Flowing Forward: XI’s Production Chain Wells To Facilities (W2F) Module Unleashes Energy Insights

June 25, 2024

Exploring Advantage Energy’s Longshore Charlie Lake/Montney Acquisition Through Production Flow Analysis

Advantage Energy Ltd (Advantage) recently finalized a strategic acquisition valued at $450 million, securing Charlie Lake and Montney assets from Longshore Resources Ltd (Longshore) as announced in early June. For an overview of Advantage’s acquisition highlights, refer to their package here. Previously, we provided a broad overview of the region encompassing 71-05W6 – 81-14W6. Today, we delve deeper into this acquisition, using AssetBook’s innovative Production Chain: Wells To Facilities (W2F) feature to analyze the production dynamics of Advantage’s newly acquired Longshore wells.

Our focus will be on mapping out the production flow of these assets, identifying processing and market points, and exploring synergies between Advantage’s existing infrastructure—most notably, the Glacier Gas Plant (Glacier GP)—and the newly acquired assets from Longshore.

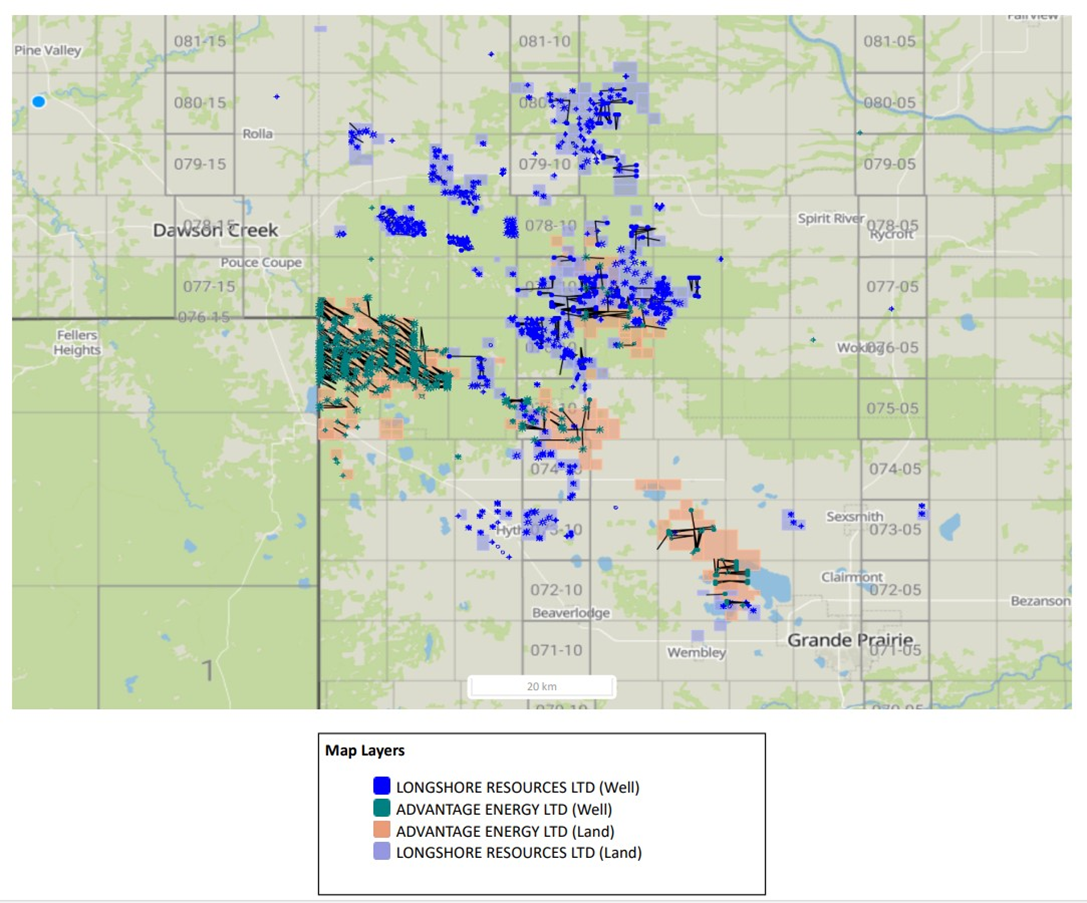

Below is an overview of the wells and land holdings of both companies within this key block of interest in Northwestern Alberta.

- Advantage’s Production: The block contains 100% of Advantage’s production, totaling approximately 66,000 barrels of oil equivalent (BOE), with natural gas accounting for 96% of this volume.

- Longshore Assets: Longshore’s assets in the area contribute approximately 12,000 to 14,000 BOE, with a production split of 47% natural gas and 53% oil and liquids, as per Advantage’s press release.

