Word to the Wise: Alberta’s IWCP is decreasing non-compliant well counts by nearly 40 per cent

July 2, 2019

Alberta operators are making significant efforts to ensure compliance with provincial standards for suspended or inactive wells.

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

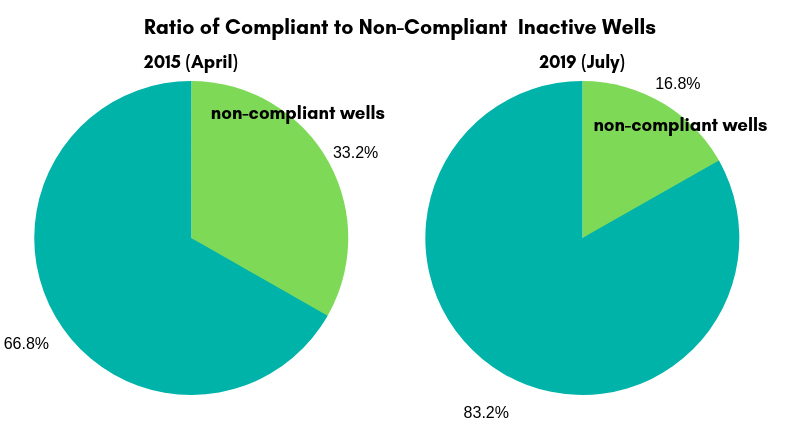

In its first four years, the Inactive Well Compliance Program (IWCP) under AER Directive 013, decreased the number of non-compliant inactive wells in the province from 25,808 on April 1, 2015, to 15,628 as of yesterday, July 2, 2019. That’s a decrease of about 39.5 percent in total non-compliant well counts, and a major sign that Alberta operators are making significant efforts to ensure compliance with provincial standards for suspended or inactive wells.

Digging a little deeper into the data, XI Technologies data specialists found that of the 77,627 licenses on the IWCP list as of April 1, 2015, about one-third – or 25,808 of the total inactive wells list – were flagged as non-compliant. By April 1, 2018, the status of 9,716 of those had changed to compliant.

For interest’s sake, XI ran an estimated Asset Retirement Obligation (ARO) cost to determine the approximate dollar impact created by those 9,716 compliant wells. Using the December 2016 status of those wells and XI’s 2018 ARO Cost Model, the estimated ARO on all non-compliant Alberta wells would have been about $940,000,000 as of December 2016. Using the same 2018 ARO Cost Model and incorporating the various stages of abandonment performed on those 9,716 now compliant wells, the ARO value appears to have decreased to around $520,000,000 as of April 2019. That’s an approximate ARO change of $420,000,000 resulting from operator compliance with Directive 013 and the IWCP.

Also encouraging is the fact that 17,977 wells from the 2015 IWCP list went from being classified as suspended to being active by April 1, 2018. The April 2019 gross production from those licenses is 210,073 boe/d. This means they are generating production and royalties – the ideal outcome for all concerned. To learn more about how to find production opportunities from the IWCP list, contact XI.

It is important to note that Directive 013 is a compliance directive, not mandatory decommissioning legislation as has been recently implemented in British Columbia. BC’s legislation is an effort to deal with the backlog of inactive sites in a timely manner and prevent the continued growth of the inactive well inventory. Their ambitious timelines are forcing companies with assets in BC to take a serious look at how they will manage liabilities to meet these new regulations.

While Alberta’s Directive 013 is acting as a catalyst to encourage higher compliance rates among inactive sites, the reality is that the IWCP list continues to grow. As of July 2, 2019, Alberta’s IWCP list includes 93,087 inactive wells – an increase of 15,460 since 2015. Of today’s inactive wells, 71,435 or about 75 percent have a compliant status. This is a solid indicator that operators are making efforts to adhere to Directive 013 guidelines. But the growth in the IWCP list since 2015 is an indicator that Alberta still has work to do to encourage more decommissioning or reactivation of wells with production.

XI’s ARO Manager is the ideal tool to help companies evaluate, track, manage, and report on asset retirement obligations. Companies can utilize a standardized cost model to assess total liabilities, or they can import alternate cost models and perform scenario analysis to determine the most efficient, low-cost approach to meeting the mandatory abandonment and reclamation deadlines.