Sed diam nonummy nibh euismod tincidunt

Ut laoreet dolore magna aliquam erat volutpat. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat. Duis autem vel eum iriure dolor in hendrerit in vulputate velit esse molestie consequat, vel illum dolore eu feugiat nulla facilisis at vero eros et accumsan et iusto odio dignissim qui blandit praesent luptatum zzril delenit augue duis dolore te feugait nulla facilisi.

Twice a year, XI Technologies reaches into the public data stored in its applications to highlight the top companies who achieved the most successful production from new wells.

To compare these results against previous years, check out our Production Top 10s blog history.

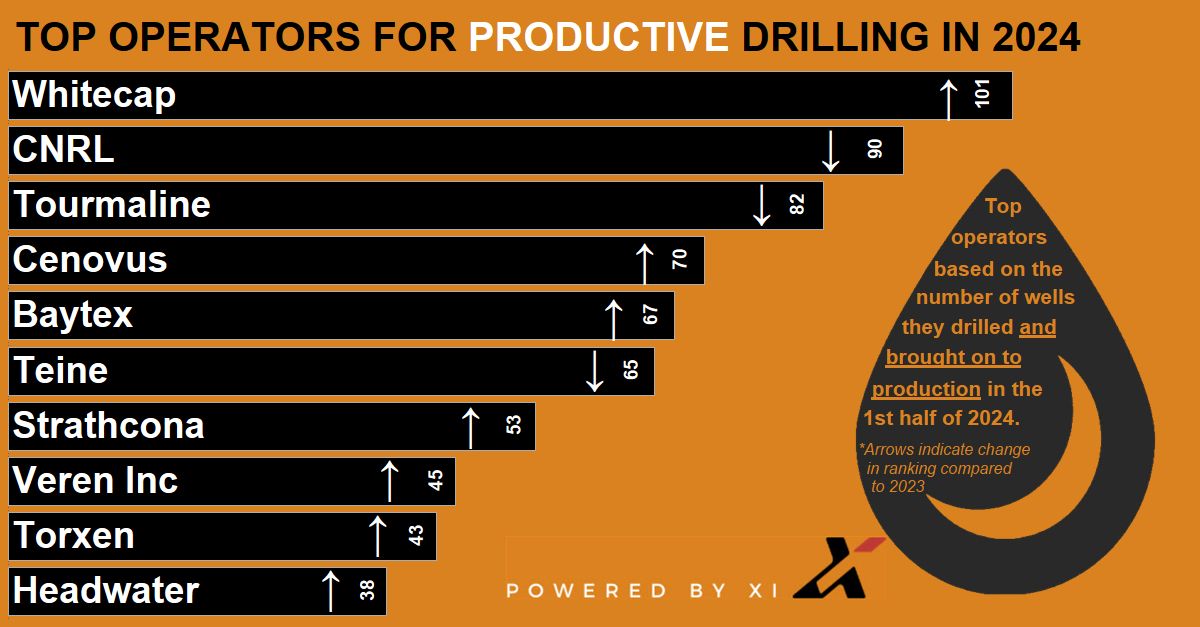

Top operators for “productive” drilling

More important than the number of wells drilled, is the production achieved with those wells. Whitecap Resources ranked first for the first half of 2024, followed by Canadian Natural Resources (CNRL), then Tourmaline in third spot. Arrows indicate how they compare to their ranking from 2023.

Top operators for new well production

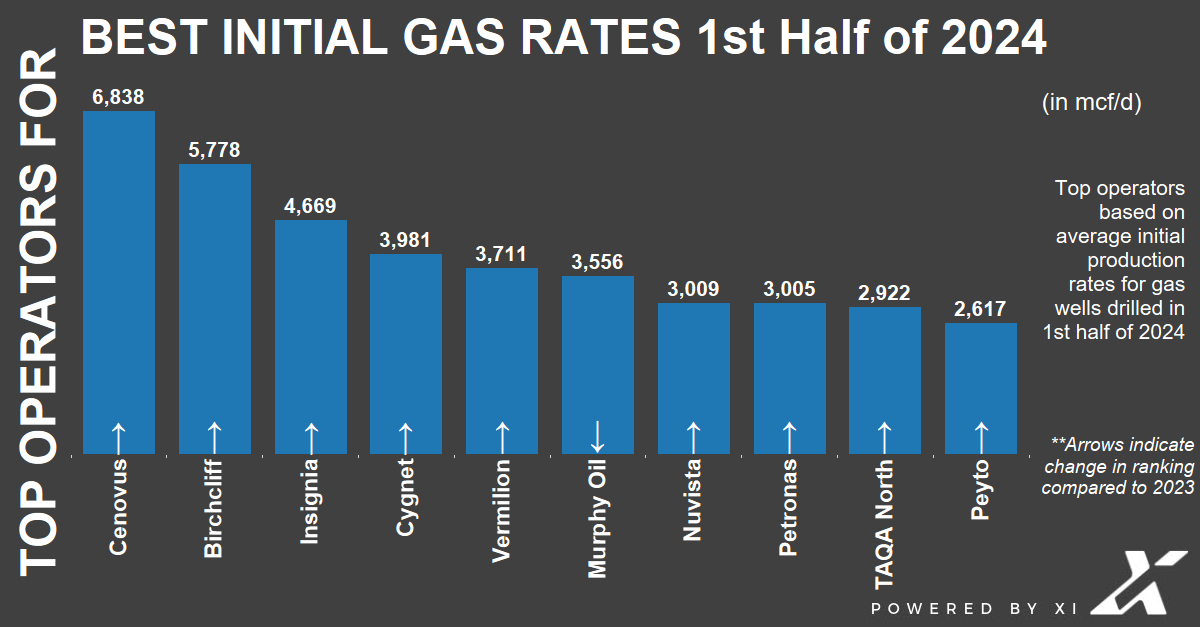

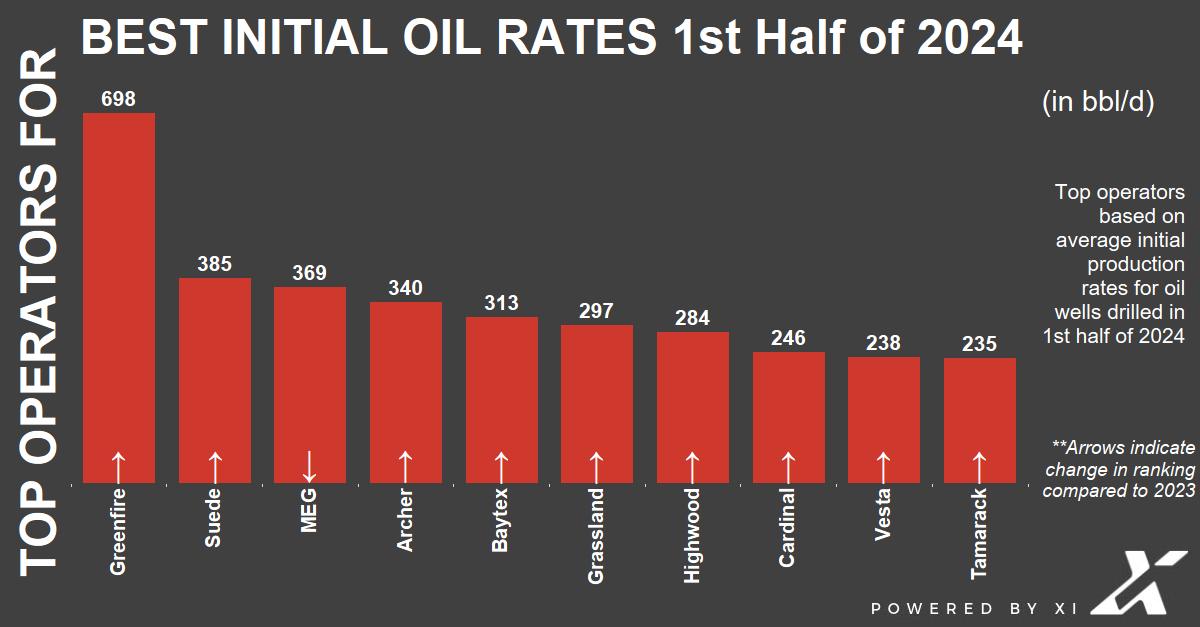

Achieving a high initial production rate can have a significant impact on the overall ROI for a well or drilling program.

In Figure 2, we’ve looked at IP 90 rates for new gas wells and oil wells drilled in the first half of this year.

Congratulations to Cenovus for topping the list in the Initial Gas Rates category this year, followed by Birchcliff, Insignia, and Cygnet.

Which operators achieved the best rates from their best oil wells drilled during the same period? Greenfire is significantly higher than the rest of the field so far for this year.

Note: Many operators shown that were NOT listed in the 2023-year end Top 10 list. Since January of 2024, nine new operators have jumped into the Top 10 list for the first half of 2024 for initial gas rates and six for oil rates, respectively.

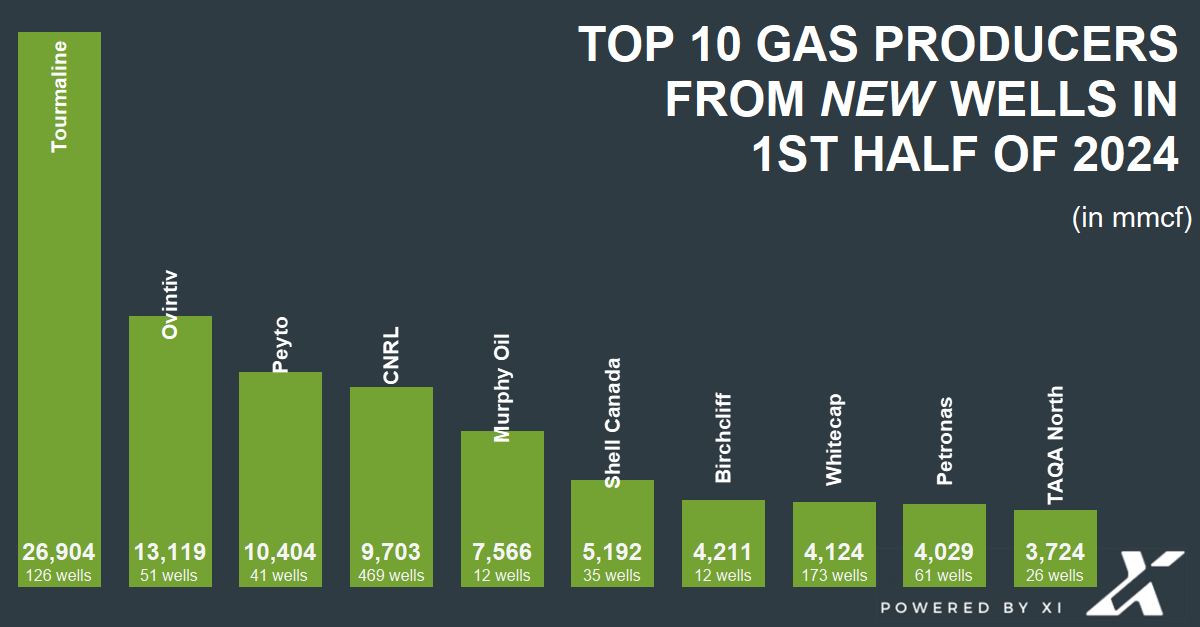

Top 10 operators for new gas production

Which operators achieved the greatest gas production (in mmcf) from wells drilled in the WCSB in 2024’s first 6 months? Tourmaline remains in top position from the end of 2023 mark. They are followed by Ovintiv Energy. Peyto moved from fifth spot at the end of 2023 up into third place for 2024’s first half.

