Don’t Go Through Pain Again – Real Stories of Streamlined ARO Management – Part 3

April 29, 2025

Don’t Go Through Pain Again – Real Stories of Streamlined ARO Management

Recently we have been talking a lot about the problem with spreadsheets and why you should consider a different tool for tracking and reporting asset retirement obligations (ARO). In this article, we share real world stories from a variety of professionals within the industry’s finance and operations teams. Our clients tell us regularly about how their workflow has improved since moving from a two-dimensional overly complicated spreadsheet into a relational, centralized database. We share three of our most interesting tales with you here.

The Day the Wizard Left

Our first story is about a client who was tracking their ARO in one of the most complex spreadsheets we had ever seen (and we’ve seen a lot!). By the time our team was called in to help bring order to the chaos, we realized how it got that way.

The company’s early ARO tracking started out as a very simple spreadsheet. This was a mid-sized producer with approximately 23,000 BOE (barrels of oil equivalent) per day and interest in over 7,200 oil and gas wells. They had kept up with their own ARO tracking as a matter of due process, relying on an internal Excel guru who appeared to have everything under control.

Then they made a sizeable acquisition.

And then they lost their spreadsheet wizard.

The wizard was the person who built the company’s original ARO spreadsheet and lovingly nurtured it to the point where it became a huge, complex, multi-coloured, formula-obscure spreadsheet. Naturally, the wizard took great pride in their spreadsheet. But the rest of the team was never in on all the complexities, so upon the wizard’s departure, this giant spreadsheet became a beast that no one wanted to tackle. The beast was tucked away in their IT closet while they desperately sought a new wizard.

