WTTW: “Beyond the Barrel” – Sharing NGL Data

March 26, 2024

In the dynamic world of energy investment, information is not just power—it’s profit. Every investor decision, whether in oil, gas, or related sector, hinges on having access to accurate and timely data. This is especially true for those eyeing Alberta’s energy landscape, a key player in North America’s energy sector. Recently, Alberta’s Energy Regulator (AER) made a groundbreaking step by releasing Natural Gas Liquids (NGL) data, a move poised to revolutionize investment strategies and reshape the industry’s landscape.

What Are NGLs?

Natural Gas Liquids are hydrocarbons extracted alongside natural gas production, including ethane, propane, butane, isobutane, and pentanes. NGLs are valuable commodities in various industrial processes and as feedstocks for petrochemical production. In today’s market, they can command similar pricing to oil, having a profound impact on the economics of the play.

The Impact of the AER’s Data Release

The AER’s release of NGL data marks a pivotal moment for investors. Historically, data on NGL production, infrastructure, and market dynamics were fragmented and often difficult to access. This lack

of transparency posed challenges for investors seeking to understand the full picture of Alberta’s energy sector. However, with the AER’s decision to make NGL data publicly available, a wealth of information has been unlocked, providing investors with unprecedented insights into this vital aspect of the energy market.

Impact on Investment Decisions

The availability of comprehensive NGL data has far-reaching implications for investment decisions in Alberta’s energy sector:

- Improved Market Analysis/Enhanced Asset Valuation: By understanding production trends, export capacity, and market trends, investors can identify lucrative opportunities and mitigate risks more effectively. Accurate NGL production data allows for more precise valuation models, resulting in better-informed investment decisions and improved portfolio performance.

- Optimization and Innovation: Transparency in NGL data fosters innovation within the energy sector. By understanding production levels and infrastructure capacities, investors can identify opportunities to streamline logistics, reduce costs, and maximize operational efficiency. Armed with comprehensive information, entrepreneurs and researchers can identify gaps in the market and develop innovative solutions to address them, driving technological advancement and economic growth.

- Facilitated Regulatory Compliance: Access to reliable NGL data aids investors in navigating regulatory requirements more effectively. By staying informed about production volumes and environmental impacts, investors can ensure compliance with regulations and minimize legal risks associated with their investments.

Looking Ahead

As you are likely already aware, BCOGC has been providing NGL data for some time now. We are pleased to announce that Alberta’s AER has followed suit by providing a breakdown of production. By increasing transparency and accessibility, this decision empowers investors to make smarter, more informed decisions, driving growth and innovation within Alberta’s energy sector. As stakeholders continue to leverage this wealth of information, we can expect to see increased efficiency, improved risk management, and sustained investment in the region’s energy infrastructure. Alberta’s journey towards a more transparent and data-driven energy landscape is well underway, and the implications for investors are profound.

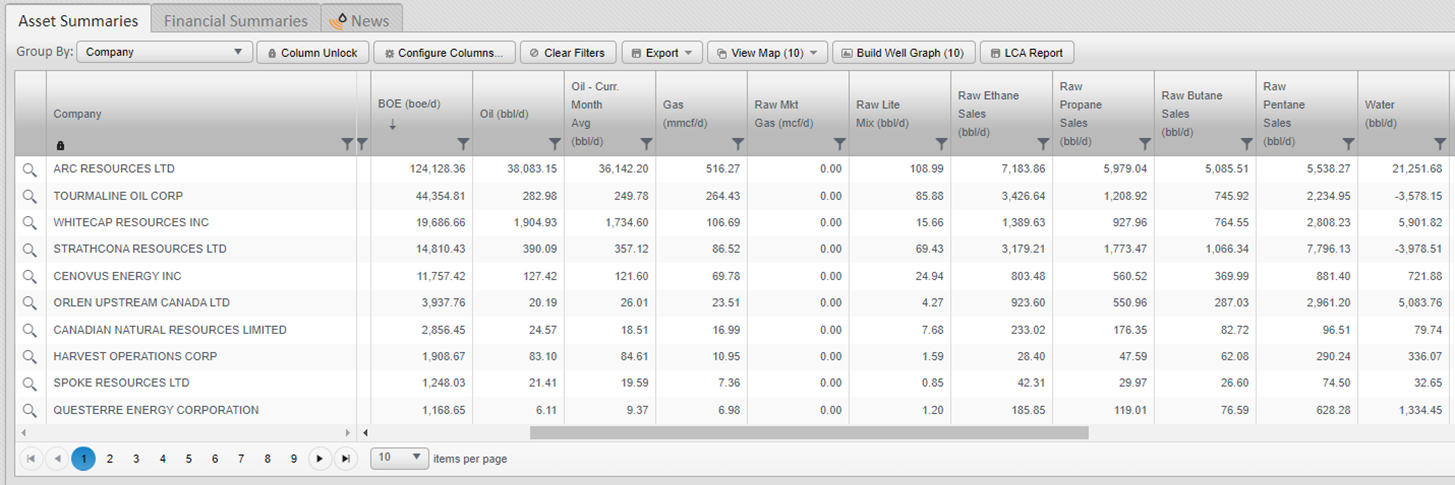

XI has integrated these breakdowns into AssetBook, offering detailed summaries organized by company or region, enriched with our working interest data.

We believe that this update will significantly enrich the capabilities of AssetBook and empower our clients to make smarter investment decisions in an ever-evolving market landscape.

- Enhanced Market Insights: More thorough analysis of market trends in the Alberta region.

- Improved Risk Management: Elevate assessments and mitigate risks with investments and portfolio management.

- Expanded Coverage: Our commitment to expanding data coverage ensures that AssetBook users have access to a diverse range of datasets, enabling more comprehensive analyses and informed decision-making across various asset classes.

The addition of NGL data from Alberta into AssetBook has been designed to ensure a seamless user experience, allowing for easy access and integration into existing workflows.

—

Note: We have been informed that our previous post had some issues with the links. As with all of XI’s articles, our previous post, Abandonment & Reclamation Across WCSB in 2023, is available on our website. Review the article and interactive dashboards here.

Upcoming Webinar:

Join us for a special presentation on ARO for Financial Tracking & Reporting.

When:

April 25th 10:00am (MST) – Register Now!

Upcoming Certification Course:

ARO Manager For Financial Tracking and Reporting Certification Course provides practical, hands-on professional development for anyone interested in expanding their knowledge of Asset Retirement Obligation (ARO) tracking and reporting.

When:

Space is limited so be sure to register now for the course. The two-half day course takes place on morning of April 30th and the morning of May 2nd.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.