Word to the Wise: Simplifying your bank credit redeterminations

October 29, 2019

Redetermination of bank credit facilities is an annual or semi-annual exercise that almost all E&P companies have become used to. How difficult is your process?

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

Following the 2019 Redwater ruling, banks began revising the metrics they use to determine the borrowing bases for energy clients. Now, in addition to reserves estimates, production forecasts and the other usual financial information, E&P companies are being asked to supply a report of abandonment and reclamation liabilities during what are typically twice-yearly credit reviews. The result for the vast majority of companies is that their borrowing base has been adjusted downward. This is clearly a sign of the times in our industry and an indicator that E&P companies will need to come to the table ready to present a fully developed picture of their liabilities, as well as a plan for how they will be managing them. Those E&Ps who haven’t assessed their liabilities will likely have them assessed for them by the bank – and they may not be happy with the result. This is why it’s important for companies to be proactive and have a plan in order to protect and defend their credit facilities.

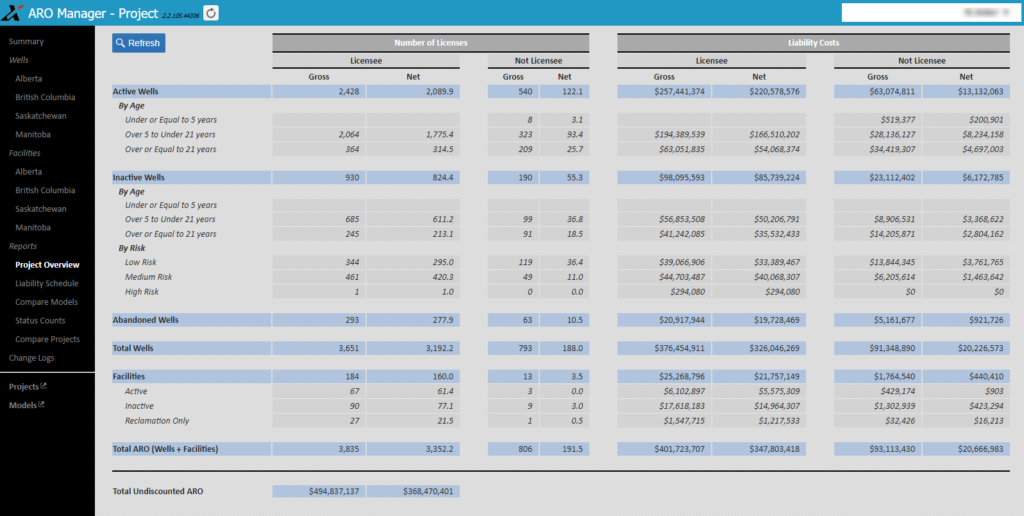

What are banks and credit syndicates looking for? XI Technologies works with almost every major bank and capital institution and their information requests are very similar. Banks need to see a report on a company’s active and inactive wells and facilities, spill counts, number of licenses and working interests, and the liability costs associated with all these assets. It’s no longer enough to focus on reserve reports and projections; the banks need a better assessment of risk.

Depending on the system you have in place, preparing this information for your bank can be time consuming to say the least. The standard way of putting this together is to pull information from a land or financial system and enter them in a cumbersome spreadsheet. The E&P company would manually compile the necessary info in this spreadsheet, entering in different cost models and formulas as required.

The potential flaws in this method are fairly evident. Not only can it take weeks out of a busy schedule to compile, but manual data entry can open a company up to a whole host of errors. Mistyped data, broken formulas, or bloated, difficult-to-maintain spreadsheets are common issues with manual reporting. Even companies who avoid these issues by having an Excel wizard on their staff can quickly find themselves in trouble should that specialist exit the company.

Working with liability experts, regulators, banks, and E&Ps, XI has developed a better way. Through XI’s ARO Manager application, you can fully prepare the information your bank requires in minutes and present it in the form of a detailed project overview report that summarizes license counts, and spills/incidents for all of your companies aged active and inactive wells, abandoned wells, and facilities. This easy-to-generate overview report provides banks with all the info they need to start the discussion over credit redeterminations, including full, realistic estimates for abandonment, reclamation, and remediation costs.

XI has put together a video demonstrating just how easy it can be to generate this report and simplify your bank credit redeterminations. Watch the video below to see for yourself:

Click here to watch the video.

If you’d like to see how easy it would be to generate this report for your company, contact XI and we’d be happy to show you.