How Liability, or Asset Retirement Obligation Insight Strengthens A&D Decisions

November 26, 2025

In the world of acquisitions and divestitures, the best opportunities rarely announce themselves. They hide in datasets, legacy ownership structures, old well files, and liability frameworks that look different depending on who compiled them. For land and business development professionals, the challenge isn’t just finding assets — it’s understanding them well enough to decide whether they’re worth pursuing.

Production and reserves still matter. But increasingly, the differentiator between a good deal and a costly misstep comes down to how clearly a team understands the liability side of the equation, and how early they understand it.

- Screening

- Evaluation

- Due Diligence

- Post-Close Integration

Each of these stages depends on reliable, timely, and comparable liability data. And today, those who invest in understanding ARO early often find themselves ahead of their competition and operating from a position of confidence — not uncertainty.

1. Screening: Finding Opportunities That Truly Fit

The first stage of A&D is always about narrowing the field. What is in my area of interest? What upside potential is possible with the land portfolio? Where can new technology increase my production yield? These are all questions often asked in the screening phase, but often overlooked is the liability information and without clear reliable information, the screening phase can mislead you.

Land and BD professionals often face challenges such as:

- Assets that have changed hands multiple times and are difficult to track

- Working interest that isn’t obvious from public sources

- LLR values that differ across jurisdictions

- Historical issues or incidents that aren’t surfaced in high-level summaries

In some cases, assets that appear to belong to one company may actually be nested under a different corporate structure and a company’s previous acquisitions may not have undergone proper clean up, obscuring the truth behind ownership.

This uncertainty can push teams toward more risk than intended or cause them to overlook strong opportunities. Early liability insight solves this by making screening more consistent, more complete, and more strategic.

