Word to The Wise: Alberta Gas Processing – A Summary

April 25, 2023

Alberta Gas Processing – A Summary

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

Who Controls Gas Processing Capacity in Alberta?

How well do you know gas processing infrastructure in Alberta? Take our brief quiz, and read below to find out more.

In the province of Alberta, there are approximately 500 active gas processing plants, 12 fractionation plants, and 6 straddle plants. The density of these facilities is shown on the map below (left) as provided by the Alberta Energy Regulator. The map on the right shows the plant locations.

Figure 1 – Gas Plant Density in Alberta

Figure 2: Gas Plant Locations in Alberta

The total gas production in Western Canada is just under 21 Billion cubic feet per day (Bcf/d), with approximately 7.4 Bcf/d coming from British Columbia and 13 Bcf/d from Alberta.

What does that production look like from Alberta’s midstream plant processing perspective? If we look at the sales gas capacity of all gas plants in Alberta, excluding straddle plants, the total capacity is 25.5 Bcf/d.

Alberta has almost double the gas processing capacity we currently need.

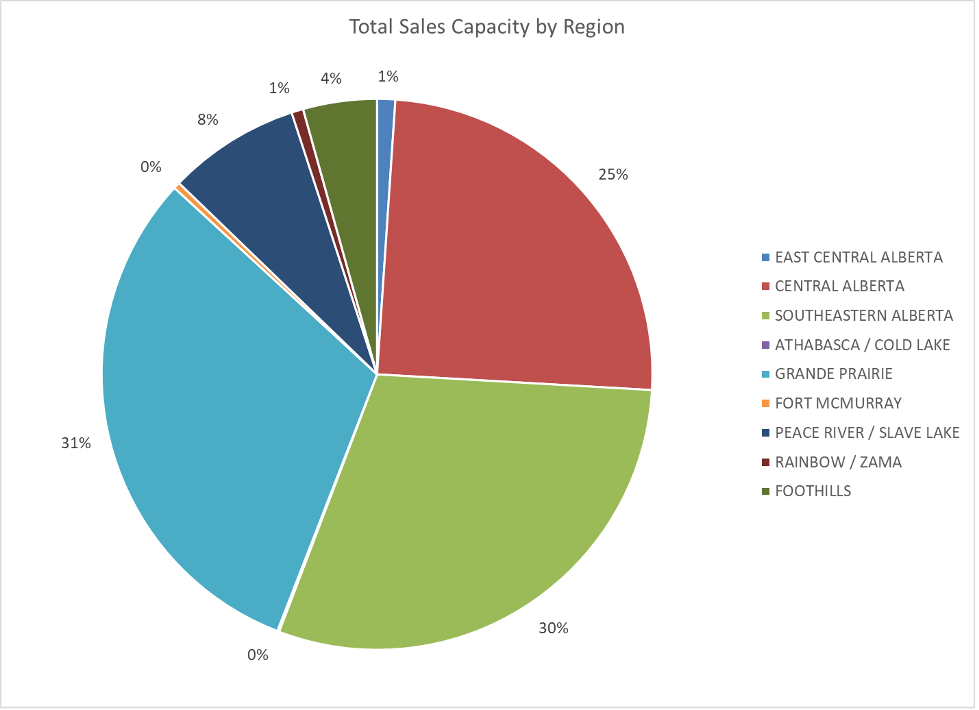

How does that capacity break down from a regional perspective?

