Tourmaline’s Energy Empire: What Crew Energy Acquisition Means for the Market

August 21, 2024

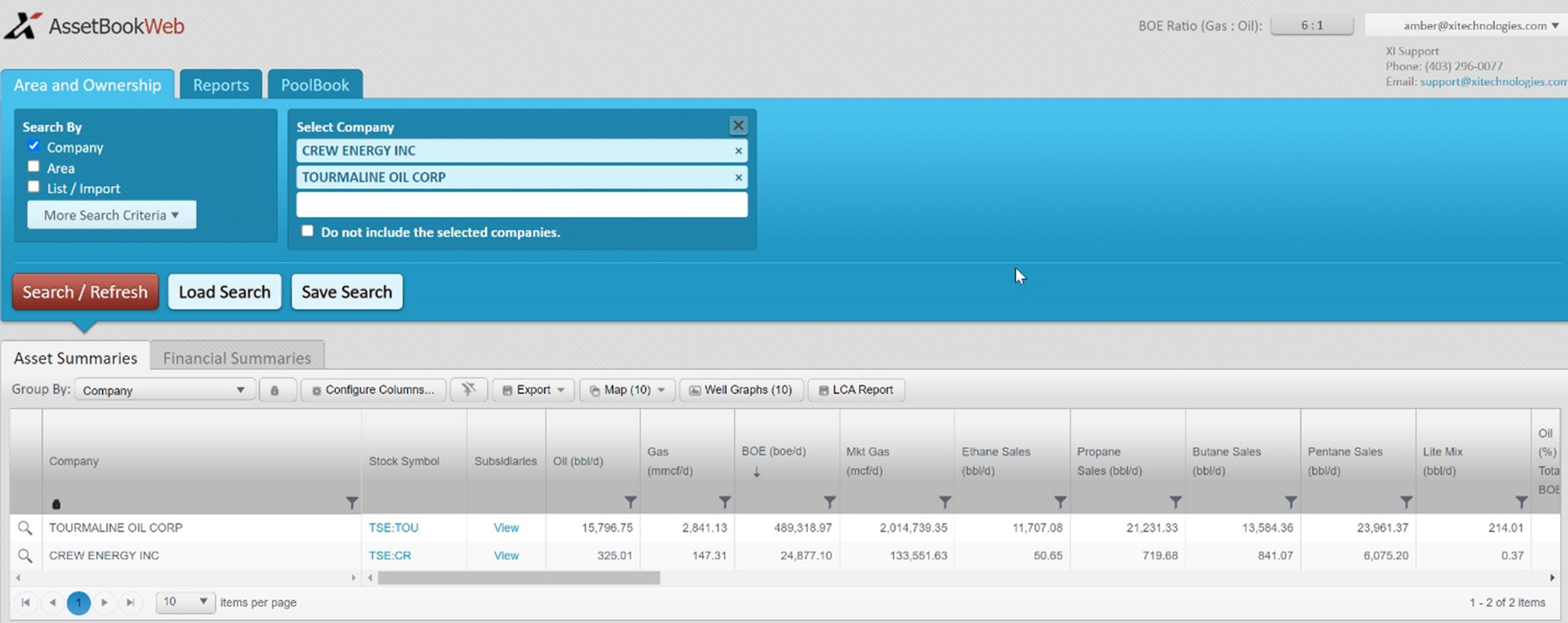

Tourmaline Oil Corp (Tourmaline) has announced that it is acquiring Crew Energy Inc (Crew) for $1.3 billion. Last year, Tourmaline acquired Bonavista Energy for $1.45 billion, which, based on AssetBook’s 6:1 ratio, translated to a valuation of about $30,400 per barrel of oil equivalent per day (boed). In contrast, the purchase of Crew, which has an AssetBook production of approximately 24,500 boe/d, shows a different picture. Given that the 6:1 ratio might not fully capture the value of Crew due to its higher liquid content, Tourmaline’s estimate of 29,000 to 30,000 boe/d implies a more precise valuation of around $44,000 per boed. This suggests that the premium associated with this acquisition might be influenced by factors beyond simple volumetric ratios, including the quality and composition of the gas reserves.