2. Evaluation: Building an Apples-to-Apples Comparison

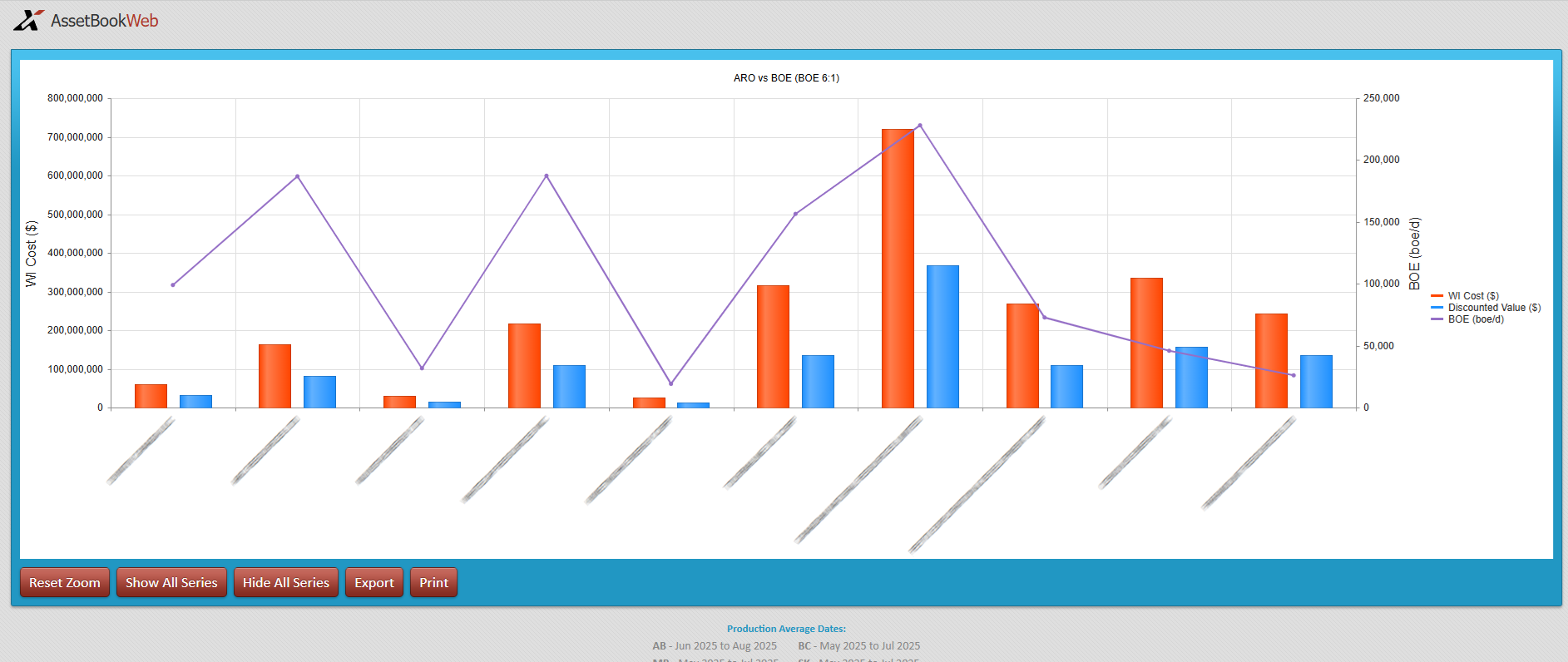

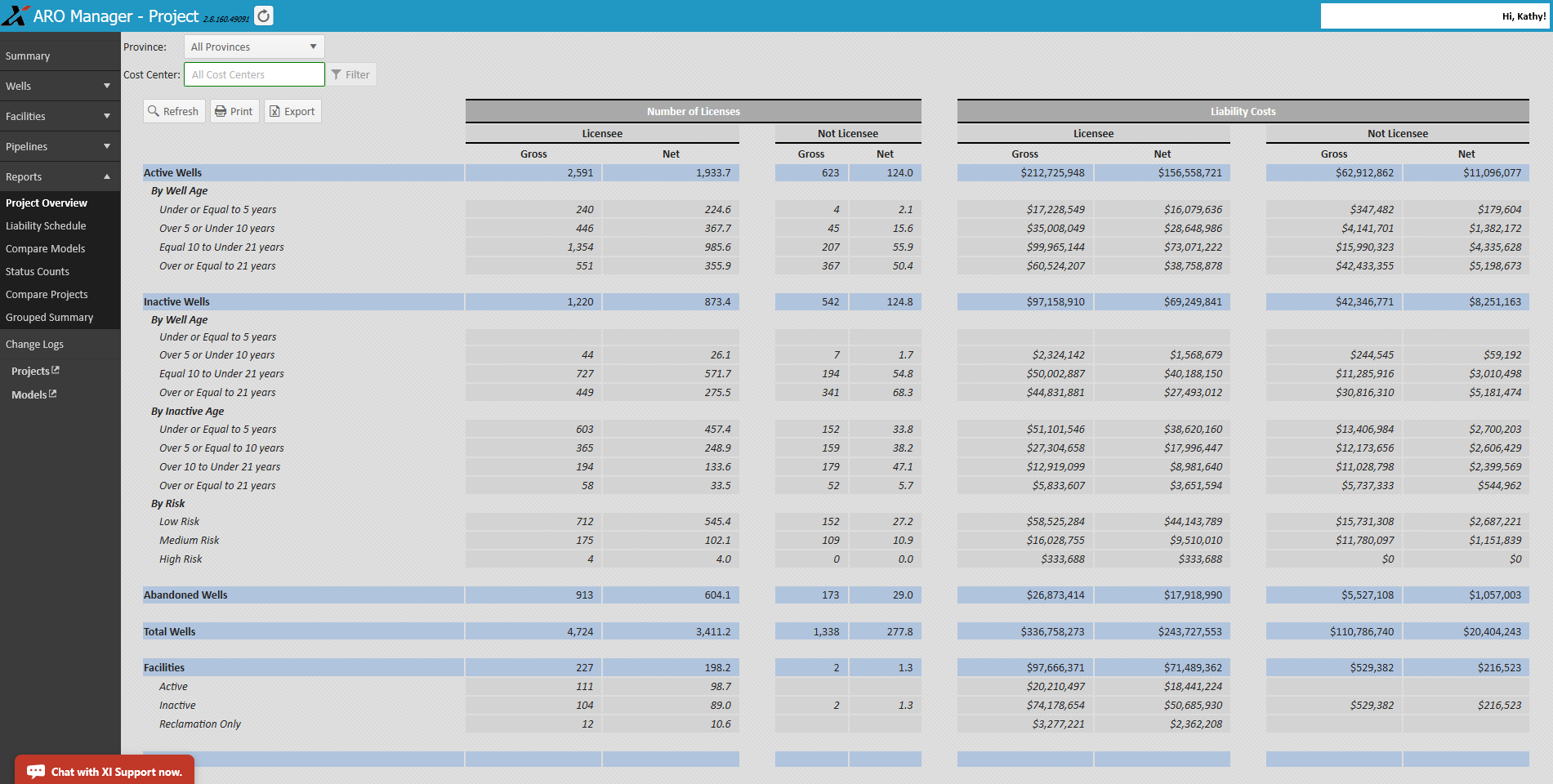

Once a target passes initial screening, the goal becomes understanding how it stacks up against other options. At this stage, liability clarity supports deeper questions:

- How much of the liability is tied to inactive wells?

- How soon are abandonment and reclamation activities likely to be required?

- How do different cost models (government, internal, industry-standard) impact total exposure?

- How do timelines, age categories, or risk classes compare across packages?

Teams that rely on spreadsheets for this phase quickly learn their limitations:

- They struggle with scenario switching

- They require constant manual updates

- They lack traceability

- They create inconsistencies across evaluations

Land and BD teams need a common lens through which to compare multiple opportunities — especially when cost assumptions vary widely between sellers, regulators, internal teams, and lenders.

A structured ARO evaluation creates clarity. It allows you to compare two or ten packages with confidence, knowing that each is being assessed using the same assumptions, the same parameters, and the same methodology.

3. Due Diligence: Verifying What You Think You Know

Once the data room opens, the focus shifts from estimation to validation.

