WTTW: Breaking Down Silos: Uniting Finance and Operations Teams

April 16, 2024

In the vibrant business landscape, the tag team match between finance and operations has taken centre stage. Once seen as solo players, they’re no longer content with playing in separate sandboxes. These powerhouses are teaming up to break down barriers, boost productivity and efficiency, unlocking profit potential by sharing savvy strategies to foster teamwork and triumph together!

Understanding the Gap

Finance and operations teams often operate in silos, with distinct objectives, metrics, and communication channels. Finance teams focus on financial planning, analysis, and reporting, while operations teams are responsible for the day-to-day execution of business activities, such as production, supply chain management, and customer service. This separation can lead to misunderstandings, misaligned goals, and missed opportunities for optimization.

The Importance of Collaboration

Collaboration between finance and operations is vital for several reasons:

- Optimizing Resource Allocation: Finance teams provide insights into budgeting, cost analysis, and investment decisions, helping operations teams allocate resources efficiently and prioritize initiatives that drive value.

- Strategic Decision-Making: Operations teams possess valuable frontline insights into processes, workflows, and customer needs. By collaborating with finance, they can leverage financial data to make data-driven decisions that align with broader organizational objectives.

- Risk Management: Finance teams assess financial risks and opportunities, while operations teams manage operational risks associated with production, logistics, and quality control. Collaboration between these teams enhances risk identification, mitigation, and contingency planning.

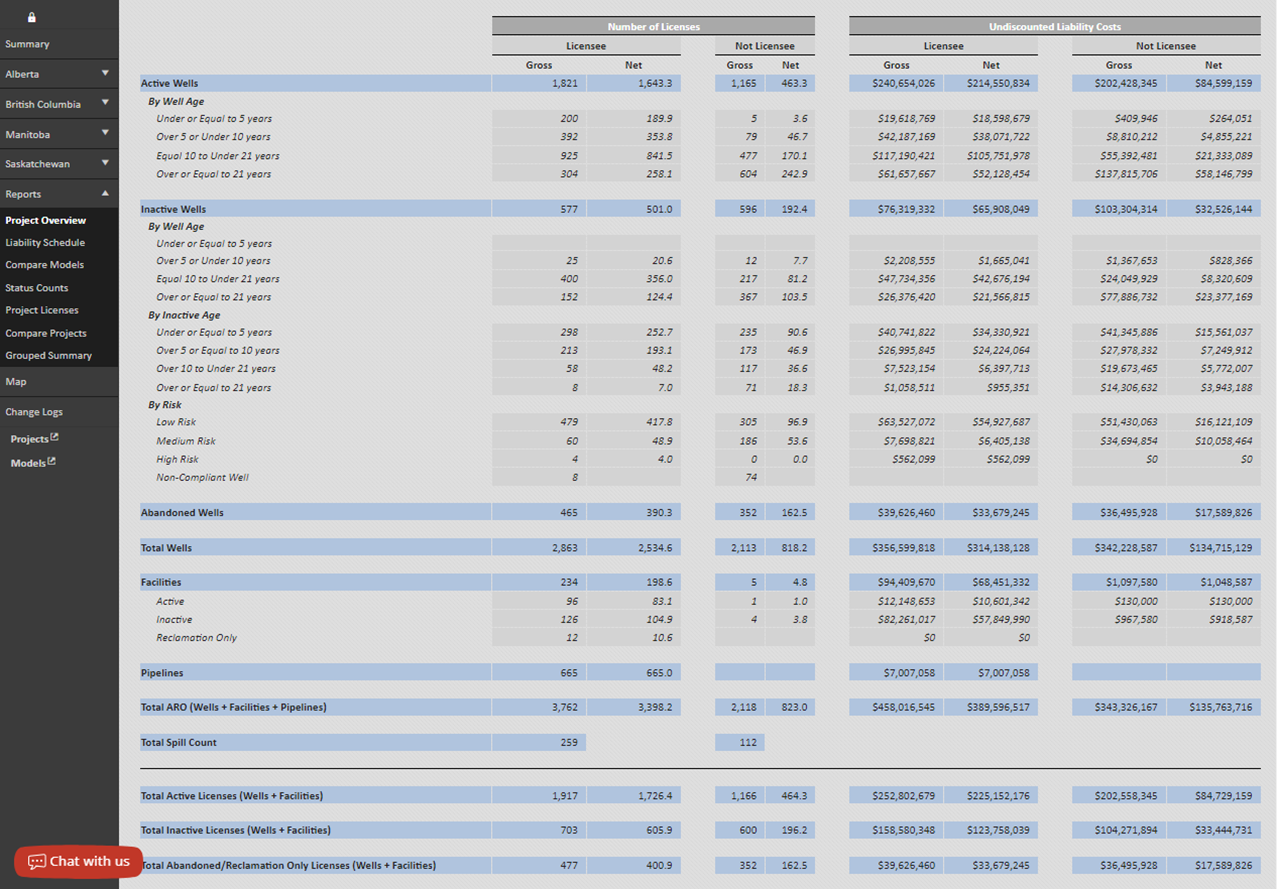

- Performance Measurement: By integrating financial and operational KPIs, organizations gain a comprehensive view of performance across functions. This holistic approach enables proactive management and continuous improvement. XI Technologies AssetBook ARO Manager helps reassure auditors with comprehensive change records and SOC 1 compliance.

Strategies for Bridging the Gap

To bridge the gap between finance and operations teams, organizations can implement the following strategies:

- Establish Clear Communication Channels: Encourage open communication and collaboration through regular meetings, cross-functional projects, and shared platforms for data exchange.

- Define Common Goals and Metrics: Align financial objectives, such as cost reduction and profitability, with operational goals, such as productivity improvement and customer satisfaction. Develop shared KPIs to track progress and measure success.

- Promote Cross-Functional Training and Development: Provide opportunities for finance and operations professionals to gain insights into each other’s roles, processes, and challenges. This cross-functional understanding fosters empathy, mutual respect, and collaboration.

- Utilize Technology and Analytics: Invest in integrated systems and analytics tools that enable real-time data sharing, analysis, and forecasting across finance and operations functions. XI’s ARO Manager is an example of a best-in-class tool for ARO tracking and reporting, leveraging automation to streamline processes and reduce manual errors.

“The efficiency of using ARO Manager vs an Excel worksheet has equated to the work of almost a full-time person for at least one month and has eliminated many formula-based errors in calculations.” Nicole K., mid-size E&P

- Encourage a Culture of Collaboration: Foster a culture that values teamwork, innovation, and knowledge sharing. Recognize and reward cross-functional collaboration, and celebrate successes achieved through joint efforts.

Bridging the gap between finance and operations teams is essential for driving organizational success in today’s competitive business environment. Using a tool like ARO Manager from XI Technologies fosters collaboration, communication, and alignment of goals and strategies. Organizations are unlocking synergies, mitigating risks, and achieving sustainable growth.

Investing in cross-functional collaboration tools and processes is not only a strategic imperative but also a catalyst for innovation, efficiency, and resilience in the face of evolving market dynamics. Together, finance and operations teams can chart a course toward long-term prosperity and competitive advantage.

—

Join us for our ARO Manager for Financial Tracking and Reporting Webinar:

April 25th 10:00am – 11:00am (MST) – Register Now to reserve your spot!

XI Technologies would also like to extend an invite to take part in the AssetBook ARO Manager for Financial Tracking and Reporting Certification Course. This is a chance to gain first-hand experience on the software.

The in-person course will span two morning sessions (April 30th and May 2nd). Due to its hands-on nature, registration capacity is limited.

More information on the course, and how to register is available here.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.