Word to the Wise: M&A Snapshot – Crescent Point Energy Corp Asset Purchase

January 24, 2023

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our weekly Word to the Wise in your inbox, subscribe here.

Geopolitical developments and economic uncertainty continue to play a role in M&A activity, with active players looking for economic deals that will provide a disciplined CAPEX strategy over the short-term market.

On December 9, 2022, Crescent Point Energy Corp (“Crescent Point”) announced their acquisition of Kaybob Duvernay assets from Paramount Resources Corp (“Paramount”) for a value of $375 million.

We’ve looked at both companies through a few different lenses using our AssetSuite software tools to allow you to compare the companies and gain some insight of your own regarding this deal.

While this is an asset purchase, it is still interesting to see the difference between the two companies. Crescent Point, well known for its Saskatchewan Bakken oil plays, has been gaining ground in the Kaybob Montney in the past few years. Meanwhile, Paramount has been primarily gas-oriented in the Grand Prairie and Central Alberta Regions but appeared to be leveraging some of its properties to pay down debt.

Click here to download a copy of the Company Book for Crescent Point and Paramount.

Core Areas

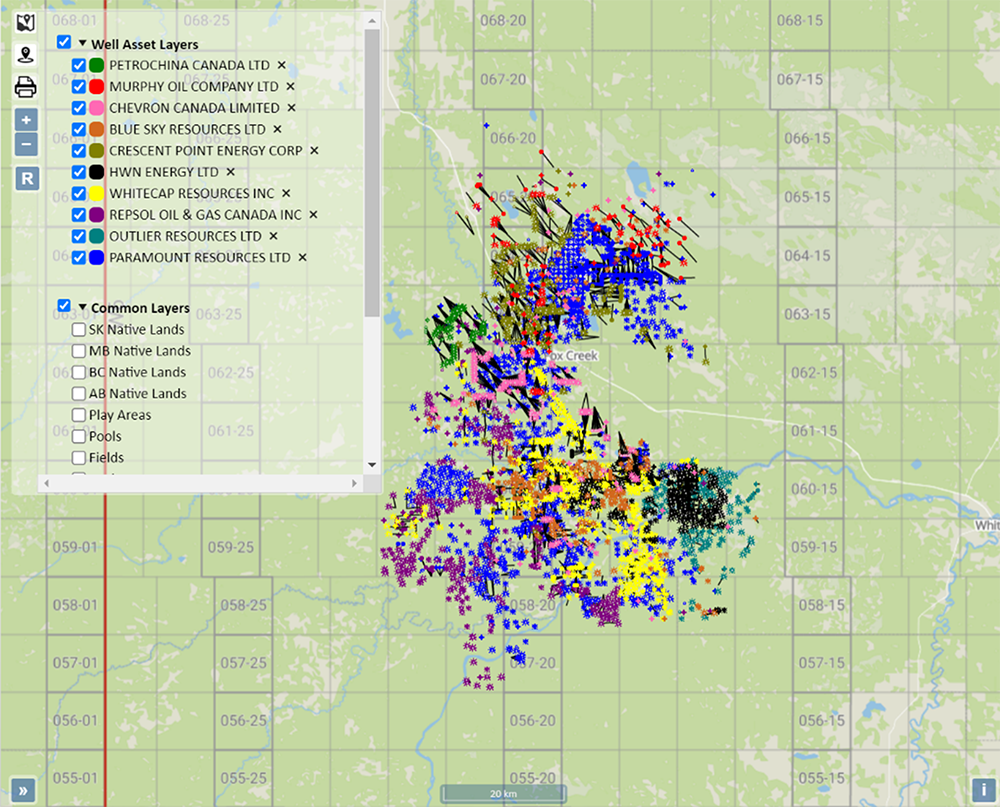

This is an interesting sale of assets by Paramount as 30% of their production comes from the Kaybob and Kaybob South fields. Non-core asset divestitures are typical, but arguably these assets fall within a core area for this company, which is unusual. This hot area has many players, with Crescent Point and Paramount being among the top ten companies in this area as seen in the image below:

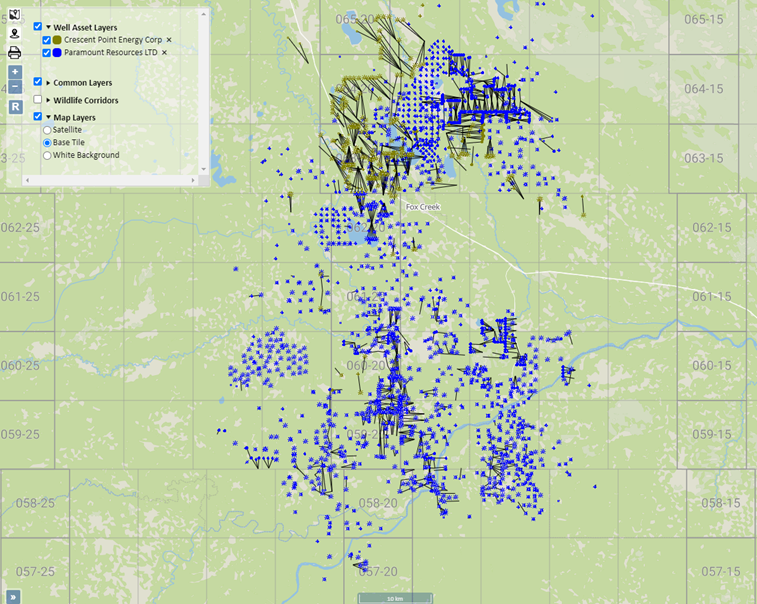

The next image shows just Paramount’s Kaybob well assets in blue and Crescent Point’s well assets in Green to provide a better picture of what the companies looked like prior to the deal geographically.

