Word to the Wise: M&A Snapshot – InPlay Oil Corp. and Prairie Storm Resources Corp.

November 2, 2021

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Note: This article is a collaboration between XI Technologies and Ryan Ferguson Young of Earth Horse Energy Advisors.

M&A is a trend that is here to stay. As companies look to grow their portfolios, they are looking for high quality assets with low present ARO and the ability to push their retirement obligations far into the future. As the premier tool for scoping and evaluating corporate and asset A&D opportunities, XI Technologies is pleased to offer some high-level summaries of the recent proposed acquisition of Prairie Storm Resources Corp. (“Prairie Storm”) by InPlay Oil Corp (“InPlay”) along side deeper insights from Ryan Ferguson Young of Earth Horse Energy Advisors.

After the close of trading on September 28, 2021, InPlay announced that it had entered into a definitive agreement to acquire Prairie Storm. The total consideration of the deal is estimated at $42.3 million, consisting of $0.0524 of a common share of InPlay and $0.2514 in cash for each Prairie Storm share (aggregate consideration of $0.3253/share based on the close share price of InPlay at $1.41/share). InPlay estimates that Prairie Storm will have a working capital surplus of $9.5 million at closing of the transaction. Concurrent with the announcement of the transaction, InPlay entered into a $11.5 million (including a 15% over-allotment option) bought deal financing of subscription receipts at $1.20 per subscription receipt and announced that its senior credit facility would be increased from $65.0 million to $85.0 million.

Prairie Storm’s assets are focused in the Willesden Green area of central Alberta and are estimated to have production of 1,800 BOE/D (53% liquids) at closing; the production is from the Cardium and Glauconitic formations. As of December 31, 2020, Prairie Storm had estimated PDP reserves of 4.9 MMboe, TP reserves of 21.3 MMboe and 2P reserves of 26.8 MMboe and adjusted for production to November 1, 2021 of 4.4 MMboe, 20.8 MMboe and 26.3 MMboe respectively. During Q2 2021, Prairie Storm had a realized field netback of $20.77/BOE on 1,964 BOE/D of corporate production. Based on current pricing and estimated production, Prairie Storm’s field netback is estimated to be closer to $30.00/BOE.

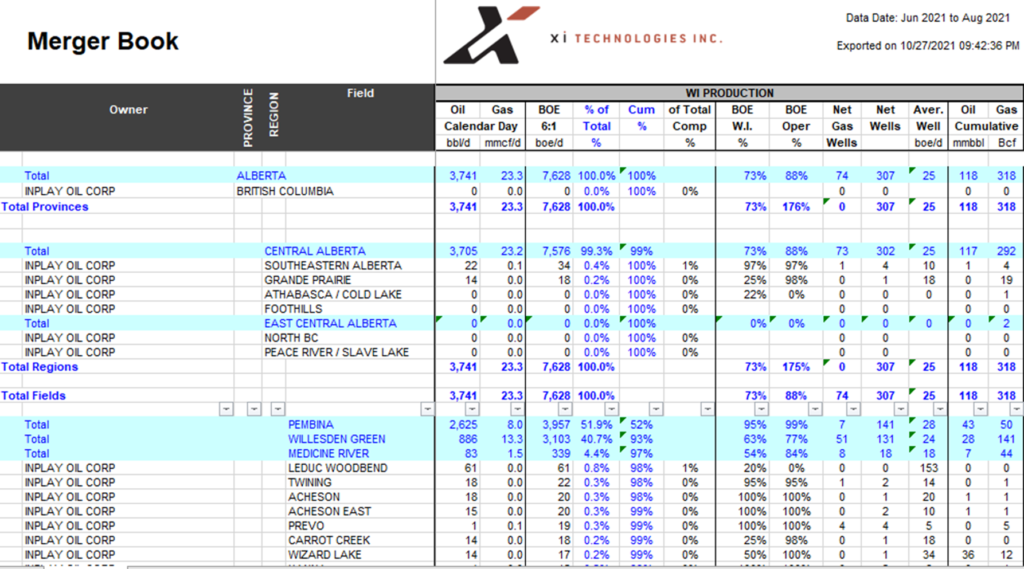

Using the AssetBook to look at both companies allows us to compare the companies and gain some further insight.

Click here to download a pdf of the Company Books for InPlay and Prairie Storm.

