Word to the Wise: Montney Drilling Overview

April 26, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

We recently published an overview of the Montney play focusing on ownership, production history, and liabilities in the region. This week, we wanted to leverage XI Technologies’ drilling data to give an overview of drilling trends throughout the entire play, narrowing in on drill history specific to wells that terminated in Lower Triassic (Montney & Doig) formations.

Top Montney Operators in Drilling

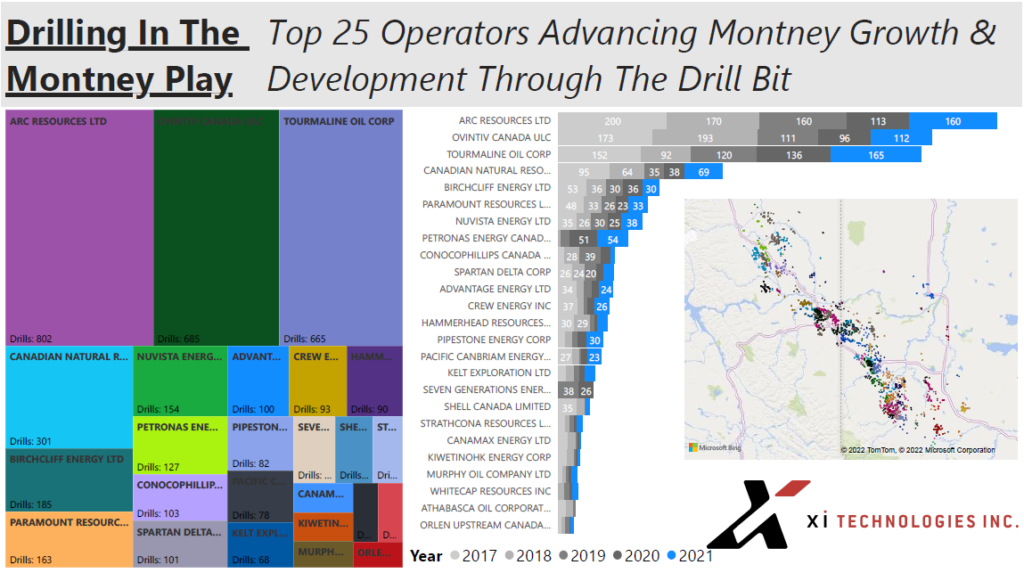

Knowing the players in the area is critical. As can be seen in the graph below, ARC Resources Ltd has become the top player in the Montney over the past five years. Montney Development has been dominated by the top three drillers – ARC, Ovintiv Canada ULC, and Tourmaline Oil Corp.

