CALEP Uncovered – Insights from the 2023 CALEP Conference

September 21, 2023

Recently, XI Technologies attended the 2023 CALEP Conference in Kelowna, BC. The Canadian Association of Land and Energy Professionals did a fabulous job of balancing education and networking with a packed “work hard, play hard” schedule.

A team from XI Technologies has attended almost every CAPL/CALEP Conference since 2001 and it has evolved to the needs of the CALEP members just as our industry has evolved over the same time period. With a changing industry and the role of landmen adapting to become more involved in A&D, regulatory requirements, and business development, we now see many landmen interested in performing liability evaluations and assessing LLR/LCA implications as a regular part of their job. In many companies, the landman gets involved in high-level economics and business decisions before passing on to the technical team. As data and software experts, we too have grown from being strictly a scoping tool to fulfilling many different workflows in support of a wide variety of functions within the industry, from land and business development to financial, C-suite, geo-technical, and beyond.

With that in mind, there was a deep realization for all of us during the late afternoon on the second day of the conference that XI’s important data, newly adapted software applications, and our expertise itself, fit in nicely with several of the presentations and info sessions throughout the program. With AssetSuite front and centre, providing supportive information and insight into all that was explained, we couldn’t help but celebrate our 23 years of synergy. CALEP and XI… we’ve come a long way!

Each talk and panel discussion was engaging and informative. But with this synergy in mind, here are the ones we’d like to highlight:

