Word to the Wise: Open Asset Evaluation for December 2020

December 8, 2020

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Succeeding in oil and gas development comes down to how well and how quickly you can analyze potential opportunities. Once a month, XI Technologies will apply its evaluation tools to a currently available asset to give readers a sense of the opportunities available and how they can be evaluated for A&D purposes.

For this month, XI will examine the InPlay Oil Corp strategic acquisition of Cardium Assets announced in their third quarter 2020 financial and operating results.

Potential Buyers

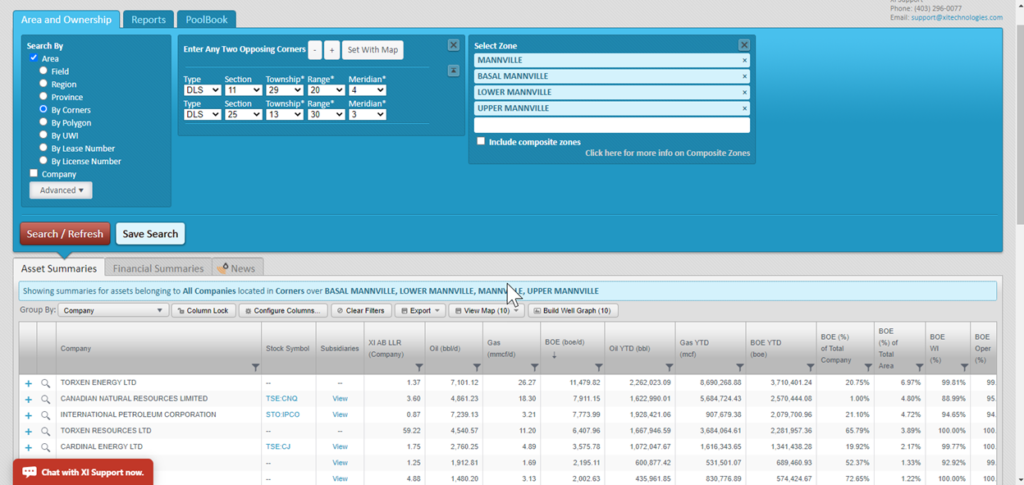

Companies looking for a strategic asset acquisition have a number of options in XI’s AssetBook. By doing a search by field or by a polygon on the map, you’re able to quickly look in your core area. Search further on zone or other advanced criteria such as average operated percent or the oil to gas ratio or as in the InPlay criteria list, decline rates and undeveloped and developed land ratios.

Using XI’s proprietary working interest algorithm, you can see how core the assets in question are to the company, allowing you to look for full corporate acquisitions or the purchase of non-core company properties, helping you make strategic decisions on the fly. To see an example of this, we’ve searched for Manville assets in a large rectangle east of Calgary.

Click here to download a full spreadsheet version of this report.

Asset Liabilities

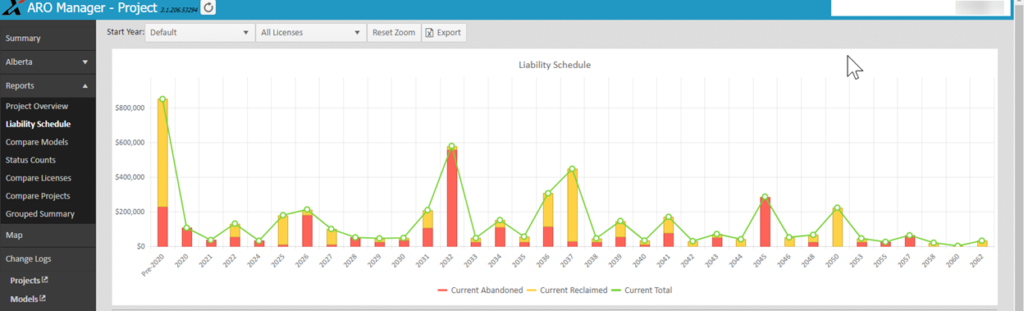

As always in this changing climate one of the most important parts of A&D research is to look at the liabilities carried by the asset. XI allows the full well and facility list to be exported, not only to Excel or a package to evaluate the reserves, but also to our powerful ARO Manager module to investigate the liability obligation using our industry standard cost model, or a cost model of your choosing. You can also export to our LLR calculator to see government numbers against the assets.

Here is XI’s unaudited ARO analysis of an asset in this search. Please note this relies on XI’s cost model and working interest assumptions. As a purchaser, you may have economies of scale or be able to provide further discounts to address your ARO obligations. Click here to download a full spreadsheet version of this report.

In addition to knowing an asset’s ARO numbers, it’s helpful to know the scheduling of those obligations and how they will fit into your company’s short, mid, and long-term planning. Here’s the liability scheduling of these assets:

These are just a few quick ways to do A&D prospecting. If you’d like to learn more about how XI’s AssetSuite can analyze potential acquisitions, watch this video or contact XI Technologies.