Word to the Wise: M&A Snapshot – Tourmaline Oil Corp and Rising Star Resources Ltd.

August 9, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

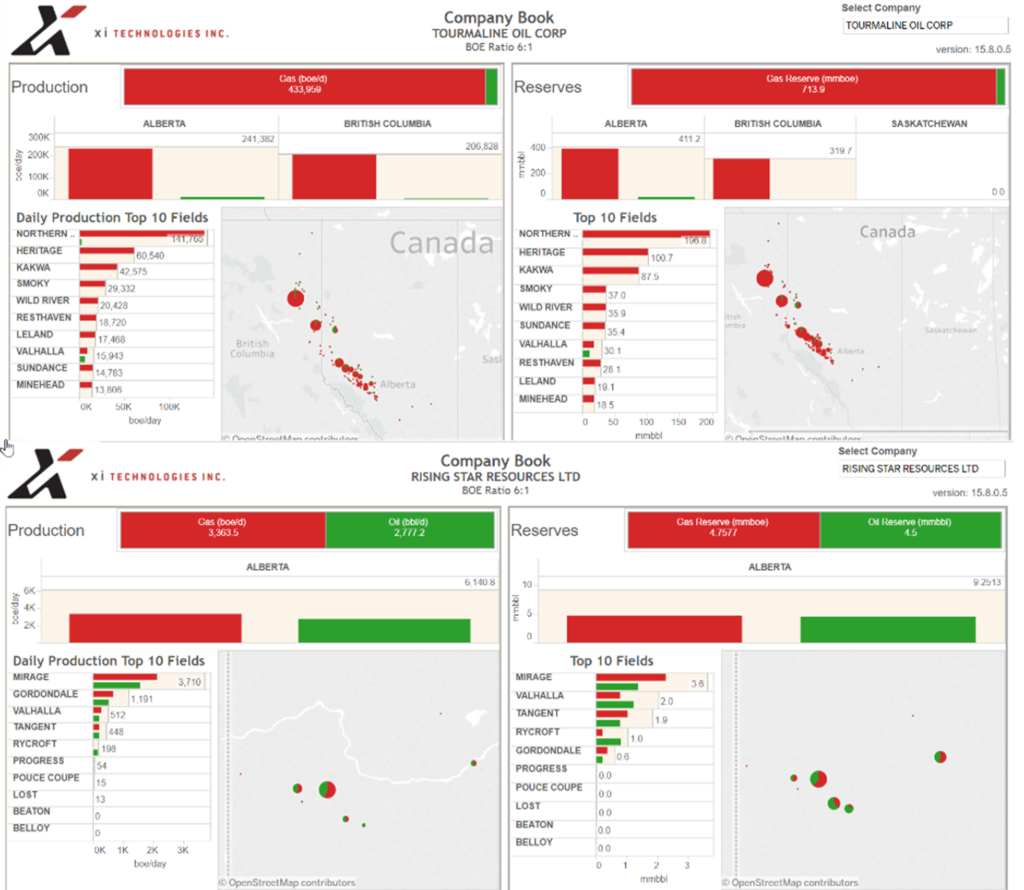

Interesting and strategic Merger and Acquisitions activity continues in premier plays in Alberta, helping to reshape the WCSB. On July 27, Tourmaline Oil Corporation (“Tourmaline”) announced their acquisition of Rising Star Resources Ltd. (“Rising Star”) and their predominantly Charlie Lake production for a value of $194.3 million.