XI Technologies evaluated this transaction through different lenses using AssetSuite software tools and looked at each company’s asset profile, plus the combined entity, to gain valuable insight into the transaction. Consideration was also given to the fall out and which other players in the area may be affected. This deep dive gives a comprehensive understanding and full picture of the resulting acquisition.

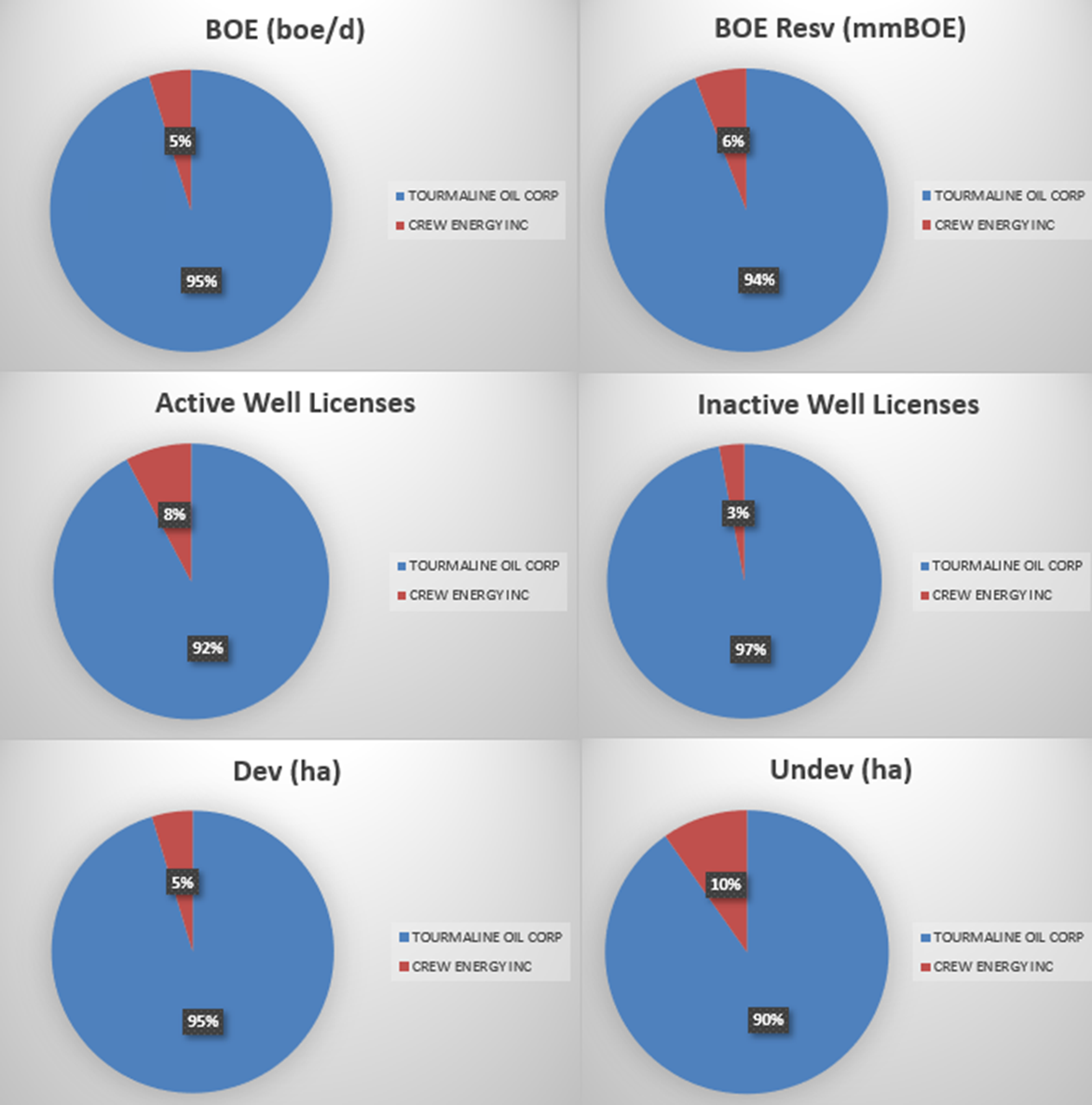

While the absolute numbers tell one story, accretion and dilution metrics tell us more. Looking at the AssetSuite summary, we can calculate some accretion and dilution metrics for this transaction relative to the increase in production.