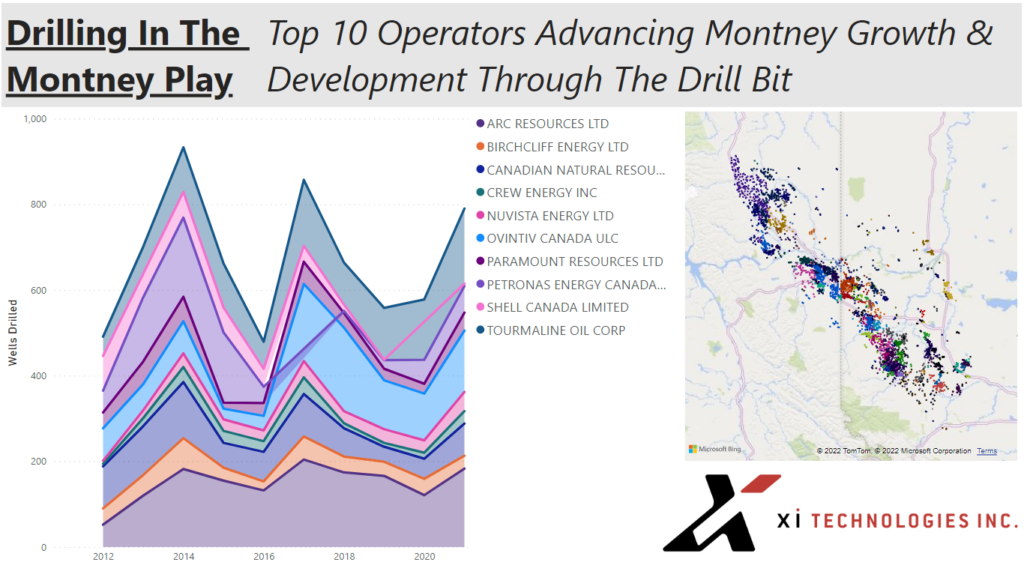

Looking at the last 10 years of activity (including two major economic swings), it becomes a bit easier to identify the newer players, as well as those who’ve withdrawn or shifted focus away from Montney over time. To get a better sense of how drilling operations have shifted in recent years, let’s drill down a bit more into the data in the graphic below.

Active Drilling Areas in the Montney

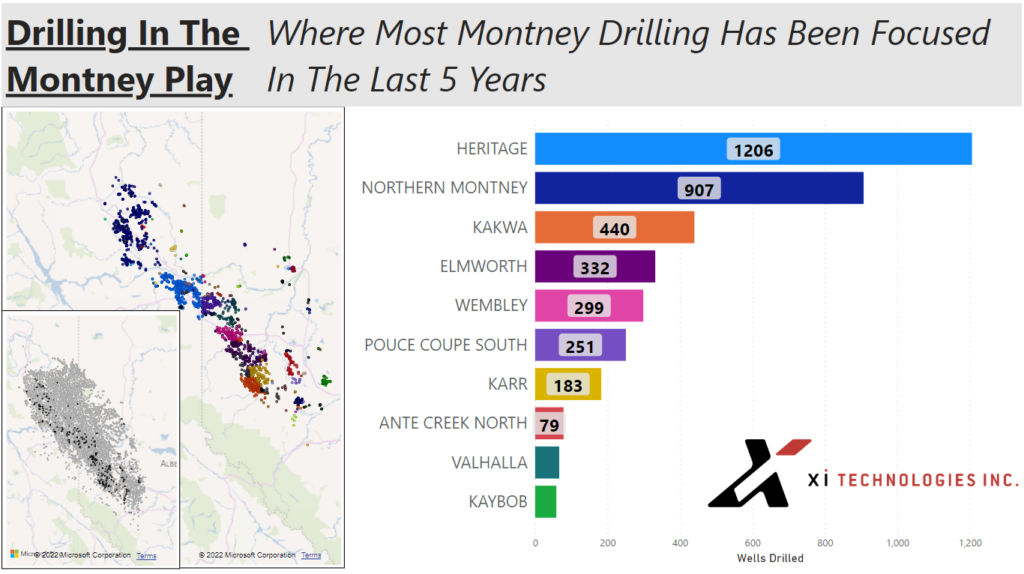

After answering the “who”, next let’s answer the “where”. The Montney play has a wide reach, spanning from NE BC to central AB. When talking “Montney drilling”, what areas are most active? The infographic below tells us that the bulk of Montney drilling is happening in the Heritage field, followed by Northern Montney, Kakwa, and Elmworth.