Both Crescent Point and Paramount are also the most active drillers in this area, with approximately 12 net wells drilled per company.

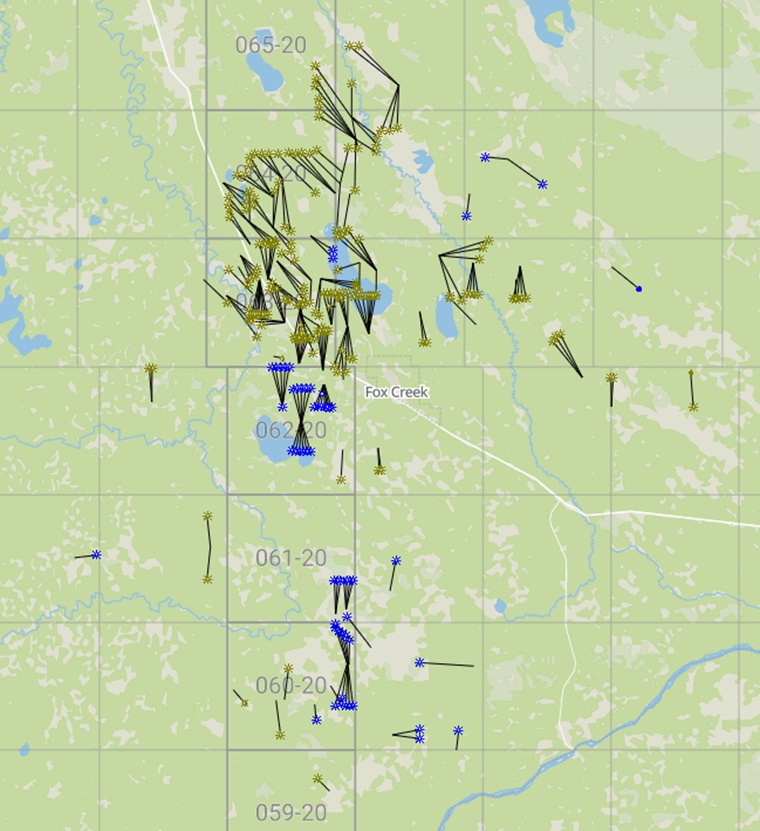

Using the AssetBook, we can add in a filter to display both companies’ working interest holdings in the government-defined Duvernay zone.

Pulling the land of this deal is a little tricky, as it is a core area to Paramount and they are only selling Duverney assets. However, the map below shows any land that could be drilled in Duvernay for both Crescent Point and Paramount. This enables us to be able to make an educated guess on what may be included in the sale.

Click here to download an All Companies report for the Kaybob and Kaybob South area.

Liability Overview

XI’s new LCA report indicates that Paramount’s production has increased approximately 5% over the past 3 years, and they currently have an approximate 54% inactive well rate compared to Crescent Point’s 5% inactive well rate. This indicates that Crescent Point can absorb some of these inactive wells. Looking at the LCA Report for the area: Spartan Delta, Petrochina, Ridgeback Resources, and HITIC Energy all have low marginal well rates, low inactive well rates, and corporate crossover dates that appear to be far into the future, making them worth looking at as acquisition targets as well.

Click here to download a copy of the LCA report.

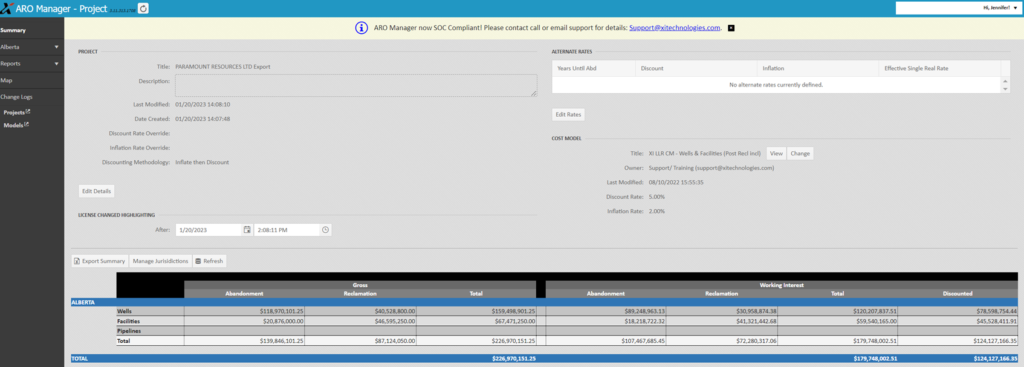

Our best estimate of the operated assets involved in this transaction (using the Government LLR Cost Model values) have a liability of approximately $150 million with an asset value of $493 million. The total working interest liability is approximately $180 million.

This acquisition does not appear to have a significant impact on Crescent Point’s emissions portfolio. As noted in their press release, “the acquisition includes an attractive ESG profile, consistent with our existing Kaybob Duvernay assets, including low emissions intensity and minimal asset retirement obligations.”

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, including examining potential liabilities and emissions, contact XI Technologies