Word to the Wise: Why LLR still matters

August 23, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

For years, the oil and gas industry in the WCSB relied on Licensee Liability Ratings (LLR) and Licensee Management Rating (LMR) to assess potential liability risks in the A&D scoping process. Recent changes to regulations in Alberta and British Columbia have declared their intention to transition away from LLR, which may lead some to believe that the time for using LLR in A&D has passed.

This comes on the heels of the AER ending their practice of providing third-party liability management rating (LMR) reports at the end of 2020 and the increased recognition within the industry that gaps in the LLR calculation can lead to inaccuracies when examining ARO (download our case study LLR vs ARO for more details). With this shift toward a more holistic approach to liability management, it is fair to ask “does LLR still matter?”

While the answer to this is multi-faceted, the simplest answer is “yes, LLR still matters because people still use it”. In a recent webinar on the Changing Role of Landmen, we polled the audience about which numbers they rely on most when scoping.

Of that group, the majority of whom work in A&D scoping, every respondent said that they require LLR numbers for their job. By comparison, Licensee Capability Assessments (LCA), the new holistic approach to looking at licensees intended by the AER to eventually phase out LLR, were deemed necessary by 40% of respondents.

Why the disparity? It’s important to note that while Directive 088 is intended to replace Directive 006, the AER is planning a phased approach and are simply making amendments to Directive 006 currently. While the regulators have correctly reasoned that the prior LLR calculation didn’t tell the true picture of a licensee’s capability to operate efficiently and responsibly, the bigger picture approach lacks the simplicity and transparency of a before and after asset transfer ratio. When attempting to gather and factor in additional metrics including financial health, magnitude of liability vs active wells, closure rates, compliance, etc., from an over-the-fence perspective, it’s easy to see why the LLR is still a go to for early-stage A&D due diligence. This is particularly true since LCA is a high-level assessment based on licensees, whereas LLR can be used to assess individual packages.

Moreover, the Deemed Liability calculations that make up LLR are used in the calculations for LCA and this will likely continue into the near future. The holistic view of Directive 088 includes these liabilities to determine which Crossover Timeline should be applied in LCA and to calculate mandatory spend values for any company.

As liability frameworks evolve, it’s unlikely that these calculations will go away completely. While the industry and the regulator work through the process of changing to the new Liability Management Framework (LMF) of Directive 088 and the particulars of LCA, they still need a quick assessment tool for early scoping and baseline comparisons before they can do the deeper analysis of capability assessments. LLR still matters and will continue to for the foreseeable future.

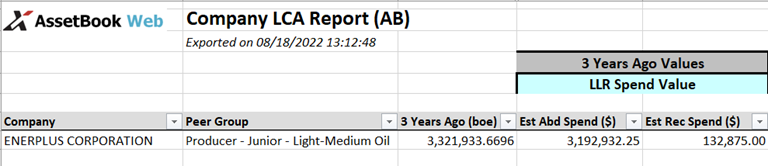

XI Technologies provides LLR calculations for all assets in Alberta, BC, and Saskatchewan with our AssetBook LLR module. Additionally, the module includes LCA Reporting capabilities, providing the Peer Group, historical BOE levels, estimated year-over-year spend, Inactive and Marginal well ratios, and Cross over timeline necessary for LCA assessments at a corporate or package level. For more details on the LLR module and LCA report, contact us today.