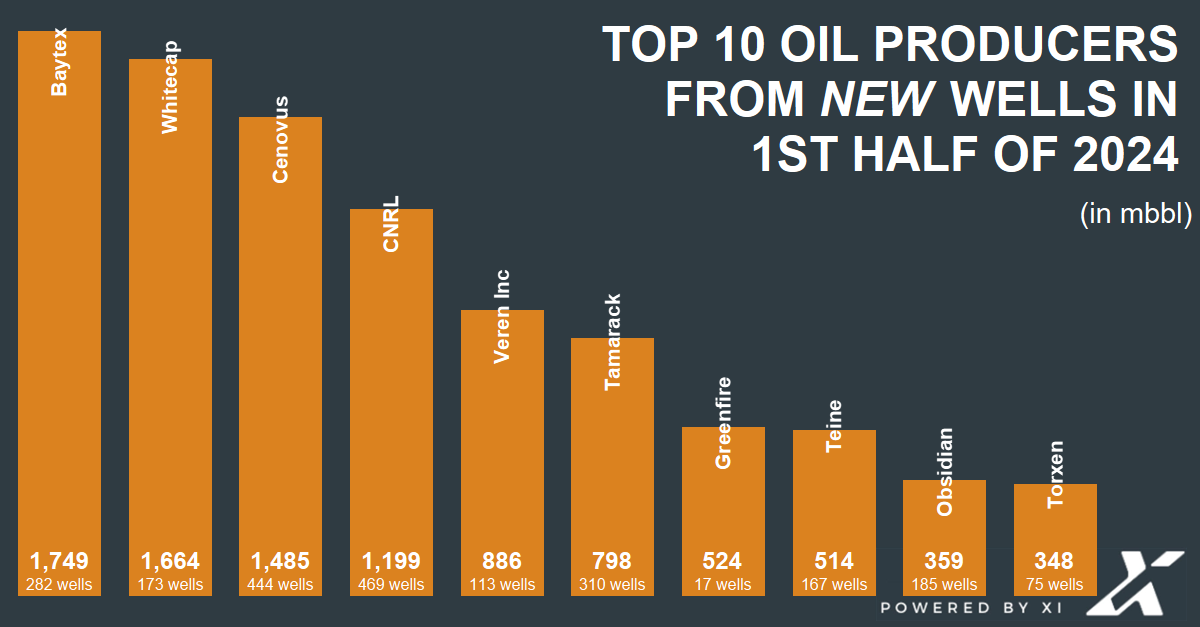

Top 10 operators for new oil production

Which operators has the highest cumulative total oil production (in mbbl) from WCSB wells drilled so far? Baytex is leading slightly over Whitecap from the beginning of 2024. Those two are followed by Cenovus, and CNRL.

Congratulations to all our WCSB operators and producers. Your commitment to innovative, responsible production helped energize our sector so far for 2024. Here’s hoping for an even more successful second half to 2024!

To compare these results against previous years, check out our Production Top 10s blog history.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s DrillingSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.

As the Canadian oil and gas industry faces evolving challenges and opportunities, the role of summer students becomes increasingly crucial. These students are not merely temporary workers; they represent the future of the various departments within the organizations they join. By integrating fresh perspectives, innovative ideas, and cutting-edge academic knowledge, summer students play a pivotal role in shaping the future of the oil industry. Additionally, leveraging the advanced tools and solutions provided by XI Technologies can further enhance the contributions of these students across various areas.

Bridging the Gap Between Academia and Industry

One of the primary benefits of employing summer students is their ability to bridge the gap between academia and industry. These students bring with them the latest knowledge from their academic programs, including advancements in technology, environmental science, and engineering practices. This infusion of current academic insights helps organizations stay at the forefront of innovation and best practices.

For example, a summer student in an engineering department might introduce new methods for enhancing oil recovery, while those in environmental science roles could suggest sustainable practices that minimize environmental impact. XI Technologies advanced data analytics and asset management tools can support these students by providing comprehensive industry data and insights, enabling them to make informed, impactful contributions. This exchange of knowledge not only benefits the organization but also prepares students for their future careers by providing practical, hands-on experience.

Driving Innovation and Technological Advancement

Summer students often possess a natural curiosity and willingness to explore new ideas, making them ideal candidates for driving innovation within their respective departments. Their fresh perspectives can lead to creative solutions that more experienced staff might overlook. In the rapidly evolving field of oil and gas, such innovation is crucial for maintaining a competitive edge.

For instance, students involved in research and development may contribute to breakthroughs in cleaner extraction technologies or more efficient refining processes. XI Technologies suite of innovative software solutions can aid these efforts by offering tools for well optimization, risk assessment, and regulatory compliance. By encouraging a culture of innovation, organizations can harness the potential of these young minds to pioneer new technologies and methodologies.

Building a Talent Pipeline

Employing summer students is a strategic way to build a talent pipeline for the future. These students, once trained and familiar with the organization’s operations, can be recruited for full-time positions after graduation. This approach ensures a seamless transition and reduces the time and resources spent on onboarding new employees.

Moreover, having a robust internship program allows organizations to identify and nurture high-potential individuals early on. XI Technologies can support this process by providing training and development resources that help students quickly acclimate to industry standards and practices. These students can be groomed for leadership roles, ensuring that the organization has a continuous supply of skilled and motivated professionals ready to take on future challenges.

Contributing to Sustainability Goals

Sustainability is a critical focus for the Canadian oil industry, and summer students play a key role in advancing these goals. Many students are passionate about environmental issues and bring a strong commitment to sustainability. They can contribute to developing and implementing strategies that reduce the environmental footprint of oil operations.

For example, students in environmental science programs can work on projects related to carbon capture and storage, biodiversity conservation, and waste reduction. Their involvement helps organizations not only comply with regulatory requirements but also achieve higher standards of environmental stewardship.

Summer students are more than just temporary additions to the Canadian oil industry; they are the future of its various departments. By bridging the gap between academia and industry, driving innovation, building a talent pipeline, and contributing to sustainability goals, these students play a critical role in shaping the future of the oil industry. Organizations that invest in summer students are not only investing in their immediate operational needs but also in the long-term success and sustainability of the industry as a whole.

—

CALLING ALL SUMMER STUDENTS! Boost Your Industry Smarts with AssetBook Training

Are you ready to level up your industry knowledge and turbocharge your professional circle? Look no further than XI’s AssetBook – it’s like having the ultimate insider’s guide to the Western Canada energy scene, dubbed by clients as “the Google of Western Canada’s Energy industry.”

There’s a good chance your new company has an AssetBook enterprise-level license, which means you’ve got unlimited access to this game-changing resource while you’re navigating your way through your new role!

Calling all summer interns, co-op students, and fellow summer warriors – we’ve got an exclusive AssetBook training just for you! Say goodbye to feeling lost in translation at those corporate meetings. AssetBook is your golden ticket to cracking the code on your company’s core areas, spotting key partners, and sizing up the competition. It’s the ultimate backstage pass to industry triumph, custom-built for launching your career in the energy sector.

But hold onto your smartphones, because AssetBook Training isn’t just about gaining insider intel – it’s also your VIP pass to building connections with other ambitious minds like yours. Picture this: mingling with other summer interns who are just as hungry for knowledge and success as you are. Together, you’ll not only conquer AssetBook but also build a powerhouse network to navigate the fast-paced, data-driven world of energy.

Join us tomorrow for a hands-on workshop where we’ll spill all the tea on how to learn the ropes of AssetBook, and rub elbows with your fellow summer stars. But act fast – spots are filling up quicker than the latest TikTok trend.

Don’t let this opportunity slide – seize the chance to boost your industry IQ, expand your network, and launch your career on the right foot. Sign up for AssetBook Training today and get ready to make waves in the professional jungle.

Know a fellow summer student in the oil and gas game who could use this insider scoop? Slide them this link and let’s make waves together!

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.

Stay connected wherever you are. Subscribe to receive WTTW directly to your inbox and enrich your understanding with ease.

As winter wanes and temperatures rise, Western Canada’s oil fields undergo a unique phenomenon known as “spring breakup.” While this term may evoke images of thawing ice and budding flowers, in the oil industry, it signifies a period of challenges and adjustments. What does spring breakup entail, what impact does it have on operations and service companies, and how has technology changed how breakup is viewed in the past number of years?

What is Spring Breakup? Spring breakup refers to the transition period between winter and spring when frozen ground and ice begin to thaw. This transition period normally runs from early March to late May (the start and length is 100% weather dependent). In Canada’s oil fields, where much of the infrastructure is built on frozen terrain, this thawing process presents significant logistical hurdles. But technology has come a long way since the first wells were drilled in the early 1900s, and with the introduction of horizontal well drilling, and pad drilling the impact of spring breakup seems to be diminished.

Impacts of Spring Breakup on Oil Field Operations:

Restricted Access: One of the most immediate impacts of spring breakup is the restriction of access to oil field sites. Road bans on Government, Weyerhaeuser (forestry companies), and some privately owned roads are put in place to maintain public infrastructure integrity. Dirt roads on public or private land that were solid during the winter months turn into muddy quagmires, making them unsuitable / unstable for heavy vehicles.

Equipment Limitations: Heavy machinery used in drilling and extraction operations can sink into the softened ground, leading to delays and potential damage. Transporting goods becomes increasingly difficult whether those goods are equipment going into the site or production being moved out. Road bans lead to partial load capacities or even the inability to move in required equipment. This necessitates careful planning and sometimes halting operations until conditions improve.

Safety Concerns: Thawing ice and snow can create hazardous conditions for workers, increasing the risk of slips, falls, and accidents. Additionally, poor road conditions can make emergency response efforts challenging.

Mitigation Strategies:

Road Maintenance: In order to minimize the impact on soft access roads, oil companies often invest in road infrastructure support. These investments can be temporary support such as laying down rig mats or road decking. However, on access points which are used more often or give access to larger installations, this may involve graveling roads or reinforcing bridges. Technology has improved allowing the utilization of horizontal drilling and creation of pad sites which creates access to many wells from a single point.

Timing Operations: Planning drilling and extraction activities around spring breakup can help minimize disruptions. With improved access roads to pad sites as well as increased project management around drill locations, companies are better able to pre-plan what goods and equipment will be required for all the drills from a single location, thereby scheduling the delivery of the goods prior to breakup, allowing drilling work to continue at a constant pace during the breakup season. Drilling from pads makes it more efficient, requires less moving of equipment, and makes it easier to bring in supplies before the thaw begins.

Increased Monitoring: Employing advanced monitoring systems can help companies track ground conditions and predict potential hazards. This proactive approach allows for timely interventions to mitigate risks.

Environmental Considerations: Beyond its operational impacts, spring breakup also affects the environment. Increased vehicle traffic during breakup can disturb wildlife habitats, damage wetlands, and lead to soil erosion.

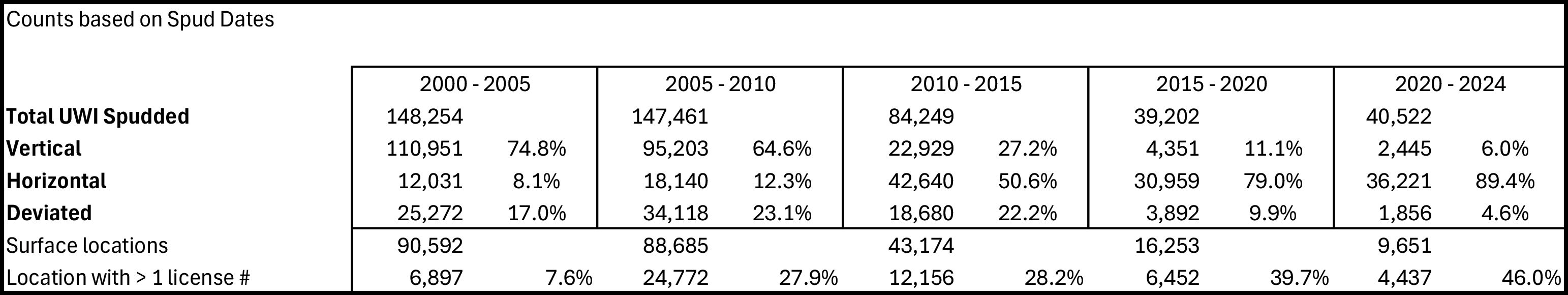

Looking at the number of wells spudded in 5 year increments since 2000 and comparing the number of vertical wells vs horizontal wells, we can see that horizontal drilling has almost taken over. This has lead to a decrease in the number of surface locations (decreasing not only the environmental impact, but also the cost of clean up at the end of the location’s life cycle).

