M&A Deep Dive – Ovintiv Acquires Montney Assets

November 20, 2024

Ovintiv Inc (Ovintiv) has announced that it is acquiring Paramount Resources Ltd (Paramount) assets for $3,325 billion. Last year, Tourmaline acquired Bonavista for $1.45 billion, which, based on AssetBook’s 6:1 ratio, translated to a valuation of about $30,400 per barrel of oil equivalent per day (boe/d). Later that year they purchased, which Tourmaline’s estimated the production at 29,000 to 30,000 boe/d with valuation of approximately $44,000 per boe/d. Ovintiv estimates this deal to provide approximately 70,000 boe/day to their production putting the boe/day price at about $47,000.

XI Technologies evaluated this transaction through different lenses using AssetSuite software tools and looked at each company’s asset profile, plus the combined entity, to gain valuable insight into the transaction. Consideration was also given to the fall out and which other players in the area may be affected. This deep dive gives a comprehensive understanding and full picture of the resulting acquisition.

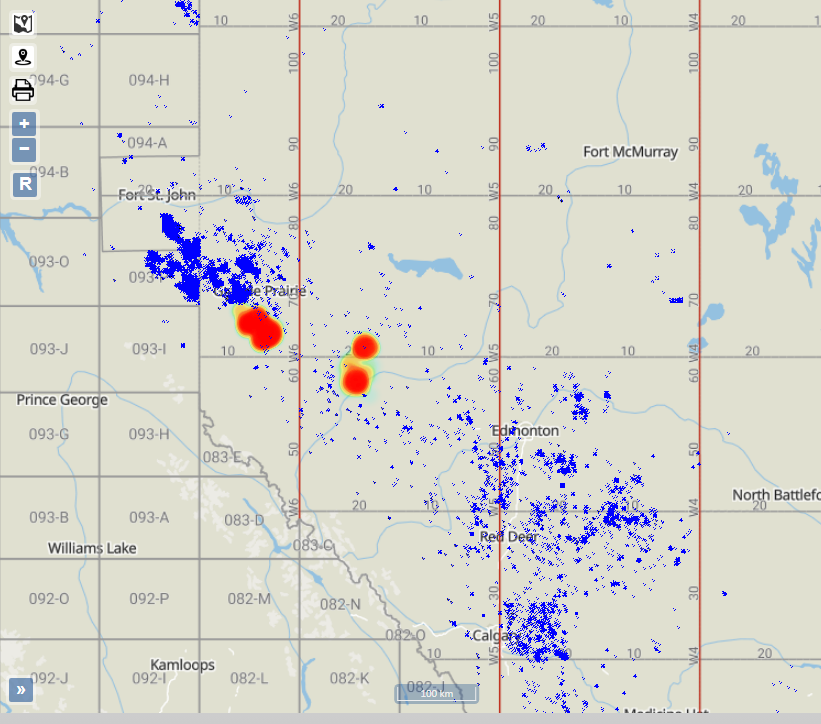

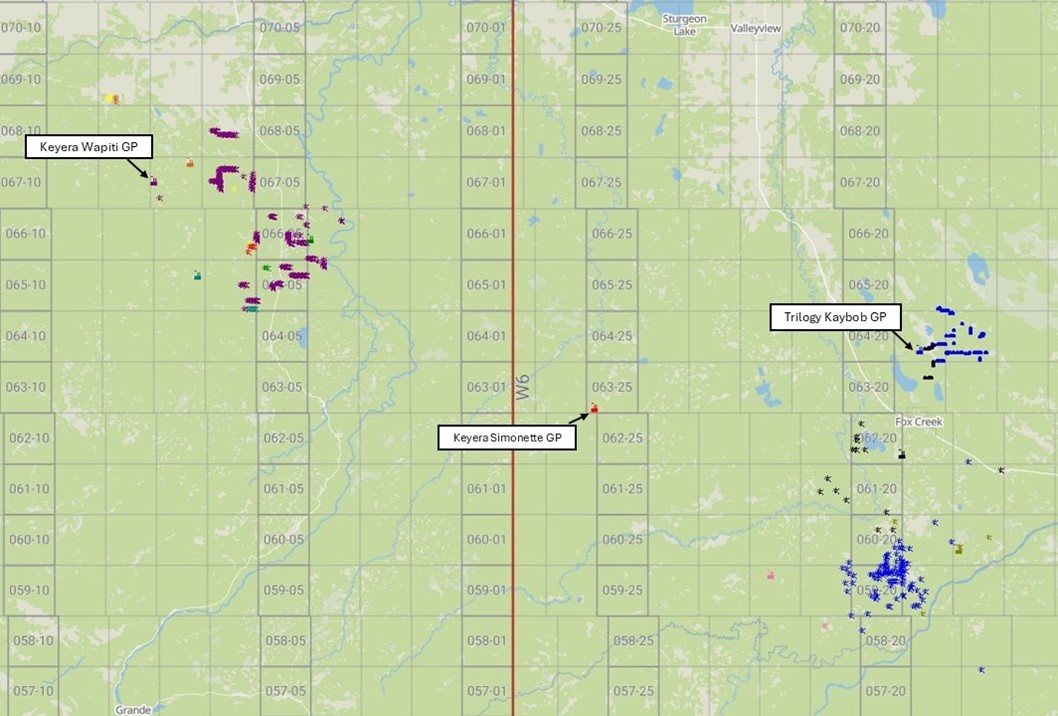

The best way to see the core of this deal is to overlay the production heat map of Paramount’s Montney wells over Ovintiv production.

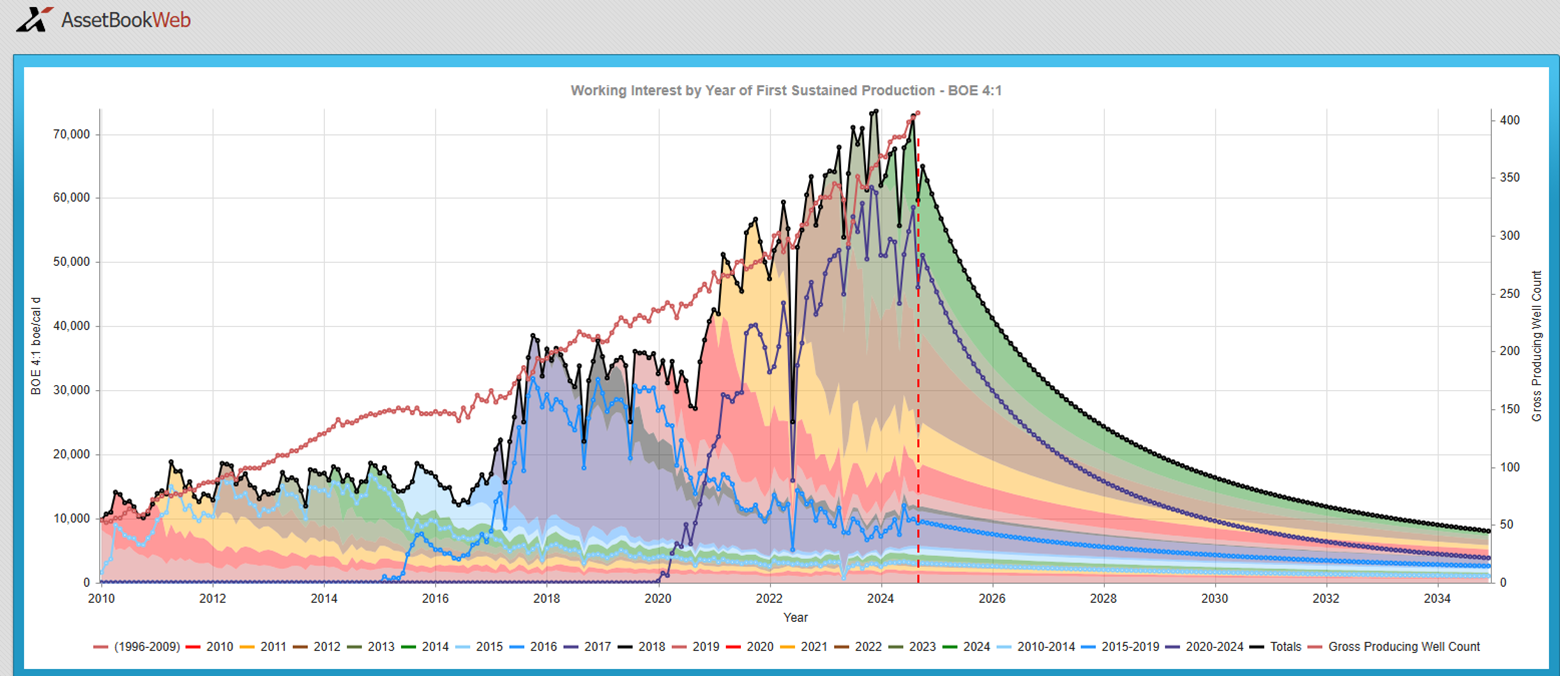

Looking at this map, there are two areas of Montney production for Paramount with only one of the two areas referenced in their press release; the one just south of Grande Prairie. This acquisition is a Montney asset purchase which is liquid rich and relatively new as shown in the production time slice graph below.

