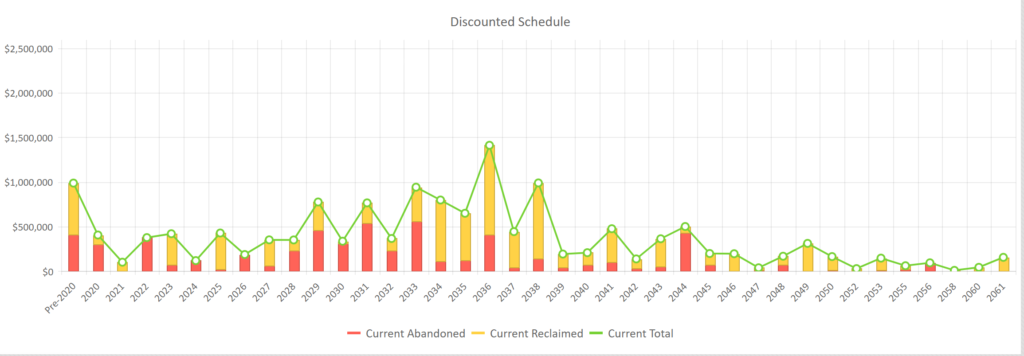

But it’s also best practice to do an independent evaluation of the asset’s retirement obligations with calculations you trust. XI’s ARO Manager makes this not only possible, but it’s quick and easy to do so. In addition to knowing an asset’s ARO numbers, it’s helpful to know the scheduling of those obligations and how they will fit into your company’s short, mid, and long-term planning. Here’s the liability scheduling of these assets:

These are just a few quick ways to do A&D prospecting, using a real-world example that is currently available for purchase. If you’d like to learn more about how XI’s AssetSuite can analyze potential acquisitions, contact XI Technologies.