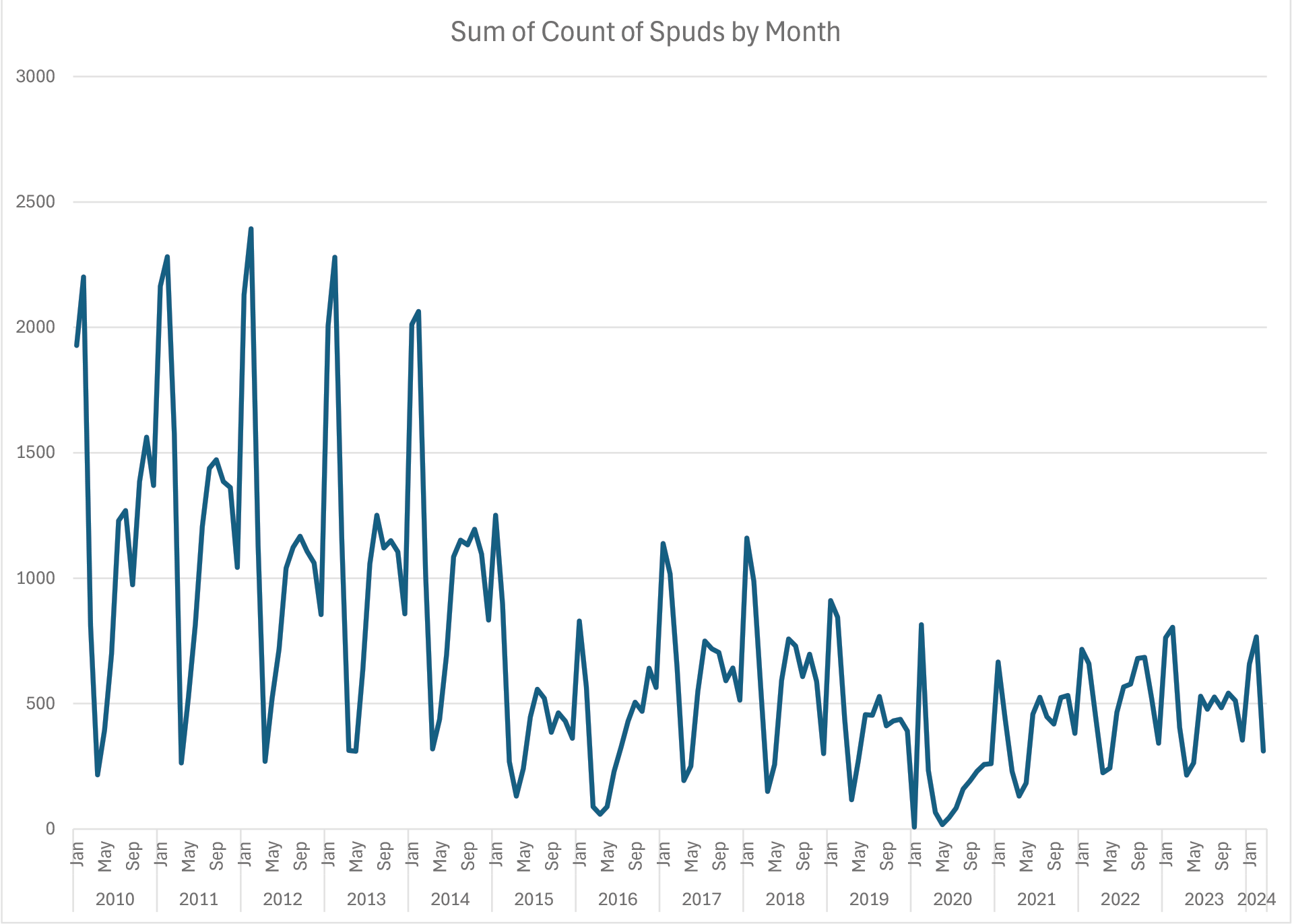

When looking at when these wells were spud, there has historically been a large drop in spuds during the breakup time period but, as you can see, that impact is lessening over time.

Spring breakup poses unique challenges to Canada’s oil field operations, requiring careful planning and adaptation. By implementing proactive strategies such as road maintenance, timing operations effectively, and increasing monitoring efforts, companies can minimize disruptions and ensure the safety of workers and the environment. As technology gains ground and climate change continues to influence seasonal patterns, understanding and managing the impacts of spring breakup will remain a critical aspect of oil field management in Canada.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s DrillingSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.

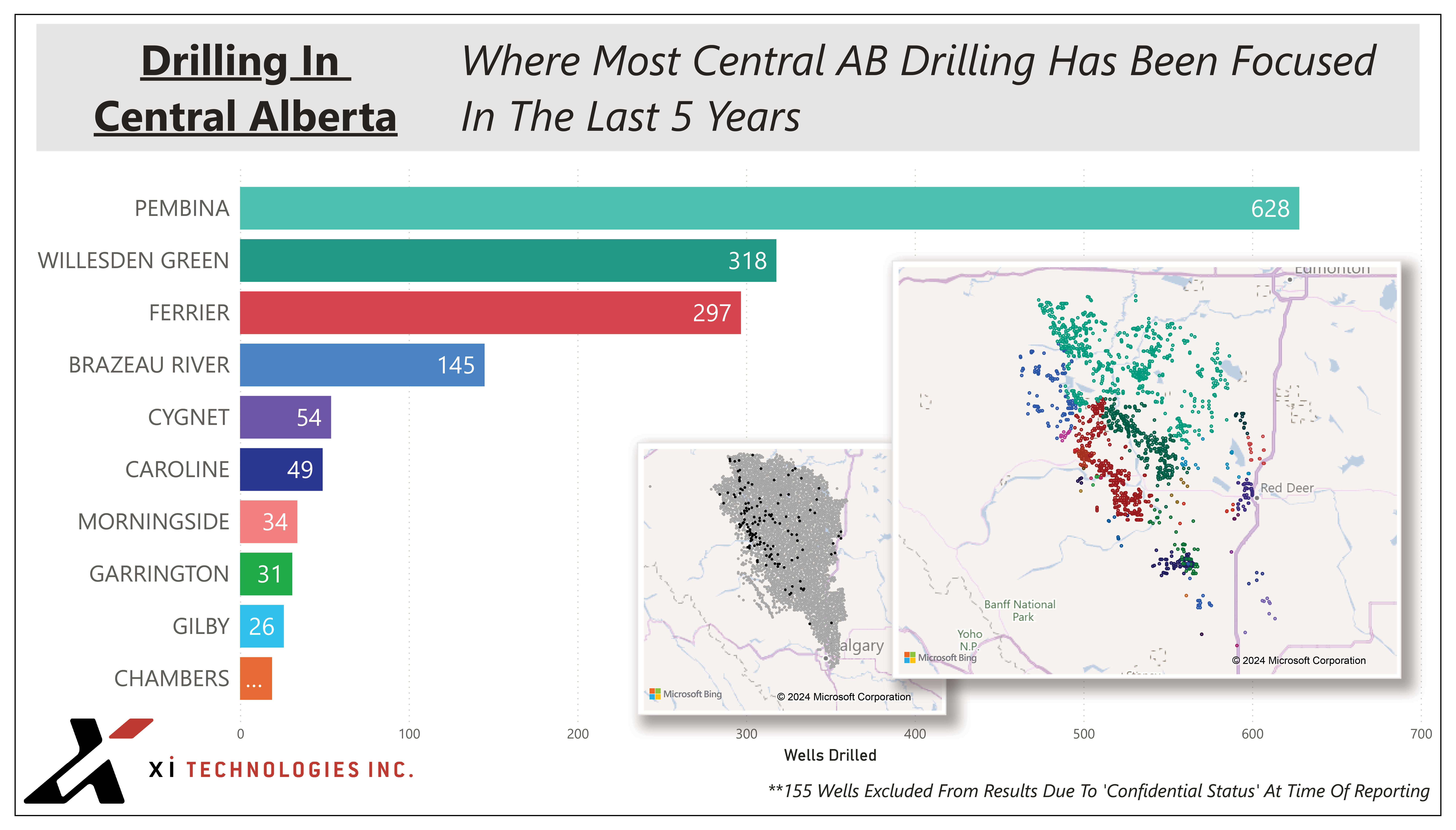

In our last article, we talked about how Central Alberta stands as a beacon of energy production, driving economic growth and innovation in the heart of Canada’s energy landscape. Amidst the vast expanse of drilling activities in this region, efficiency and optimization are paramount for success. Data from XI Technologies’ DrillingSuite serves as part of the revolution in the way companies navigate the complexities of drilling operations, empowering them to unlock valuable insights, optimize performance, and reduce costs.

Central Alberta’s Oil and Gas Drilling Scene

Central Alberta boasts a diverse array of drilling operations, from conventional vertical wells to advanced horizontal drilling and hydraulic fracturing techniques. With extensive reserves spread across multiple formations, including the prolific Western Canadian Sedimentary Basin, the region presents both opportunities and challenges for energy companies.

Navigating this dynamic landscape requires access to comprehensive data and sophisticated analytical tools to inform strategic decisions, optimize drilling programs, and mitigate risks. Using XI Technologies’ DrillingSuite, we can streamline research, analysis, and decision-making processes for oil and gas professionals. For example, what can we learn from the Top 10 operators in Central Alberta who are advancing growth and development through the drill bit?

Unlocking Insights with DrillingSuite

XI Technologies’ DrillingSuite provides unparalleled access to a vast repository of drilling data for evaluating historical drilling performance, assessing regulatory compliance, or identifying optimization opportunities. DrillingSuite’s intuitive interface and robust features enable users to extract valuable insights quickly and efficiently.

When applying advanced search capabilities, customizable filters, and interactive visualizations, engineers and analysts can dissect drilling data with precision, uncovering patterns, trends, and anomalies that may impact decision-making. Learning from the Top 10 Operators within the region helps others make informed decisions and drive operational excellence. What has led to Bonterra Energy’s success in Central Alberta over the past five years? How are the likes of Yangarra Resources, Obsidian, Westbrick and Whitecap catching up? To understand the power of data in action, click on the image below.

Optimizing Performance and Reducing Costs

Obviously, it’s a competitive landscape where every decision counts. From well planning and site selection to drilling execution and post-drilling analysis, the ability to identify optimization opportunities and streamline operations is crucial for success. Whether it’s optimizing well trajectories to maximize reservoir exposure, identifying cost-saving measures through benchmarking and best practices analysis, or mitigating risks through regulatory compliance monitoring, DrillingSuite empowers users to make data-driven decisions. By leveraging actionable insights derived from comprehensive drilling data, companies operating in Central Alberta can enhance operational efficiency, minimize downtime, and maximize returns on investment.

For example, let’s look at areas where the most drilling has occurred in Central Alberta to start to understand production efficiencies. Click below to understand why.

Since 2019, over 60% of the activity in Central Alberta has occurred in the Pembina region with 628 wells drilled by the end of 2023. Willesden Green and Ferrier are a distant second (318 wells) and third (297 wells). But we are watching increased activity coming out of Cygnet, Caroline, Morningside, Garrington and Gilby. Once you unlock valuable insights gleaned from the region’s leaders, then you can start to identify optimization opportunities and plan to reduce drilling costs, ultimately driving operational excellence. Data paves the way for companies to navigate the complexities of drilling operations with confidence, efficiency, and success.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s DrillingSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.

Twice a year, XI Technologies reaches into the public data stored in its applications to highlight the top companies who achieved the most successful production from new wells.

To compare these results against previous years, check out our Production Top 10s blog history.