A CORE AREA OVERVIEW

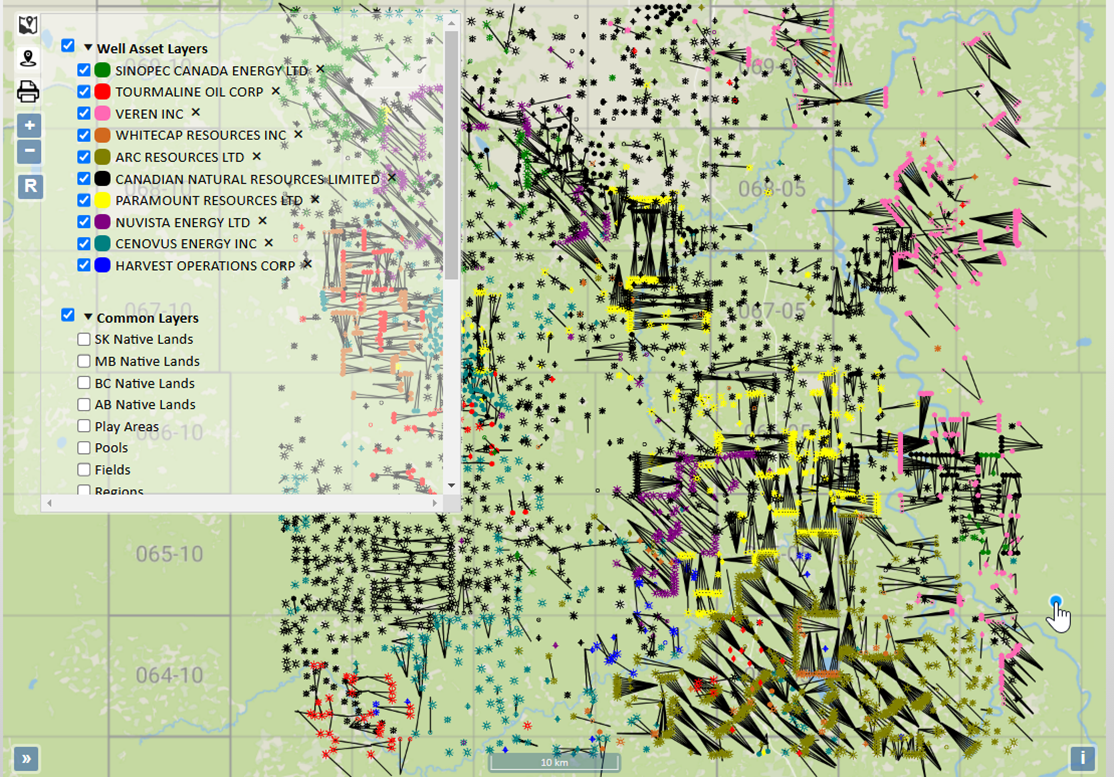

With the AssetBook we can create a rough area around where Paramount’s Grande Prairie Montney assets fall and see all other players in that region. Arc Resources Ltd is the largest player in this area with approximately 34k boe/d or 24% of the total area (Source: AssetBook, using a 6:1 boe rate). The area has 48 producers and 80% of the production is held by the top 5 producers.