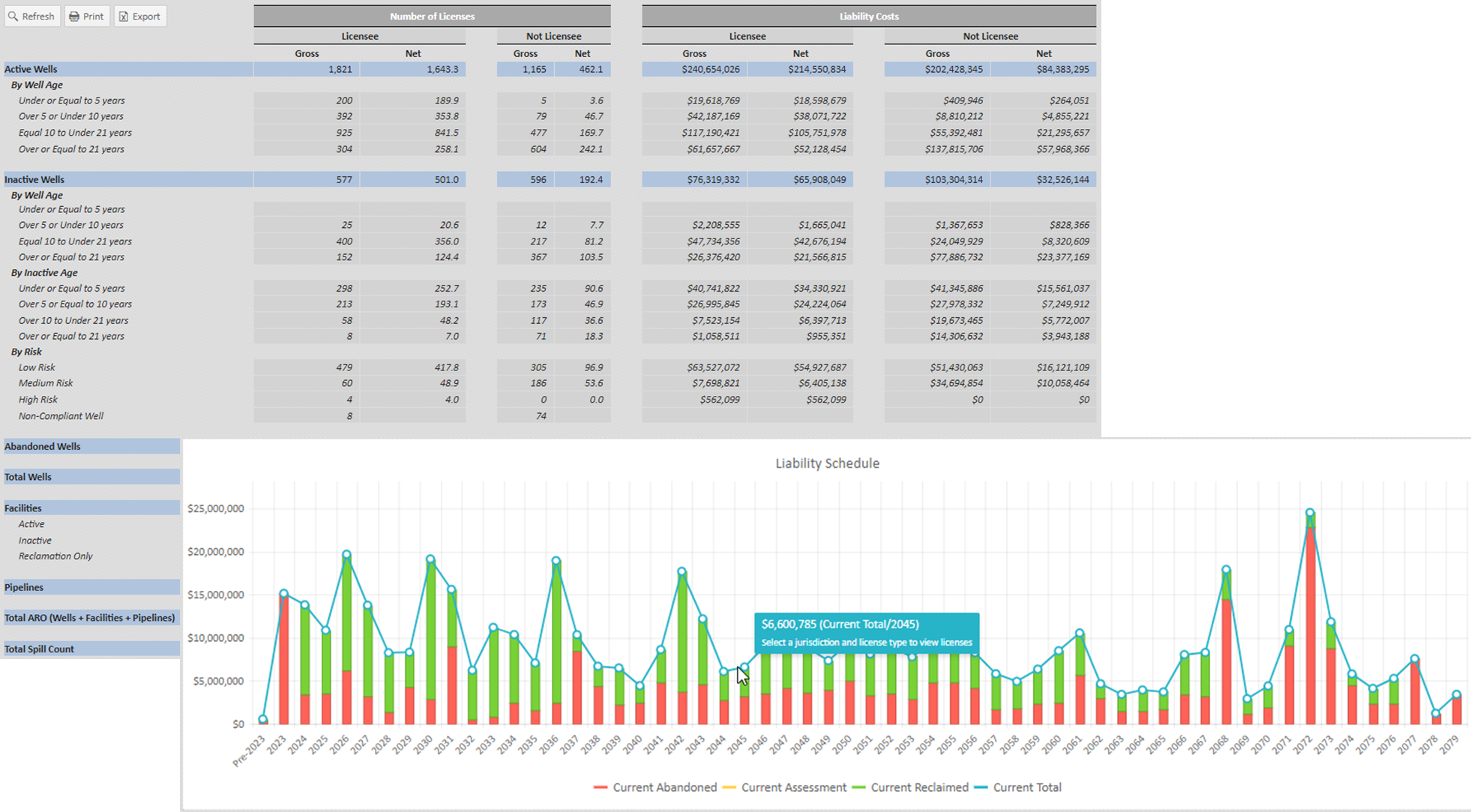

- Bankers Panel –This was a robust discussion among those currently dealing with financial transactions in the energy industry. All the panelists happened to be clients of XI and we enjoyed hearing their perspectives. We found it interesting how much of the M&A activity happening today incorporates ARO and LLR/LMR considerations, a huge growth area for AssetSuite’s expansion as well. Jason Brooks from Invico had a fair amount to say on liabilities. His colleague, Bruce Cameron, reinforced with us afterwards, the importance of AssetBook and ARO Manager in his workflow. Other panelists included Arun Chandrasekaran from National Bank, and Jeff Lawson (formerly from Peters & Co.), now at Cenovus. We appreciated the valuable insight from this financially savvy group!