Figure 3 – Total Sales Capacity by Region

Central Alberta, Southeastern Alberta, and Grande Prairie account for 85% of the available processing capacity in Alberta. Receipts from these same plants are just over 13 Bcf/d. Breaking this down by region shows the following:

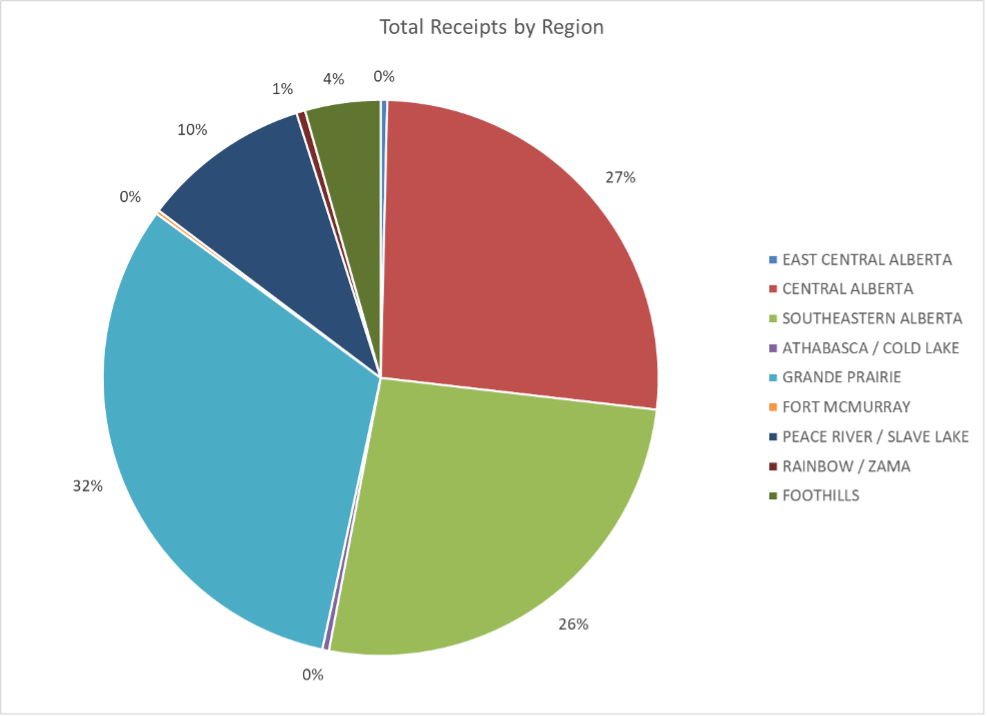

Figure 4 – Total Receipts by Region

Central Alberta, Southeastern Alberta, and Grande Prairie also account for the majority of receipts, with 85% of the receipts in Alberta. The breakdown is consistent with the sales capacity breakdown, showing consistent regional utilization percentages across the province.

If we break down receipts by operator and working interest share, the top 25 operators in Alberta are:

| Company | WI Receipts | % of Total | Cumulative |

| PEMBINA PIPELINE CORPORATION Total | 1,863,888 | 15% | 15% |

| CANADIAN NATURAL RESOURCES LIMITED Total | 1,078,573 | 9% | 24% |

| TOURMALINE OIL CORP Total | 971,180 | 8% | 32% |

| KEYERA CORP Total | 851,395 | 7% | 39% |

| PEYTO EXPLORATION & DEVELOPMENT CORP Total | 539,892 | 4% | 43% |

| ENERGY TRANSFER CANADA ULC Total | 484,865 | 4% | 47% |

| CENOVUS ENERGY INC Total | 441,493 | 4% | 51% |

| ALTAGAS LTD Total | 394,459 | 3% | 54% |

| ARC RESOURCES LTD Total | 385,133 | 3% | 57% |

| TIDEWATER MIDSTREAM AND INFRASTRUCTURE LTD Total | 334,766 | 3% | 60% |

| OVINTIV CANADA ULC Total | 332,439 | 3% | 63% |

| ADVANTAGE ENERGY LTD Total | 297,414 | 2% | 65% |

| BIRCHCLIFF ENERGY LTD Total | 265,094 | 2% | 67% |

| PARAMOUNT RESOURCES LTD Total | 230,736 | 2% | 69% |

| CSV MIDSTREAM SOLUTIONS CORP Total | 224,470 | 2% | 71% |

| SHELL CANADA LIMITED Total | 217,637 | 2% | 73% |

| TORXEN ENERGY LTD Total | 186,135 | 2% | 74% |

| CONOCOPHILLIPS CANADA RESOURCES CORP Total | 170,873 | 1% | 76% |

| REPSOL OIL & GAS CANADA INC Total | 166,537 | 1% | 77% |

| TAQA NORTH LTD Total | 157,257 | 1% | 78% |

| WHITECAP RESOURCES INC Total | 151,324 | 1% | 80% |

| CANLIN ENERGY CORPORATION Total | 144,056 | 1% | 81% |

| NORTHRIVER MIDSTREAM ENERGY LIMITED Total | 136,545 | 1% | 82% |

| NUVISTA ENERGY LTD Total | 116,630 | 1% | 83% |

| OBSIDIAN ENERGY LTD Total | 114,614 | 1% | 84% |

Figure 5: Top 25 Working Interest Receipts showing Midstream (underlined) and Producers

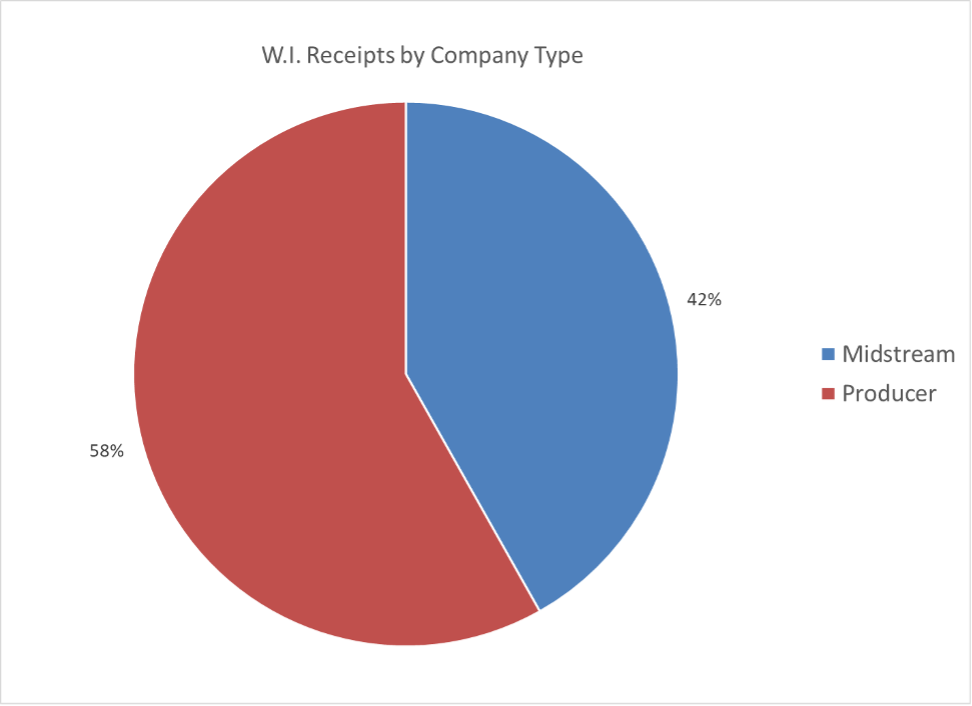

The top 25 Operators account for 85% of receipt production in Alberta. Within the top 25 corporations, midstream companies represent 42% of the total, with producing companies holding the remaining 58%.

Figure 6: Working Interest Receipt Percentage by Company Type

Of course, processing capacity is one piece of bringing new gas onstream. When considering new development, you also must consider:

- Pipeline ownership

- Pipeline infrastructure

- Pipeline capacity

Stay tuned for future posts where we continue to explore midstream infrastructure in Alberta.

If you’d like to learn more about how XI’s AssetSuite software can analyze companies, packages, or regions throughout Western Canada, visit our website or contact XI Technologies.