Per Figure 2 below, Tourmaline’s production base will grow by 5% through this acquisition, while liabilities will only increase by 4%. All other metrics are marginally accretive to Tourmaline.

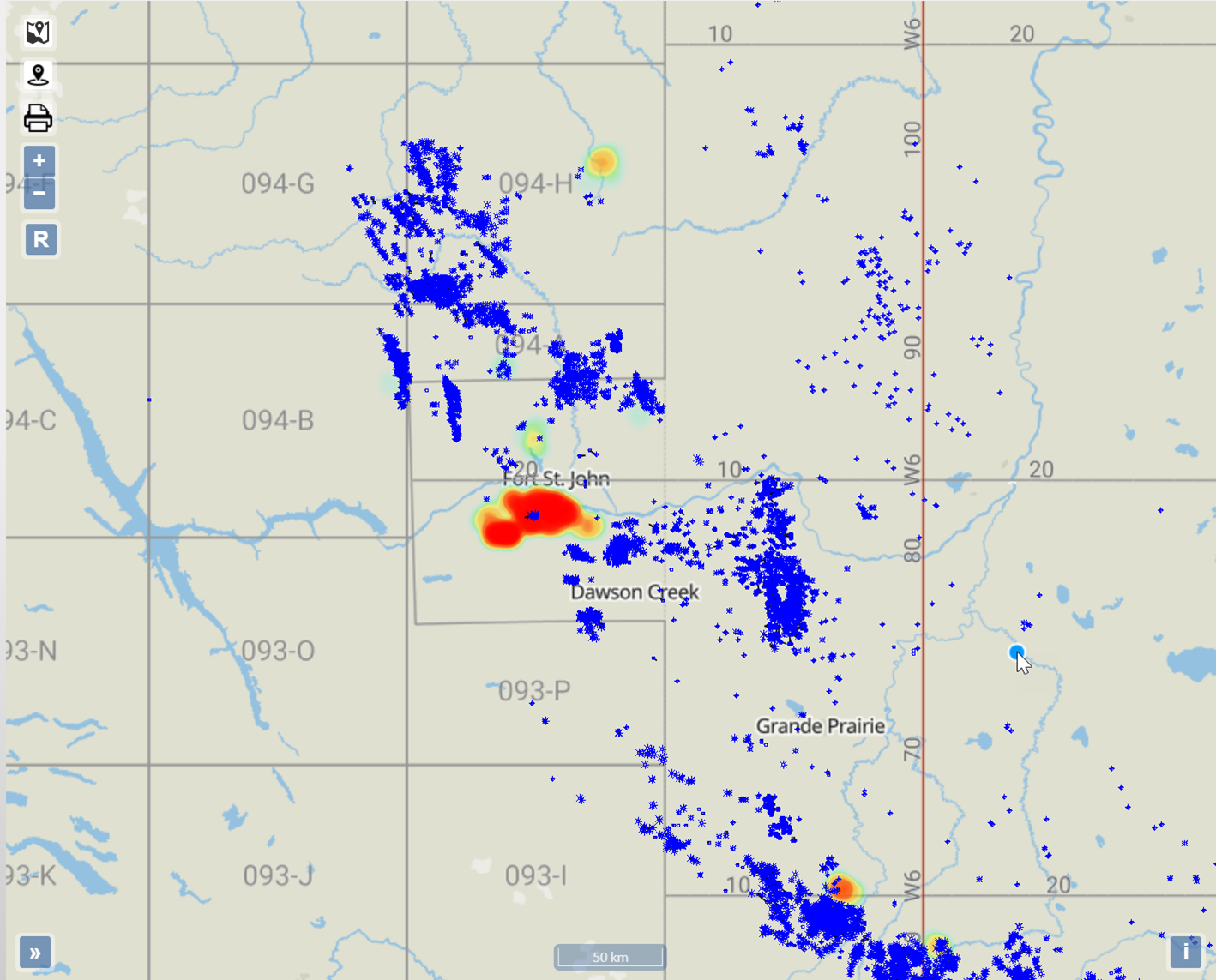

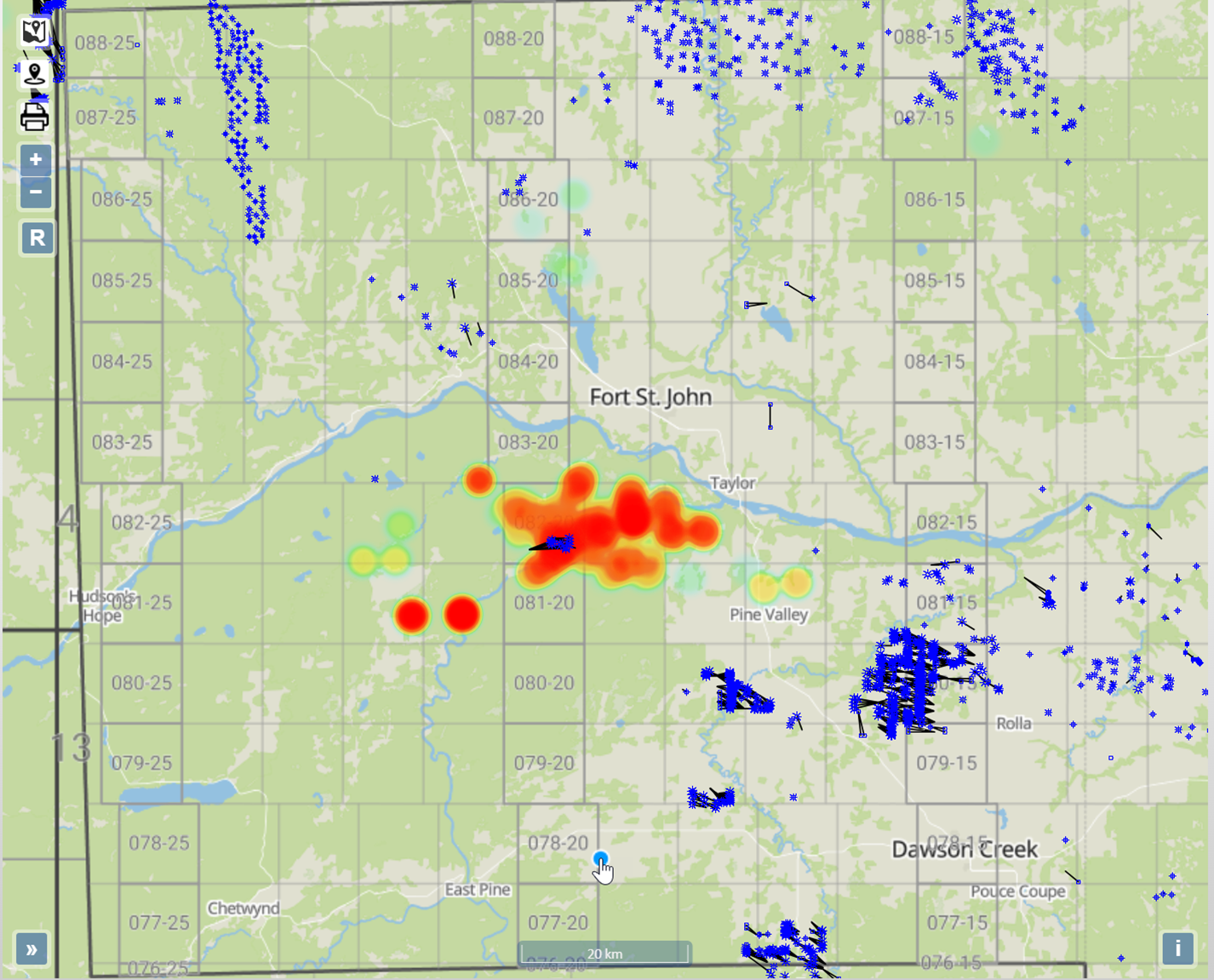

The best way to see the core of this deal is to overlay Crew’s production heat map on Tourmaline’s well map. It becomes apparent that the deep basin and central deep basin are at the core of this deal, but there are some non-core properties that are being purchased east of these.