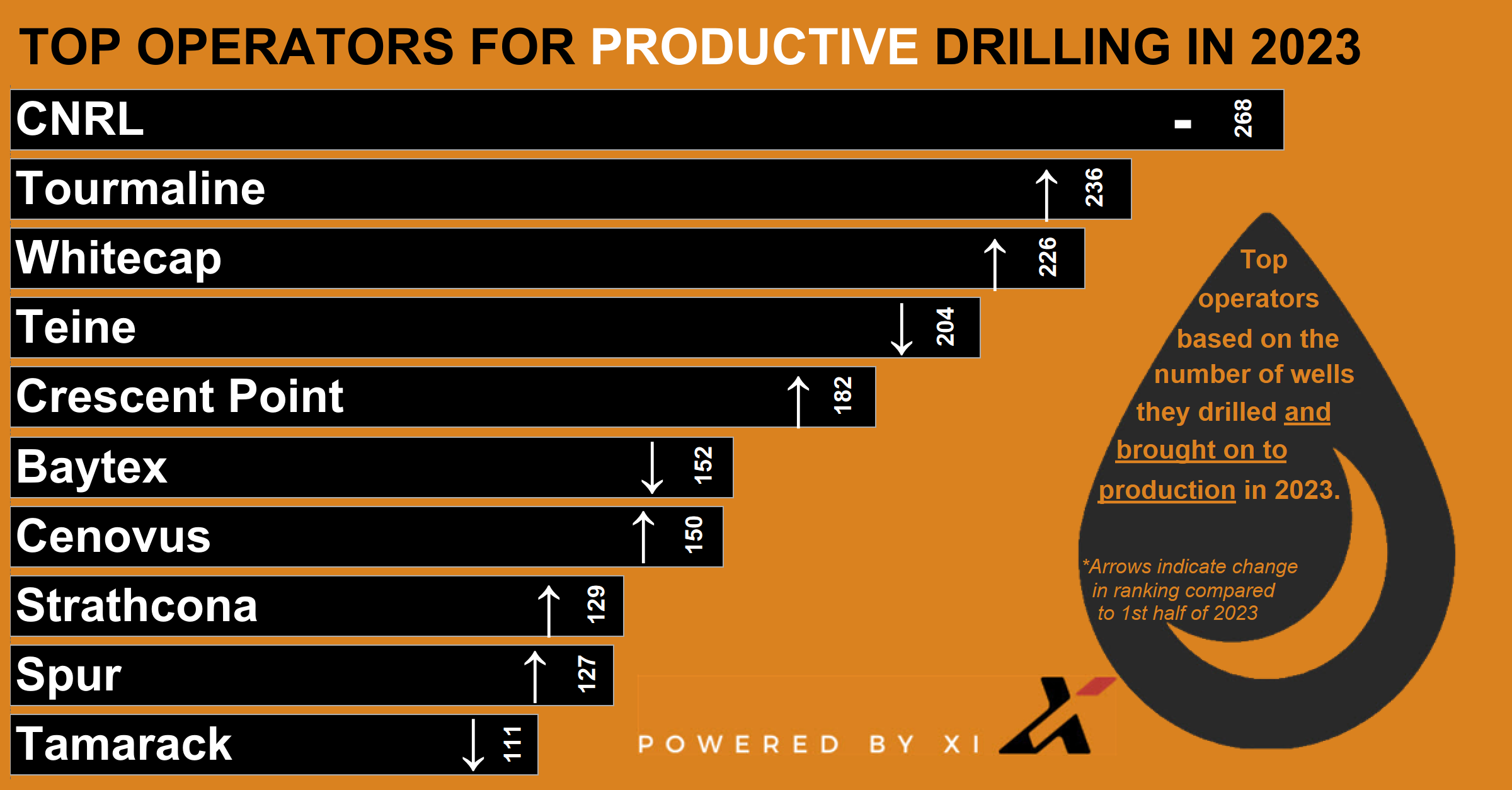

Top Operators For “Productive” Drilling

More important than the number of wells drilled, is the production achieved with those wells. Canadian Natural Resources Limited (CNRL) ranked first in 2023, followed by Tourmaline and Whitecap Resources in third spot. Arrows indicate how they compare to their ranking from mid-year 2023.

Top Operators For New Well Production

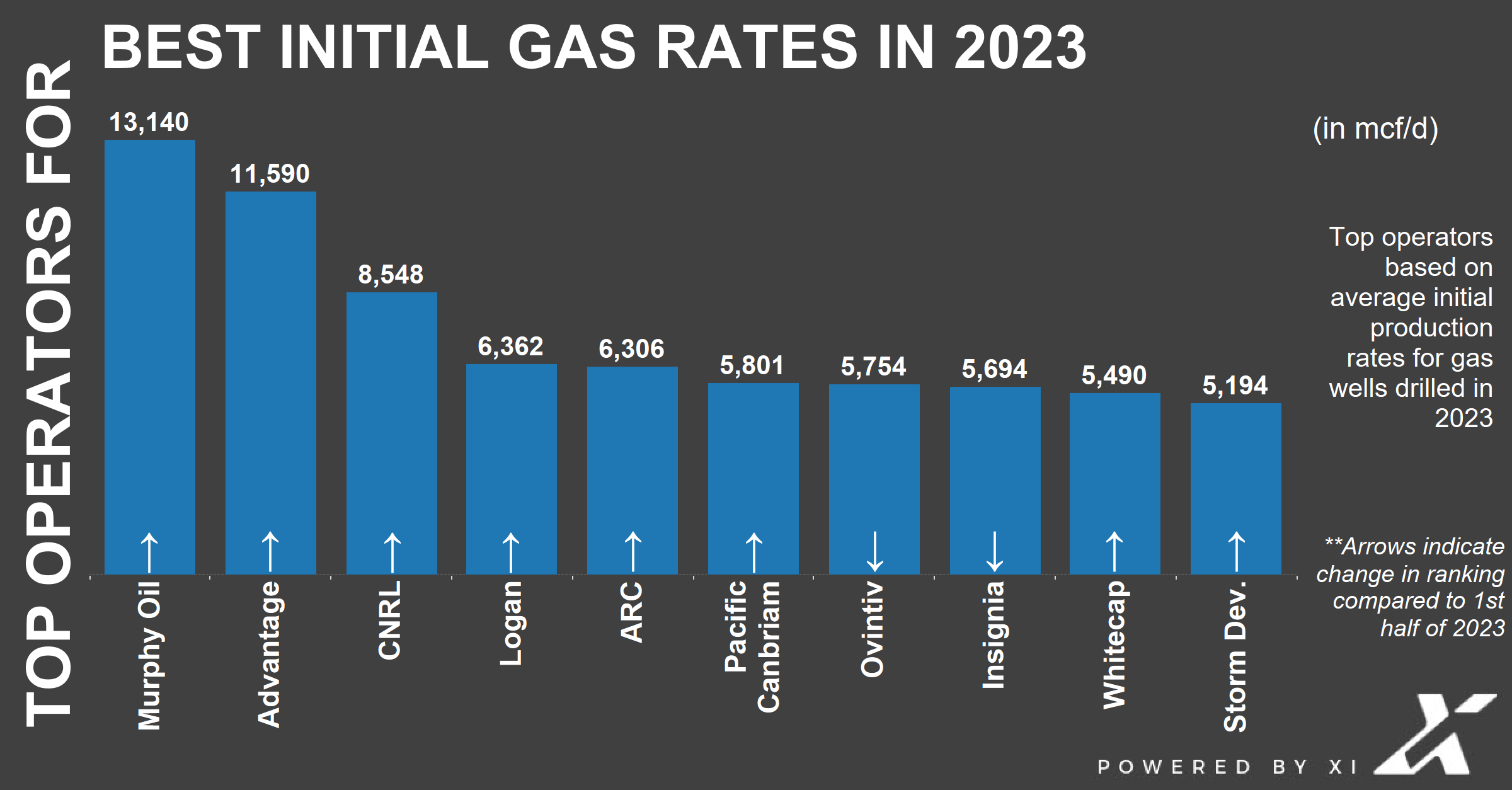

Achieving a high initial production rate can have a significant impact on the overall ROI for a well or drilling program.

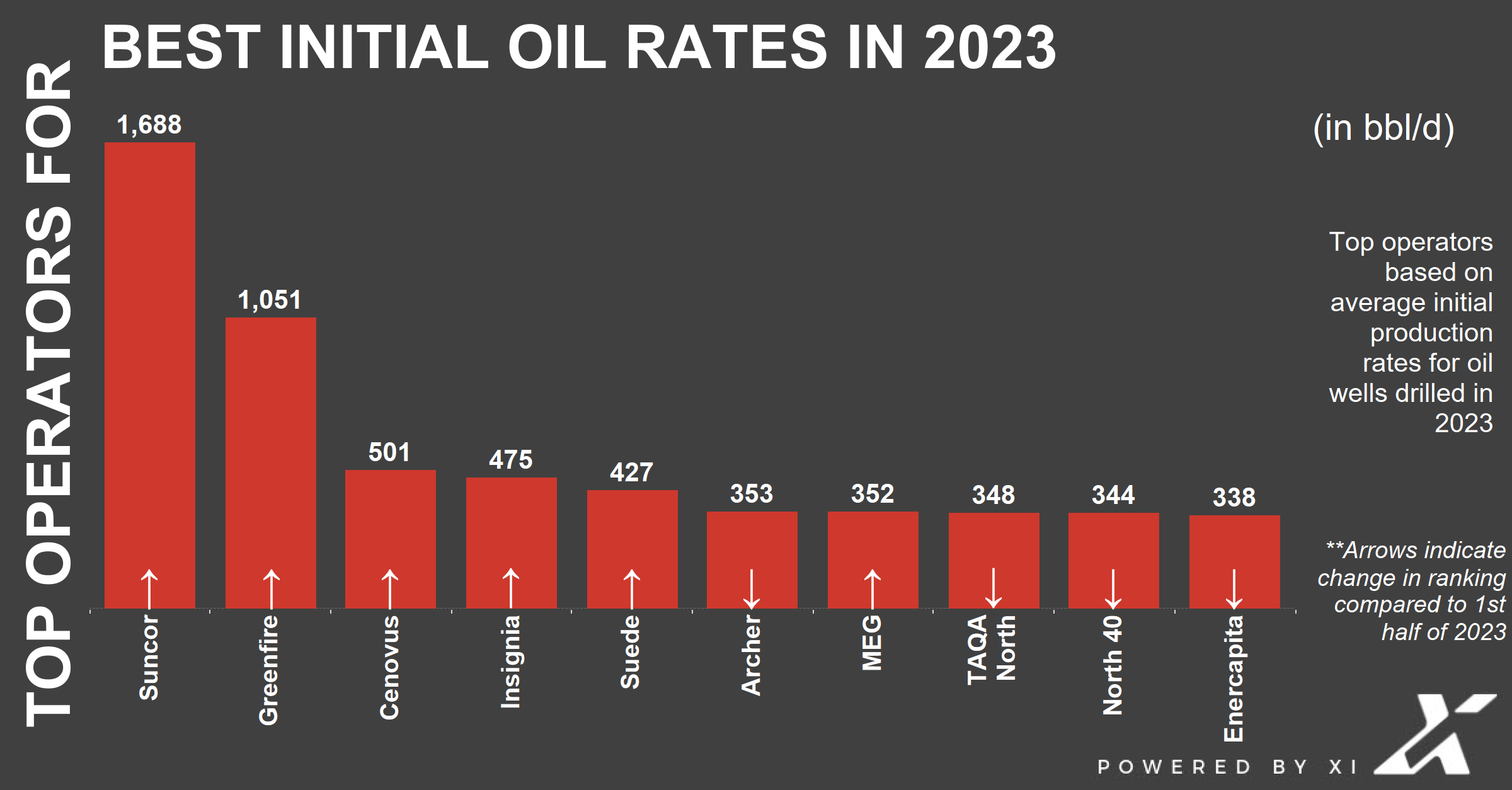

In Figure 2, we’ve looked at IP 90 rates for new gas wells and oil wells drilled in 2023.

Congratulations to Murphy Oil for topping the list in the Initial Gas Rates category this year, followed by Advantage, CNRL, and Logan.

Which operators achieved the best rates from their best oil wells drilled during the same period? Suncor and Greenfire were significantly higher than the rest of the field in 2023.

Note also the many operators shown that were NOT listed in the mid-year 2023 Top 10 list. Since June of 2023, seven new operators have jumped into the Top 10 list for 2023 for initial gas rates and six for oil rates, respectively.