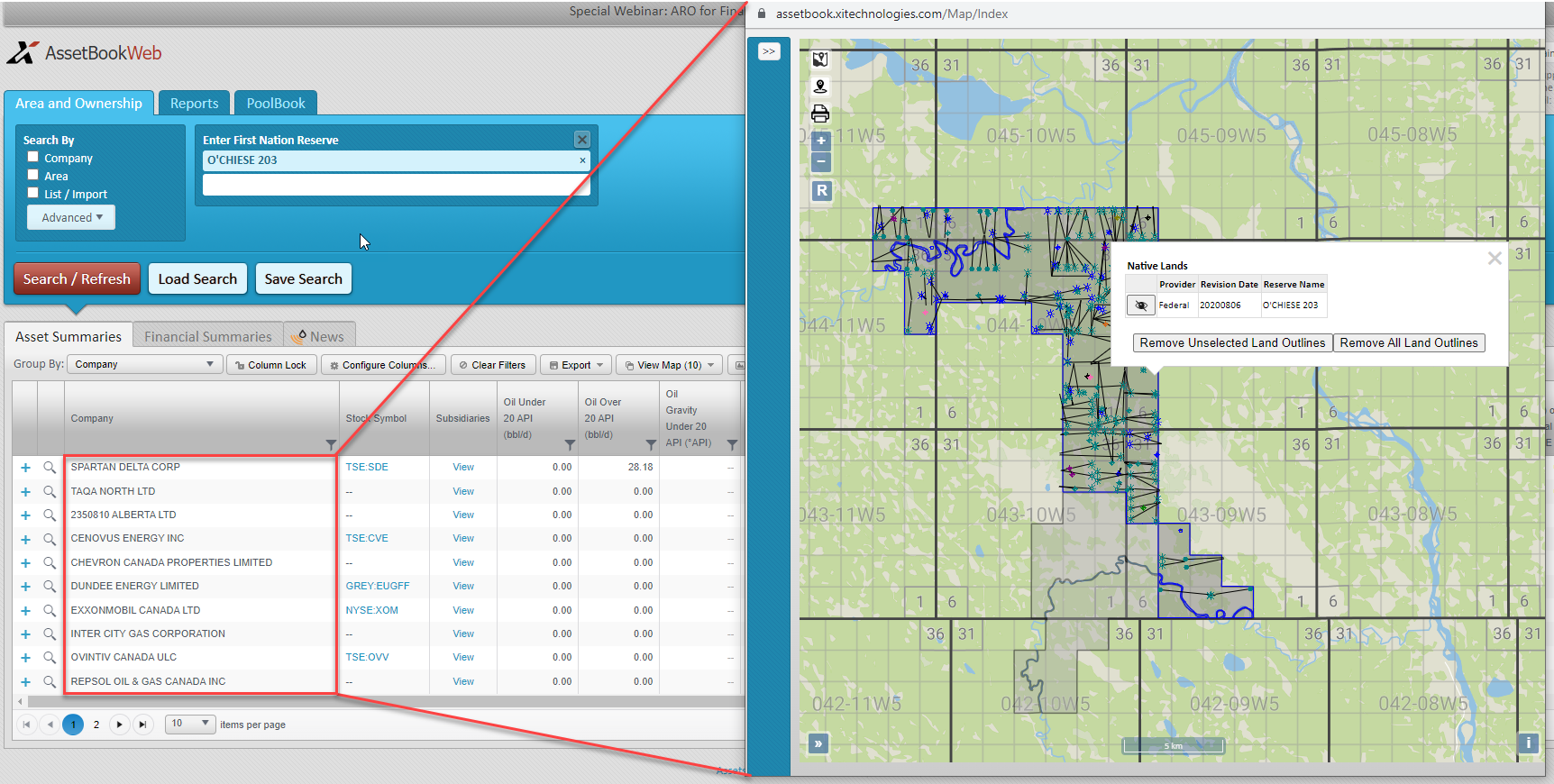

Figure 1: Liability costs for any company or area, broken down by age and risk class and a Liability Schedule with costs broken down by abandonment and reclamation date. - Building Meaningful Relationships Between Industry and Indigenous Peoples – Stephen Buffalo of Indian Resource Council and Judy Desjarlais of Blueberry First Nations. This timely and important discussion reminded us how working together can benefit both the industry at large and the First Nations communities. Partnerships need to be based on trust and collaboration. In our opinion, these relationships can be built and strengthened much more effectively when both parties have understanding, which comes with access to accurate information. XI’s AssetBook now has all First Nations boundaries available as search criteria and as map layers. We’ve been working with many Nations to help calculate assets and liabilities. There is something special about starting from a place of common understanding by honouring land information through real and reliable data.

