Unpacking Directive 011: What You Need to Know

July 17, 2024

In a recent communication to our clients, XI Technologies announced a significant update to its AssetBook ARO Manager’s XI LLR cost model, aligning it with the revised Directive 011 from the Alberta Energy Regulator (AER Bulletin 2024-16). This update marks a proactive step by XI Technologies to integrate the latest regulatory changes, ensuring compliance and accuracy in their offerings.

These costs impact calculations with the AssetSuite modules of AssetBook, LLR/LCA, and ARO Manager. XI uses Directive 11 costs to generate Corporate LLR value, LLR analysis reports, LCA reports and Graphs, and ARO cost models for calculations of retirement obligations.

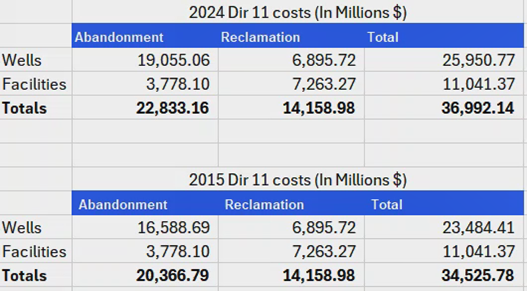

We did some comparison of impact of the update to the Directive 11 costs, and XI calculates that the new costs will represent an increase of 7% in overall liabilities across Alberta.

Key Updates in Directive 011

The revised Directive 011 focuses on enhancing the accuracy of liability cost estimates related to well abandonments under the new Liability Management Framework. Here are the primary updates highlighted:

- Revised Regional Well Abandonment Cost Tables: These tables, now detailed in section 5 (formerly section 6), include updated depth ranges and liability costs for categories such as Empty not perforated, Empty perforated, Tubing Only, and Tubing & rods across different well depths.

- The average increase in costs based on these updates is 48%, with the break down in each of the areas as follows:

- Athabasca / Peace River: Average increase of 68%

- Calgary / Edmonton: Average increase of 29%

- Drayton Valley: Average increase of 88%

- High Level: Average increase of 131%

- Lloydminster: Average increase of 3%

- Medicine Hat: Average decrease of 34%

- When looking at these updated values vs the XI 2024 Cost model, they are 41% higher than XI’s values (previously 39% higher).

- The average increase in costs based on these updates is 48%, with the break down in each of the areas as follows:

- Enhanced Parameters for Vent Flow Repair and Gas Migration: The updates aim to provide more accurate cost assessments in these critical areas.

- Vent Flow was decreased by 7%, and Gas Migration values were increased by 118.6%. In this iteration of the Dir 11 costs, the Vent Flow and Gas Migration problem costs were aligned to be approximately the same, which is vastly different than the 2015 costs published. Ground Water Protection problem costs remain unchanged.

- In XI’s Cost Model, we had already identified that the costs for the Vent Flow and Gas migration costs for abandonment were nearly identical. With the changes to the D11 costs, XI’s 2024 Cost Model is now an average of 29% lower for these problem areas than the AER’s current costs.

If you’re looking for a comprehensive comparison of XI’s 2024 Cost model vs the 2024 Directive 11 cost model, or a comparison of the 2 Directive 11 cost models, download the Excel sheet.

Addressing Client Concerns

In response to the announcement, clients have raised several pertinent questions about how these updates will affect their operations and values from AssetSuite.

AssetSuite includes 1 columns and 2 modules which utilize the Directive 11 cost values:

- The column XI AB LLR (Company) found under the Asset Summaries shows a calculated corporate Licensee Liability ratio based on Directive 6 methodology

- The LLR / LCA module uses the Directive 11 costs to generate an LLR analysis report, LCA reports, and LCA graphs used to evaluate information under the lens of Directive 88.

- and ARO Manager, allowing companies to view the impact of deals on their bottom line Asset Retirement Obligations (ARO) as well as calculations of their corporate ARO for financial reporting purposes.

Updating each of these areas required work from the XI teams to ensure that the values were updated to reflect these changes as quickly as possible.

- When will the numbers in the XI database start changing?Within ARO Manager, XI proactively created an updated, globally available LLR Cost Model on June 27 (the day the bulletin was released by the AER), BUT we did not update any client projects to use these new values (and we never will). Publishing this global cost model allowed users to start applying this new cost model to any of their projects as they saw fit without having to create new cost models themselves. As each client works through how this update applies to their ARO calculations, they can quickly apply the updated Directive 11 values by simply changing the cost model applied to the project, easily quantifying what the change will mean to their bottom line or possible pending deals.The LLR /LCA Module allows users to generate reports and graphs detailing the liability costs and Directive 88 information as they investigate opportunities. The values used in these reports and graphs will be updated when we receive the next month’s production data – expected to be rolling out on July 25th (or sooner – depending on government release of public data). This will apply to the following reports: LLR Analysis download, LCA Report, LCA Overview graphs, ARO Company Report, and the ARO Company Inactive Reports

- Will it be relatively easy to identify the differences in the liability numbers between the old and the new regulations

Projects and data in ARO Manager clearly shows all clients which cost model is applied to the calculated values, both on screen and within any exports. If the global cost model has been applied, the naming convention of the cost model shows the costs being used are due to the AER Dir 11 update.LLR and LCA reports will automatically be switched over when the monthly data is rolled out. There will be an indication in the form of a banner with the AssetBook site as well as on the Data Release Notes page. Comparison between the two different cost regulations will only be available if the client has subscribed to the Historical Module of AssetSuite.

- Will this data be available at both the company level and well license level?

Easy answer is YES! ARO, LLR and LCA all calculate liability values at a license level, with all reports that can be generated being available at a corporate level if preferred. This enables comprehensive assessment and planning for affected entities.

Looking Ahead

XI Technologies anticipates further updates to Directive 011 in the fall, with AER plans to phase out Directive 6 and its associated programs by fall 2024. Detailed information on these updates will be communicated as it becomes available.

For further details, the revised Directive 011, historical liability estimation records, and a detailed methodology presentation are available on the AER website.

In conclusion, the proactive approach by XI Technologies in integrating the latest regulatory changes underscores their commitment to providing robust tools and information for navigating evolving industry standards. Clients are encouraged to reach out to their account manager or customer support team for any clarifications or inquiries regarding the impact of these updates on their operations.

—

Upcoming Events:

AssetBook Production Chain: Wells To Facilities (W2F) Product Demo.

July 23rd – 11:00am MST

With our latest feature – AssetBook Production Chain: Wells To Facilities (W2F) feature, you can delve into the intricate network of well-to-facility routes, with the aim of identifying processing and market points, for companies, areas, or specific groups of assets. If you’re interested in learning more about AssetBook Production Chain, be sure to register for the demo to learn how to make the difficult look easy.

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.