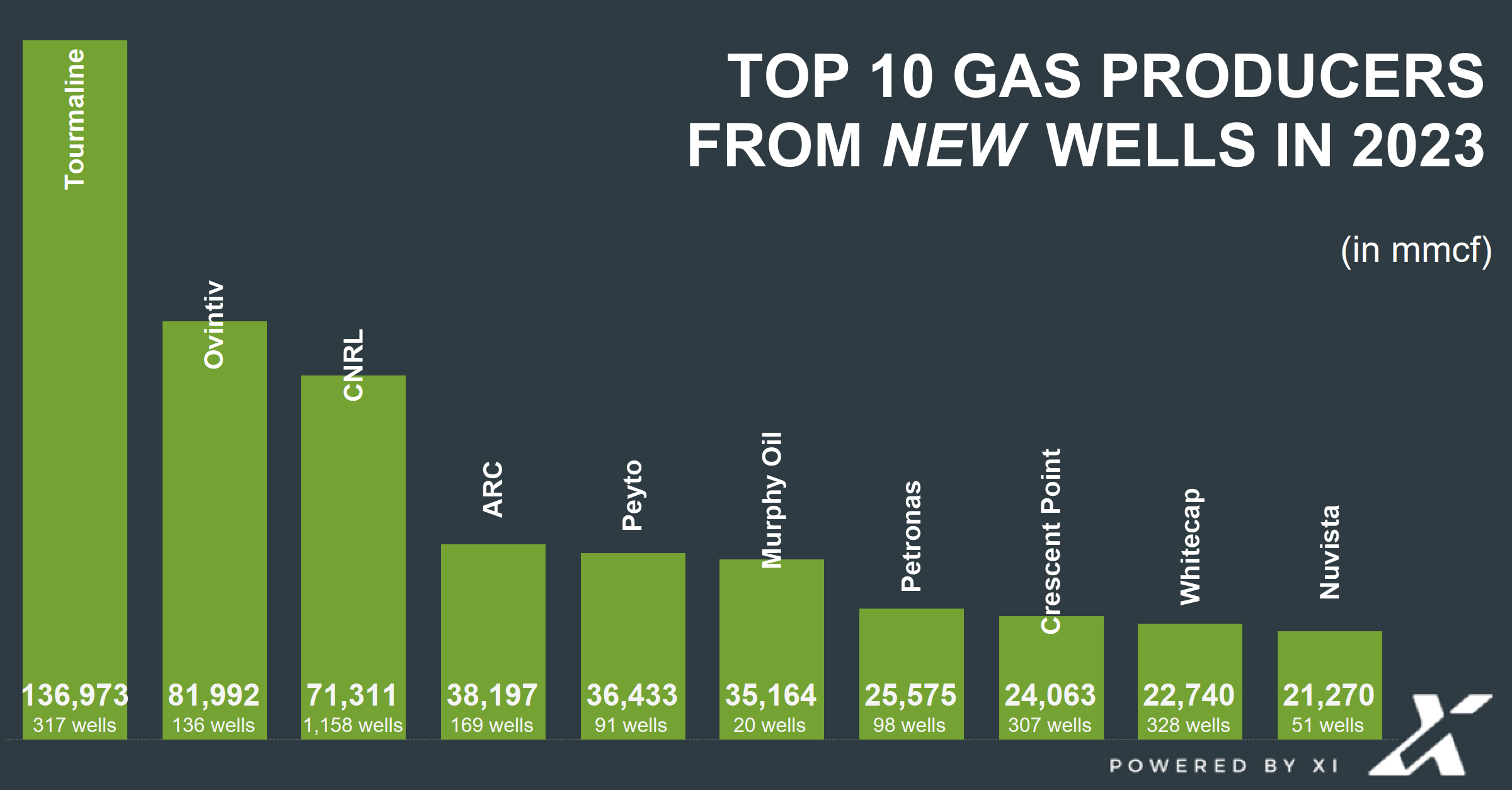

Top 10 Operators For New Gas Production

Which operators achieved the greatest gas production (in mmcf) from wells drilled in the WCSB in 2023? Tourmaline remains in top position from the mid-year mark. They are followed by Ovintiv Energy. CNRL finished in third place in 2023.

Top 10 Operators For New Oil Production

Which operators added the highest cumulative total oil production (in mbbl) from WCSB wells drilled in 2023? CNRL continues to lead, going from mid-year 2023 to beginning of 2024. They’re followed by two operators who both jumped up the Top 10 ranking from the mid-year point, with Cenovus, who leaped from third to second place, and Crescent Point going from sixth to third.

Congratulations to all our WCSB operators and producers. Your commitment to innovative, responsible production helped re-energize our sector in 2023. Here’s hoping for an even more successful 2024!

To compare these results against previous years, check out our Production Top 10s blog history.

Couldn’t catch our last webinar?

AssetBook M&A Workflow in Action is now posted on our website.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s DrillingSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.

Each week, XI Technologies scans their unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Word to the Wise in your inbox, subscribe here.

Twice a year, XI Technologies reaches into the public data stored in its applications to highlight the top companies who achieved the most successful production from new wells.

To compare these results against previous years, check out our Production Top 10s blog history (click here).

Top Operators for “Productive” Drilling

More important than the number of wells drilled is the production achieved with those wells. Just like the previous year, CNRL is in the top spot for the first half of 2023, followed by Teine Energy, then Baytex, who replaced Tourmaline, in third spot. Arrows indicate how they compare to their ranking from our ‘22 year-end recap.

Top Operators for New Well Production

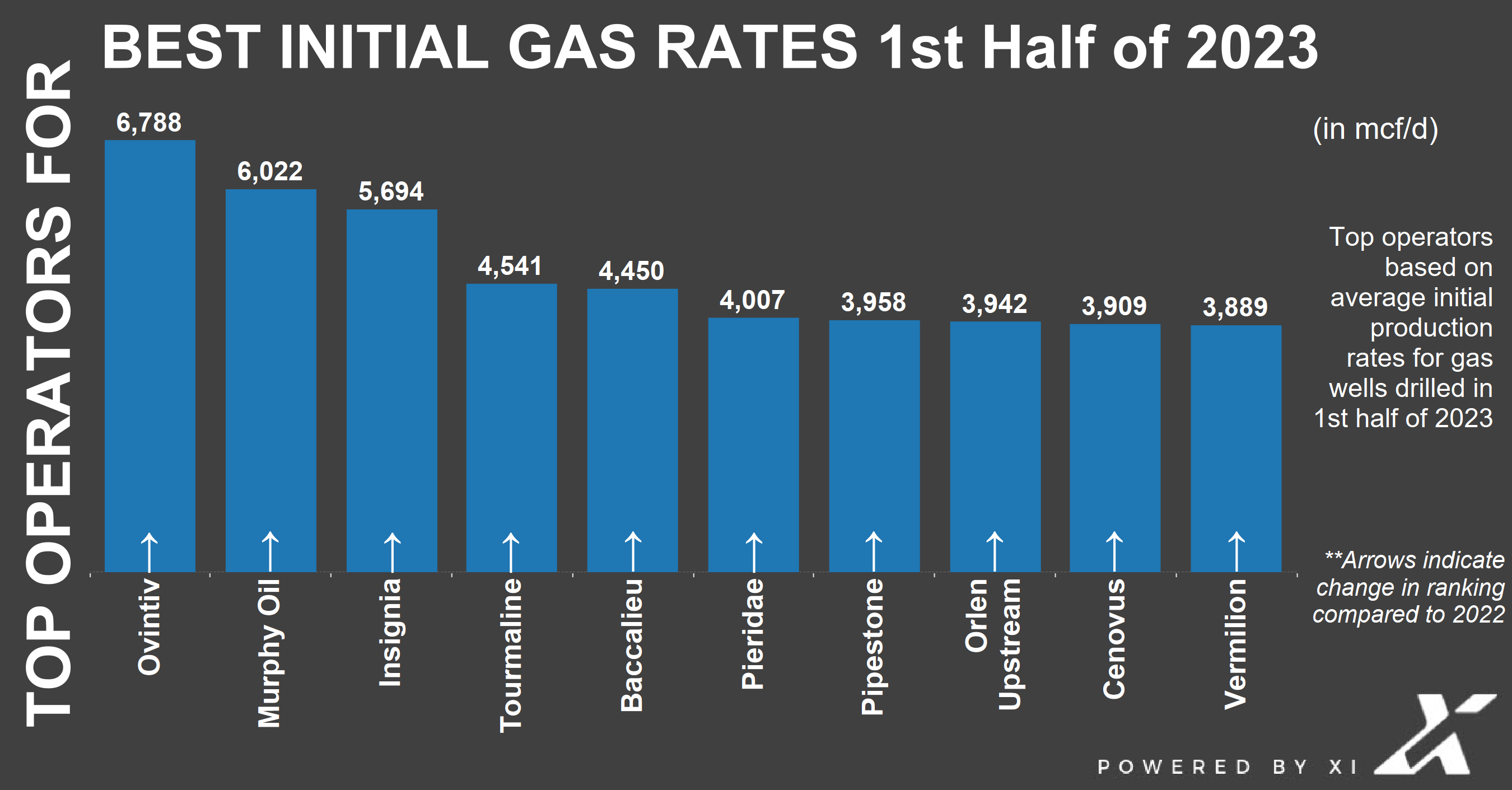

Achieving a high initial production rate can have a significant impact on the overall ROI for a well or drilling program.

In the graphics below we look at IP 90 rates for new gas wells and oil wells drilled in the first 6 months of 2023.

To view and compare these results with our 2022 year-end recap, click here.

Congratulations to Ovintiv for topping the list and jumping three spots from last year in the Initial Gas Rates category, followed by Murphy, Insignia, and Tourmaline.

Which operators achieved the best rates from their best oil wells drilled during the same period? Kelt was significantly higher than the rest of the field in the first half of 2023. Highwood and Archer were only separated by 5 and came second and third respectively.

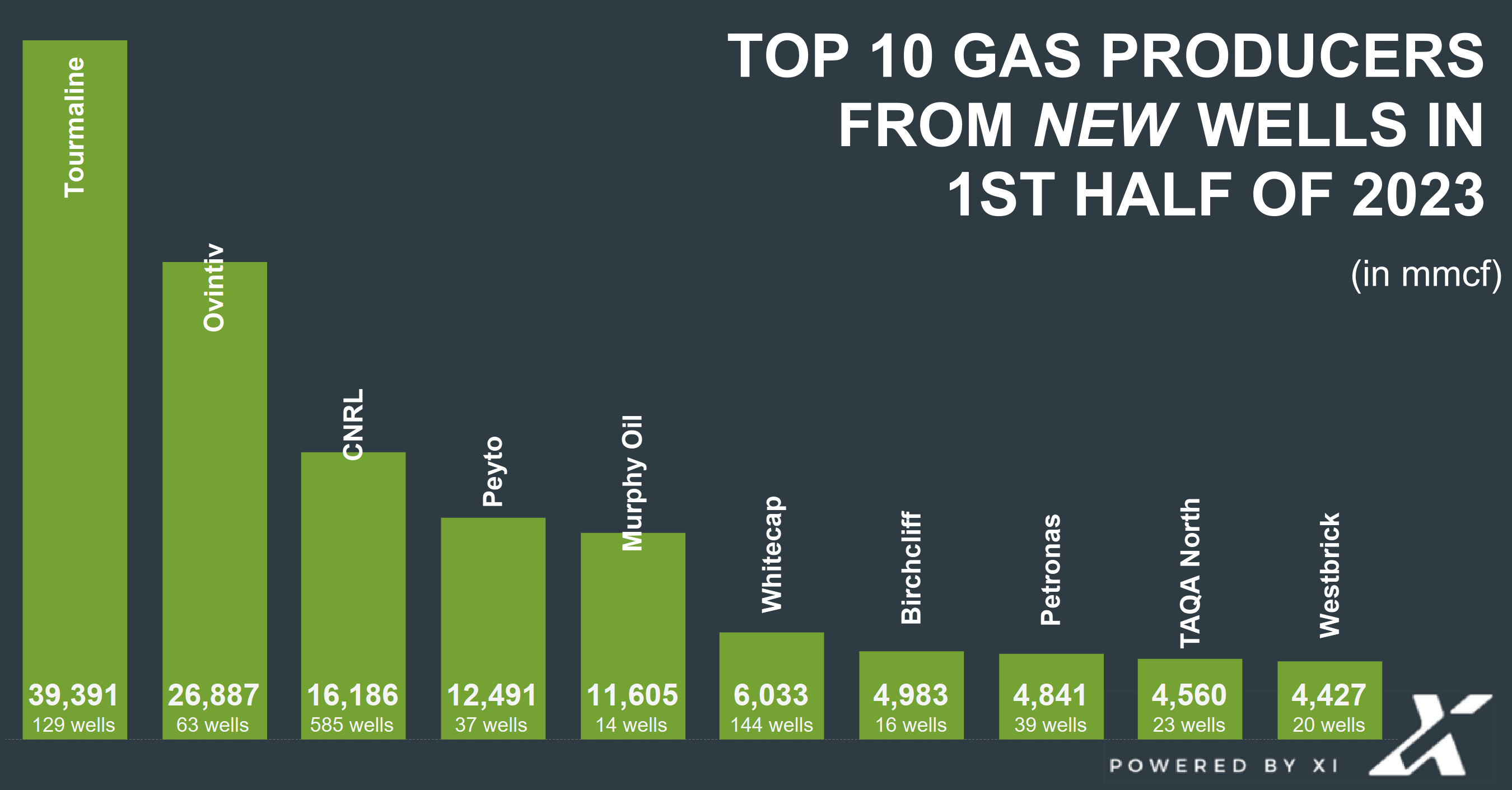

Top 10 Operators for New Gas Production

Which operators achieved the greatest gas production (in mmcf) from wells drilled in the WCSB in the first half of 2023? Tourmaline remains in the top position. They are followed by Ovintiv Energy who gained four places by jumping from sixth to second. Canadian Natural Resources landed in third place.