A Deeper Dive into Production Flow of Acquired Longshore Assets

Beyond standard metrics such as reserves and reserve life, netbacks, G&A costs, production costs, and scaling efficiencies – assessing operational synergies, production flow, and infrastructure is a critical yet difficult aspect of evaluating any acquisition. Understanding how wells flow to market and identifying necessary developmental steps for growth are paramount. Equally important are considerations of capacity limitations and potential joint venture implications. While such analysis is typically conducted in a data room setting, or even after a deal has closed, it can be complex and time-consuming when assessing multiple over-the fence opportunities, pre-data room, without access to corporate proprietary data.

With this framework in mind, let’s perform a high-level analysis of the production chain and processing/market access points for Advantage’s newly acquired Longshore assets in the area, with a primary focus on active gas production (note that oil production chains typically conclude at batteries). Utilizing AssetBook’s new feature, Production Chain: Wells To Facilities (W2F), we gain insights into these operational dynamics.

Advantage’s Glacier Gas Plant, operating near capacity, serves as a pivotal piece of infrastructure in this assessment. Notably, Advantage is preparing to bring another key processing facility online—the Progress Gas Plant—in the near future. This strategic move underscores their proactive approach to managing capacity constraints and optimizing operational efficiencies. Furthermore, our analysis reveals evidence of existing operational synergies, with Longshore already leveraging Advantage’s Glacier Gas Plant for a significant amount of their regional production processing needs.

It’s important to note that the market points discussed here are estimates derived from algorithms and may not reflect exact figures. However, they provide a foundational understanding of where Longshore assets currently flow, and how Advantage’s acquisition of Longshore assets integrates into their existing operational framework.

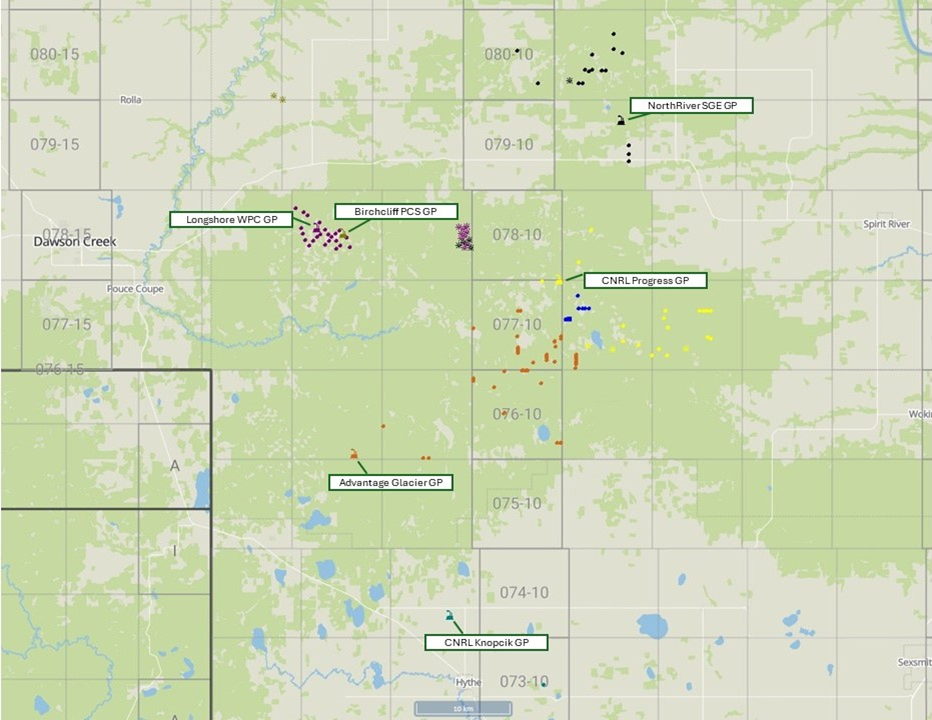

A look at Acquired Longshore’s gas flow in the area

According to Advantage’s press release, Longshore’s wells in the area produce approximately 47% oil and 53% natural gas and liquids. In this analysis, we will specifically examine where the gas from Longshore’s wells is directed, identifying intersections with Advantage’s gas infrastructure and other plants operated by key players in the region.