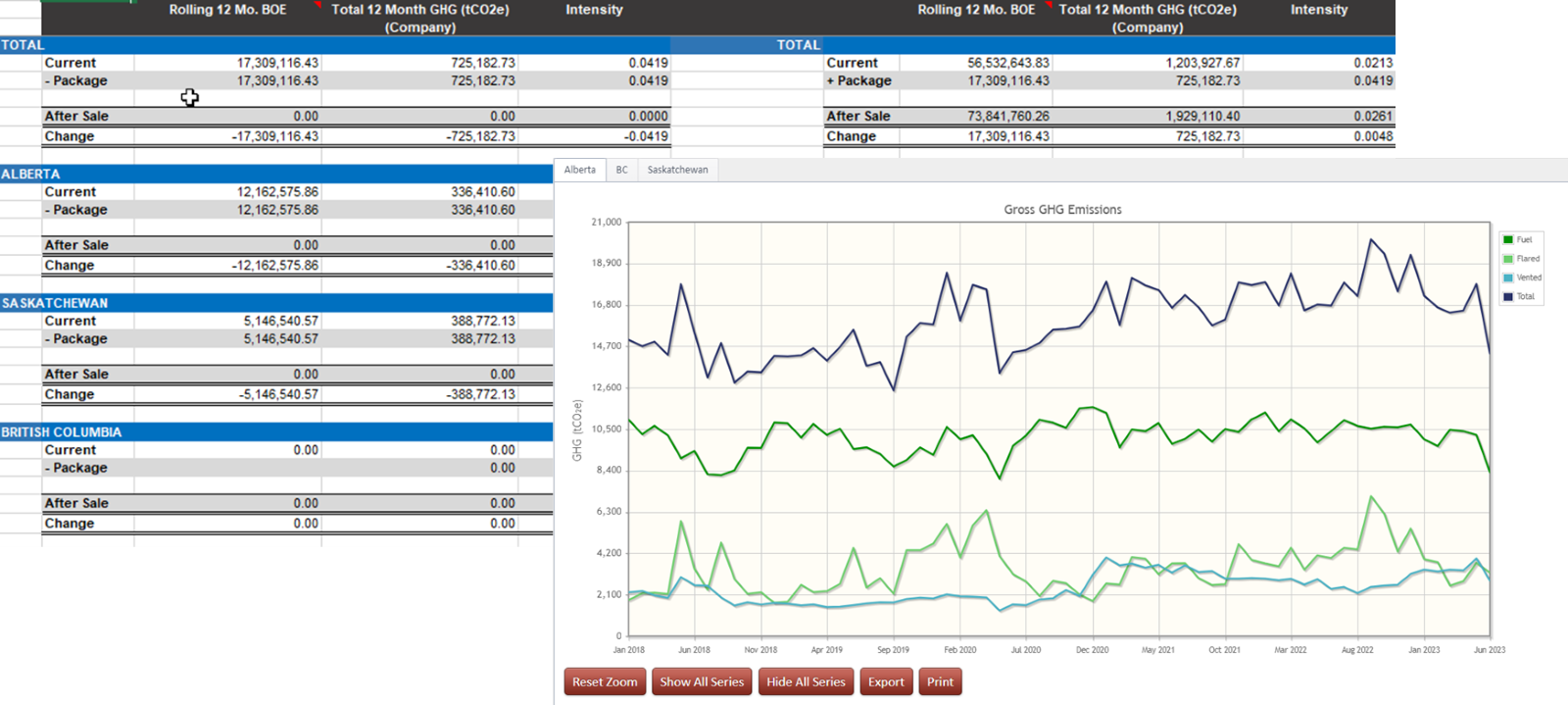

Figure 2: First Nation Search and Map Layers. - Carbon Sequestration and Storage Overview (with Panel Discussion) – Greg Owen from GLJ, discussed some of the concepts surrounding CCS and how companies can benefit from being strategic in this area. Carbon capture becomes more critical as governments begin to regulate this area more. Being able to look over the fence to see what emissions are associated with a potential deal becomes a strategic advantage. XI has developed an Emissions Report which calculates Scope 1 emissions for any company or area. Using government data, you can understand total GHG volumes and weights. There were 2 other panelists: Patricia Mroch from Skoki Energy Advisors talked about Canada’s advantage, and Stephen Arseniuk from Pathways Alliance (an alliance between major heavy oil producers) who focused on collaboration.

Figure 3: Pro-forma Emissions report and historical monthly fuel/flare/vent data. - CALEP Talks:

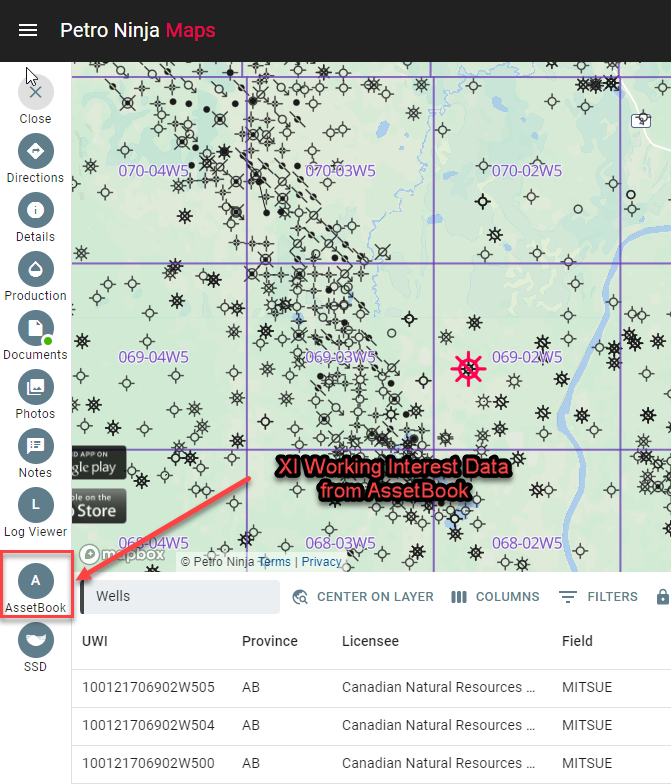

Dan Rutherford of BOE Intel adeptly explained how PetroNinja and BOE Intel are displaying data in a unified way to provide some very useful workflows for landmen, giving them the ability to query data and visualize on the map or through charts/graphs quickly and easily. Currently, users who are clients of both PetroNinja and AssetBook can integrate XI’s working interest data into their queries. Both products aim to help users make better decisions through concise summaries/visuals of public data. Whether you start with a map in PetroNinja or start with a query in AssetBook, working interest is key so stay tuned for more integration between the two systems!

Figure 4: XI Integrated Working Interest Data within PetroNinja.

