Licensee Capability Assessment: A Strategic Tool for Better Energy Deals

December 3, 2024

A year ago we talked about how The Alberta Energy Regulator (AER) has introduced a significant overhaul in its approach to licensee assessments with the launch of Directive 88 and the accompanying Manual 23. Guidelines aimed at providing a comprehensive, holistic framework for evaluating licensees across five key areas:

- Licensee Capability Assessment

- License Transfers

- Licensee Management Programs

- Inventory Reduction Programs

- Security Deposits

In that post, we focused specifically on the License Transfers component and explore how stakeholders could navigate these changes.

Transparency Challenges in License Transfers

A recurring theme among stakeholders in the license transfer process—whether it’s E&P companies, bankers, lawyers, or investors—is the lack of transparency. This has not changed from Directive 88’s implementation. Many institutions, including banks and lenders, continue to rely on the traditional Liability Management Rating (LLR) ratio to guide their decisions, as it offers clear, easily understandable metrics. Whereas, the calculations behind the LCA metrics often remain opaque. Given that most license transfer transactions trigger regulatory reviews, stakeholders often question whether it’s worth the effort to fully decipher the complex data involved.

While Directive 88 may initially seem like a “black box,” it does provide an outline for evaluating the key factors that influence the deal. Once confidentiality agreements are in place, the information required by the AER under this directive aligns closely with the metrics needed to assess a deal. These calculations are crucial for identifying potential cost obligations and streamlining the transaction process.

A Peek Behind the Black Box: Licensee Assessment (LCA)

In November 2023, our team was invited to present at the PADA Society breakfast, hosted in collaboration with Burnet, Duckworth & Palmer LLP (BD&P). During this session, we discussed how the new framework is shaping deal-making in the energy sector. After BD&P’s insightful overview of Directive 88 and its impact on current transactions, we shared methods for reverse-engineering the AER’s Licensee Capability Assessment (LCA) metrics using publicly available data. The goal was to offer attendees a “peek beyond the black box” of regulatory assessments. This same principle applies one year later.

The AER classifies licensee capability into two main categories: Risk and Performance.

- Risk: This group assesses a company’s financial distress level and the magnitude of its liabilities.

- Performance: This category evaluates operational factors like the remaining lifespan of resources, operational efficiency, closure plans, and ongoing administration.

By understanding these categories, companies can be grouped and prioritized based on their potential risks and performance. This allows regulators to identify liabilities and risks that must be mitigated by the licensee before transferring the license.

Estimating Licensee Profiles and Transaction Timelines

The good news is that a wealth of public data is available to help estimate a company’s licensee profile and gauge how long a transfer might take. By strategically compiling and analyzing this data, you can begin to estimate critical factors like the remaining lifespan of resources, which can significantly influence your deal structure.

For the purposes of this article, we’ll focus on one specific performance factor: the Remaining Lifespan of Mineral Resources. However, if you’re interested in exploring the other assessment categories and where to find the data, be sure to download our whitepaper on Licensee Capability Assessment and Transparency.

