Word To The Wise: Tax Pools Part 2: Evaluating 2023 Acquisitions Through a Tax Lens

January 16, 2024

In September 2023 XI Technologies released a whitepaper on tax pools titled The Tax Man Cometh – How Strategic Acquisitions Can Help Your Tax Issues. It was one of the highest downloaded papers in XI’s history, so naturally we wanted to dive deeper into the topic of taxes.

Clearly the topic resonates. A rejuvenated market has led to increased tax obligations, resulting in a renewed interest in finding financially advantageous tax pools.

Here are some key reasons why tax pools are significant for the energy space:

- Tax Sheltering Losses

- Cyclical Nature of the Industry

- Resource Expenditure Pools

- Encouraging Investment

- Supporting Capital-Intensive Projects

- Maintaining Competitiveness

Tax pools are essential to Canadian energy companies for several reasons, primarily related to the unique tax environment in Canada. By generating tax pools through capital investments, tax pools can offset the tax on future profits.

Tax pools can be a strategic piece of deal flow in the context of acquisitions and divestitures. By acquiring tax pools, an operator can extend their taxable horizon, in addition to acquiring development opportunities to generate new tax pools. As we discussed in The Tax Man Cometh, the conditions created up to, through, and following the COVID19 Pandemic created a perfect storm where companies started being concerned about looming tax horizons.

In 2023, deal flow started to recover with continued consolidation, as well some notable exits from Canada. Today, we look back on a few key deals from 2023 against our Tax Man Cometh white paper to look for some of those indicators.

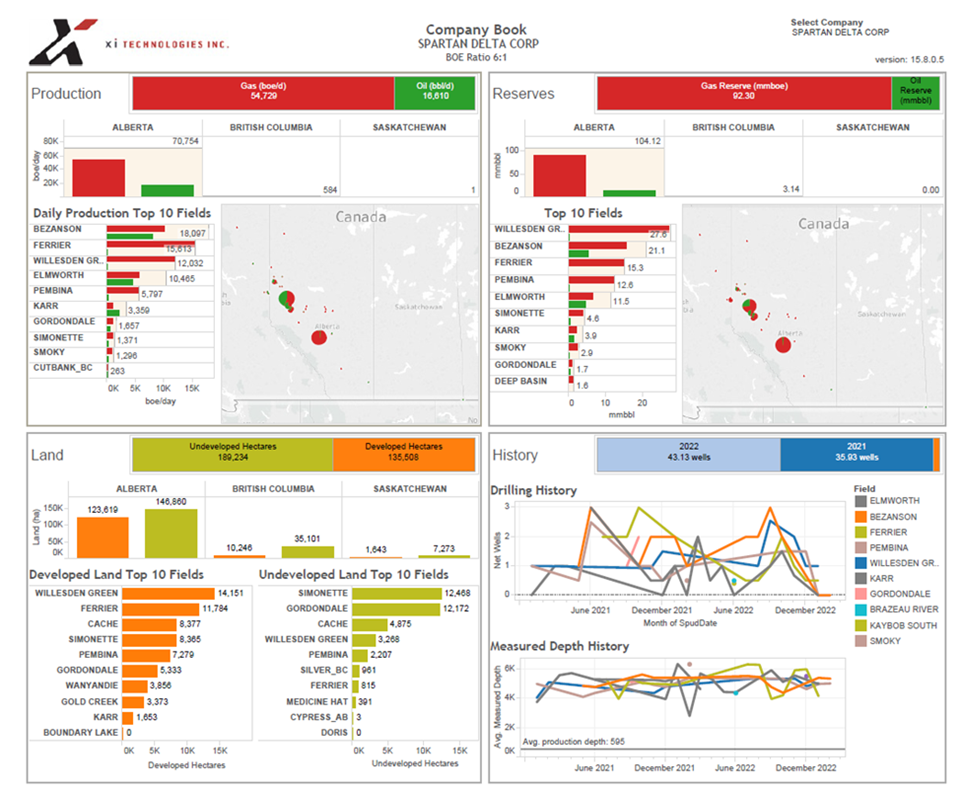

From an AssetBook Company Summary, we were able to look at each of the following transactions in terms of drilling activity, undeveloped land, and undeveloped land ratios:

Crescent Point Energy Corp. → Spartan Delta Corp.

Crescent Point Energy Corp.→ Hammerhead Resources Inc.

Tourmaline Oil Corp. → Bonavista Energy Corp.

Strathcona Resources Ltd. → Pipestone Energy Corp.

Peyto Exploration & Development Corp. → Repsol Canada Energy Partnership

Saturn Oil & Gas Inc. → Ridgeback Resources Inc.

Figure 1 – Company Book Example (Spartan Delta Corp.)

In each transaction, the acquirer was either taxable or noted near-term taxable horizons. Our analysis shows how some of the indicators in our Company Summary report can be used to look for clues when public data isn’t available on tax pools or tax horizons.

Our findings: of the six deals evaluated, near-term tax pool benefits for the acquirer likely played a role in the following:

- ✔ Crescent Point → Spartan

- ✔ Crescent Point → Hammerhead

- ✔ Tourmaline Oil Corp. → Bonavista Energy Corp.

- Strathcona Resources Ltd. → Pipestone Energy Corp. (Neither company appears to have gained a taxable advantage in this transaction, but they do have 2023 drilling activity to help to start regenerating tax pools.)

- Peyto Exploration & Development Corp. → Repsol Canada Energy Partnership (Repsol likely wasn’t generating any significant tax pools over the past two years. As Repsol is private in Canada, financial statements are not disclosed)

- ✔ Saturn Oil & Gas Inc. → Ridgeback Resources Inc.

Read the full analysis in our white paper, Tax Pools Part 2: Evaluating 2023 Acquisitions Through a Tax Lens

For more on how you can incorporate tax pool considerations, plus ARO scenario analysis, emissions, and wells to facilities production chain, into your high-level scoping, join us for our webinar:

AssetBook M&A Workflow in Action – Register Now!

Or visit XI’s website or contact XI for a demo.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.