Word to the Wise: Liabilities and reclamations in 2021

March 22, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

The past two weeks, we’ve looked back on the oil and gas sector in Western Canada in 2021, focusing on production from new wells and existing wells. This week, we wanted to examine a different part of the E&P landscape and look at how the WCSB managed liabilities in 2021.

For this we wanted to examine liability values and reclamation totals from January to December 2021 to get a broad picture of the state of oil and gas liabilities. We then compared these totals with those from 2020.

Liability Values

The information was compiled using XI’s ARO Manager and AssetSuite well and facility data. Pipeline information was specifically excluded for this compilation as provincial LLR calculations do not currently include those assets.

Comparing the 2021 numbers with 2020’s show that liability values have been reduced in the WCSB by just over $400 million, with Alberta reducing their liabilities by over $500 million. Note: a previously published version of this article had incorrect values for Saskatchewan that have since been fixed. We apologize for the error.

For a look at five major differences between XI’s proprietary third-party cost model and regulator LLR costs, download this case study. The biggest difference noted here is due to regulators understating reclamation costs, and not factoring in remediation costs.

Reclamations in Western Canada

Now let’s look at the number of site reclamations done in 2021. This data is based on the license status change for a site, which is to say that it’s not necessarily reflective on when the work was done, but when the status changed according to the regulators (i.e., when the site has officially been “reclaimed”). Cost calculations are done using LLR numbers.

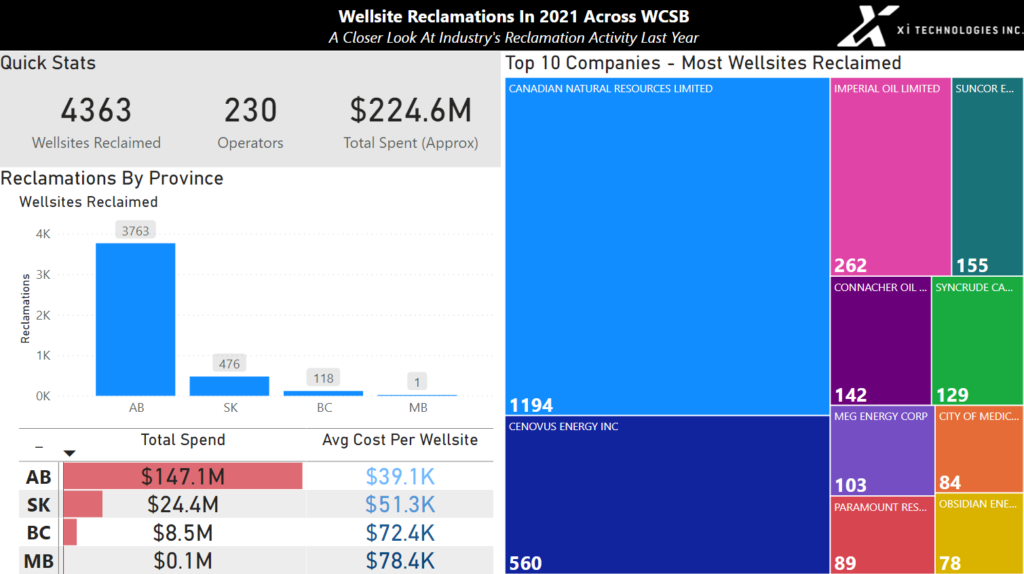

Above are the total reclamations in 2021, broken down by province. The four western provinces combined for 4363 reclaimed well sites at a spend of approximately $224.6 million.

On the right are the operators who were most active last year in terms of reclamations, led by Canadian Natural Resources Limited, Cenovus Energy Inc, and Imperial Oil Limited. Note: this list does not include reclamations performed by the Orphan Well Association.

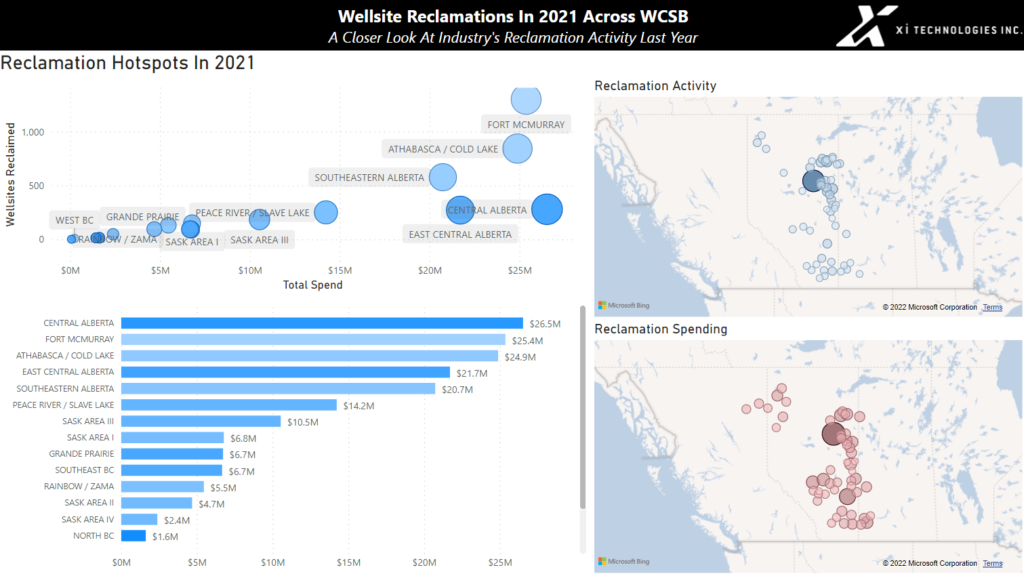

Digging a little further into the data can show where reclamations are being done. In 2021, the highest reclamation spend took place in Central Alberta with $26.5 million, followed closely by Fort McMurray and the Athabasca/Cold Lake region. If you’d like to dig deeper into the two reclamations graphics, click here to access interactive dashboard versions.

This data was calculated using XI’s liability software module AssetBook ARO Manager. ARO Manager is the only standardized tool for estimating and monitoring asset retirement obligations in Western Canada’s oil and gas sector. To learn how XI’s ARO Manager can help with the planning and reporting of liability management, visit our website or contact us for a demo.