The Role of the Remaining Lifespan of Resources

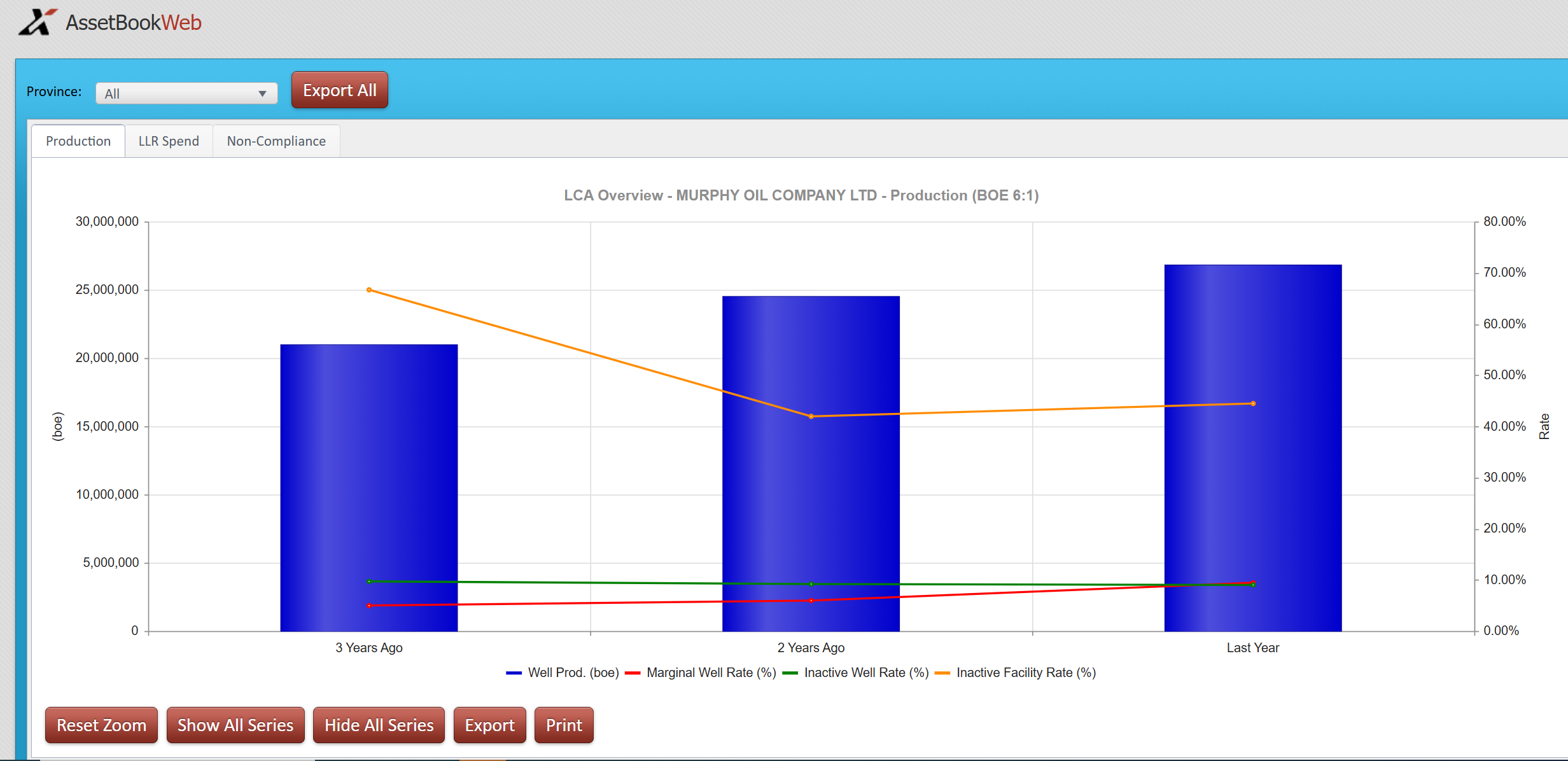

The AER’s framework defines the Remaining Lifespan of Mineral Resources through a set of key metrics, such as:

- Production Trend: The trajectory of a company’s production over time.

