Emissions – Mandates & Measurements Affecting Alberta’s Oil & Gas Sector

November 12, 2024

The oil and gas sector continues to be a focal point in the global conversation on climate change, and governments are taking additional steps to regulate and reduce emissions. Recent news about the emissions production cap (equivalent to 35 percent below 2019 levels) announced by the Government of Canada last week is controversial. Our industry has weathered many changes in regulations over the decades through perseverance and our entrepreneurial spirit. While this news can seem like one more straw that will eventually break the camel’s back, a holistic view based on data can provide insight and a path forward. At XI, we have built our business on government data and on helping our clients navigate regulations and are pleased to provide an article originally published in January 2024, updated for currency.

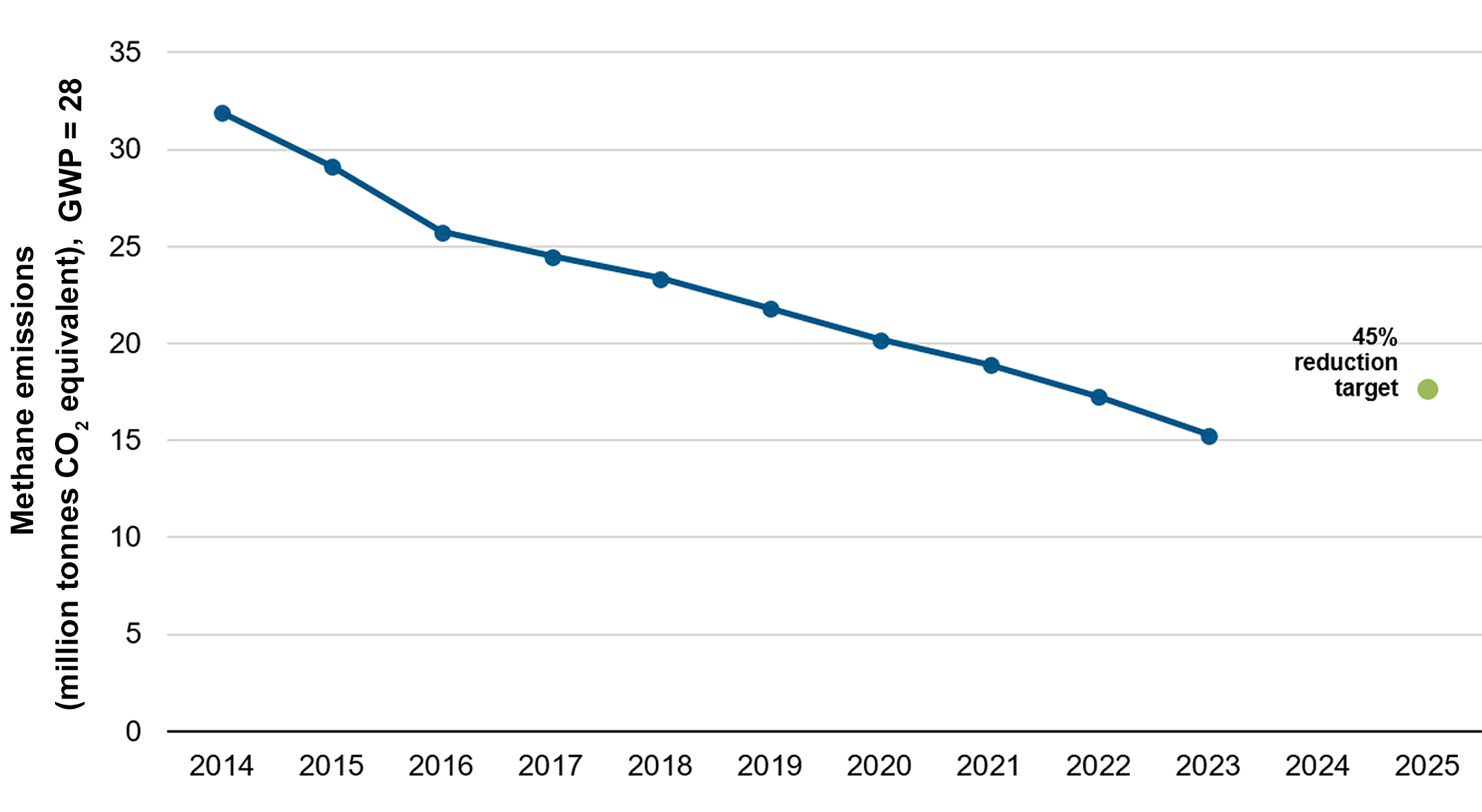

In early January 2024, the AER published their updated Methane-Emissions package, including an updated Upstream Petroleum Industry Emissions Report (ST-60B). The report is a summary of performance updated in November 2024 to include 2023 data, breaking down fuel, flare, vent, and fugitive emissions (including source specific emissions). Accompanying the report, the Methane Performance report brought attention to this fact:

Alberta has achieved the Government’s goal of a 45% reduction in methane emissions from the 2014 baseline, reaching this milestone two years ahead of the 2025 deadline.

The latest AER reporting is current to 2023. How are individual companies in Alberta currently responding to these mandates? Let’s delve into the emissions trends over the last three years, plus add in Year to Date (YTD) metrics, with a focus on intermediate peer group companies.

