How Spreadsheets Are Undermining ARO Efficiency

September 24, 2024

Recent government directive changes are posing potential challenges for companies managing their Asset Retirement Obligations (ARO) through traditional spreadsheets. In particular, the Alberta Energy Regulator (AER) revised Directive 011 in June for greater accuracy of liability cost estimates related to well abandonments under the new Liability Management Framework (for an overview, see our previous article – Unpacking Directive 011: What You Need To Know).

While these updates aim to enhance accountability and transparency, they also introduce complexities that can lead to inaccuracies and broken spreadsheet formulas. If your organization is still relying on spreadsheets for ARO management, you may find that this method falls short in addressing the intricacies of the new requirements.

ARO planning, tracking and reporting can be daunting, especially when changes to costs disrupt traditional spreadsheet-based cost models. With numerous cells affected by one data point, these manual changes in a spreadsheet may lead to inaccuracies and inefficiencies in your financial tracking and forecasts, affecting risk-related decisions.

XI Technologies created the industry-leading solution in ARO Manager, a more robust and stable database software designed to adapt seamlessly to directive shifts while keeping your cost model intact, ensuring precise calculations for your future planning.

Efficient ARO management is crucial for maintaining financial health and compliance. While spreadsheets have been a go-to tool for many organizations, the recent webinar by XI Technologies, “The Problem with Spreadsheets,” sheds light on the growing challenges associated with relying on spreadsheets for ARO management. Here’s a breakdown of the key insights from the webinar and why it’s time to consider a more robust solution.

What is Asset Retirement Obligation (ARO)

Asset Retirement Obligation (ARO) is an accounting term utilized across various industries. For the oil and gas sector, it refers to the costs associated with the abandonment and reclamation of wells and facilities, including pipelines. The significance of ARO has grown increasingly critical in recent years, especially in relation to Directive 88 of the Alberta Energy Regulator (AER), which focuses on Licensee Life-Cycle Management (LCM). ARO and LCM have become central to discussions in the industry.

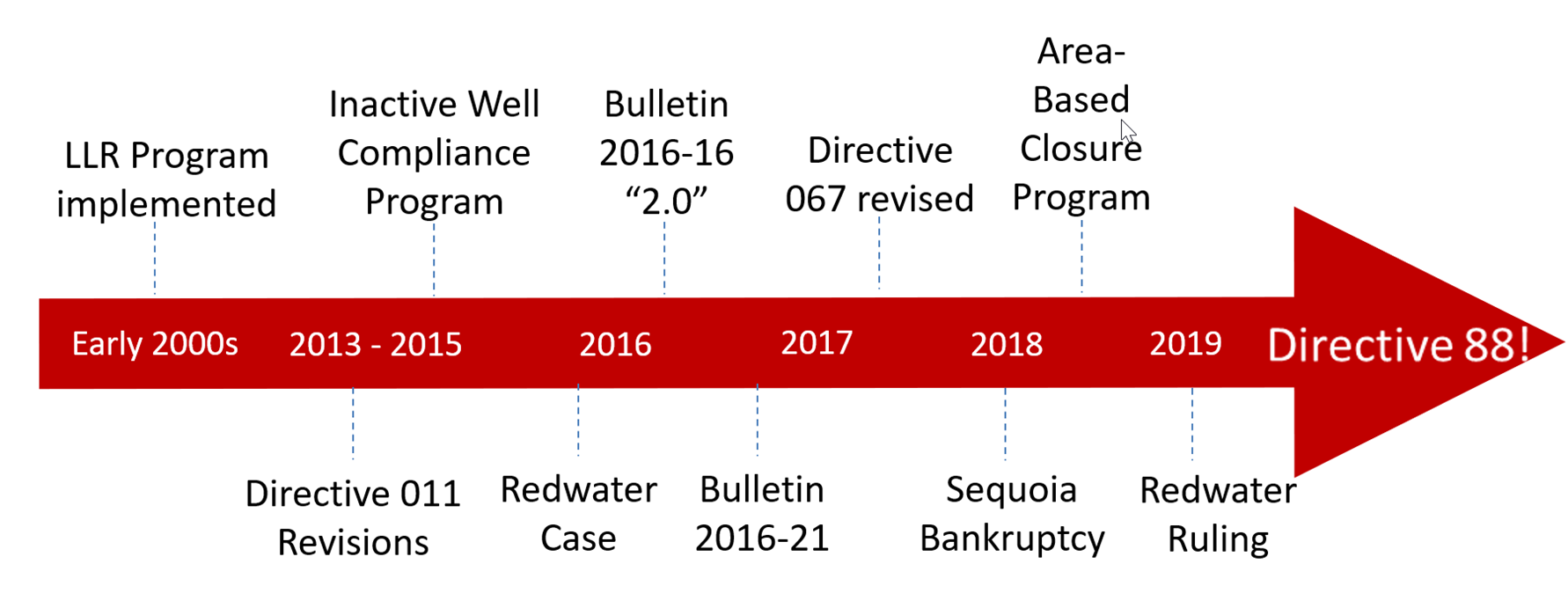

Key Events in Liability Management

Why is ARO Important

Asset Retirement Obligation (ARO) is critical to the oil and gas industry for several reasons. First and foremost, accurate ARO financial tracking and reporting ensures that companies properly account for the future costs associated with decommissioning wells and restoring sites to their natural state. This financial planning is essential to avoid unexpected liabilities that could impact a company’s profitability and sustainability.

