Word To The Wise: ARO – What’s Really Under The Sheets?

February 13, 2024

Is love in the air this Valentine’s Day? Let’s take a moment to examine a relationship that might not be as picture-perfect as it seems – the one between spreadsheets and Asset Retirement Obligations (ARO). While spreadsheets have long been the sweetheart of financial modeling, their shortcomings in managing the intricate dance of ARO can leave businesses heartbroken. In this article we unveil the hidden flaws beneath the sheets and explore why database software makes for a more reliable and steadfast partner in the world of ARO.

Do you trust your significant other [data]?

Spreadsheets are notorious for their susceptibility to errors, with studies suggesting that up to 88% of all spreadsheets contain mistakes. In the realm of ARO, accuracy is paramount, as it involves intricate calculations and a multitude of variables, usually across several departments. A simple input error in a spreadsheet can have cascading effects on ARO estimations, potentially creating misleading financial reports and compliance issues.

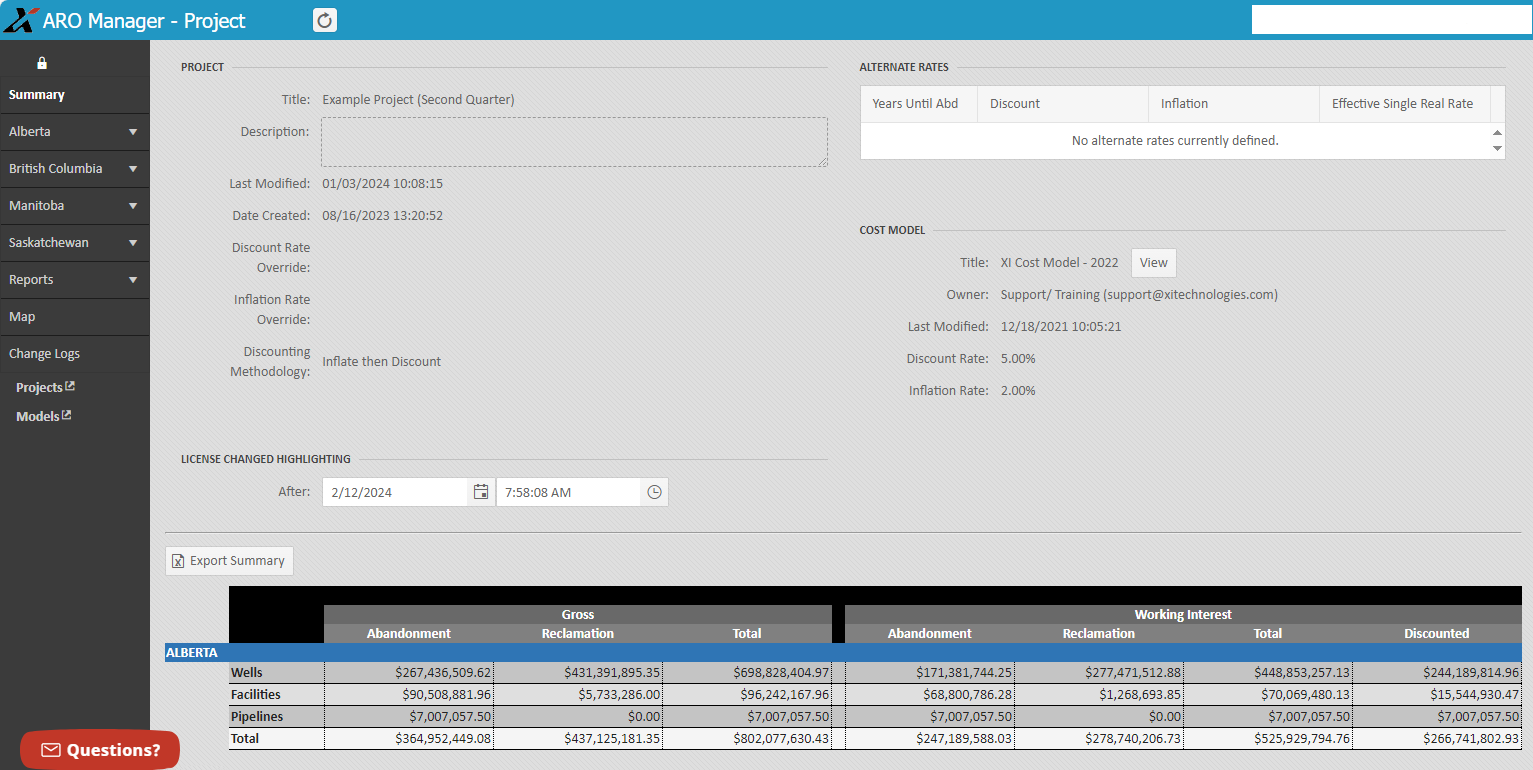

A database software like AssetBook’s ARO Manager, on the other hand, employs robust data validation and integrity checks, minimizing the risk of errors. The structure of ARO Manager ensures that information is consistent and reliable, providing a solid foundation for ARO calculations. With change logs and SOC compliance factored in, the resulting reports give peace of mind for both users and auditors.

How can you nurture the development of your relationship?

As oil and gas companies grow, so do their ARO complexities. Spreadsheets, originally designed for simpler tasks, struggle to handle the increasing volume of data and calculations associated with expanding asset portfolios. This lack of scalability can result in sluggish performance, increased susceptibility to errors, and a limited ability to adapt to changing business landscapes.

Moving from a spreadsheet-only platform into a relational database allows for long-term scalability, efficiently managing vast datasets and complex relationships as the company changes through acquisitions and/or divestitures. This scalability is crucial for organizations dealing with diverse and evolving ARO requirements, allowing them to adapt without compromising performance.

Who else is messing with my sheets?

