Word to the Wise: Pembina/Cardium Drilling Snapshot

June 21, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

In May, we published an overview of the Pembina field focusing on ownership, production history, liabilities, and emissions in the region. This week, we’ll leverage XI Technologies’ drilling data to give an overview of drilling trends in the formation. This follows a similar overview we previously published for the Montney.

To profile the highly sought-after production in the Pembina field, you’ll see drilling activity targeting a range of formations, from Upper Cretaceous (Belly River, Viking) to Devonian (Duvernay, etc). For this article, we’ll focus on the play that is getting the most attention lately: Cardium (and other members of the Cretaceous period).

Note: for the purposes of this article, we define the Pembina field using the boundaries defined by the AER. This may differ from other internal company definitions. “Year” refers to Final Drill Date.

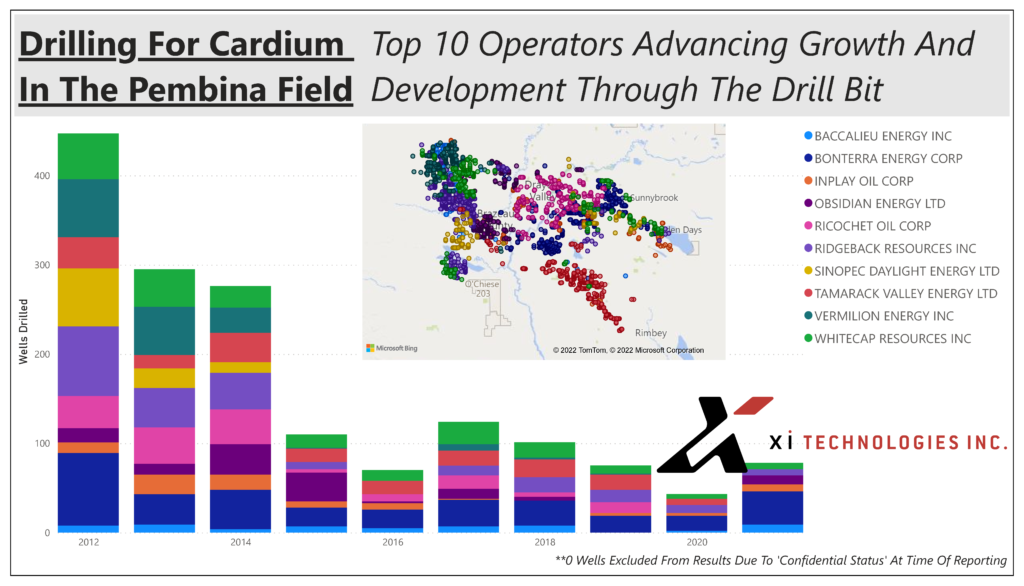

Most active operators

Bonterra Energy Corp has consistently maintained the top spot for the past 5 years of being the most active Cardium driller in Pembina, followed by Whitecap Resources Inc, Tamarack Valley Energy Ltd, and Ridgeback Resources Inc.

Looking further back in the history of this play, we see much of the same, but with a few other noteworthy findings.

Many of the top operators pre-2014 have remained active in the area since (though scaled back significantly). For other companies, this 2014 shift may represent a different story, projecting a more permanent shift in priority in the area. Several companies who’d scaled back Cardium drilling either haven’t returned or remain only in a very limited capacity.