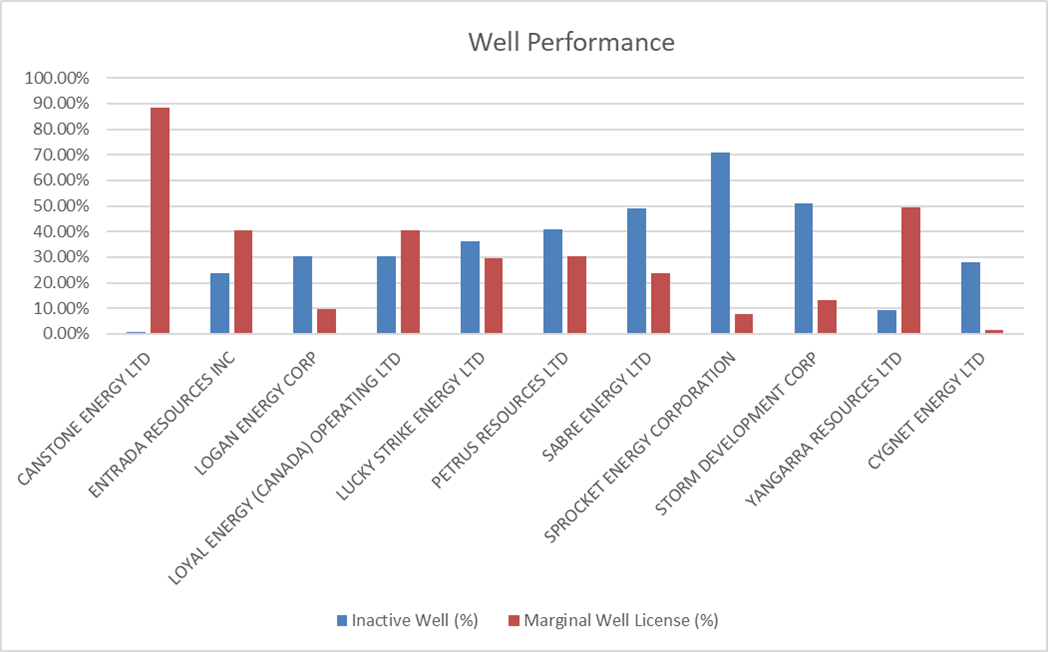

- Inactive Well Ratio: The percentage of wells that are no longer producing.

- Marginal Well Ratio: The proportion of wells producing less than 10 boe/d.

- Inactive Facility Ratio: The percentage of facilities that are inactive.

- Crossover Timeline: The date when a company’s production is expected to significantly decline.

These factors provide insights into a company’s operational efficiency and its ability to meet future closure and reclamation obligations.