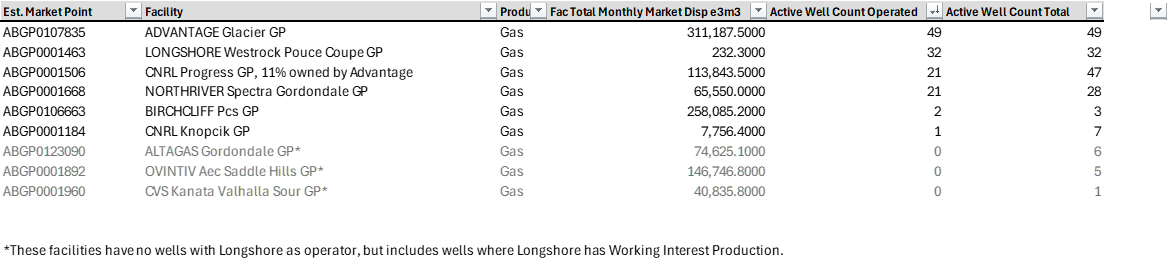

Longshore Well Production Chain Estimated Market Points (Gas)

A significant portion of Longshore’s wells directs its gas production to both Longshore’s Westrock Pouce Coupe Gas Plant and Advantage’s Glacier GP. However, a notable number of wells also transport their output to facilities managed by Canadian Natural Resources Limited (CNRL) and NorthRiver Midstream Inc. (NorthRiver).

Longshore Gas Market Points Mapped:

In Advantage’s recent acquisition press release, it was highlighted that the acquired gas from Longshore assets can be redirected to the new Progress Gas Plant upon its completion. This strategic decision is particularly significant because Advantage’s Glacier Gas Plant is currently operating near capacity, exceeding 90% of its licensed rate of 425 million cubic feet per day (mmcf/d).

Advantage’s Glacier Gas Plant plays a crucial role in processing operations within the region, but its nearing capacity underscores the need for additional infrastructure to accommodate growing production volumes effectively. The forthcoming Progress Gas Plant represents a proactive measure by Advantage to alleviate these capacity constraints, optimize operational efficiencies, and continue to grow production in the region.

Advantage Glacier Gas Plant: Strategic Capacity and Operational Synergies

Advantage’s Glacier Gas Plant has undergone significant expansion, reaching its planned capacity of 425 million cubic feet per day (mmcf/d) in June 2023, aligning with their strategic growth objectives in the region. This expansion has enabled Advantage to consistently operate near capacity, with the most recently available data indicating utilization approaching or exceeding 90%.

