M&A Snapshot – Tourmaline Oil acquires Bonavista Energy

October 24, 2023

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

Tourmaline Oil Corp (Tourmaline) has announced that it is acquiring Bonavista Energy Corporation (Bonavista) for $1.45 billion.

When assessing this transaction through different lenses using AssetSuite software tools, we look at each company’s asset profile, plus the combined entity, to gain valuable insight into the transaction. We also consider fall out and which other players in the area may be affected. Our deep dive ensures the reader has a comprehensive understanding and full picture of the resulting acquisition.

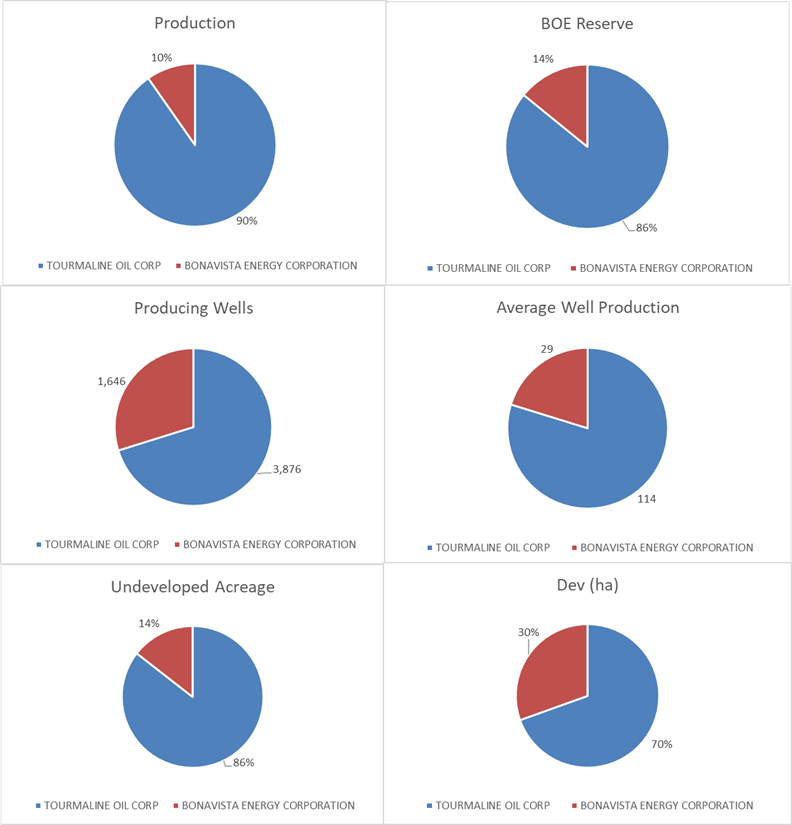

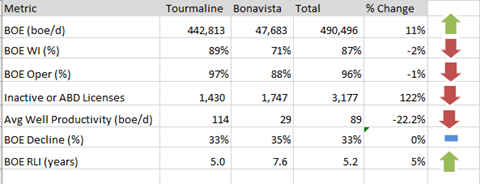

Tourmaline contributes 90% of the production to the combined entity. Tourmaline tends to be the licensee on most of their production, operating 97%. Tourmaline has a high working interest percentage of 89%. Bonavista has a lower operating interest of 89% and tends to have more partnerships with a working interest average of 71%. This will play into looking at the liabilities of Bonavista as it will be important to address non-operated working interest liabilities to gain a fulsome picture.

While the absolute numbers tell one story, accretion and dilution metrics tell us more. Looking at the AssetSuite summary, we can calculate some accretion and dilution metrics for this transaction relative to the increase in production.

Per Figure 2 below, Tourmaline’s production base will grow by 11%, while operatorship was negligibly affected, decreasing by 1%

As we can see, contribution of inactive licenses, and a decline in average well productivity did have a net negative effect but boe/d and a slight increase in RLI are accretive.

