Word to the Wise: Smoky Area Overview

October 17, 2023

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

Given the recent transaction between Peyto and Repsol, we thought we would look at another Deep Basin field that has several upcoming land expiries: Smoky.

Geographically, the Smoky Field sits mainly in the SW side of the Grande Prairie region. While the Grande Prairie Region primarily produces from the Montney (approximately 48%) and commingled pools (approximately 23%), the Smoky field is mainly commingled but also has a large amount of production that comes from Montney, as well as Spirit River and equivalent formations.

There are a lot of senior producers in this area, including Tourmaline Oil Corp (Tourmaline) and Canadian Natural Resources Limited (CNRL), and two companies who have hit the news lately for acquisitions, Strathcona Resources Ltd (acquired Pipestone Energy Corp) and Peyto Exploration & Development Corp (acquired Repsol’s Canadian assets).

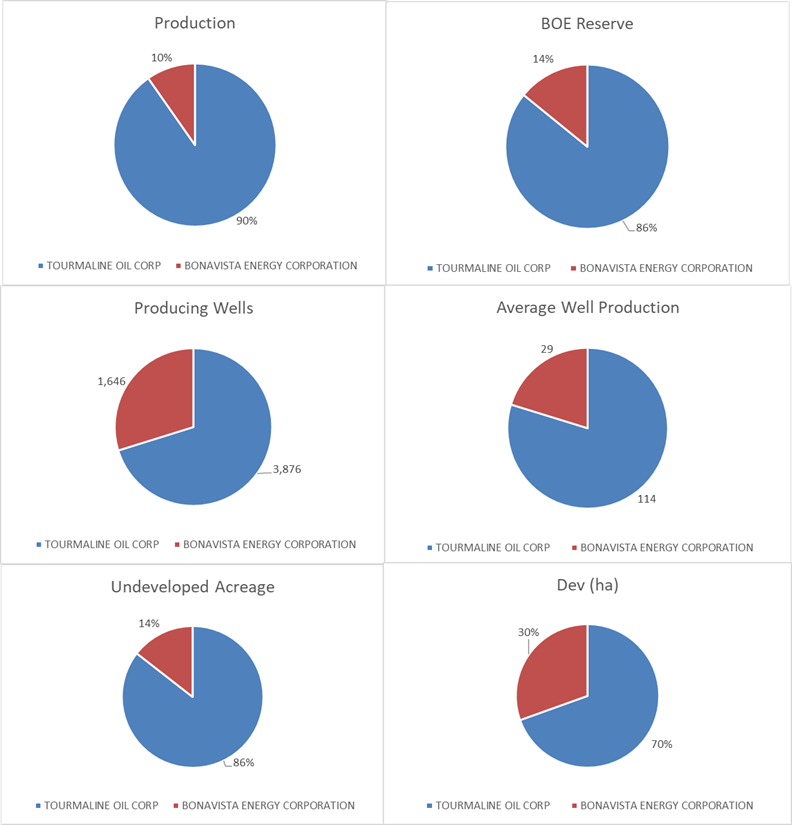

The biggest owner of this play is Tourmaline, with a little over 57% ownership. This play is relatively concentrated, with approximately 81% of the production held by the top 2 companies in the field and only 14 companies having production here.

The light grey line in the below graph shows a steady increase in the production coming from wells with a first sustained production date between 2019-2023, with a large amount of that production coming from the 2021/2022 wells.

The Smoky Field is less than 30% developed, with about 170 hectares of undeveloped land allowing for significant upside potential.

If you look at the Smoky/Resthaven Field, these are the top companies and their expiring hectares:

To get a sense of where the expiries are happening in the next six months, we can easily filter to show a map by expiry date:

Looking at the wells and facilities in the Smoky Field:

Using the government’s cost model, these Smoky wells and facilities have a total undiscounted liability of approximately $130 million, with 17% of the well licenses and 17% of the facilities designated as inactive. About 60% of the active wells are between 10-21 years old, and there have been incident reports, but no reported spills on these assets.

Interested in getting a free ARO report on one of the companies listed? Fill out this form specifying which company you’d like to see.

Learn more about how XI’s AssetSuite software can analyze companies, packages, or regions throughout Western Canada. Visit our website or contact XI Technologies.