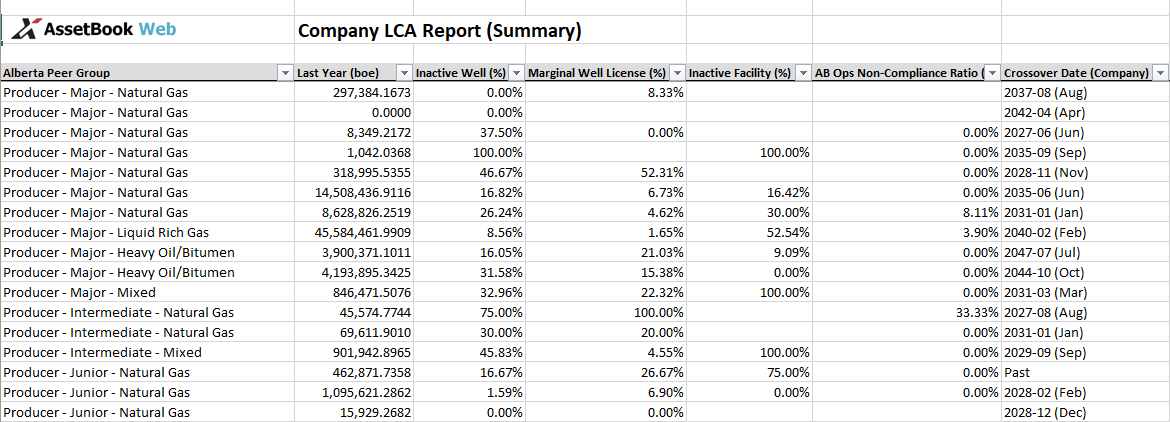

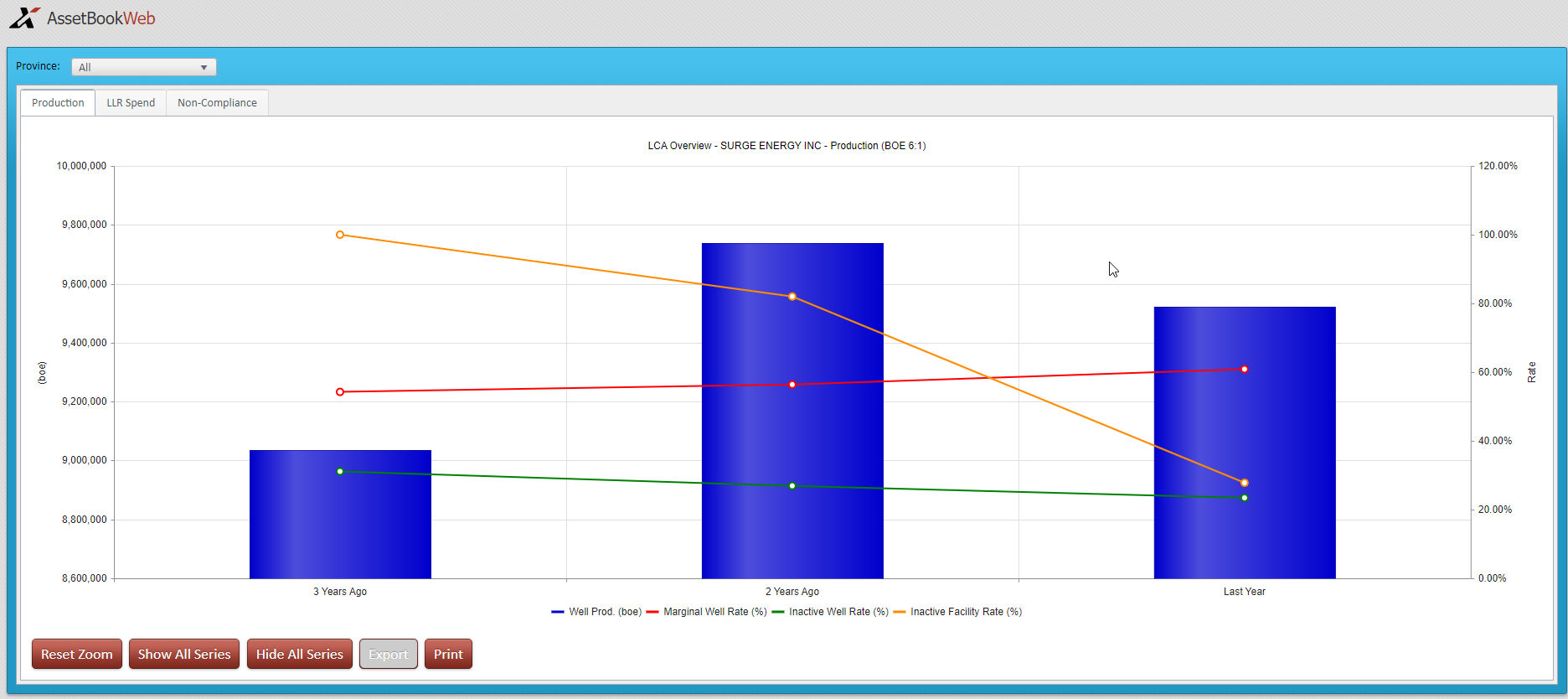

Mike Newton of 360 Energy Liability Management gave a great summary of the most recent changes to AER directives around liabilities and Directive 88’s holistic approach. XI has built several reports that specifically highlight the information the AER is using to classify and grade companies to determine how easily they will be able to transfer well licences.

Figure 5: LCA Report to provide you with some estimated Directive 88 information.

Figure 6: Sneak peak of one of our upcoming LCA Graphs to visually display Directive 88 information.