Of note, further strategic rationale for the deal is the acquisition of existing tax pools generated by Bonavista. As discussed in XI’s Whitepaper: The Tax Man Cometh – How Strategic Acquisitions Can Help Your Issue, Tourmaline was specifically noted as a company that had recently passed its crossover threshold where taxable income exceeded available tax pools. In its 2023 Q2 Financial Statements, the company recorded three and six-month income taxes of $54.6 million and $253 million, respectively, compared to nil and nil from the same periods in 2022. Tourmaline noted, “In the third quarter of 2022, the Company became taxable as a result of taxable income being in excess of available tax deductions.”

CORE AREA

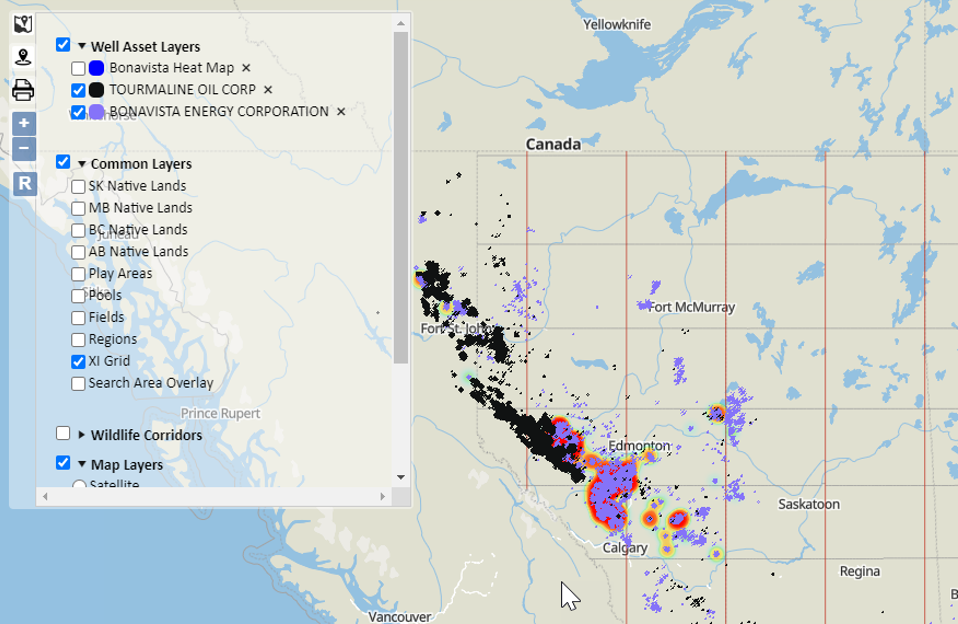

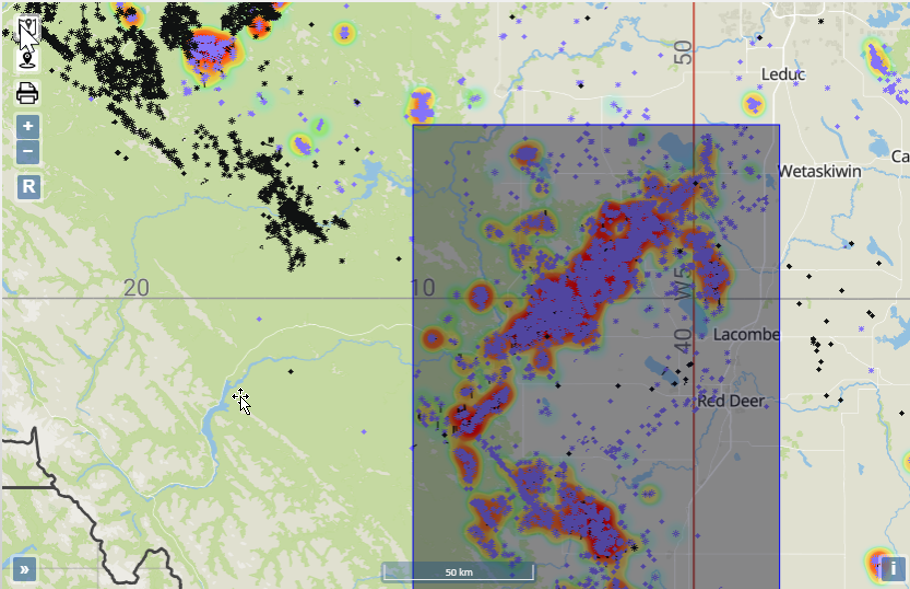

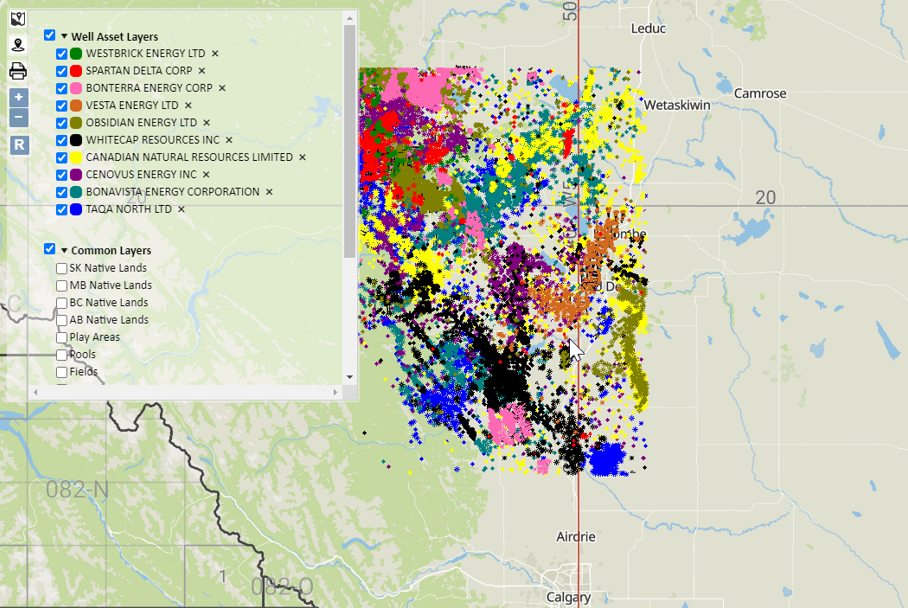

The best way to see the core of this deal is to overlay Bonavista’s production heat map on the Tourmaline and Bonavista well map. It becomes apparent that the deep basin and central deep basin are at the core of this deal, but there are some non-core properties that are being purchased east of these.

Expanding Tourmaline’s Deep Basin assets, this acquisition pushes Tourmaline south and east from their current base. Both companies are primarily gas companies with over 90% of their production from gas. It is important to note that Alberta does not track liquid at a well head and much of this gas is most likely liquid rich.

Let’s explore two outcomes of this Bonavista deal: one will likely create a Tourmaline core that will affect other players in the area, while the other appears to be outside of Tourmaline’s area of focus and may become a good divestiture for them.

AN EXTENDED CORE AREA

With the AssetBook we can create an area around each of these and see all other players. TAQA North Ltd. is the largest player in this area with approximately 38,000 boe/d of the 326,000 boe/d producing from this area. The area has 245 producers and 63% of the production is held by the top 10 producers. This is primarily a gas producing area with a little more than 80% of the production coming from gas and only 24 companies producing predominantly oil. Download more information on the companies in this area here.

