Word to the Wise: Why you need to take more interest in your working interest partners

October 1, 2019

We begin this week’s article with some seemingly simple questions that might be more difficult to answer than you realize: do you know all your working interest partners? Do you know all the inactive wells in which you have a working interest? Do you share assets with any companies that may be flirting with insolvency?

This week, our Wednesday Word to the Wise looks at how data can help drive improvements in your drilling program. If you’d like to receive our weekly blog in your inbox before anyone else, subscribe here.

The instinct would be to assume that companies know the assets they own and what is going on with them. However, with large asset portfolios combined with years and years of acquisitions, swaps, and divestitures being a regular part of day to day business, it’s difficult to maintain a solid understanding of one’s working interest properties, liabilities, and partners. Knowing your own working interest ownership is more manageable – as long as you don’t dispose of your working interest, you still have it. But, with a working interest you acquired as part of a large acquisition, the remaining interest could change hands multiple times before you’re ever forced to think about it as anything more than an accounting line item. That leaves you unaware – or at least potentially uncertain – about who you’re in business with, and their relative financial stability.

An even trickier proposition than knowing all your own working interest partners is to have a good understanding of the working interest of an over-the-fence potential asset of interest. Historically, this has been an important piece of information during the preliminary analysis of an asset acquisition. It is even more critical now, following the landmark Redwater decision, with such a large focus being placed on liabilities and potential closure orders.

Typically, a defunct company’s assets will require closure via AER closure order (within 60 days) by any remaining solvent companies that own the asset. Primary responsibility for the closure and associated costs usually goes to the largest remaining WIP shareholder, who can then claim a refund of the defunct partners’ portion through the OWA’s Working Interest Claims program.

Despite the potential for a partial refund, a closure order due to the sudden, unexpected insolvency of a working interest partner can blindside you and your company. Liability and closure costs you hadn’t budgeted for – or didn’t even realize you were responsible for – can suddenly come due. Even worse, a closure order could be triggered by regulator records that are far out of date, and don’t accurately reflect current ownership.

XI Technologies recently had a client who, by using XI’s AssetBook software, discovered that the land transfers on nearly a hundred working interest properties it sold two years ago had never been completed by the provincial regulatory body. Had a closure order been issued related to these lands it would have been a very unpleasant surprise that might have to be sorted out under pressure of the 60-day closure timeline.

Historical trends indicate that accuracy and transparency in working interest has become more important than ever precisely when it is becoming more difficult than ever to track. With more companies running up against tough times, it forces producers to come up with new solutions for verifying and monitoring their working interest partnerships. Depending on the size and breadth of your portfolio, traditional spreadsheets might not cut it. And simply ignoring the problem is no longer an option.

The Solution: XI Synergy Report

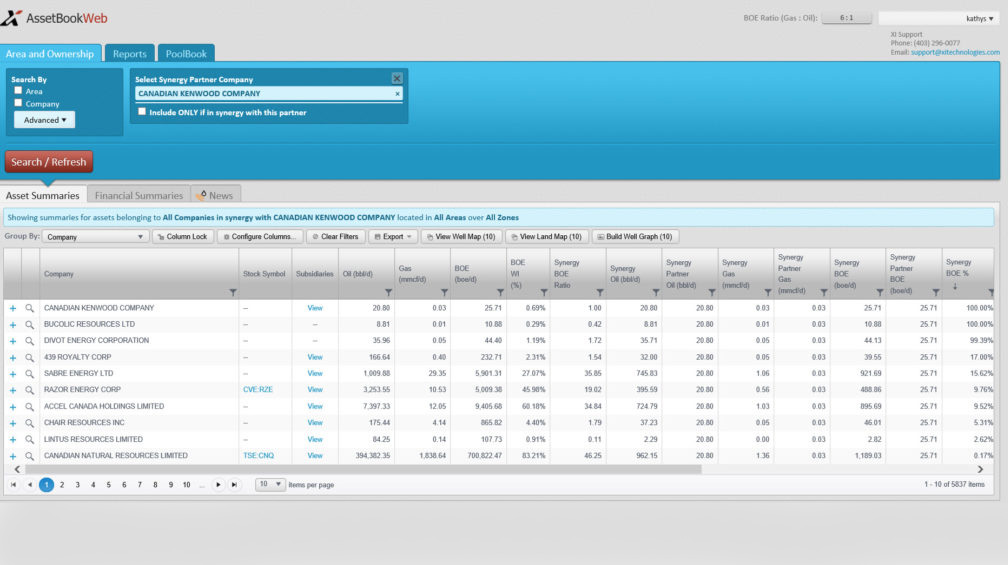

Some time ago, XI recognized the need to understand all parties involved in an asset portfolio, and the estimated shared amounts of assets between multiple companies. A simple report can give you a target company’s working interest partnerships, weighted by shared BOE percentage, and what percentage of both partner company’s total assets the shared BOE represents.

Using tools like the Synergy Report in XI’s AssetBook can help producers have a reliable, easily produced way of assessing working interest partnerships, which is fast becoming an essential workflow in the world of insolvent asset management and ownership. XI’s AssetSuite helps producers achieve more timely and complete industry intel with critical research and strategy tools for oil and gas. To see how you can create a Synergy Report similar to the one pictured above, watch the video by following this link.

For a more in-depth look at XI’s Asset Planning, LLR, ARO, Drilling or Regulatory solutions book a personalized demo.