Word to the Wise: Tracking the Alberta Inactive Well List

July 27, 2021

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

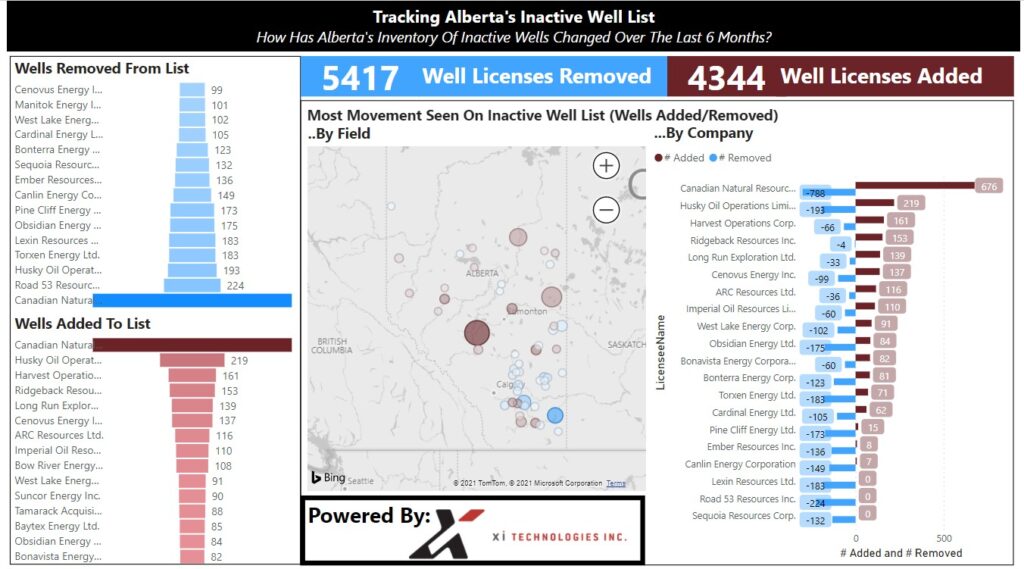

Alberta is showing its commitment to managing the clean up of oil and gas wells with the announcement of a new Directive for Licensee Life-Cycle Management (see our article from last week for details). With that in mind, we thought it time to once again examine the Alberta Inactive Well List. Tracking the changes to the number of wells added and removed from this list can be a helpful indicator of the health of the industry and can help drive liability decision-making.

In general, a well in Alberta is deemed “inactive” if it has no reported volumetric activity for 12 consecutive months. AER’s definitions of inactive are in place to help prioritize wells requiring attention, considering both volumetric activity and H2S content. For more on these definitions, refer to Directive 013 from the AER. We wanted to take a six-month look at how this list has changed in that time.

Click here to dig into this information with an interactive dashboard view.

In the past half year, 4344 well licenses were added to the Inactive Well List. There are several reasons why a well could be added to the Inactive List, whether they are temporary economic shut ins or if they’re on their way to being abandoned and reclaimed.

The last time we did a six-month look at the Inactive Wells was from May – October 2020. In that time frame, there were 5490 well licenses added to the Inactive Well list with 1905 removed, so this current six-month look shows improvement in both categories.

Of the 5417 well licenses removed from the list, about one quarter were reactivated. We thought it would be interesting to look at the most current month in the data set (May 2021), and view production and producing hours. Here’s how that breaks down:

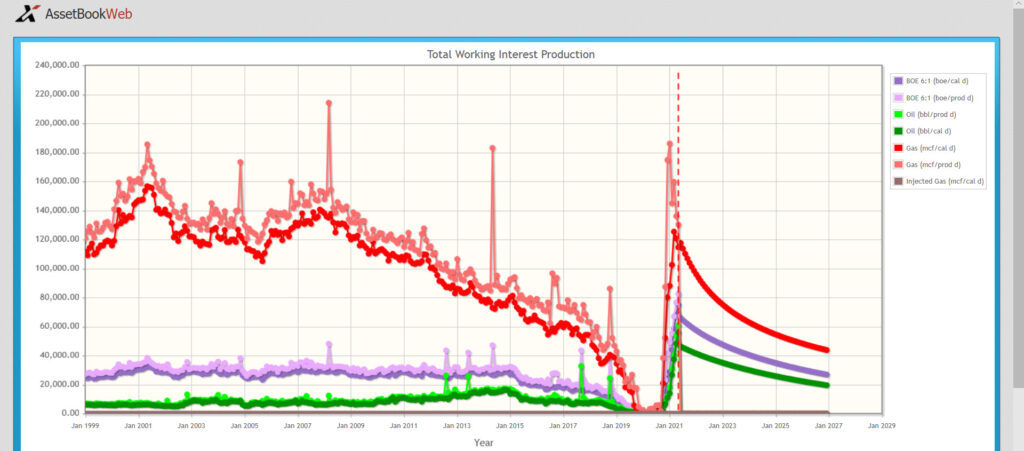

Production on these 1300 or so reactivated licenses was just over 67,000 BOE per day, with average producing hours for the past 3 months at 665 hours.

This information was compiled from the data available in XI’s AssetBook ARO module, which allows you to monitor and optimize liabilities from initial deal right through to abandonment and reclamation. For those who don’t require the full capabilities of AssetSuite, we’ve created a report purpose-built for service companies. Click here to learn more about our InactiveLiability Report. To learn how these products can help you navigate inactive wells and liabilities, contact us for a demo.