Core Areas

As shown in XI’s AssetBook, Prairie Storm’s assets are complimentary to those of InPlay, resulting in InPlay being a more dominant land holder in the Willesden Green area. As of December 31, 2020, Prairie Storm had approximately 18,500 net acres of undeveloped acres on which InPlay has identified 80.1 net Cardium drilling locations. Based on the $42.3 million in consideration, the metrics of the transaction are $23,475/BOE/D, $8.62/BOE for PDP reserves, $2.03/BOE on a TP basis and $1.60/BOE on a 2P basis, along with a multiple of net operating income of approximately 2.2 times. The metrics do not take into consideration Prairie Storm’s reported $32.1 million in discounted ARO ($38.8 million undiscounted) as of June 30, 2021, the value of its net undeveloped land or future assumed G&A; this data was excluded to allow better comparisons with other deals that have been announced in Central Alberta and which do not have this information publicly available. For comparison purposes, XI’s ARO Module calculates the decommissioning liabilities of Prairie Storm to be $37.3 million undiscounted.

Looking at XI’s Merger Book, we can quickly see the same trend with the assets falling within both companies’ core fields of Pembina, Willesden Green and Medicine River.

Click here to download the Merger Book report from AssetBook.

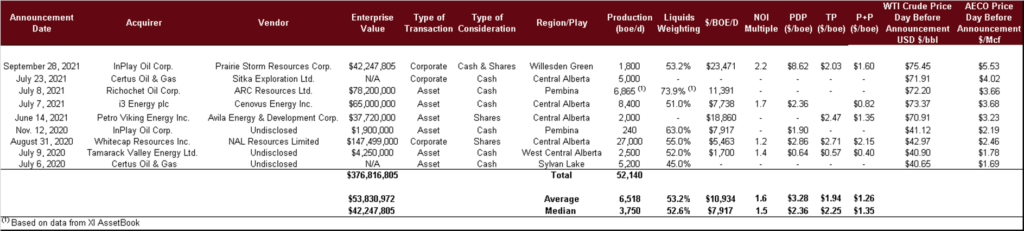

Outside of the InPlay/Prairie Storm transaction, there have been nine transactions announced that have involved assets or companies with properties focused primarily in Central Alberta since the summer of 2020, when the price of crude oil had started to recover from its April collapse. In total there have been an estimated 52,140 BOE/d of production that has changed hands. There are two deals whereby the consideration was not announced; these deals included privately-held Certus Oil & Gas Ltd. which acquired Sitka Exploration Ltd. and certain assets in the Sylvan Lake area of central Alberta. Excluding the consideration of those two deals, the total transaction value of deals in central Alberta has amounted to $376.8 million since the summer of 2020; based on estimates of what the Certus deals may have been completed at, the total value of transactions in central Alberta could be in the $445-470.0 million range. The nine deals are outlined in the table below along with the average and median acquisition prices paid for assets and companies focused primarily in Central Alberta.

The average price paid for production in Central Alberta since the summer of 2020 has been $10,934/BOE/d while the median was $7,917/BOE/d. The average price paid for reserves was $3.28/BOE on a PDP basis, $1.94/BOE on a TP basis and $1.26/BOE on a 2P basis; the median prices paid were $2.36/BOE, $2.25/BOE and $1.35/BOE respectively. The large majority of deals in the M&A marketplace are being transacted based on net operating income; the average multiple of NOI is 1.6 times while the median NOI multiple is 1.5 times. As the commodity prices increase, the multiple paid will most likely start to increase as buying demand increases. The historical range of prices paid on a NOI basis has been closer to 3-5 times for working interest properties.

The deals that have been focused in Central Alberta outlined below, do not include asset retirement obligations, net undeveloped land or estimated G&A that a purchaser would assumed in a transaction. This was done to provide a better comparison among transaction and also due to those details not being publicly available for some of the transaction. XI’s ARO Module can provide a thorough scope of the ARO attributed to certain deals and/or companies providing insight to the future obligations which may not have been disclosed in press releases.

As illustrated in the table, the prices of AECO natural gas and WTI crude oil has been rallying, resulting in an increase in M&A activity. Companies with investor support and a lower cost of capital have been the most active in the M&A marketplace.

Up to the end of the third quarter of 2021, there have been there have been nearly 75 transactions announced with aggregate transaction value of approximately $12.2 billion in the Canadian upstream oil and natural gas sector. A large majority of the transactions have involved resource plays in the Montney, Clearwater and Charlie Lake formations. The M&A landscape has been dominated by a select number of companies, most notably ARC Resources Ltd., Spartan Delta Energy Ltd., Tamarack Valley Energy Ltd., Tourmaline Oil Corp. and Topaz Energy Corp., which have collectively acquired approximately $8.6 billion in oil & natural gas assets and companies in 2021.

As commodity prices continue to rally and are forecasted to remain strong in Q4 2021 and into 2022 from a lack of oil & natural gas drilling, some companies may take this opportunity to provide their shareholders with liquidity while other players will be acquisitive and grow. In the current marketplace, larger companies are getting more attention from the investment community and the capital markets, and it is imperative for public companies to be of scale to get noticed.

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, contact XI Technologies. For more information on transactions within this area, please contact Earth Horse Energy Advisors.