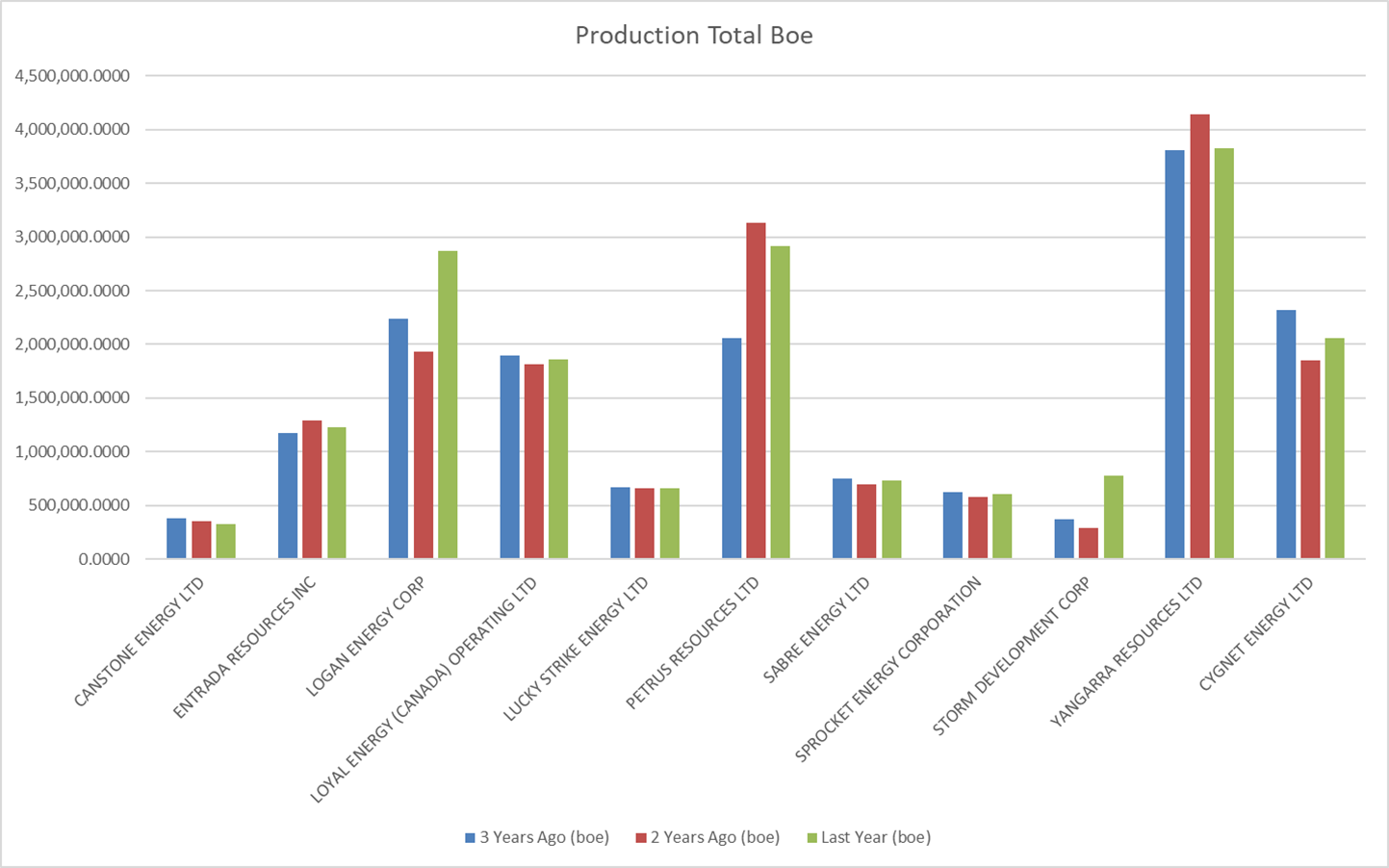

A Real-World Example: Junior Peer Group Comparison

To better illustrate how these factors work, let’s take a look at companies from the Junior Natural Gas and Liquid Rich Gas Peer Group (as classified by the AER) that have LLR ratios above 2, based on the newest cost model calculation from Directive 11, and using an industry standard 6:1 boe ratio.

The second comparison highlights how different companies in the same peer group may have varying operational efficiencies and risk profiles, which can impact their ability to meet future obligations. While these are basic data points, there are obviously many factors to consider when evaluating both opportunities and risks. For instance, all of these companies had crossover dates calculated by XI well into the future, indicating these assets are very sustainable.

Benchmarking with Public Data

By utilizing publicly available data, you can benchmark companies in the same peer group against one another based on their Remaining Lifespan of Resources. This allows you to quickly identify those with stronger operational metrics or longer resource lifespans, providing valuable insight into the potential risks and rewards associated with a deal.

For a more detailed comparison, download the full LCA report, where you can explore how these companies rank across a range of factors.

The Bottom Line: Key Takeaways for License Transfers

While the full scope of the AER’s Directive 88 can be complex, the Remaining Lifespan of Resources factor offers an accessible starting point for evaluating potential license transfers. By understanding the key metrics and utilizing available public data, stakeholders can better navigate the deal process, uncover hidden risks, and structure transactions more effectively.

If you’re looking to dive deeper into the nuances of the AER’s framework, including how to calculate potential liabilities and security deposits, be sure to check out our full whitepaper and LCA report. And remember, in a rapidly evolving regulatory environment, staying informed and adaptable is key to successfully executing license transfers.

Want More Insights?

- Download our whitepaper: Learn how to reverse-engineer the AER’s licensee capability assessments using public data.

- Explore our LCA report: See how companies in the Junior Peer Group measure up against key performance metrics.

AssetBook LLR/LCA Analysis

Our Module for determining the Licensee Capability Assessment (LCA) helps eliminate the “black box” of AER regulations:

- Make good business decisions by evaluating holistically with more transparency: LCA helps you get a sense of likely regulatory approval for potential acquisitions.

- Comparison of all companies allows for easy benchmarking and compliance.

- XI uses AER’s format to determine health of company based on historical performance. This helps with strategic planning, financial forecasting and risk management.

See for yourself! Request a FREE sample LCA Report for companies in your core area.

Upcoming Certification Course:

ARO Manager For Financial Tracking and Reporting Certification Course provides practical, hands-on professional development for anyone interested in expanding their knowledge of Asset Retirement Obligation (ARO) tracking and reporting.

When: December 10th and December 12th at 8:30am (almost full)

When: February 25th and February 27th at 9:00am

Space is limited so be sure to register now for the course. This is 2 x half- day course taking place in person at the XI office.

Office move/support holiday season hour info:

- December 6, 2024 – Office will be closed for the day for our staff Christmas Party.

- December 20, 2024 to January 2, 2025 – Office closed for the holidays and for our office move!

We’re Moving! New Location in 2025:

XI Technologies Inc.

2400 – 500 4th Avenue SW (Altius Centre)

Calgary, Alberta T2P 2V6

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.