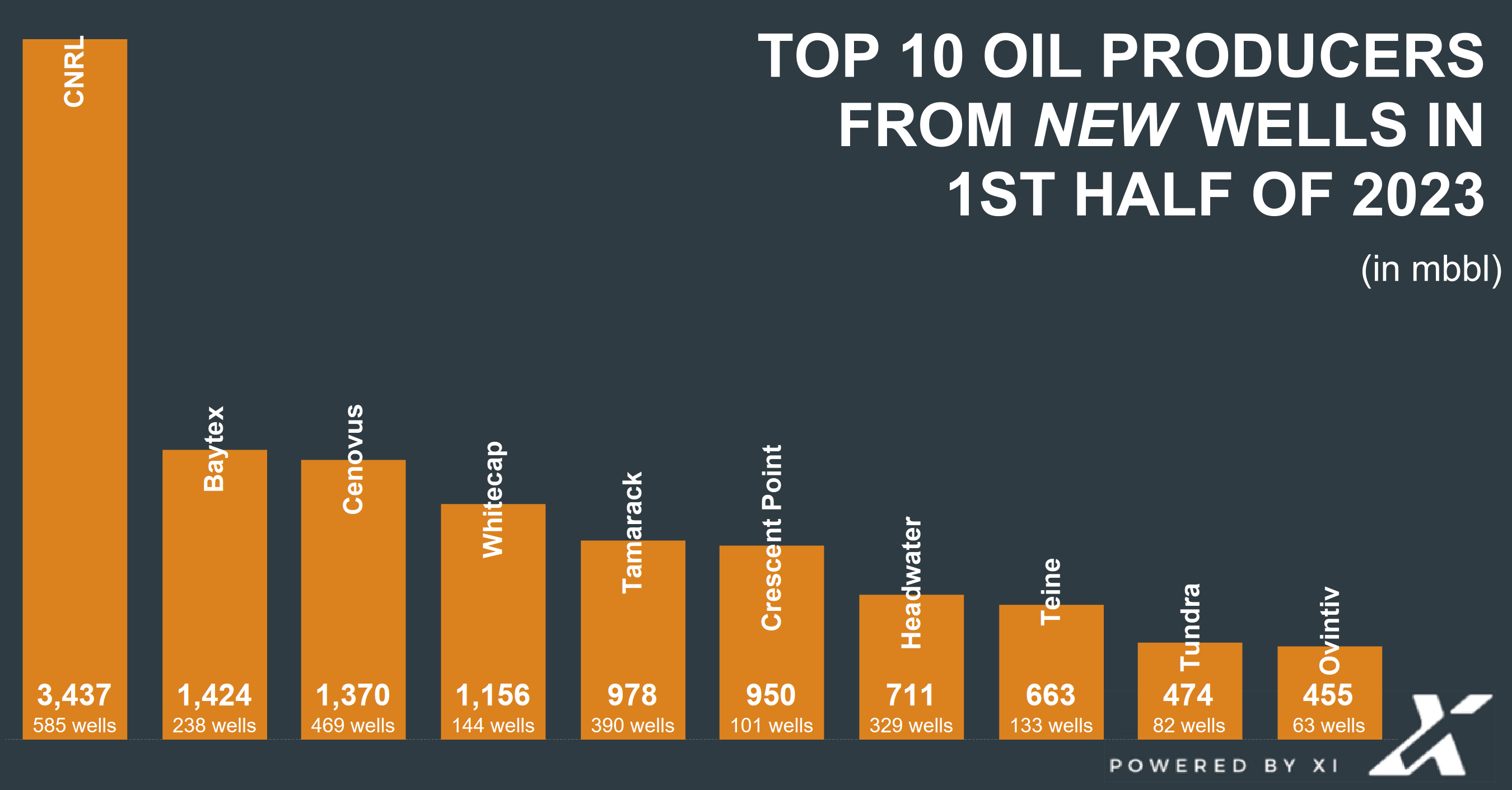

Top 10 Operators for New Oil Production

Which operators added the highest cumulative total oil production (in mbbl) from WCSB wells drilled in the first half of 2023? CNRL continues to lead from last year. They are followed by Baytex and Cenovus who take a distant second and third place respectively.

Congratulations to all our WCSB operators and producers. Your commitment to innovative, responsible production continues to re-energize our sector in 2023. Here’s hoping for an even more successful second half of 2023!

If you’d like a copy of this report, click here to download.

Want to learn more about these top-rated operators and their high performing wells? Contact XI Technologies for a demo.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

As drilling picks up throughout the Western Canadian Sedimentary Basin (WCSB), a lot of companies find themselves drilling in unfamiliar territory or working from an information deficit due to reductions in experienced staff. Operators are exploring new drilling opportunities in unfamiliar plays, whether from new asset acquisitions or adopting programs from acquired or consolidated companies.

When planning a drilling program, the information-gathering phase is critical to the success of the drilling project. Before a bit can break ground, you need to have an estimated drill time, an approach to take to setting kickoff point, a plan to minimize tripping, an understanding of what problems to anticipate, and an unbiased assessment of what equipment/suppliers are most likely to deliver the desired results. The necessity of this data has only been made more important with companies operating in new areas due to consolidation or the loss of institutional knowledge due to staffing reductions.

There are a lot of ways to get this information and the quality of information could be the difference between a successful vs. Unsuccessful drilling program. The three main sources of that data and why they are important are as follows:

Internal information

Internal information is derived from your past experiences in the planned area. What learnings have you picked up from drilling similar wells? How much data have you accumulated firsthand? At XI, we frequently hear from clients and prospects that they know the area they’re drilling in very well, having gained hard won data and experience by drilling there for years. This gives them confidence that they know what they need to know and don’t need to look for outside sources of information for new wells in the same area.

And there’s something to this idea. Information you gain internally can be incredibly valuable. As the saying goes, experience is the best teacher, and thus there’s no replacement for the firsthand knowledge gained in an area. In addition, this keeps the data readily available, formatted to best suit the needs and workflows of your organization.

However, just relying on your own internal information, even if it’s backed by extensive experience in the area, can lead to planning in a bubble. You don’t know what you don’t know and thus will be benchmarking only against yourself, without knowing how you compare to other drills in the area. It’s difficult to know if alternative techniques or technology would improve or harm performance if all your information is based solely on your own past techniques and technology.

Additionally, internal information can only go so far in an environment where consolidation and acquisitions have many producers drilling in new areas. Access to more information can give you a more complete picture.

Relationships

Another way to collect drill planning information is by seeking input from peers, suppliers, vendors, consultants, etc. There is value in the knowledge gained from suppliers and vendors with experience in an area, and from subject matter experts. This is particularly useful if your own knowledge of the area is limited. As many drilling departments saw staffing reductions over the past few years, there is now a push toward this outsourcing of information gathering and expertise.

But be careful not to blur the lines between input and decision-making. How much of your decision-making apparatus do you want outsourced to people who are not responsible for the results? If you’re relying on vendors or suppliers or bid processes to help you acquire data, how unbiased do you expect it to be? The very nature of the bidding process demands that a company position themselves in a way that convinces you to choose them. And when depending on the data collection capabilities of a third-party provider, a lot of the information you get from relationships will tend toward anecdotal, rather than fact-based and data-driven evidence.

External data

The third major way to gather information for your drill planning is by collecting external data of past drilling in a specified area from available sources. This can provide you with a wider spread, more objective perspective given detailed information about specific wells of interest. Using public records through software solutions and data suppliers, and research and analysis based on past drilling by other operators, puts the control in your hands. OffsetAnalyst is an example of software that allows users to access and analyze nearly 180,000 digital tour reports for detailed drilling plans.

When you use external data in your drilling plans, you can benchmark your performance with competitors as well as yourself. It gives you a view of what others in the area have tried, giving you the option to test and validate ideas you might have for your upcoming drills. This data is independent and impartial, giving control to your analysts to explore and interpret it as they see fit.

For example, let’s spotlight how a prominent operator drilling Montney wells in Karr might plan to avoid/mitigate circulation losses.

A drill program designed based on only their historical experience can only draw from the 20 circulation loss instances they’d encountered. By broadening their scope and considering offsets drilled by other operators in their area, insight can be drawn from 10 other operators that recorded 580 loss circulation events!

A proper balance

While current conditions stress the importance of external data, it doesn’t mean there isn’t a place for internal information or relationships as valuable sources of information in drill planning. All of these sources are valuable methods of collecting information for your drill plan, complementing each other for a complete picture. No single source is sufficient by itself. The key to a successful drill plan is to find a proper balance of information sources, and to use them to validate each other.

Found this valuable? Download a complimentary OffsetAnalyst report.

Eliminate inefficiencies and minimize the cost associated with tour research and get nearly 180,000 digitized well records accessible at the click of a button using XI’s OffsetAnalyst

To learn more, visit our website or contact XI Technologies.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

In this second of our 2-part series looking at the last 12 months of drilling across the WCSB, we’ll be looking at activity from a geographical perspective. (In case you missed it, here’s a link to part one: Operator Spotlight. To better understand where the industry is focusing investment and development efforts, we look at the nearly 6,000 wells spudded since June 2022 regionally, to find key trends and noteworthy insights. We ask:

- What areas are seeing the most/least drilling activity?

- How does drilling vary across regions in terms of well depth and meters drilled?

- What does activity look like in each region during peak drilling months?

A Regional Breakdown Of WCSB Drilling Over The Last 12 Months

How Many Wells Were Drilled?

If You’re Using the Interactive Version: (Click here)

Click a region to highlight the wells drilled on the map.

What We’re Learning:

Based on the visual representation provided, it becomes evident that the Athabasca/Cold Lake region boasts the highest number of wells drilled, totaling an impressive 1014 wells over the past 12 months. Following closely behind is the Fort McMurray region, which has witnessed the drilling of 714 wells.

How Has Regional Drilling Activity Changed Over Time?

What This Tells Us:

These 2 visuals help us see changes in how the distribution of regional drilling has changed over the last 5 years.

- Left: A visual comparison of wells drilled in each region in the past year.

- Right: Historical drilling activity in each region year-over-year, to help spot any significant trend shifts in drilling activity compared to others, over time.

If You’re Using the Interactive Version: (Click here)

- Left: Click a Region to highlight wells drilled in the last year on the map and graph.

- Right: In the graph legend, click a Region name to highlight the wells drilled on the left and map.

What We’re Learning:

Over the past year, Athabasca emerged as the leader in drilling activities, with an impressive 463 wells drilled. Following closely behind is Fort McMurray, which recorded 333 wells drilled, securing a strong second position. Meanwhile, Grand Prairie secured the third spot with a notable 233 wells drilled. However, when we zoom out to a broader timeframe, an interesting picture emerges. Since 2018, Fort McMurray has consistently held the top position for the most wells drilled, closely trailed by Sask Area II

How Does Activity Compare Between Regions During Peak Drill Times?

What This Tells Us:

The 5 most active months for ‘Number of Wells Spudded’, and a regional breakdown of wells in each of those months.