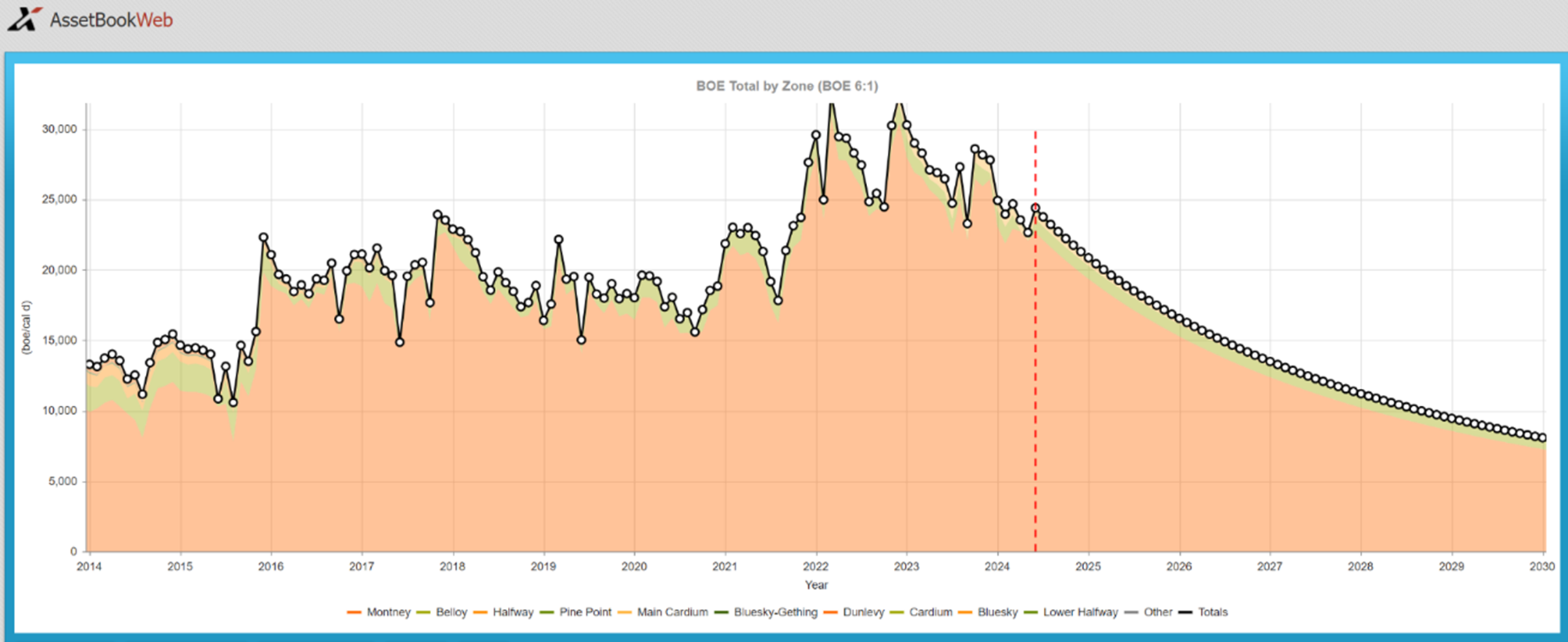

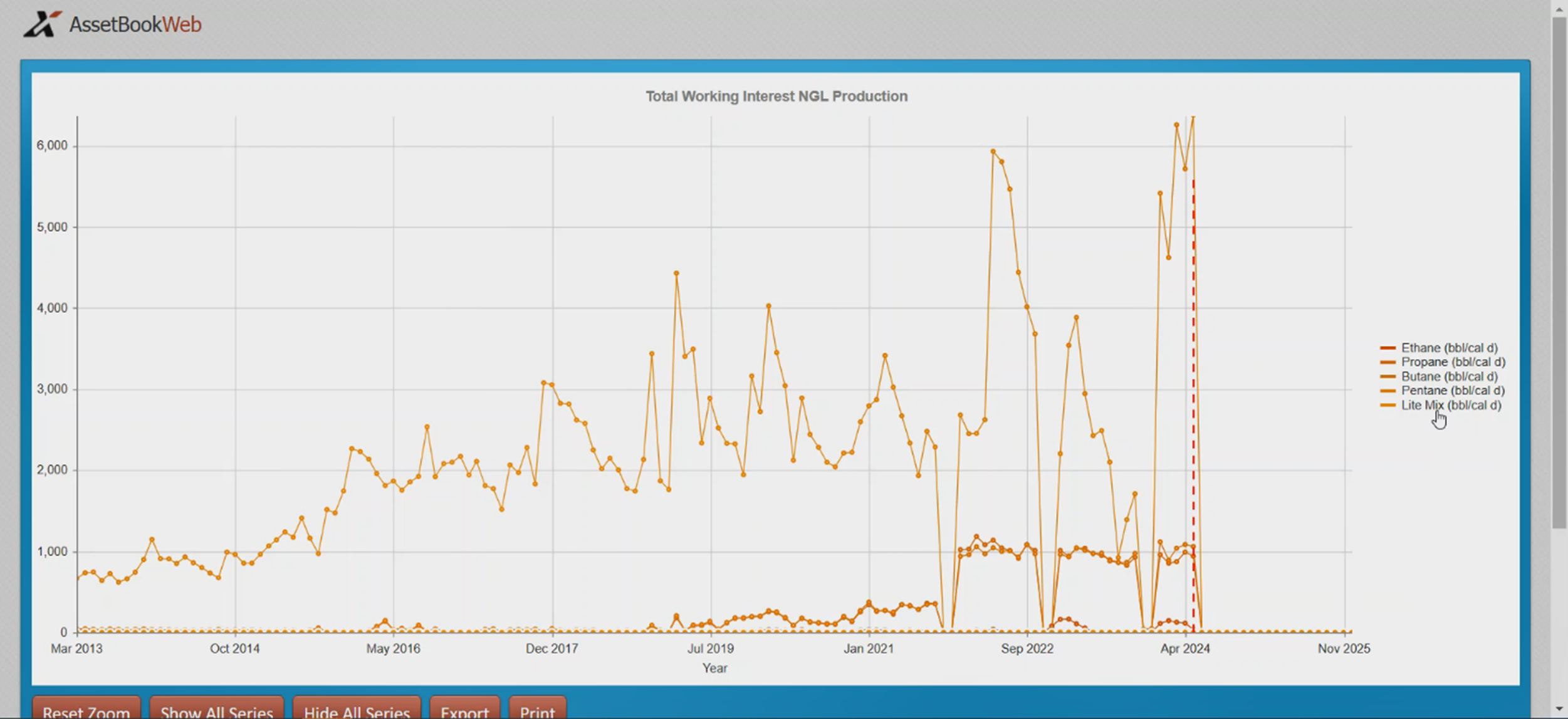

Expanding Tourmaline’s Peace River assets, this acquisition augments their production around Fort St. John. This acquisition is primarily a Montney asset purchase which is liquid rich as is demonstrated by figure 5 below.

According to government reported numbers, this deal will increase Tourmaline’s Pentane Sales gas by a significant amount. Note that these numbers are what are currently being reported through the BC and Alberta authorities with XI’s proprietary working interest algorithms applied. These numbers were only just released publicly April 2023 in Alberta.