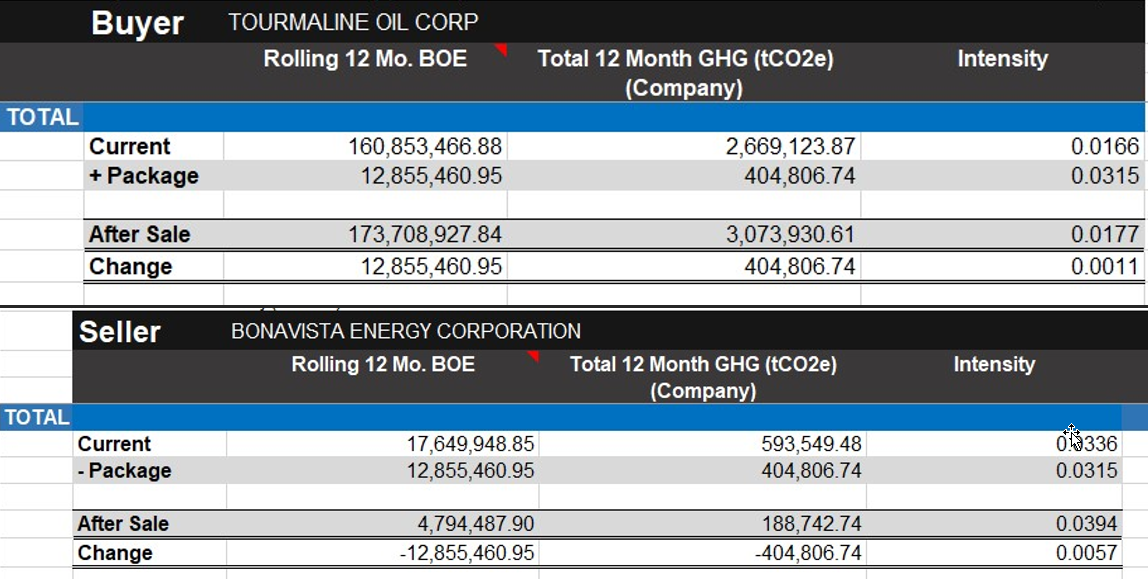

EXTENDED CORE AREA EMISSIONS

Taking a high-level look at Scope 1 Emissions implications on the deal, Tourmaline’s extended core area from Bonavista acquisition contains about two thirds of Bonavista’s total corporate emissions, adding an approximate 400,000 tCO2e (trailing 12 months). The assets in this area have an estimated emissions intensity of 0.032, approximately double that of the 0.017 XI-calculated Scope 1 corporate intensity of Tourmaline. The net impact of the deal will have added a minor bump to Tourmaline’s corporate intensity by approximately 0.002.