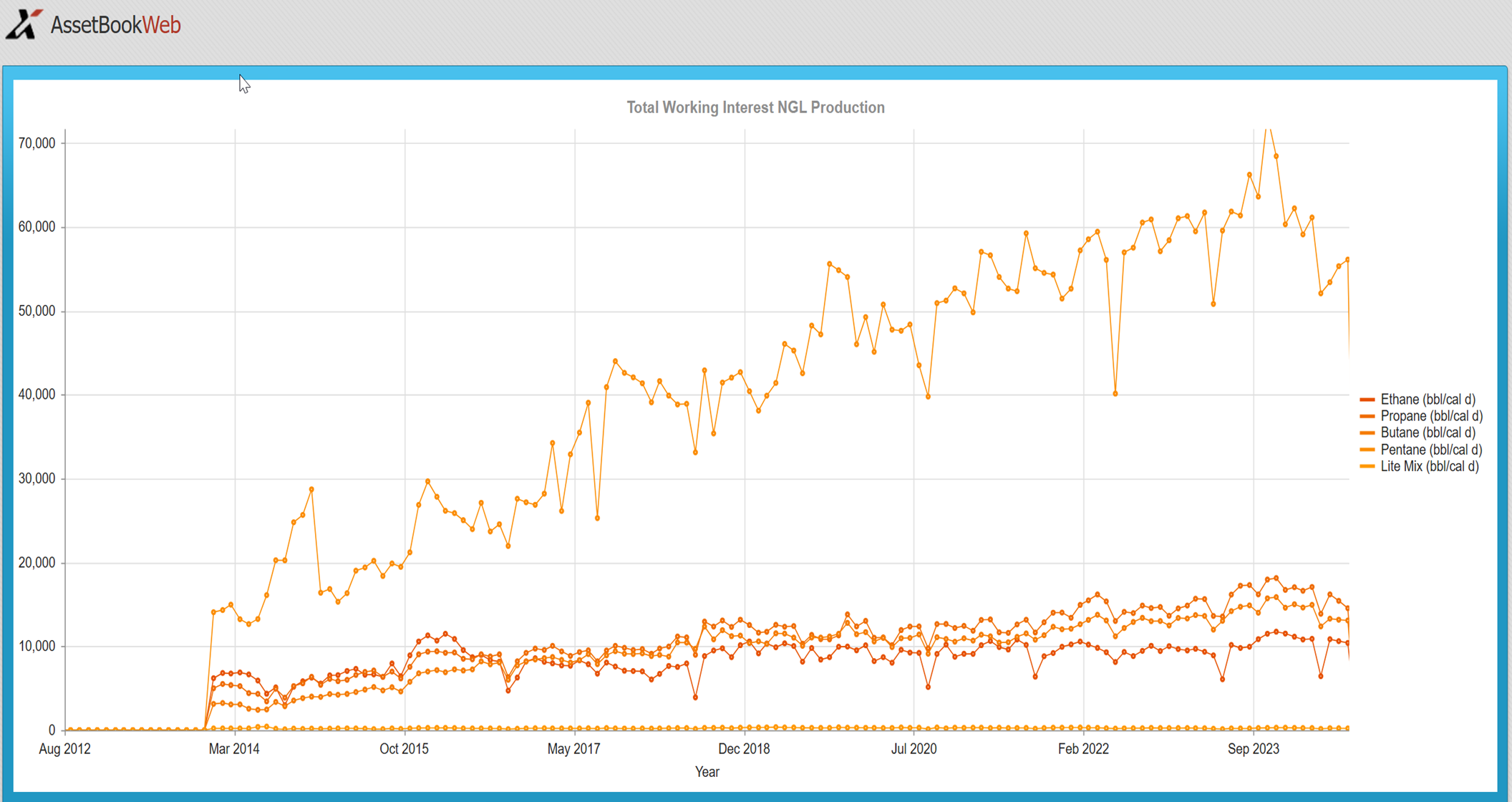

This is primarily a gas producing area with a little more than 74% of the production coming from gas. This area is Natural Gas Liquid rich. To see a breakdown of companies in this area including their NGL production please click here.

We can also graph the NGL production over time in this area and see that it is steadily increasing:

Where does Paramount Montney Gas and NGL production go for Processing?

Using XI’s newest Production Chain feature, we can instantly see where Paramount’s Montney assets are likely going for processing and to market. We’ll focus on gas processing, as most produced oil here leaves for refining via transport from multiwell batteries (a particularly large crude multiwell proration battery is Paramount’s Para Kaybob which sits adjacent to Paramount’s Trilogy Kaybob Gas Plant).

In our estimation, the majority of the gas and NGLs are processed at two plants, Paramount’s Trilogy Kaybob Gas Plant, and Keyera’s Wapiti Gas Plant. It has not been disclosed if Paramount’s Trilogy plant is part of the acquisition. Interestingly, the entirety of the active well inventory (210 wells) at Keyera’s Wapiti plant appear to belong to Paramount Resources.

If you’d like to learn more about these assets, or have a demo of our newest Production Chain feature that traces the molecule from well to facility market point, please contact XI at support@xitechnologies.com.

While analyzing deals after they are announced is interesting, XI’s tools are uniquely positioned to provide advanced information for proactive scoping. This allows you to look at your own deals in the works and mitigate potential risks or find new deals that offer better value.

The evolving landscape of emissions regulations in the oil and gas sector demands a nuanced understanding of individual company efforts. As we move towards a sustainable future, dissecting these graphs and exploring the underlying dynamics becomes crucial in shaping effective regulatory frameworks and industry practices.

Here’s how YOU can prepare: Join our “Expert Xchange” on Emissions presented by GLJ and XI Technologies.

- What: Learn more about the mandates affecting Alberta’s oil & gas sector, what’s coming, how you’ll be expected to track and report on your own emissions, and how you can manage the process related to M&A activities and line of sight planning.

- Where: XI Technologies – 1700, 734-7th Ave SW Calgary T2P 3P8

- When: Dec. 3 @ 8:15am

- How: This is a live event & space is limited – Register HERE

Upcoming Certification Course:

ARO Manager For Financial Tracking and Reporting Certification Course provides practical, hands-on professional development for anyone interested in expanding their knowledge of Asset Retirement Obligation (ARO) tracking and reporting.

When: December 10th and December 12th at 8:30am (almost full)

When: February 25th and February 27th at 9:00am

Space is limited so be sure to register now for the course. This is 2 x half- day course taking place in person at the XI office.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.