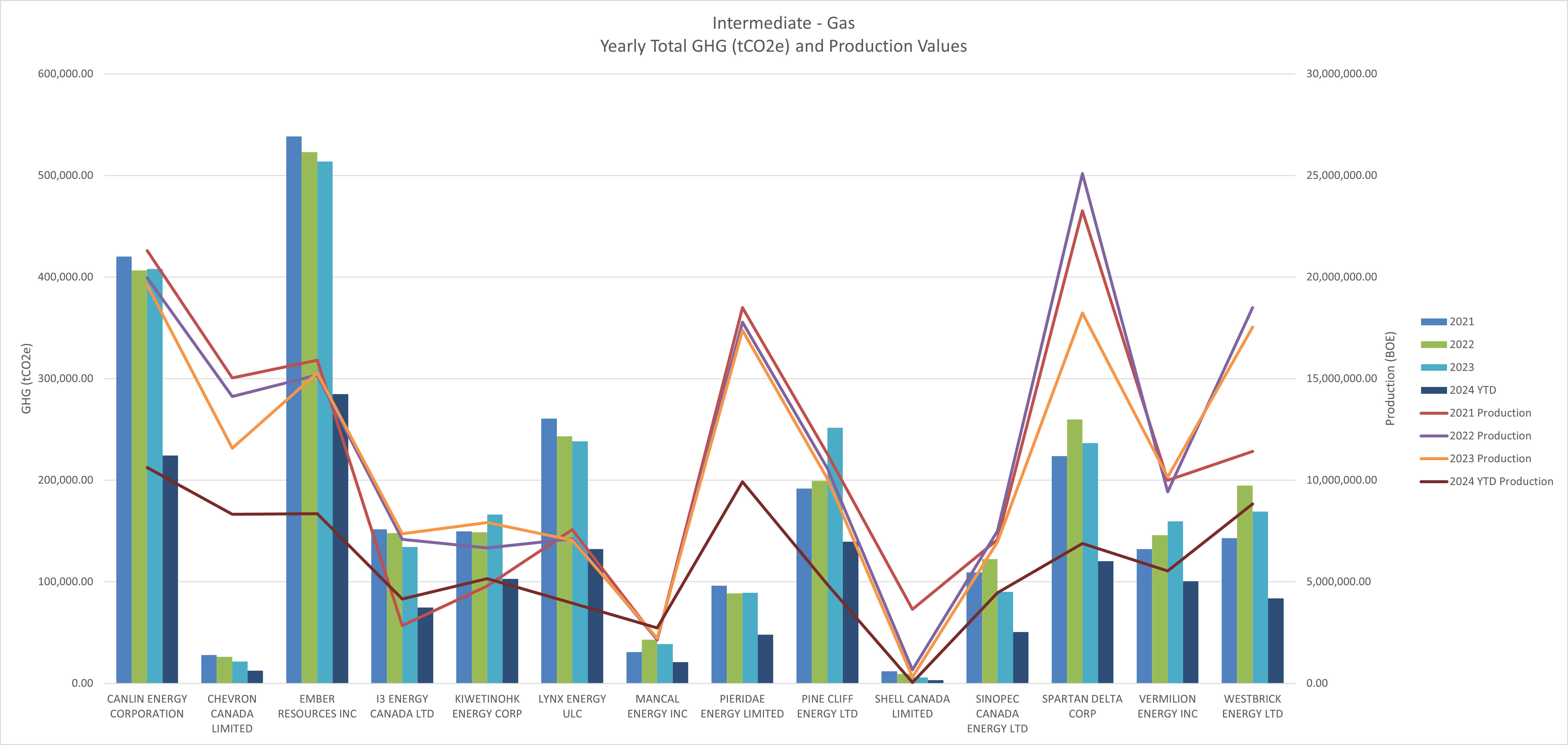

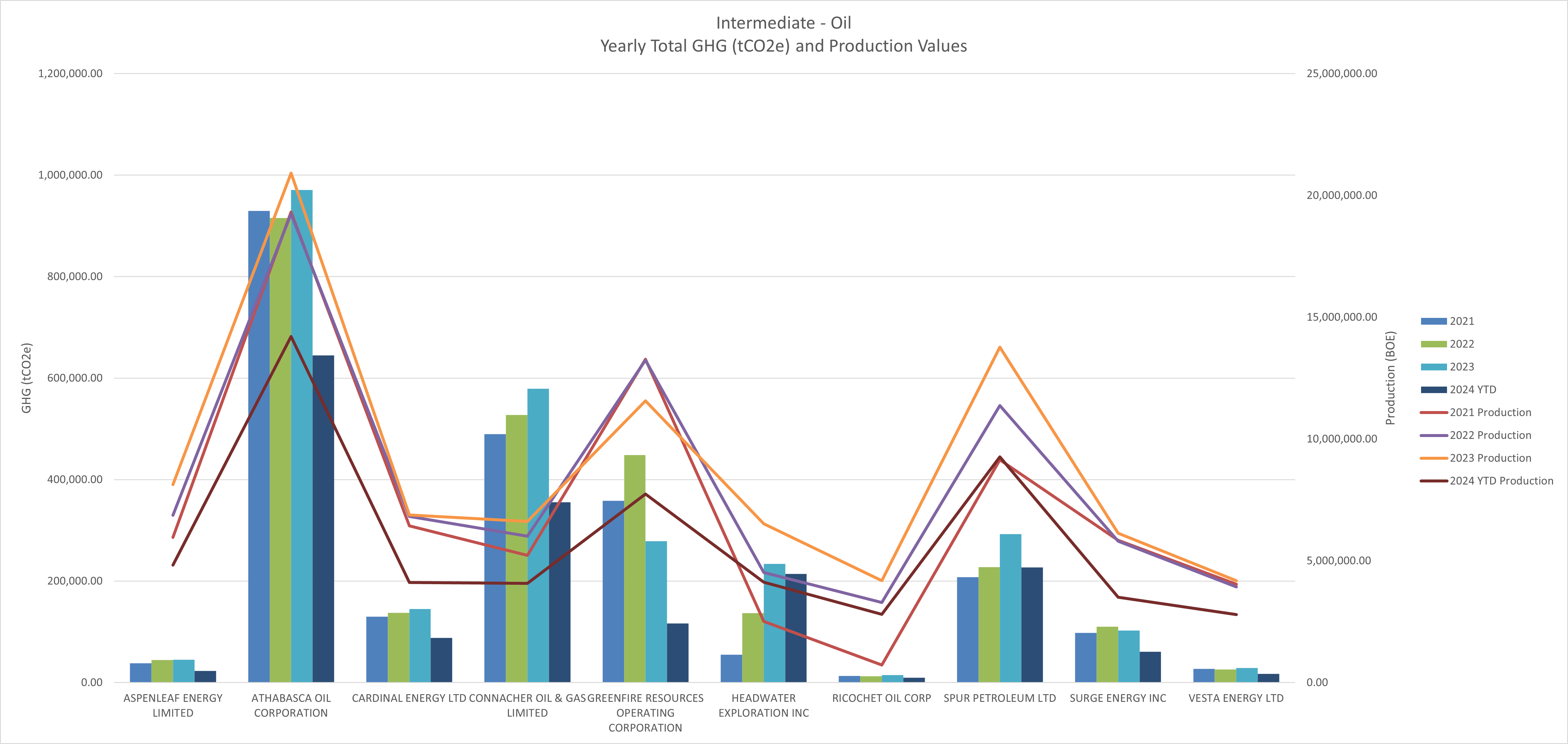

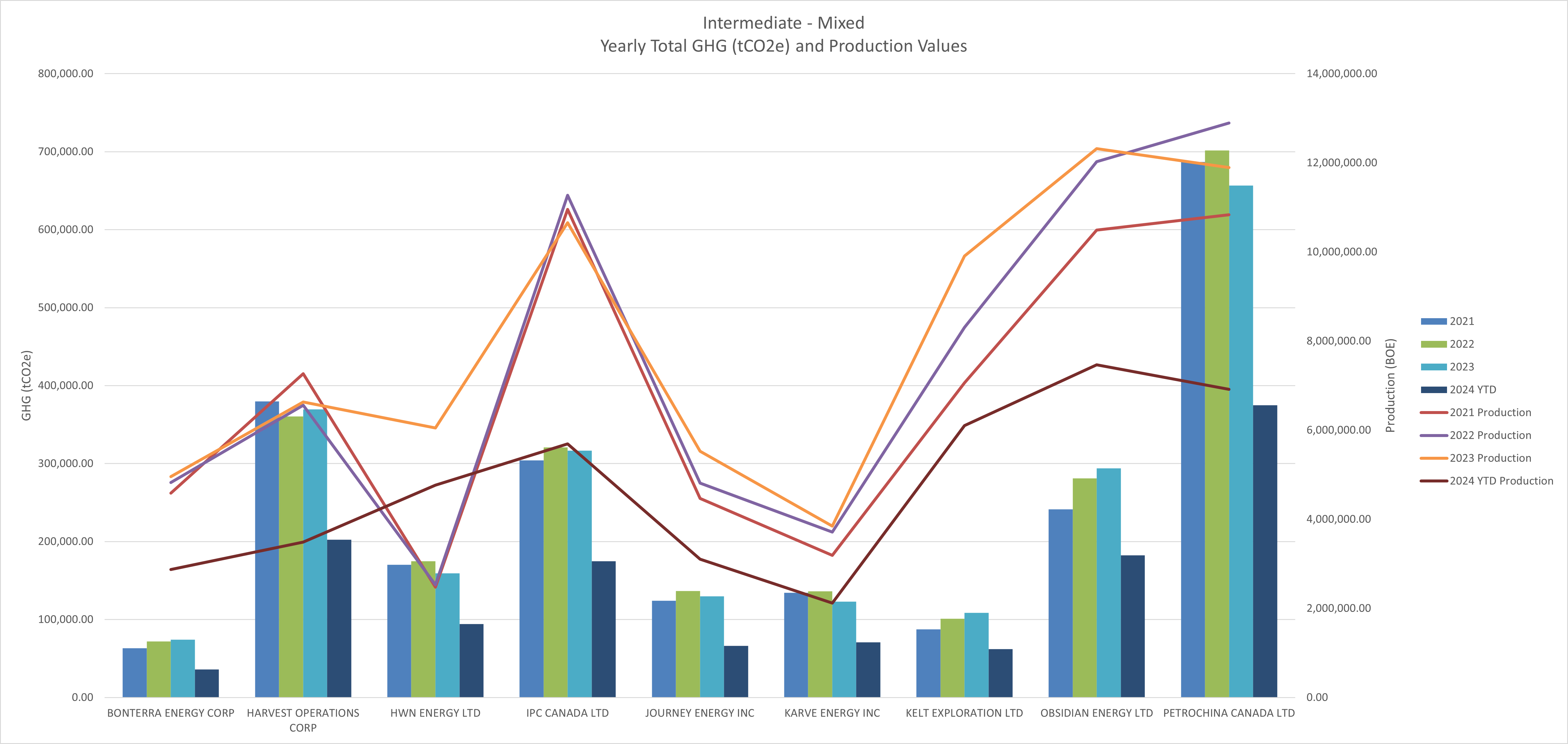

The following graphs were generated from XI Technologies AssetBook Emissions Module that can be used to view Scope 1 emissions data for any asset in the WCSB. Peer Groups were generated from our Licensee Capability Assessment (LCA) Module, focusing on AER’s Directive 88: Licensee Life-Cycle Management directive. In addition to 2023 totals, the charts include 2024 YTD totals.