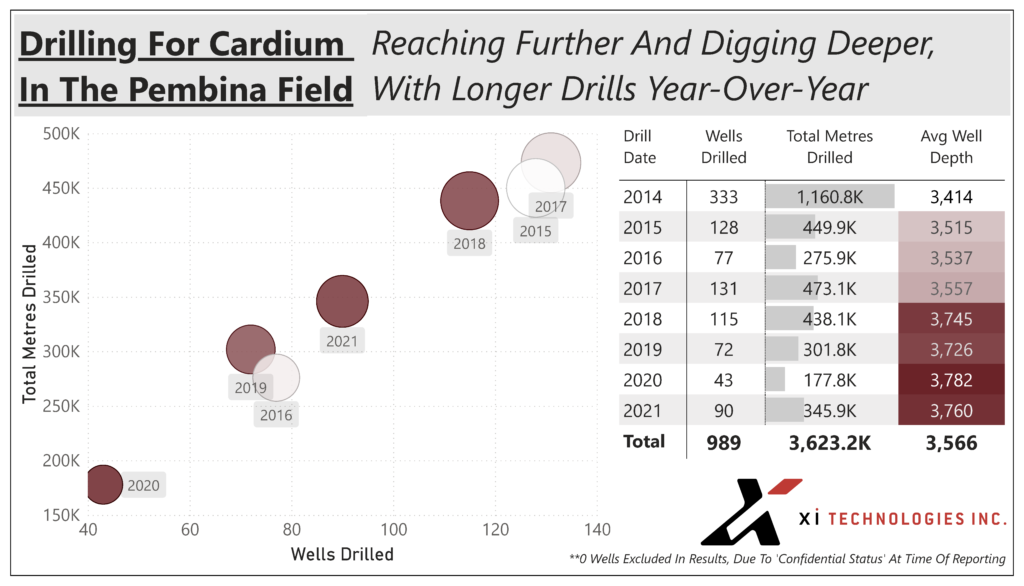

Trends in wells drilled and well depths over time

As previously noted, and as shown here, the number of drills dropped significantly after 2014 but grew in 2021 as compared to the year previous. Take note however, that while the well count dropped, the avg well length has risen from 3,300m to over 3,700m.

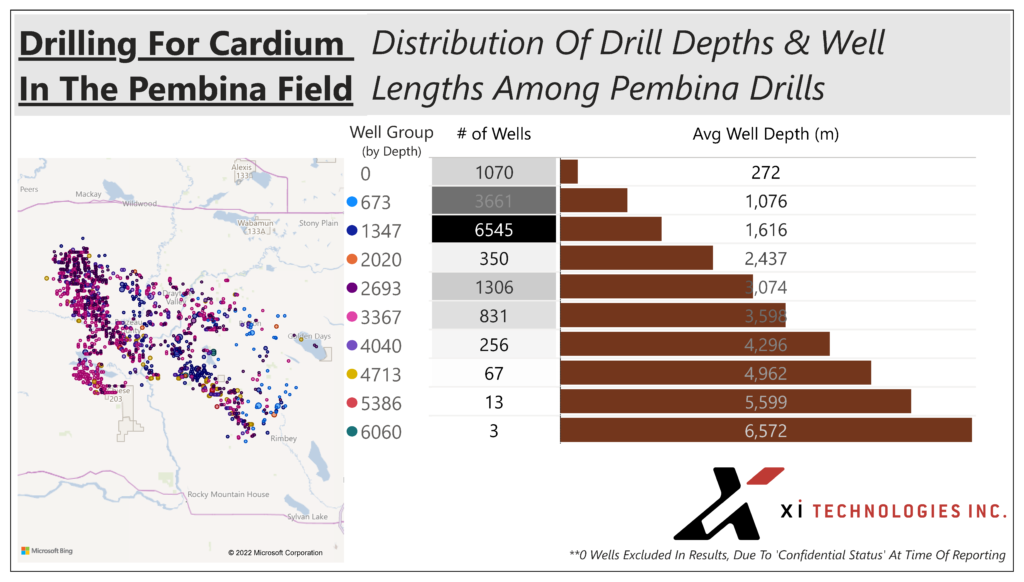

Still, as we look at the big picture of well profiling (by depth) over time, most wells drilled remain in the 1,000-2,000m depth range. If renewed activity in this play continues to gain momentum, expect these figures to change as the “new normal” of longer-reaching laterals has taken hold.

To learn more about how XI’s OffsetAnalyst software can help you improve drilling research and performance, contact XI Technologies.