Collaboration is a fundamental aspect of financial management, and spreadsheets often fall short in facilitating seamless teamwork. The challenges lie in concurrent access, version control, and the potential for conflicting edits. In the context of ARO, where multiple stakeholders contribute to calculations and projections, spreadsheet limitations can impede collaboration and introduce inconsistencies.

The AssetBook ARO Manager module offers sophisticated collaboration features, including role-based permissions, and robust version control. This ensures that ARO calculations are collaborative, transparent, and free from the versioning headaches that plague spreadsheet users.

Are You Keeping Tabs on the Quirks of your Love Story?

ARO calculations are subject to rigorous scrutiny, especially in industries with stringent regulatory requirements. Spreadsheets lack the necessary audit trail capabilities, making it difficult for organizations to trace changes, validate calculations, and demonstrate compliance with regulatory standards.

ARO Manager provides comprehensive audit trail functionalities, allowing organizations to maintain a detailed record of every change made to ARO data. SOC compliance not only ensures accountability but also facilitates compliance with regulatory frameworks, giving businesses peace of mind in the face of audits.

Moving away from spreadsheets to a software tool like AssetBook ARO Manager alleviates many of these problems. ARO Manager was purpose-built for the oil and gas industry, developed through a culmination of government resources, expert opinion, and industry data.

There’s been a long-running love affair with spreadsheets. They’ve been our go-to partner in crime, but when it comes to dealing with tricky stuff like Asset Retirement Obligations, it’s time to spice things up a bit! As businesses navigate the intricate landscape of ARO management, the adoption of a web-based platform becomes not just a technological upgrade but a strategic improvement for accurate financial planning and compliance.

Watch our webinar on The Problem with Spreadsheets in ARO Management

Stay tuned for more insights, and don’t hesitate to reach out for a demo if you’re eager to explore the data further.

Join us for our upcoming events:

H2S Success – February 28th – 10am

XI Technologies will also be part of the Pandell Leadership Series – ARO reporting Process, on February 27th at 1pm (MST). Don’t miss out on our presentation by registering today!

Couldn’t catch our last webinar?

AssetBook M&A Workflow in Action is now posted on our website.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.