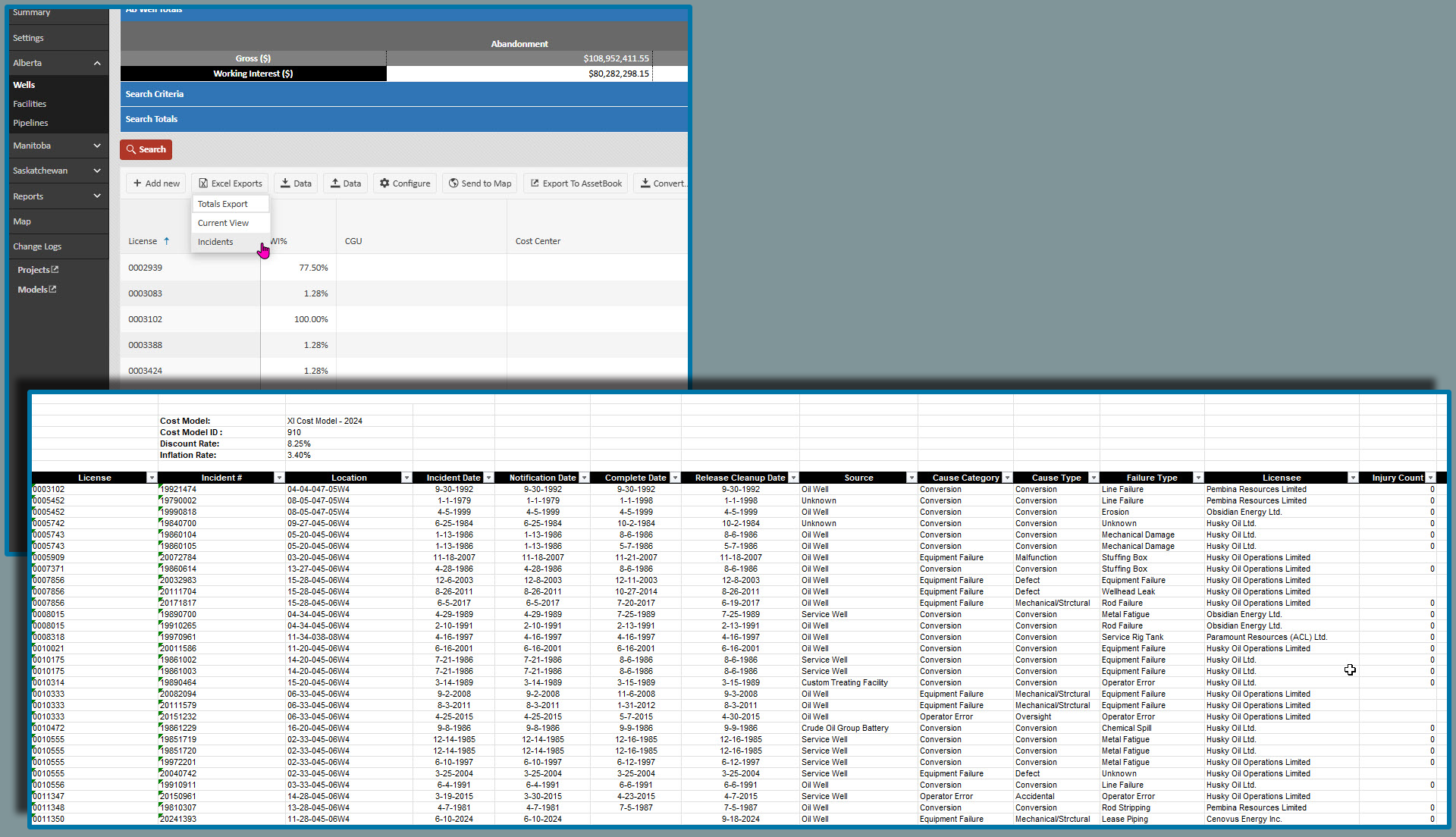

However, due diligence comes with its own challenges:

- Well lists may be incomplete or formatted inconsistently

- Working interest may not align with public data

- Cost assumptions may differ from your internal standards

- Incident history may surface new red flags

At this stage, teams need a way to incorporate proprietary information into the liability lens they’ve already built — not start from scratch. This allows them to:

- Confirm that nothing is missing

- Identify issues the seller may not have highlighted

- Reassess valuation based on the most accurate inputs available

- Ensure the package still aligns with strategic objectives and valuation assumptions.

Liability analysis in due diligence is ultimately about protecting the deal — or deciding not to advance it.

4. Post-Close Integration: Turning Evaluation Into Action

Once a deal closes, liability work becomes real work.

Post-close, land and BD teams must transition their evaluation into operational planning. This stage becomes significantly easier when the work done during screening, evaluation, and due diligence carries forward seamlessly.

With a clear, structured ARO view:

- New assets can be integrated without rebuilding spreadsheets

- Working interest and assumptions flow directly into operational ARO processes

- Timelines and obligations become visible immediately

- Priority high-risk assets surface faster

- Teams can begin regulatory filings, internal reporting, and planning without delay

For organizations that acquire assets regularly, this continuity between A&D evaluation and long-term liability planning becomes a major strategic advantage.

Why ARO Insight Has Become Strategic — Not Optional

Across the industry, A&D teams are recognizing a simple truth:

Liability insight is now as important as production, reserves, or economics.

A strong ARO evaluation process helps teams:

- See what lenders and regulators will see

- Identify red flags before committing resources

- Avoid overpaying for liabilities

- Strengthen deal positioning

- Reduce internal uncertainty

- Build better cross-department alignment

It protects buyers from hidden exposure and dramatically improves decision quality.

Why A&D Teams Are Moving Toward an “Industry Standard” Approach

The final question for land and BD professionals is no longer whether they should incorporate ARO insight early in the process — it’s how they should do it.

Teams that take liability management seriously tend to converge on the same conclusion:

A&D evaluation requires a standardized, trusted, industry-aligned ARO tool — not spreadsheets, stitched-together data, or one-off calculations.

A strong ARO system provides:

- Accurate working interest inputs

- Standardized or customizable cost models

- Year-by-year liability schedules

- Consistent assumptions across deals

- Audit-ready transparency

- Faster, more defensible decisions

For teams committed to disciplined growth, this has quietly become the new standard.

While many tools exist, the A&D community increasingly gravitates toward platforms that combine speed, accuracy, and reliability — platforms like XI’s ARO Manager — that give them the confidence to evaluate opportunities with clarity and the foresight to pursue only the deals that truly fit.

—

Missed our Webinar on AssetBook ARO Manager for A&D?