- Left: The number of wells spudded, summarized by calendar month.

- Right: For each region, the number of wells spudded during those peak months.

If You’re Using the Interactive Version: (Click here)

- Left: Click a Month to show on the map, the number of wells drilled in each region.

- Right: Hover over the pie sections for a quick count on wells drilled in a region for a given month. Click a pie section to highlight the wells drilled in that month/region.

What We’re Learning:

This section provides valuable insights into the optimal drilling periods throughout the year. It reveals that February experiences the highest level of drilling activity, closely followed by January. As we move into the latter half of the year, September and October emerge as the third and fourth most active months for drilling operations, respectively.

How Much Drilling (In Metres) Is Happening in Each Region?

What This Tells Us:

Measuring the number of wells drilled in a region gives one perspective of drilling activity. When considering the depth & complexity of those wells, we draw a very different picture when looking at where drilling is most active.

If You’re Using the Interactive Version: (Click here)

- Hover over each region for a quick summary of: wells drilled and total metres drilled.

- Click a region to highlight it on both visuals.

What We’re Learning:

In terms of both well count and metres drilled, Athabasca/Cold Lake region is far and above the most heavily targeted. Looking closer however, the regional rankings do shift dramatically when comparing regional well counts (Figure 1).

For example, Fort McMurray was the 2nd most drilled in terms of well count, but 8th for metres drilled. Inversely, (and somewhat expected, given the zones targeted and horizontal reach) we see that Peace River/Slave Lake ranks 2nd in metres drilled, but ranked 6th in well count.

How Does Well Depth Vary Across Regions?

What This Tells Us:

The average depth in metres (measured, not TVD) for each region among all wells drilled in the last year.

If You’re Using the Interactive Version: (Click here)

- Hover over each region for a quick summary of: wells drilled, total metres drilled, and average well depth.

- Click a region to highlight it on both visuals.

What We’re Learning:

Emphasizing the results above in Figure 5, these results help draw out the ‘drilling profiles’ of various regions across the WCSB. Highlighted here, are the top regions for deepest well depth on average: Grande Prairie, Central Alberta, and Foothills.

______________

Grande Prairie, Central Alberta, and Foothills represent the most high– profile plays in WCSB today, in terms of capital spending, and drilling advancement/technology.

As companies continue to invest and innovate in the drilling space, these reports help illustrate successes in their ability to:

- Reach deeper targets and access more production with a single drill

- Improve efficiency and stretch drilling budgets further to drill more wells

Eliminate inefficiencies and minimize the cost associated with tour research and get nearly 180,000 digitized well records accessible at the click of a button using XI’s OffsetAnalyst

To learn more, visit our website or contact XI Technologies.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

Today’s article is the first of a 2-part series where we take a closer look at drilling activity over the past year.

This week, we’ll be looking at the 25 most-active operators drilling wells across the WCSB.

- Who are they, and how many wells are we talking about? How deep are they going?

- Where are they drilling?

- What are they drilling for?

The 25 Most Active Operators in the Last 12 Months

How Many Wells Did They Drill?

What This Tells Us:

A breakdown of the 25 companies who’ve drilled the most wells in the past 12 months.

- Left: A visual comparison of those 25 companies and the wells they’ve drilled.

- Right: The drilling history of each showing their activity year-over-year, to help spot any significant trend shifts in their drilling activity over time.

If You’re Using the Interactive Version: (Click here to access)

Click an operator to highlight their drilling numbers and show their wells on the map.

What We’re Learning:

When it comes to drilling wells, some companies have been leading the way with their impressive numbers. In the past year, it’s clear that Cenovus Energy has taken the top spot, showing their commitment to expanding their drilling operations by drilling a whopping 598 wells. Not far behind is Canadian Natural Resources Limited (CNRL), who takes the second position with 413 wells drilled. Another notable performer is Teine Energy Ltd. (“Teine”), securing the third spot with 283 wells drilled.

How Many Meters Did They Drill?

In terms of drilling ‘spend’, the number of wells drilled is only one part of the story. The depth & complexity of a well is the true driver of drilling cost, so let’s have a look.

What This Tells Us:

- Left: The same breakdown (as previous) of the top 25 companies for wells drilled.

- Right: Those same companies, but sorted by total number of meters of those wells drilled in the last year.

If You’re Using the Interactive Version: (Click here to access)

Find a company’s average well depth by either:

- clicking an operator or

- hovering over their corresponding color on the scatterplot to view a quick summary

What We’re Learning:

From this angle, we see a very different story playing out. With 598 wells drilled, Cenovus Energy Inc (“Cenovus”) may have outdrilled the 2nd ranked operator by 45% (CNRL, with 413 wells), CNRL drilled over 150% more total meters!

Focusing solely on Total Meters Drilled, Tamarack Valley Energy Ltd. (“Tamarack”) has claimed the leading position, having drilled an impressive 3 million meters in the past 12 months.

And yet, the plot thickens further when well depth becomes a factor; 3 operators rise above the pack when we look at average well depth. Peyto Exploration and Dev. (“Peyto”), ARC Resources Ltd. (“ARC”) and Ovintiv Canada ULC (Ovintiv) may not have topped the charts for total wells or meters drilled, but they distinguish themselves with their average well depths of 4,485m, 4,237m, and 4,132m respectively.

Where Are They Drilling?

The heavy-hitters in our industry are vastly diverse in terms of asset portfolios, growth objectives, and areas of focus. This couldn’t be more apparent, as when we observe this particular visual.

What This Tells Us:

- The primary ‘hotspots’ where drilling activity was most prevalent.

- For a more detailed breakdown of the “who’s” and “where’s”, a provincial/regional* breakdown of where our top 25 operators drilled.

* WCSB Regions – Wells throughout WCSB are assigned to one of 19 regions across 4 provinces. For reference, here’s a sample map showing all WCSB regions.

If You’re Using the Interactive Version: (Click here to access)

- Select an operator (left) to see where their drilling is most concentrated, and the distribution of wells across various regions.

- To display more than 1 operator at a time, hold ‘Ctrl’ as you click.

- Compare the well counts of specific operators in a given region by hovering over the pie-graph sections on the map.

What We’re Learning:

Not surprisingly, Alberta’s heavy oil regions dominate WCSB drilling activity with nearly 40% of wells drilled. As we look across to the western side of Alberta, the Peace River & Grande Prairie regions make up nearly 16%.

Saskatchewan drilling remains a core focus for several companies, as this makes up 28% of WCSB wells drilled last year.

Click here to access our interactive dashboard.

Eliminate inefficiencies and minimize the cost associated with tour research and get nearly 180,000 digitized well records accessible at the click of a button using XI’s OffsetAnalyst

To learn more, contact XI Technologies.

Subscribe to XI Technologies’ Word to the Wise newsletter for valuable insights and trends derived from their unique combination of enhanced industry data. Get the latest updates delivered directly to your inbox. Subscribe here.

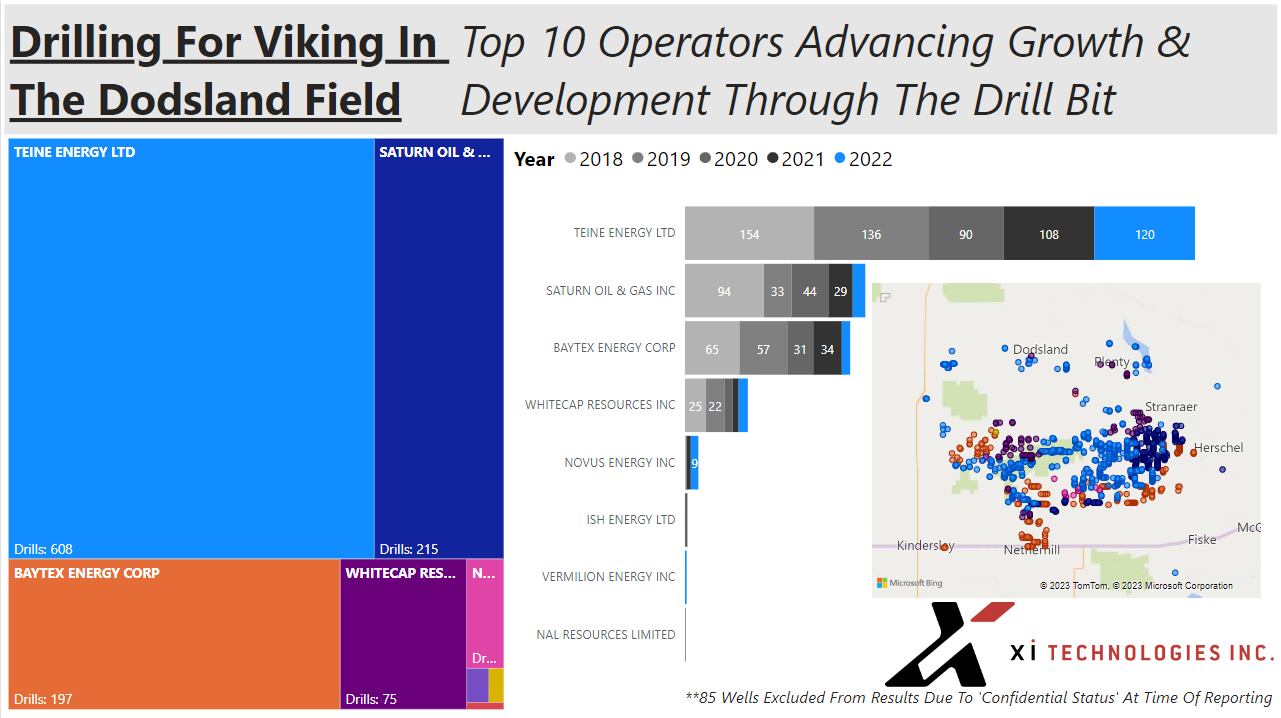

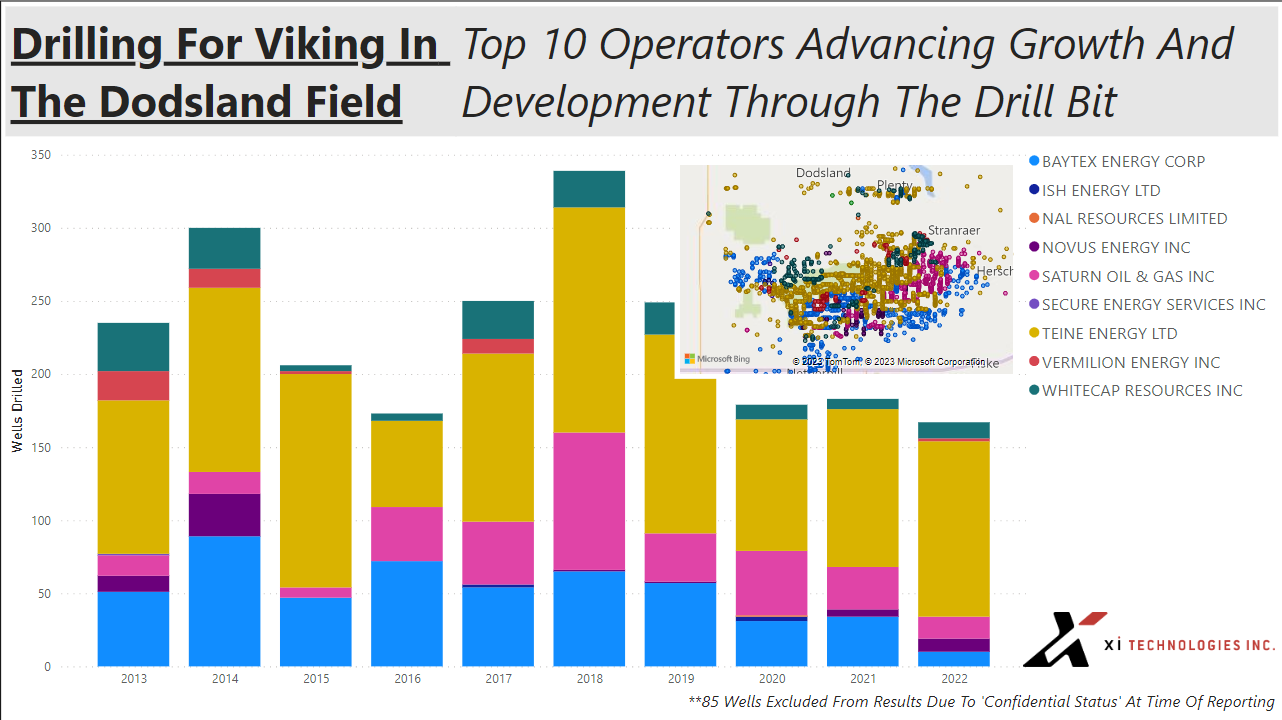

Previously, we explored the Dodsland field in Saskatchewan, which has become a predominately horizontal oil play in the Viking sand. Check out this article where we examined various aspects of Dodsland such as ownership, production history, and emissions. Building on that, we have now utilized drilling data from XI Technologies to gain a comprehensive understanding of drilling trends across the entire play.

