Word to the Wise: Open Asset Evaluation for February 2020

February 18, 2020

Succeeding in oil and gas development comes down to how well and how quickly you can analyze potential opportunities. Once a month, XI Technologies will apply its evaluation tools to a currently available asset to give readers a sense of the opportunities available and how they can be evaluated for A&D purposes.

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

For this month, XI will examine the receivership sale of Wolf Coulee Resources Inc. On November 18, 2019, Hardie & Kelly Inc. was appointed as the receiver and manager of Wolf Coulee Resources Inc. Hardie & Kelly then engaged Sayer Energy Advisors to assist it with a sale of Wolf Coulee oil and natural gas properties in whole or in part.

Potential Buyers

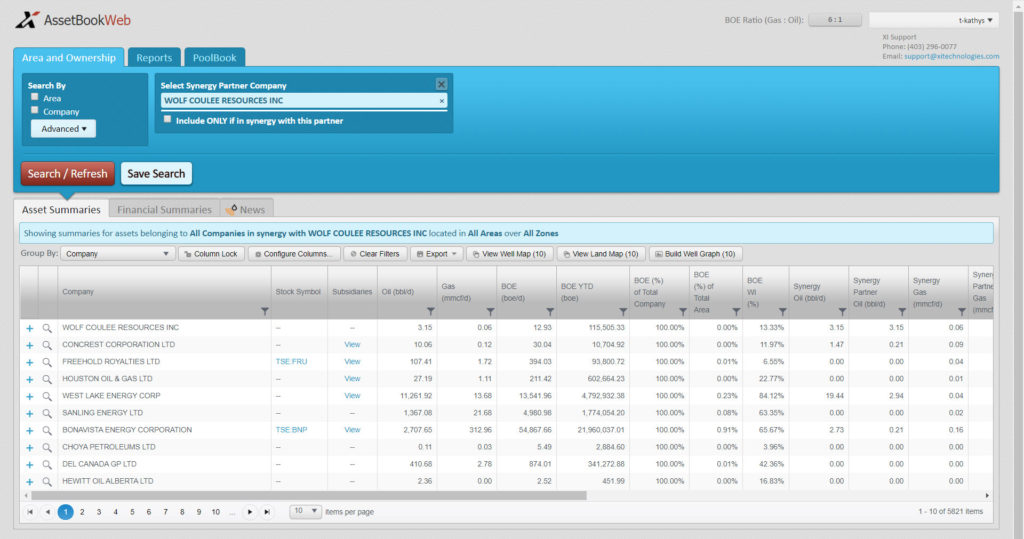

An important thing to do when evaluating a potential acquisition is to look at who the most likely bidders for the asset would be. The first thing to check for is whether the properties have any working interest partners who might be looking to increase their share of the asset by running a Synergy Report.

It is also important to look at what other companies own in the area, as they may be looking to increase their imprint in the area to benefit from economies of scale. Here’s a Synergy Report for this asset. If you’d like to see the area report, please contact XI.

Click here to download a full spreadsheet version of this report.

Asset Liabilities

One of the most important parts of A&D research is to look at the liabilities carried by the asset. XI calculates the LLR for the listing at 059 with a deemed asset value of $10,584,402 and liabilities of $18,285,215 (please note the AER has discontinued publishing the LMR of a company, but XI is still using AER rules to create this calculation for our clients). It is good to do an independent evaluation of an asset’s ARO when possible with calculations you trust. In Wolf Coulee’s case, using XI’s unaudited numbers and cost model, the working interest liabilities are actually reduced.

Here is XI’s unaudited ARO analysis of the asset. Please note this relies on XI’s cost model and working interest assumptions. As a purchaser, you may have economies of scale or be able to provide further discounts to address your ARO obligations. Click here to download a full spreadsheet version of this report.

In addition to knowing an asset’s ARO numbers, it’s helpful to know the scheduling of those obligations and how they will fit into your company’s short, mid, and long-term planning. Here’s the liability scheduling of these assets:

These are just a few quick ways to do A&D prospecting, using a real-world example that is currently available for purchase. If you’d like to learn more about how XI’s AssetSuite can analyze potential acquisitions, contact XI Technologies.