Watch it online now and learn to:

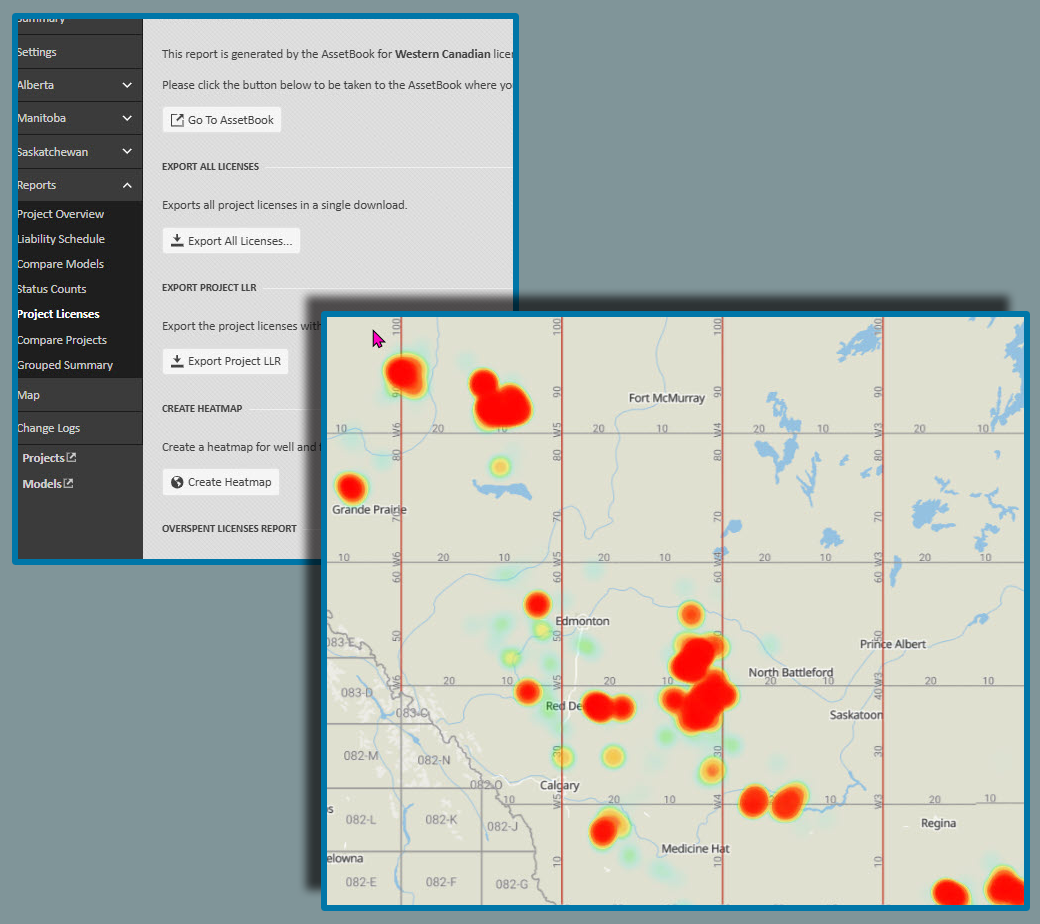

- Perform A&D scenario analysis using any combination of properties and ownership structures

- Calculate potential ARO using XI’s standardized cost model, based on real-world abandonment and reclamation data from the WCSB

- Upload and integrate proprietary corporate ARO cost data for enhanced precision

- Monitor and optimize liabilities from acquisition through abandonment and reclamation

- Collaborate, save, and report with AssetBook’s secure, web-based platform

—

📅 Ready to Level Up? Check Out Our New Training Calendar!

Stay ahead with our latest Training Calendar, featuring all upcoming online and in-person courses. Whether you’re looking to sharpen your skills or dive into something new, there’s a session for you.

👉 View the Training Calendar now and reserve your spot today!

—

Curious to learn more about XI’s product suites? Book a product demo today!

The number of users for XI Technologies modules is not limited to individual seats. The modules are accessible on a corporate wide subscription. Your company may have a XI Technologies AssetBook subscription. To register for access to your corporate account, click here.

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.