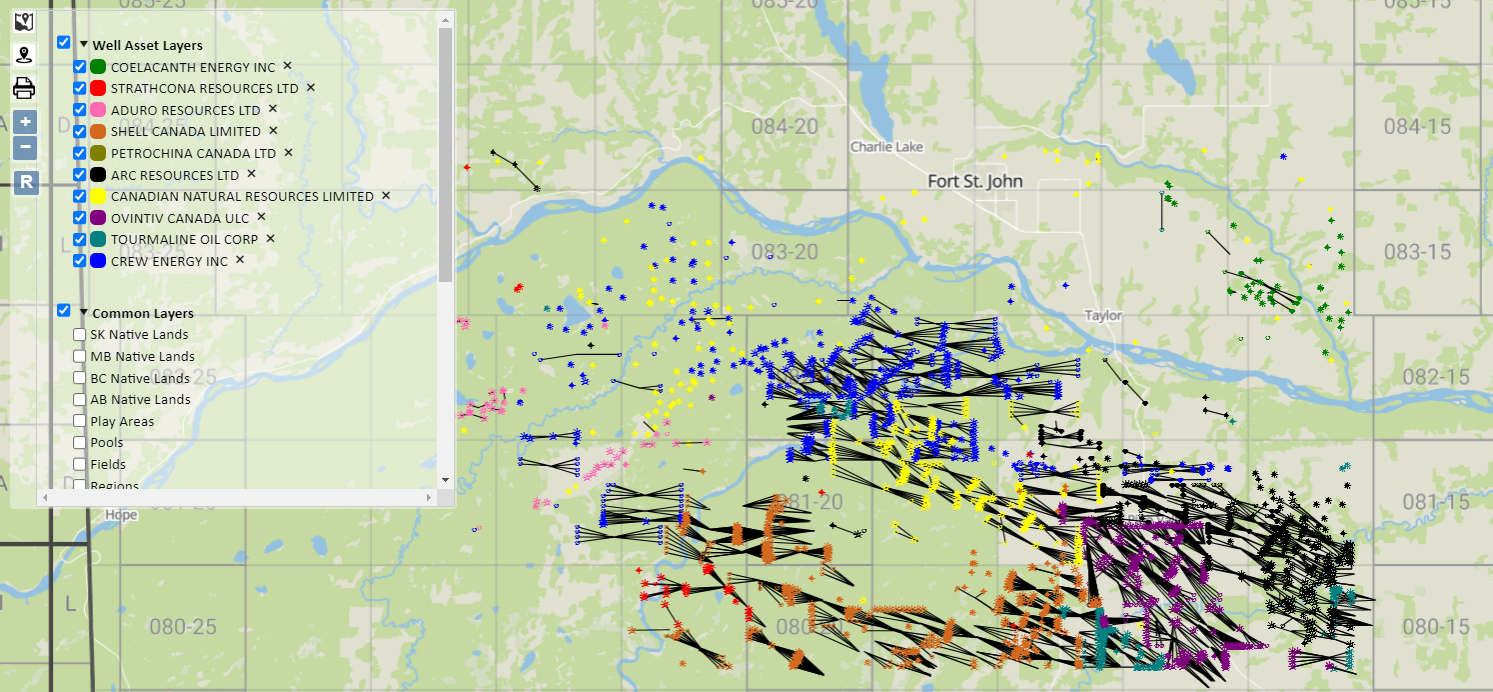

A CORE AREA OVERVIEW

With the AssetBook we can create an area around each of these and see all other players in that region. Shell Canada Limited is the largest player in this area with approximately 63,300 boe/d of the 204,242 boe/d producing from this area (Source: AssetBook). The area has 15 producers and 80% of the production is held by the top 4 producers. This is primarily a gas producing area with a little more than 93% of the production coming from gas. Download more information on the companies in this area here.