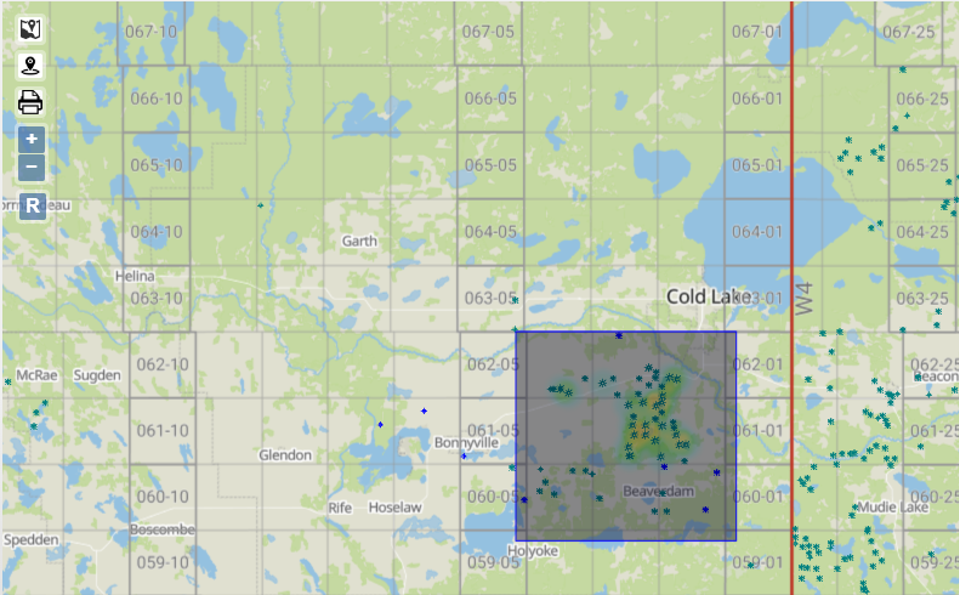

NON-CORE AREA ASSETS

Northeast of the above core of the acquisition we can see a different ownership structure. Here Canadian Natural Resources is the largest player with 51% of the production of this area. Not surprising given the area is smaller, the ownership is more concentrated with the top 5 companies owning over 97% of the production. However, this Bonavista production could be a good acquisition for someone else, as there is also 1,214 ha of undeveloped land and a low decline of only 6.98%. This area appears to be well outside of Tourmaline’s area of interest. If you’d like to learn more about these assets, please contact XI at support@xitechnologies.com

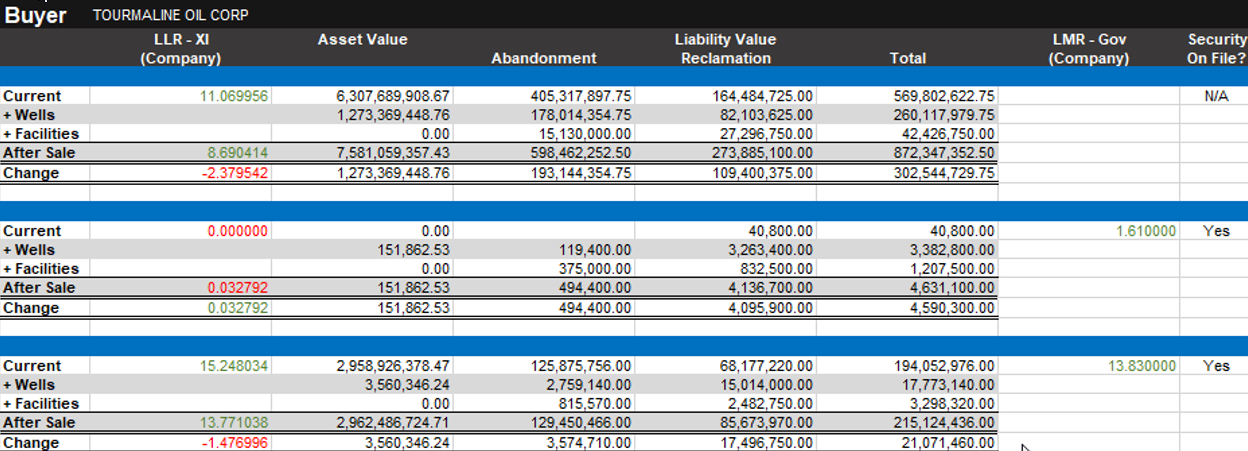

Liability Overview

Using an LLR analysis, Tourmaline is in a strong position to absorb these liabilities with an initial estimated LLR of 11 (for Alberta) based on current public government information. This deal lowers their original LLR calculation to 8.69. According to AssetBook’s LLR Module (which only accounts for licensed assets), Tourmaline will absorb approximately $328,200,000 in deemed liabilities, mainly from Alberta.

In this case, as Bonavista does a 71% working interest average, it would be important to also look at their actual Asset Retirement Obligation using a tool like AssetBook ARO Manager. If you are interested in seeing this, please contact us at support@xitechnologies.com

While analyzing deals after they are announced is interesting, our tools provide the leg up required to look at your own deals or find deals proactively to create better value. For more results, contact XI Technologies to learn more about how XI’s AssetSuite software can analyze potential mergers, acquisitions, and opportunities, including examining potential liabilities and emissions.

Discover how XI’s ARO Manager can help with the planning and reporting of liability management. Visit XI’s website or contact XI for a demo.