Word to the Wise: How synergy shapes acquisitions and divestitures

March 16, 2021

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

2021 is shaping up to be a year of aggressive mergers and acquisitions. As companies look to recover from 2020, find new opportunities, or reposition themselves considering recent challenges, it’s become essential to have proactive A&D scoping strategies to compete in this environment. It seems like every week there’s a new major announcement of a merger or acquisition and many of these are not from listed opportunities. Companies looking to acquire or move assets need to be able to find hidden opportunities and to assess which potential opportunities best fit their operations.

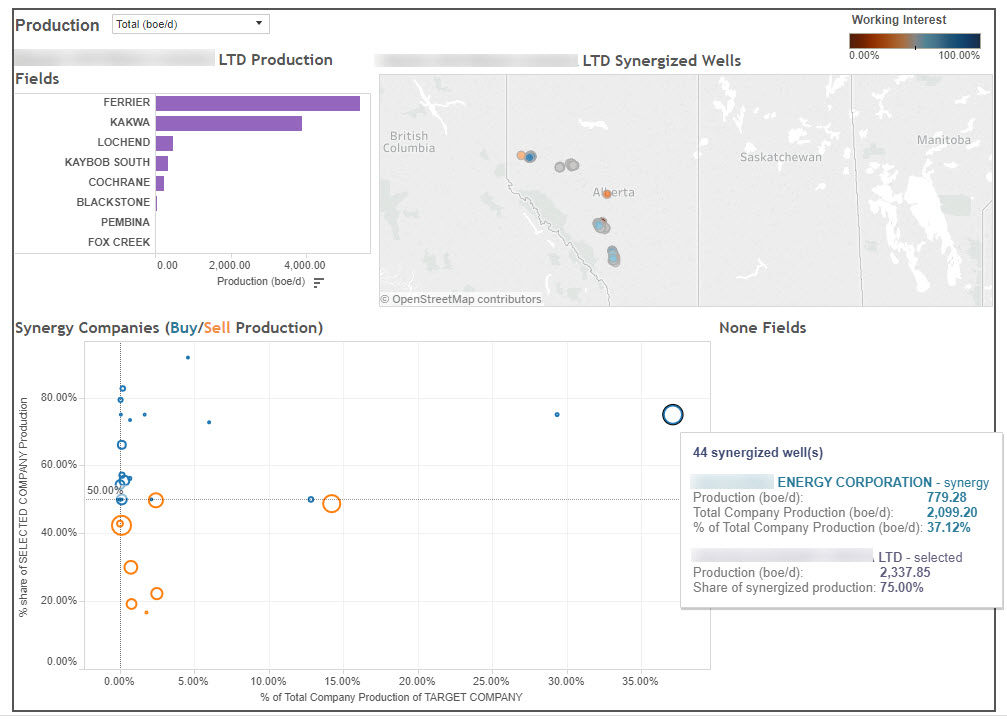

This is where synergy comes in. When it comes to A&D scoping, synergy refers to companies that share working interest in the same UWI or lease or other asset. In an uncertain oil and gas environment, synergies often provide companies with an option to acquire a known entity, thereby reducing the unknown risks associated with the acquisition. Costs can be better managed with assets in areas where a producer is already active due to existing area expertise, infrastructure ownership, and partners. Economies of scale can be realized by maximizing existing efficiencies or creating new ones.

For third party evaluators, finding synergy is an important step in evaluating transactions. With the industry shifting from a growth model to a focus on free cash flow, return of capital to shareholders, and leverage reduction, they like to see that a potential merger or acquisition synergizes with existing assets of the purchaser. Rationale for M&A&D is often driven by synergies, whether through G&A reductions or operational synergies, so the more synergies you can find in a deal, especially for recurring synergies, the more aligned a company is to the free cash flow model. From an enterprise value perspective, recurring synergies can be worth 3 to 5 times the yearly synergy savings.

How do companies find synergies in potential deals? It depends on the company, the tools they have available, and how proactive they are in A&D. Some companies regularly monitor offsetting operators and targets and thus are always aware of potential synergy opportunities. Others may rely on time-consuming research from individual corporate presentations, press releases, data from mapping packages, or information from selling agents. At XI, we’ve made finding synergy simple, with a Synergy Search function in our oil and gas research software AssetBook that allows users to run a report on any company and find their working interest partners.

Regardless of the time and effort it takes to investigate synergy, there’s no doubt that it’s an essential part of succeeding in A&D scoping. Companies that want to survive and thrive in this current market of consolidation and aggressive M&A need to understand their synergies and those of their targets in order to do so.

If you’d like to learn how XI Technologies can help make finding synergy in A&D scoping easier, contact us for a demo or sign up for a webinar.