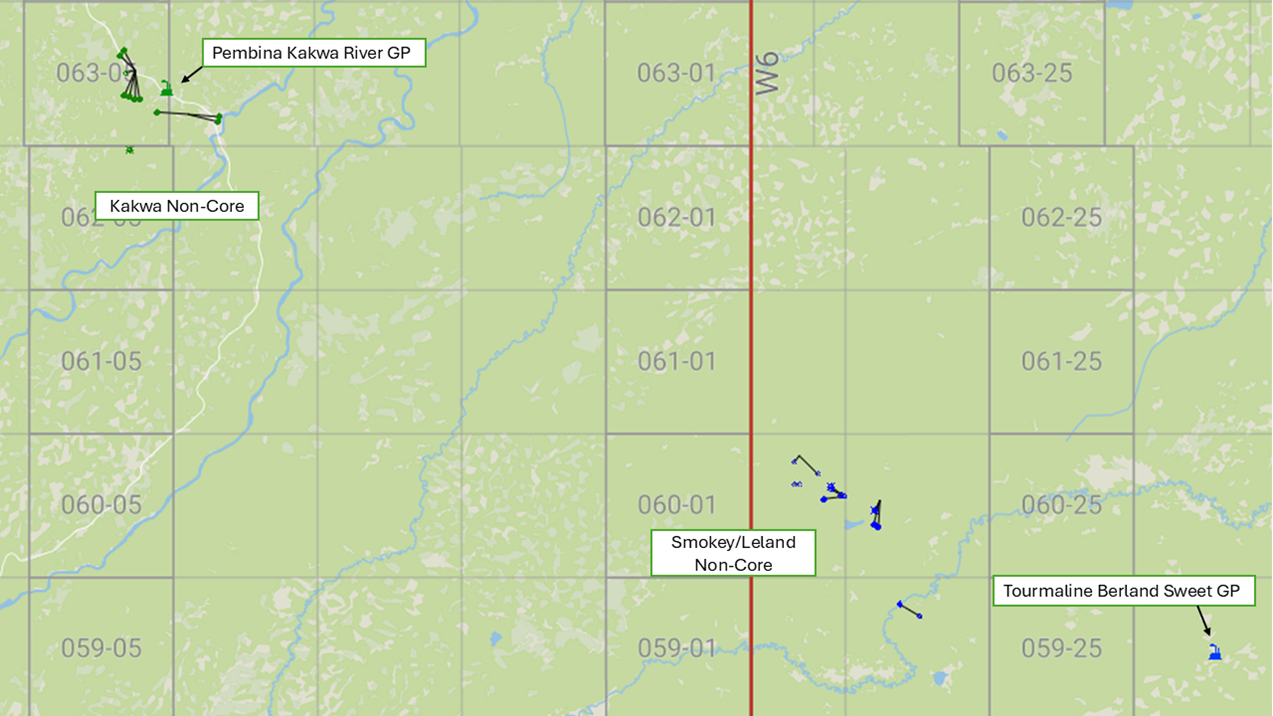

NON-CORE AREA ASSETS

The core of this acquisition is in the BC Peace River Arch, but a common workflow within the AssetSuite is to look for potential non-core or fallout properties from a deal. The non-core wells are in two groups, the majority in the field of Kakwa, and a few in Smoky/Leland fields. The non-core producing area in question is quite small and some assets do fall in line with other Tourmaline production, particularly the Smokey/Leland wells. Through XI’s new AssetBook Production Chain feature, we see that these Cardium producing wells (centered around 60-27W5) are already processing their gas at Tourmaline’s Berland Sweet Gas Plant. The other group of Kakwa assets (12 Cardium-producing wells centered around 63-5W6) are predominantly oil, with gas from them produced at the Pembina Kakwa River Gas Plant. The Kakwa assets are less of a contiguous fit and may be of interest to start ups, micros or juniors looking to add incrementally to their asset base. All of these additional Smokey/Leland/Kakwa assets are operated by Crew Energy and have shared working interest with Kaden Energy Ltd (now owned by Beta Energy Corp). Gross production of the wells is ~1200 BOE/day.

In the area in question, an overarching search near the non-core property shows that Arc Resources Ltd is the largest player with 40% of the production of this area, and it makes up 30% of their company.

Tourmaline Oil Corp’s $1.3 billion acquisition of Crew Energy Inc is a strategic move that underscores a transformative shift in the energy sector landscape. By integrating Crew’s assets, particularly its high-value liquid-rich Montney reserves, Tourmaline is not only bolstering its production base but also enhancing its operational efficiency and market position. The nuanced valuation of Crew’s assets, as reflected in the premium per barrel of oil equivalent, highlights the added value of quality and composition beyond mere volume metrics.

The transaction’s impact extends beyond Tourmaline, influencing the regional dynamics of the Peace River Arch and potentially reshaping the competitive landscape. With Crew’s core assets augmenting Tourmaline’s existing footprint and the non-core assets presenting opportunities for other industry players, the deal sets a new benchmark for strategic acquisitions in the sector.

As the energy market continues to evolve, this acquisition exemplifies how companies can leverage strategic investments to consolidate market presence and drive future growth. Tourmaline’s move to absorb Crew Energy not only amplifies its resource base but also positions it as a formidable player in the energy industry, poised to capitalize on the evolving demands of the industry. The full ramifications of this acquisition will unfold over time, but it undoubtedly marks a significant milestone in the ongoing evolution of the energy landscape.

—

Upcoming Events:

August 28, 2024 – Re-Discover AssetBook Online Demo – 9:00am (MST) – Register Now!

September 11, 2024 – XI Technologies will be part of EASC Education Day “Navigating Tomorrow” – Learn More

September 17, 2024 – AssetSuite for Juniors Presentation – Register Now!

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.