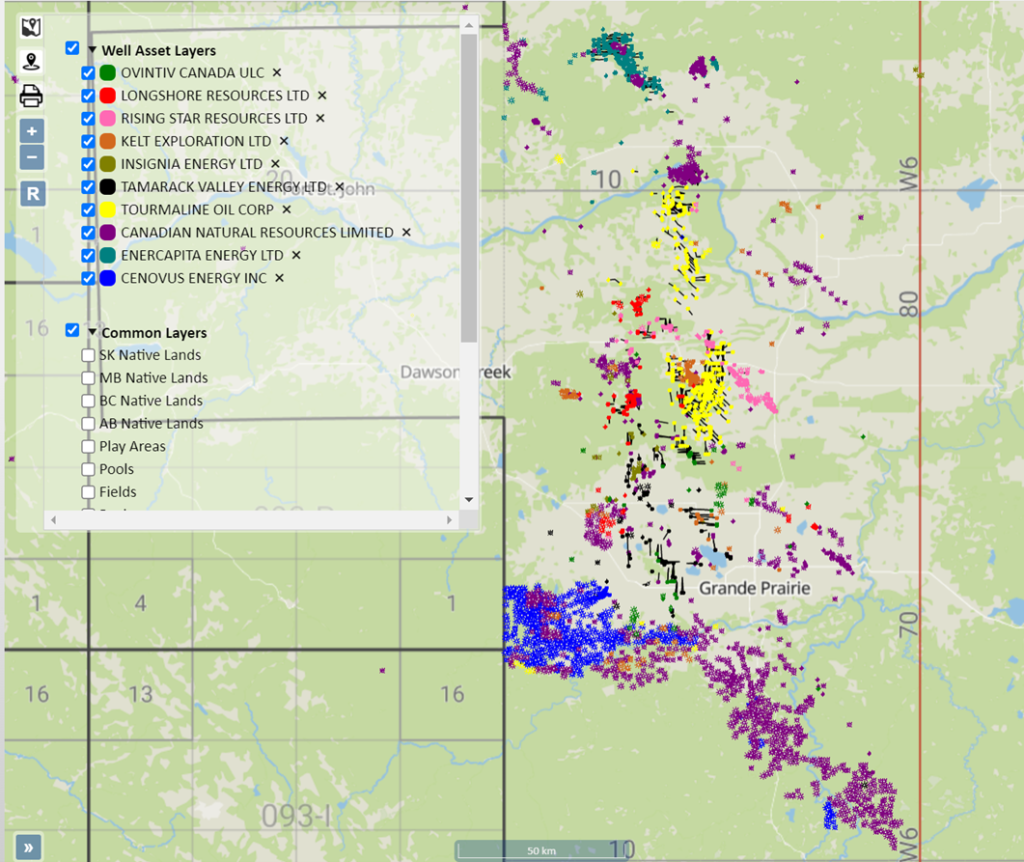

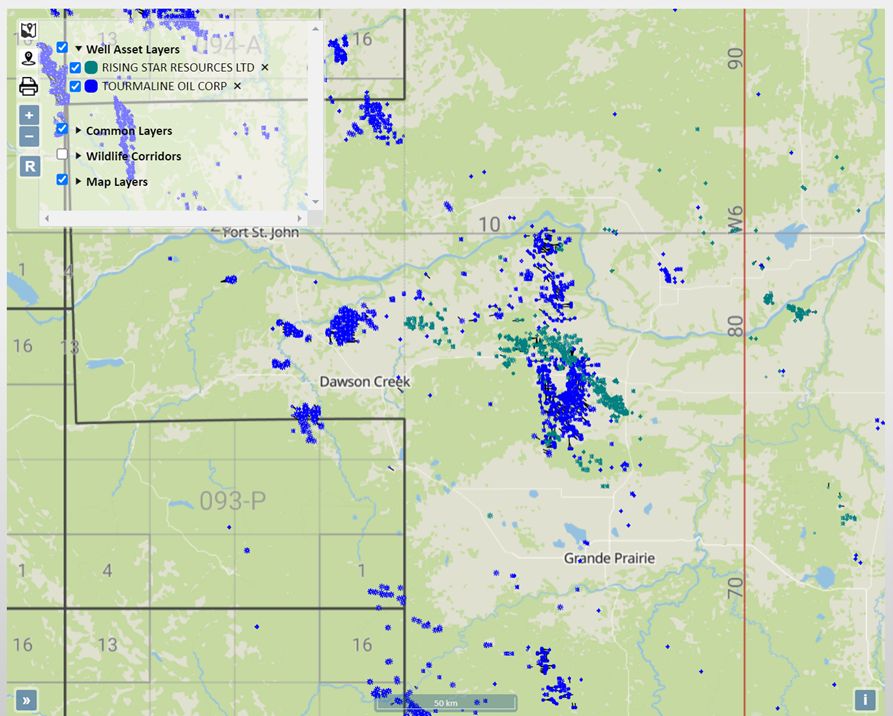

What do the companies look like prior to completing the agreement? What do we know about each company’s assets, core areas, and recent activity? How might this combination affect others in the area? We’ve looked at both companies through a few different lenses using our AssetSuite software tools to allow you to compare the companies and gain some insight of your own.

Core Areas

Falling in the top 10 producers in the Charlie Lake formation, Rising Star was a natural candidate for Tourmaline to pursue.

XI’s new LCA report indicates that Rising Star’s production has increased approximately 38% over the past 3 years, providing an indication of growth opportunities in this play in the future. These assets fit well in Tourmaline’s portfolio, augmenting their production in the government-defined field of Valhalla and Mirage.

Click here to download the Merger Book report from AssetBook.

ESG Snapshot

From an emissions perspective, due to the size of the acquisition compared to Tourmaline’s holdings, there is a negligible impact on Tourmaline’s after-purchase emissions intensity profile. Both companies have relatively low corporate intensities, around the 0.019 range (GHG/tCO2e).

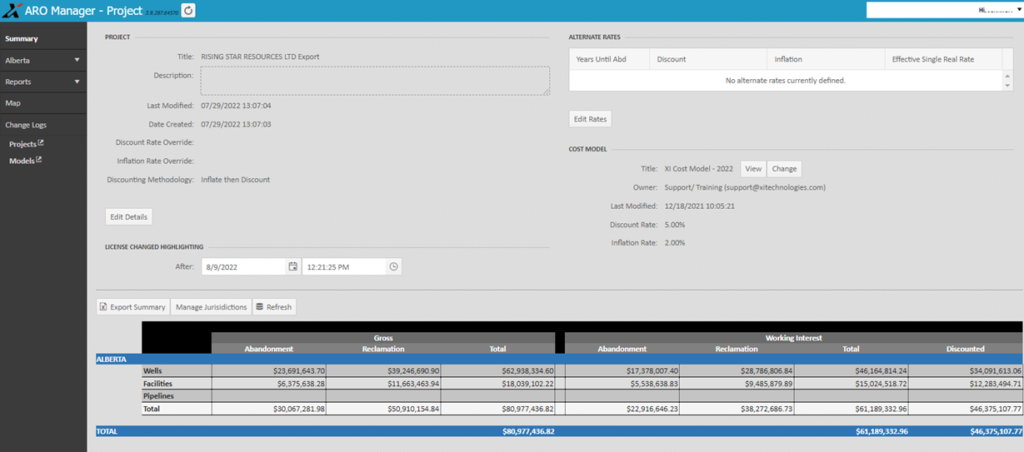

Rising Star’s operated assets (using the Government LLR Cost Model values) have a liability of approximately $50 million and using AssetBook’s ARO module, an undiscounted net liability of approximately $61 million, an estimated $18 million of which is from inactive wells.

Click here to download a combined ARO and LCA report from AssetBook.

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, including examining potential liabilities and emissions, contact XI Technologies. You can also attend our upcoming info session on The Problem with Spreadsheets on August 16 by registering through this link.