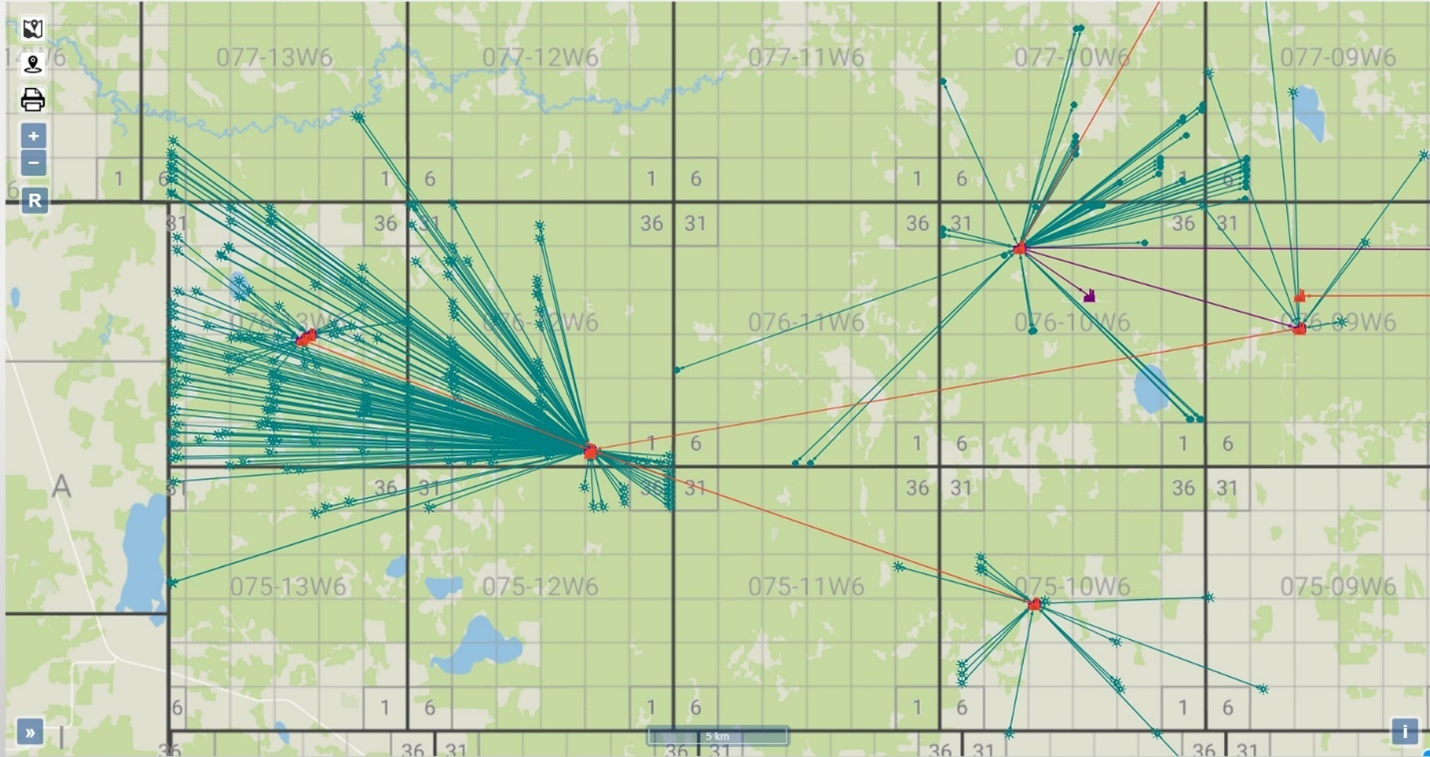

An interesting observation noted through our production chain analysis, is that even prior to the announced acquisition Longshore was identified as the only other operator besides Advantage utilizing this facility. This established collaboration underscores existing synergies between the two companies well before the completion of the deal.

The close operational ties between Advantage and Longshore at the Glacier Gas Plant highlight effective resource utilization and operational efficiencies. As Advantage prepares to integrate Longshore’s assets, this existing partnership at the Glacier Gas Plant positions them favorably to leverage shared infrastructure and enhance overall operational effectiveness.

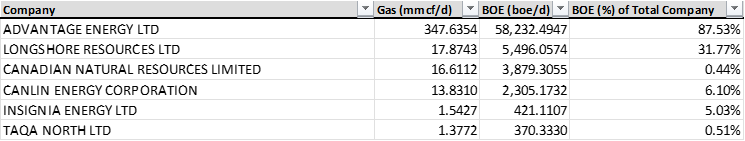

Production of Wells Flowing to Advantage Glacier GP

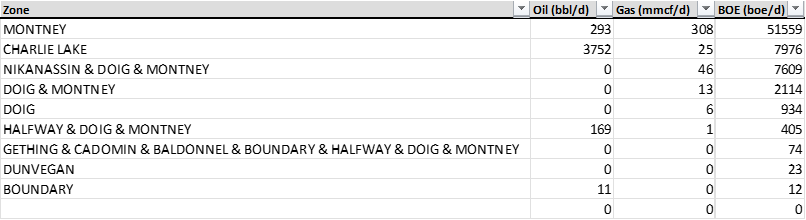

Production By Zone of Wells Flowing To Advantage Glacier GP

According to AssetBook’s Production Chain: Wells To Facilities (W2F) data, an estimated 312 active wells terminate their production chain at Advantage’s Glacier Gas Plant en route to market. Of these wells, 263 are operated by Advantage, and 49 wells are operated by Longshore, highlighting their collaborative utilization of this critical infrastructure. The wells are, unsurprisingly, predominantly Montney and Charlie Lake. Non-operating WIP partners on the wells include CNRL, Canlin Energy Corporation, Insignia Energy Ltd, and TAQA North Ltd. Other partners in the area include Enerplus Corporation, Kelt Exploration Ltd, Obsidian Energy Ltd, and Tamarack Valley Energy Ltd.

Takeaways from our analysis of production flow of Longshore Assets, in the context of the acquisition

Through the lens of production chain and asset flow analysis of Advantage Energy’s strategic acquisition of Longshore Resources’ Charlie Lake and Montney assets, it becomes evident that the integration of production flows and infrastructure synergies played an important role in the deal, with an eye on growth while maximizing operational efficiencies. The strategic alignment of production streams, as evidenced by the significant overlap of operated wells flowing to Advantage’s Glacier GP, underscores pre-existing synergies that facilitate seamless integration and operational efficiency.

Moreover, the impending commissioning of the Progress Gas Plant underscores Advantage’s proactive approach to scaling infrastructure in anticipation of growing production volumes, thereby mitigating capacity constraints observed at the Glacier GP. This forward-looking strategy not only supports current operations but also positions Advantage favorably for future growth opportunities in the area.

In conclusion, the integration of Longshore’s assets in the area into Advantage’s portfolio through a lens focused on production flow highlights a strategic move aimed at optimizing resource utilization and enhancing market competitiveness. By leveraging AssetBook’s innovative tools, this analysis underscores the importance of thorough operational assessments in strategic acquisitions, with the aim to make the assessments fast, easy and trusted.

Utilizing AssetBook’s Production Chain: Wells To Facilities (W2F) feature, you can delve into the intricate network of well-to-facility routes, with the aim of identifying processing and market points, for companies, areas, or specific groups of assets. If you’re interested in a demo of an area or assets, be sure to book a demo to learn how to make the difficult look easy.

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.