Furthermore, ARO plays a significant role in regulatory compliance. With increasing scrutiny from regulators and stakeholders, companies are required to demonstrate their commitment to environmental stewardship and responsible resource management. Properly accounting for ARO helps ensure that operators fulfill their legal obligations and adhere to industry standards, particularly under frameworks like Directive 88 from the Alberta Energy Regulator.

Additionally, ARO contributes to risk management. By accurately estimating the costs and timelines for abandonment and reclamation, companies can better prepare for potential challenges, reducing the risk of financial and reputational damage. This proactive approach fosters trust among investors, communities, and regulatory bodies, ultimately supporting a company’s long-term viability.

Finally, as the industry shifts toward more sustainable practices, ARO is integral to transitioning away from traditional extraction methods. It encourages companies to consider the full lifecycle of their operations, promoting practices that mitigate environmental impact and enhance social responsibility. In summary, accurate ARO tracking is vital not only for financial stability and compliance but also for fostering a culture of accountability and sustainability in the oil and gas sector.

Spreadsheets: A Double-Edged Sword

Spreadsheets have long been popular due to their flexibility and ease of use. They allow users to quickly input data, perform calculations, and generate reports. For many organizations, this convenience makes spreadsheets a tempting choice for managing ARO tracking and reporting. However, as highlighted in the webinar, this very flexibility can become a significant drawback.

The Key Problems with Spreadsheets in ARO Management

- Data Integrity Issues

- Manual Errors: Spreadsheets are prone to human error. Data entry mistakes, formula errors, and accidental deletions can lead to inaccurate information, which can have serious implications for financial reporting and compliance.

- Version Control: With multiple users accessing and modifying spreadsheets, keeping track of the most recent and accurate version can become a challenge, leading to discrepancies and confusion.

- Scalability Challenges

- Complexity Over Time: As organizations grow and ARO portfolios become more complex, spreadsheets often struggle to keep up. Managing large volumes of data and performing complex calculations can slow down spreadsheet performance and increase the risk of errors.

- Integration Issues: Spreadsheets typically operate in isolation, making it difficult to integrate with other financial systems and databases. This lack of integration can hinder comprehensive reporting and analysis.

- Limited Collaboration Capabilities

- Real-Time Collaboration: Spreadsheets are often not designed for real-time collaboration. Multiple users working on a spreadsheet simultaneously can lead to conflicts and inconsistencies.

- Access Control: Managing who has access to sensitive ARO data and ensuring that permissions are correctly set can be cumbersome in a spreadsheet environment.

- Compliance and Audit Difficulties

- Documentation Gaps: Spreadsheets lack built-in audit trails and documentation features. This makes it challenging to track changes, verify calculations, and ensure compliance with regulatory requirements.

- Risk of Non-Compliance: The inability to easily track and manage complex ARO obligations can lead to potential compliance issues and financial penalties.

A Better Solution: Specialized ARO Management Software

Given these challenges, it’s clear that relying solely on spreadsheets for ARO management is not sustainable. Specialized ARO software offers a more robust and reliable solution. Here’s why:

- Enhanced Data Integrity

- Automated Calculations: Specialized software reduces the risk of manual errors by automating calculations and data entries.

- Centralized Data: These solutions centralize data management, ensuring consistency and accuracy across the board.

- Scalability and Integration

- Efficient Data Handling: Designed to handle complex and voluminous data, specialized software can scale with your organization’s needs.

- Seamless Integration: Modern ARO management tools integrate with other financial systems, facilitating comprehensive analysis and reporting.

- Improved Collaboration

- Real-Time Updates: Advanced software enables real-time collaboration and updates, allowing multiple users to work efficiently without conflicts.

- Controlled Access: Enhanced security features and access controls ensure that sensitive data is protected and managed appropriately.

- Compliance and Audit Readiness

- Audit Trails: Specialized software provides detailed audit trails and documentation features, making it easier to track changes and maintain compliance.

- Regulatory Alignment: These tools are often designed to meet regulatory requirements, helping organizations avoid compliance issues and penalties.

Conclusion

The XI Technologies webinar underscores a critical point: while spreadsheets have served their purpose for many years, their limitations fall short when it comes to managing complex datasets required for ARO tracking and reporting. Given the industry’s increasing importance on ARO in relation to securing funding, adhering to regulatory compliance, and performing acquisition and divestiture analysis, it’s time to embrace software that can mitigate the risks associated with spreadsheets, enhance data integrity, and streamline compliance processes.

For more insights and a deep dive into the problems with spreadsheets, check out the full webinar by XI Technologies here.

The AER has posted a video on the new direct to provide updated industry parameters and regional abandonment and reclamation costs used in calculating liability under the Licensee Liability Program. Watch their video here.

—

Upcoming Certification Course:

ARO Manager For Financial Tracking and Reporting Certification Course provides practical, hands-on professional development for anyone interested in expanding their knowledge of Asset Retirement Obligation (ARO) tracking and reporting.

When: October 22st and October 24rd at 9:00am

Space is limited so be sure to register now for the course. This is 2 x half- day course taking place in person at the XI office.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.