Having knowledge of the key drilling players in the area is crucial. The graph presented below provides a clear representation of their respective activity over the last five years.

Figure 1 – Top 10 Operators Advancing G&D Through the Drill Bit

Figure 1 – Top 10 Operators Advancing G&D Through the Drill Bit

Based on this analysis, Teine Energy Ltd (“Teine”) emerges as the largest player in the region, followed by Saturn Oil & Gas Inc. (“Saturn”), with Baytex Energy Corp (“Baytex”) and Whitecap Resources Inc. (“Whitecap”) occupying the third and fourth positions, respectively.

Looking at the graphic below we get a better understanding of all the players that have been involved in drilling operations over the past decade – Baytex, Whitecap, Teine and Saturn have been the most consistent players in the area while there have been many that shifted their focus away from Dodsland over time. This was Saturn’s top field until the purchase of Ridgeback Resources Inc. Which was discussed in our blog from Feb 28, 2023, located here.

Figure 2 – Top 10 Operators Advancing G&D Through the Drill Bit Over 10 Years

Figure 2 – Top 10 Operators Advancing G&D Through the Drill Bit Over 10 Years

Let’s compare that to production during this period. The first image is a comparison of Initial Production to Rig Release date showing the increase in initial production from these more complicated drills:

Figure 3 – Initial Production vs Rig Release Date

Figure 3 – Initial Production vs Rig Release Date

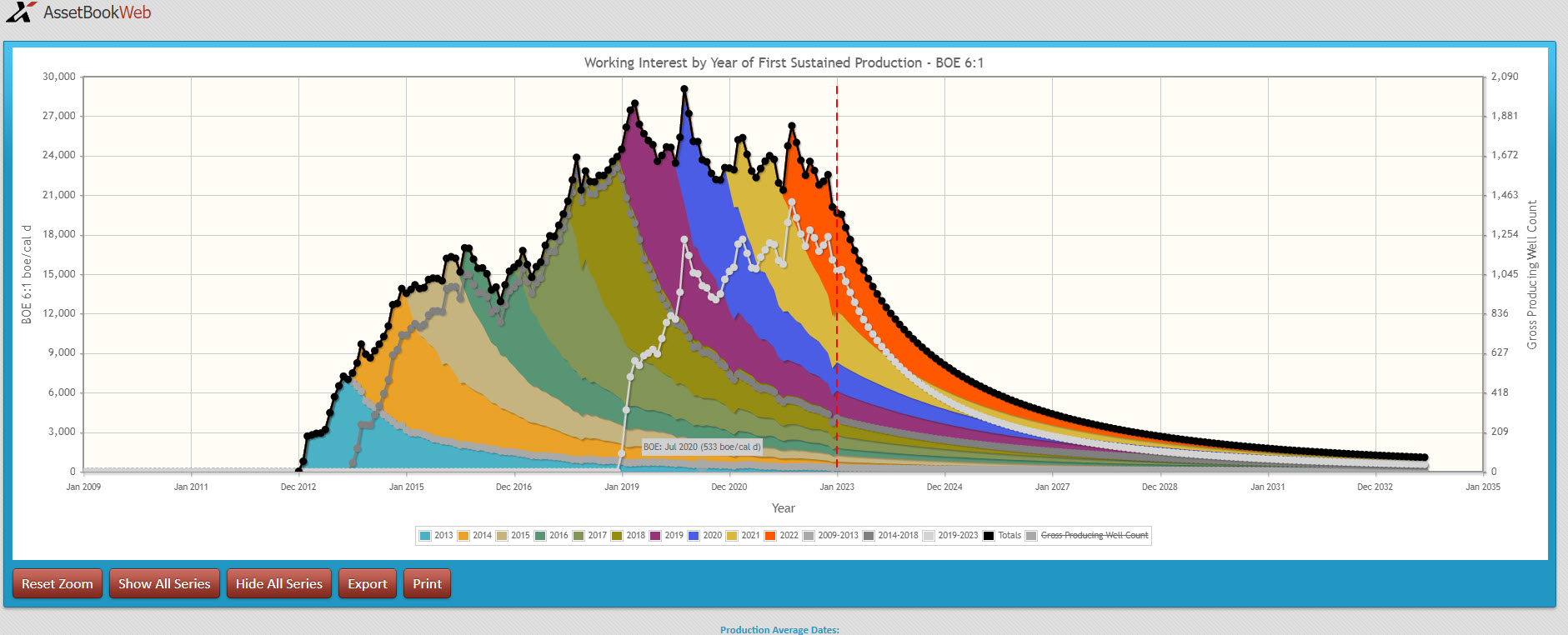

If we look at production by year, we can see that 2014, 1017 and 2018 appear to have been very successful with all recent years being relatively consistent:

Figure 4 – Working Interest by Year

Figure 4 – Working Interest by Year

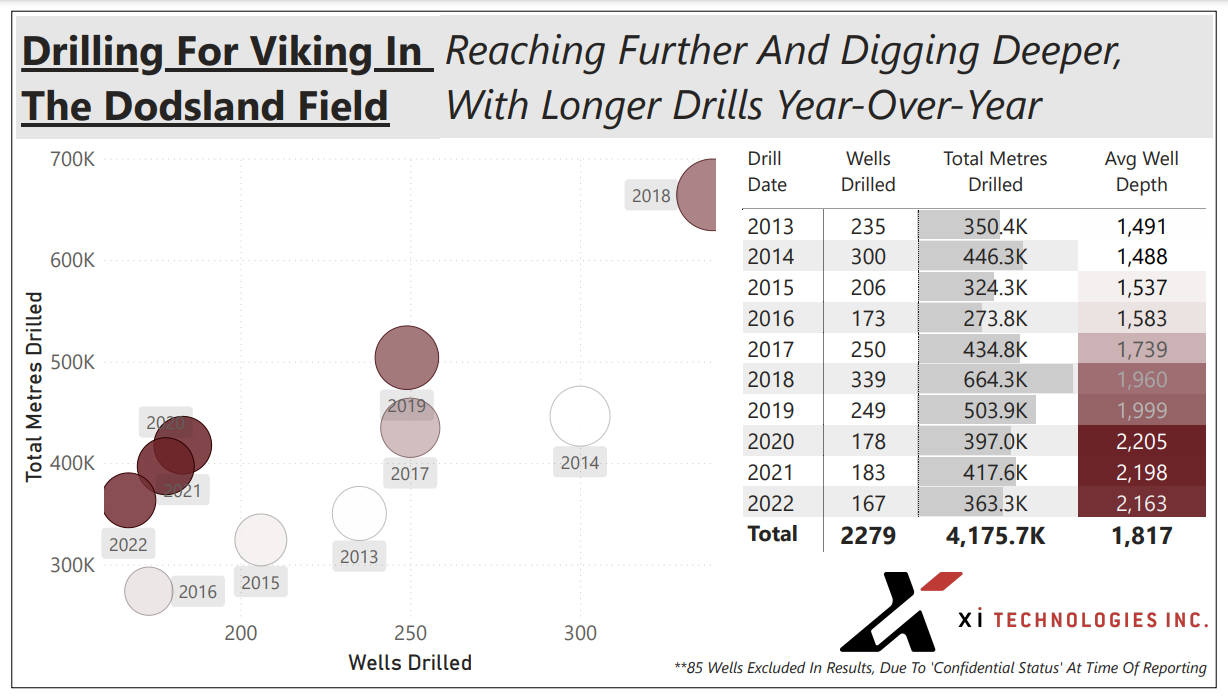

Canada’s oil and gas sector is making the global stage with top-notch innovation in well construction. Check out the graph below, where you can see companies reaching new heights (and depths) with each passing year, as they drill increasingly complex and lengthy wells as the play becomes predominately horizontal wells.

Figure 5– Depth of Wells in The Area

Figure 5– Depth of Wells in The Area

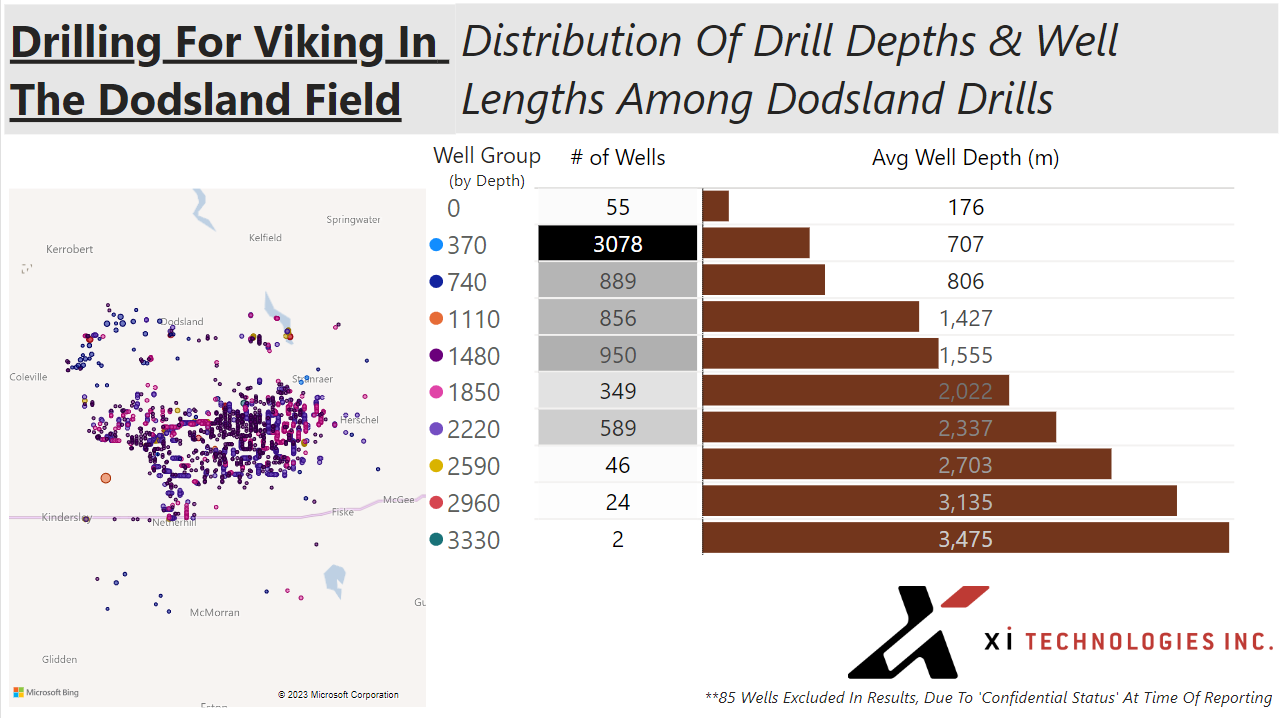

So, we just explored the trending ‘reach’ as drills continue to lengthen, but of course not all wells are created equal.

As shown in Figure 6, Dodsland has seen a broad spectrum of drilling techniques, with the majority leaning toward shorter wells (350-750m). Should this area continue to remain a hotspot however, we can surely expect the scale to tilt in favor of these deeper depth groups.

Figure 6 – Distribution of Drill Depths & Well Lengths

Figure 6 – Distribution of Drill Depths & Well Lengths

You can also access the free and interactive dashboard with the above data on Dodsland.

To learn more about how XI’s OffsetAnalyst software can help you improve drilling research and performance, contact XI Technologies.