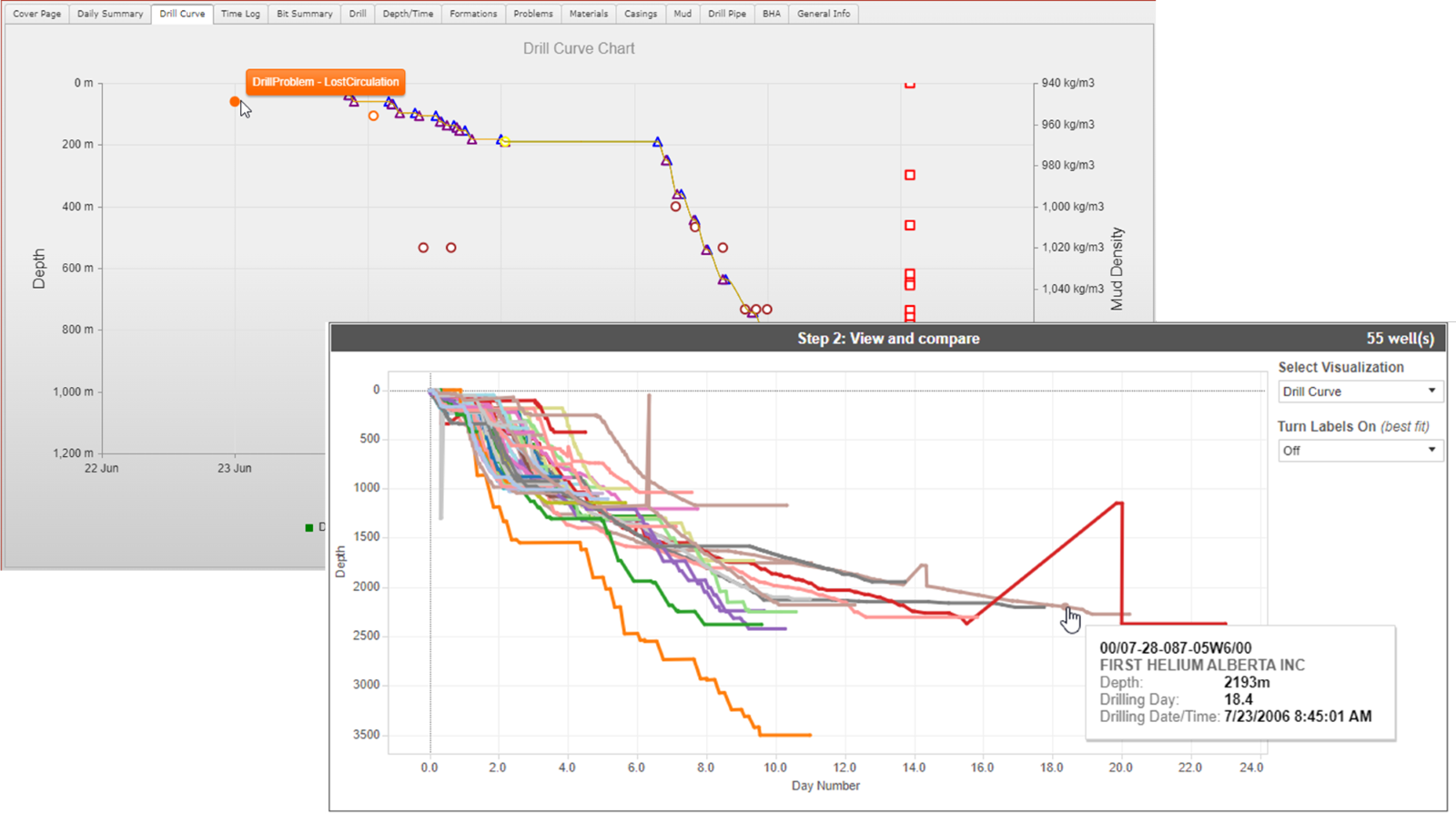

Figure 7: Generate a Single Drill Curve showing Mud Density, Bit Changes and Drill problems, or have the option to generate a Multiple Drill Curve comparison.

Jesse Griffith/Helium – While the assumption might be that traditional oil and gas companies don’t need to pay attention to some of the developments in this space, we learned that there are more similarities than differences in terms of how Helium is extracted and monetized. XI has the ability to comb through massive amounts of data to help identify potential areas for Helium. Our Offset Analyst can identify pace setters and problem wells and allows you to view digital tour data on over 200,000 wells.

- Lost Art of Critical Thinking – Brett Wilson was, as always, entertaining and thought provoking. Back when he was at First Energy, Brett and his team were avid AssetBook users. Yes… this was back in the day when it was an Excel workbook delivered quarterly by CD!

As the energy industry evolves, XI is proud to support CALEP moving forward. Given our growth in data, development, expertise and education, it is our mandate to continue to serve this organization and the industry at large. We look forward to collaborating on the 2024 CALEP Conference in beautiful Banff Alberta!

Join one of our TWO upcoming sessions to learn more about AssetBook:

- WEBINAR – Tuesday, October 3

Time: 10:00 a.m. MT

Where: Zoom – Register here

- LUNCH ‘N LEARN – Thursday, October 12

Time: 10:00 a.m. MT

Where: XI Technologies Calgary Office – Register here

If you’d like to learn more about how XI’s AssetSuite software can analyze companies, packages, or regions throughout Western Canada, visit our website or contact XI Technologies.