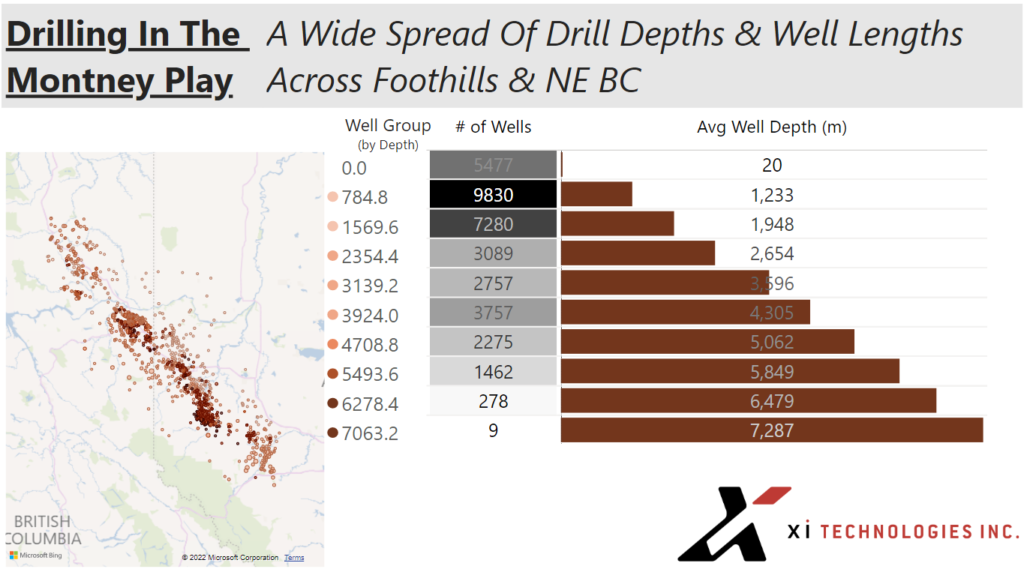

Montney Drilling Depths and Lengths

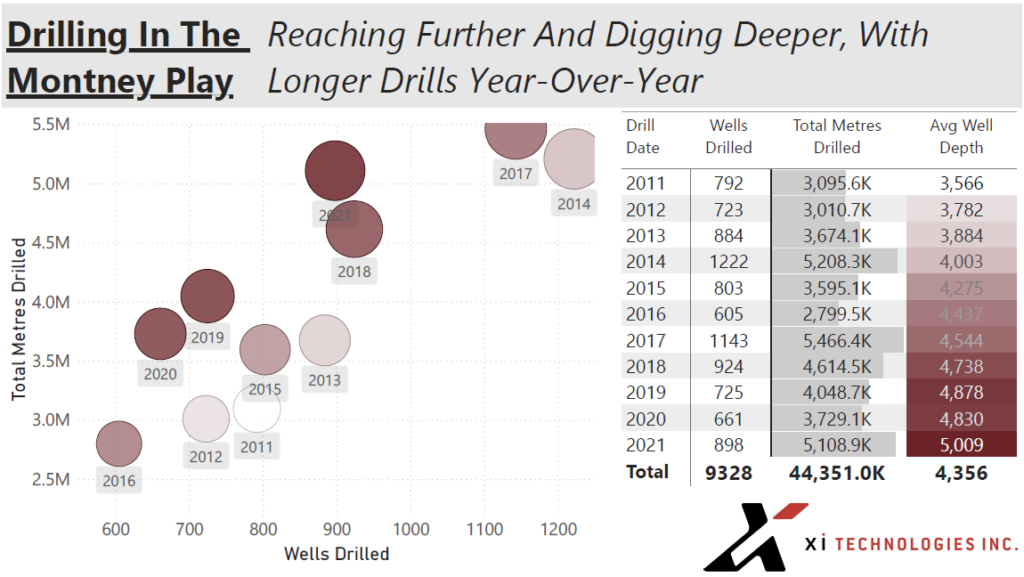

Now it’s time for the “what”. Let’s look deeper at information that tells us more about the drills themselves. Canada’s oil and gas sector is internationally admired for its innovation in well construction, much of which is highlighted in Montney drilling. As illustrated below, companies continue to extend their reach (pun intended) as they drill deeper, more complex wells year-over-year.

This data shows what has been assumed anecdotally: 2021 represented an increase in wells drilled from the past two years, but still hasn’t reached pre-COVID numbers. Also interesting is the increase in Total Meters Drilled and Average Well Depth. The combination of these three factors suggests that Montney drilling in 2021 closely rivaled the 2017 peak of drilling investment in Montney.

To learn more about how XI’s OffsetAnalyst software can help you improve drilling research and performance, contact XI Technologies.