Unveiling the Data: Alberta’s Emissions Landscape

Three distinct graphs, representing intermediate peer group companies, shed light on the reported Scope 1 emissions (fuel, flare, vent) and production trends in Alberta’s oil and gas sector. These companies are categorized based on their size and primary product type, following the guidelines outlined in Directive 88. The trends are based on an operator’s current asset holdings (as of Nov 2024), with a look back at how they have performed over time.

Puzzling Disparities: Efficiency or Selective Operations?

A notable observation is the presence of companies with significantly higher production relative to their reported emissions. This raises intriguing questions – are these companies operating more efficiently, or are they not operating their higher emitting facilities?

Understanding the nuances behind these disparities can offer valuable insights into best practices within the industry. It might signify innovative approaches to emissions reduction or indicate areas where operational efficiencies can be replicated across the sector.

The Road Ahead: AssetBook Emissions Analysis

Another change is coming via the Canadian Sustainability Standards Board (CSSB) as it follows international protocol already in action elsewhere. The new rules enforce mandatory sustainability and emissions disclosures for all Canadian companies. You can learn more about this here.

CSDS 1 and 2 largely align with IFRS S1 and S2, but contain some recommended Canadian-specific modifications, which include:

- Extending the earliest voluntary adoption dates for CSDS 1 and CSDS 2 from January 1, 2024, to January 1, 2025.

- The proposed transition relief for disclosures beyond climate-related risks and opportunities has been extended from one year granted by the ISSB to two years. This means entities that voluntarily adopt the CSSB standards on January 1, 2025, will be required to disclose information on all sustainability-related risks and opportunities from the reporting period beginning on or after January 1, 2027.

- The proposed transition relief for disclosure of Scope 3 GHG emissions has been extended from one year granted by the ISSB to two years. This means entities that voluntarily adopt the CSSB on January 1, 2025, will be required to disclose Scope 3 GHG emissions from the reporting period beginning on or after January 1, 2027.

Whether it’s through new government announcements about the pending emissions cap, or imminent disclosure requirements heading our way, one thing is clear: emissions reporting is no longer optional, nor can it be left to each company’s self-reporting methodology.

For those keen on exploring this analysis in greater detail or examining different peer groups, AssetSuite offers a comprehensive solution. Whether you desire a deeper dive into the data or wish to explore trends, a demo of AssetBook Emissions could provide the answers you seek.

The evolving landscape of emissions regulations in the oil and gas sector demands a nuanced understanding of individual company efforts. As we move towards a sustainable future, dissecting these graphs and exploring the underlying dynamics becomes crucial in shaping effective regulatory frameworks and industry practices.

Here’s how YOU can prepare: Join our “Expert Xchange” on Emissions presented by GLJ and XI Technologies.

- What: Learn more about the mandates affecting Alberta’s oil & gas sector, what’s coming, how you’ll be expected to track and report on your own emissions, and how you can manage the process related to M&A activities and line of sight planning.

- Where: XI Technologies – 1700, 734-7th Ave SW Calgary T2P 3P8

- When: Dec. 3 @ 8:15am

- How: This is a live event & space is limited – Register HERE

Upcoming Certification Course:

ARO Manager For Financial Tracking and Reporting Certification Course provides practical, hands-on professional development for anyone interested in expanding their knowledge of Asset Retirement Obligation (ARO) tracking and reporting.

When: December 10th and December 12th at 8:30am (almost full)

When: February 25th and February 27th at 9:00am

Space is limited so be sure to register now for the course. This is 2 x half- day course taking place in person at the XI office.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.