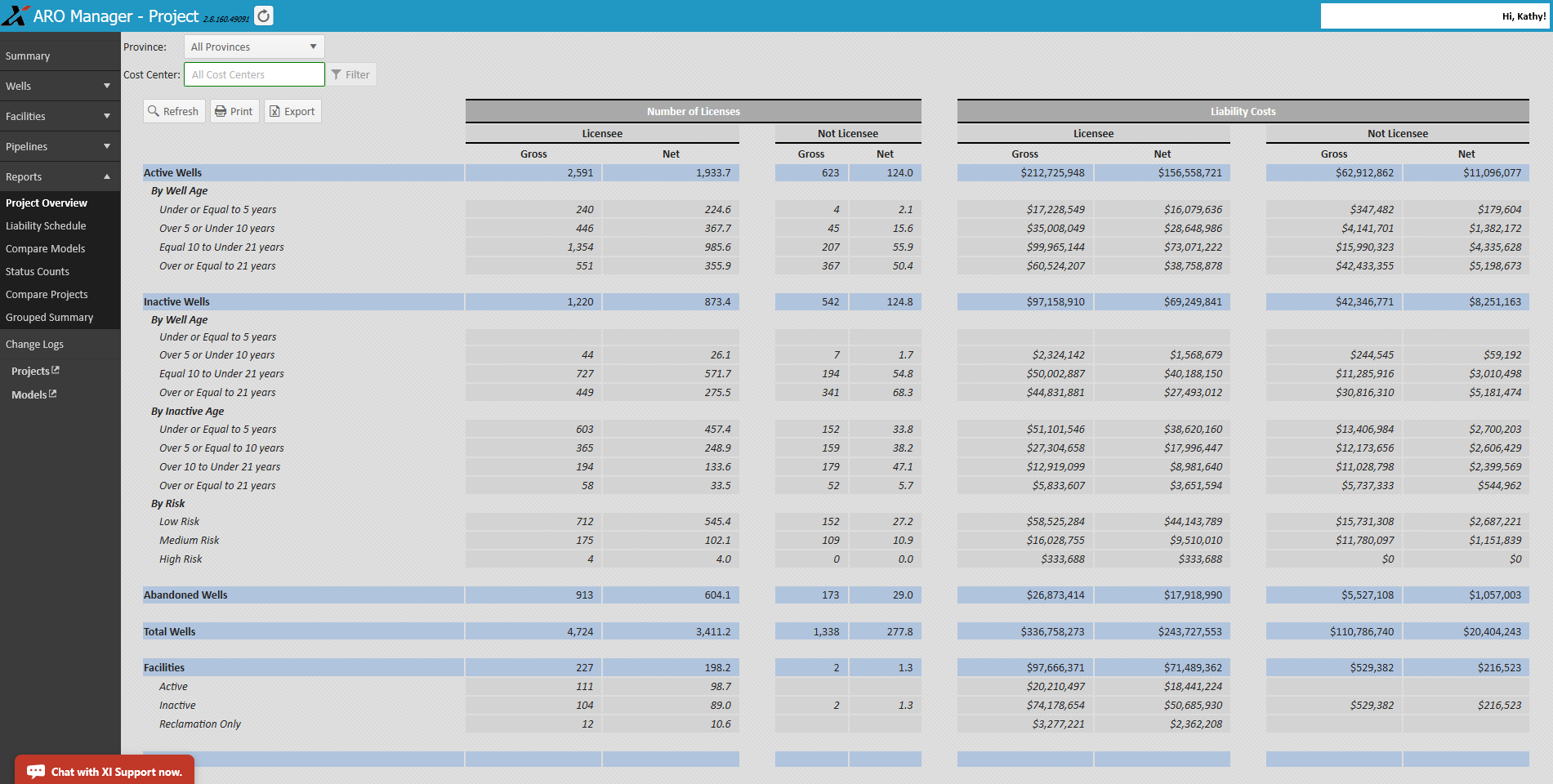

Enter XI Technologies. With ARO Manager, the company was spared the angst of hiring a new spreadsheet unicorn. ARO Manager’s centralized database quickly became the solution that helped the company’s finance team regain control across several departments. In the process of onboarding, XI deployed our own implementation wizard who assisted with uploading all the existing well files, along with the newly acquired well list, and swiftly pulled together several key reports.

The CFO looked at the Group Summary Report and gave an audible sigh of relief.

This story has a happy ending. The company is now able to accomplish three things with mere clicks of a few buttons:

- Evaluate new acquisition opportunities with an eye on liabilities.

- Update company liabilities (with new well lists, changed cost models, revised discounts) to equip the leadership team with speedy analysis for ARO decisions.

- Submit reports to banks or auditors with the assurance of SOC compliance.

The Day the Company was Sold

This story’s hero knew the importance of positioning. He came to us with what seemed like a simple ask: help me position my company for sale. He was the president of a junior oil and gas company who was ready to retire.

In a time where a company’s value is based on intense scrutiny of both liabilities and production potential, the ability to be competitive in the mergers and acquisition space depends upon transparency across the board. Our hero knew how important it was to ensure they created a highly transparent view of their liabilities for a potential buyer’s apples-to-apples comparisons. They knew their value, but they wanted to make sure nothing held them back from making a swift deal in today’s market.

Once their wells were entered into ARO Manager, they were able to produce their Liability Schedule, a Discount Schedule, bank packages, internal summaries, and stakeholder snapshots that were widely accepted by all involved.

Their happy story was a successful sale. As for XI, we also celebrated with the easy move of data into a new company that used ARO Manager to integrate their new acquisition.

The Day the Auditor Beckoned

Our final story had a different opening scene. It started with the doomed “uh-ohhh” when the company – a producer with production of approximately 4,800 BOE per day and interests in 2,100 wells – was asked to resubmit their ARO reports to their auditors.

The spreadsheet machine went into overdrive to meet the due date. The small finance team worked overtime. The brows furrowed and sweat dripped down as everyone worked tirelessly to double- and triple-check every Excel input and formula.

The good news: they got the job done, despite their painful spreadsheet.

The bad news: it was the worst audit process they had ever been through.

The best news: they said, “never again” and turned to XI to get ARO Manager so that they would be prepared for the next round.

We are happy to report that this story’s final scene shows the shiny red “easy” button (yes, XI’s red is very similar to Staples), with the company’s finance lead pressing the button each quarter to quickly share their trustworthy SOC compliant report with the auditor.

Post-Story Reviews

The three stories above are about industry professionals who have made the switch from spreadsheets to ARO Manager, resulting in a profound positive impact to their ARO workflows. Here are some additional reviews from those who have also made the transition from spreadsheets:

- Senior Analyst: “Switching to AssetBook’s ARO Manager has been transformative. We no longer have to deal with the inefficiencies and errors that come with spreadsheets. The web-based platform gives us quick access to accurate data, streamlining our workflow and improving overall data accuracy.”

- Operations Manager: “Spreadsheets were prone to version control issues, which made it difficult to manage and access detailed working interest data. Having a centralized, web-based platform eliminates those problems and has improved our decision-making process significantly.”

- Decommissioning Coordinator: “Managing ARO obligations in spreadsheets was incredibly challenging, especially with the volume and complexity of the data. ARO Manager’s web-based platform makes it so much easier to track and update our ARO data, helping us stay compliant and plan decommissioning activities more efficiently.”

If you enjoyed these stories and would like to explore how your company can transition from the pain of spreadsheets to a streamlined database like ARO Manager, contact XI Technologies today.

We’re happy to help you create your own happy ending.

Upcoming Events / Trainings:

Getting the Most Out of Maps Information: Discover the available functions and workflows utilizing all aspects of the mapping tool, including:

- Searching using corners or polygons

- Layering sets of assets on the map

- Searching using mapped assets

- Workflow demonstrations to show assets on the map that meet set criteria

When: April 30th 1pm (Online)

Length: 30 minutes

Check out our new Training Classes & Events calendar page to get the most value from your XI products. More training classes added to the May, June, July Calendar. Would you like to save time by learning pro tips, short-cuts, and added functionality? Want to upgrade your skills and expertise?

Latest Webinars:

ARO Manager for Financial Tracking & Reporting

- Get a more complete picture of asset retirement costs.

- Cost management is a vital part of the business and operating strategy for every Canadian oil and gas producer. But if you are focused primarily on development and operations costs, then you are missing a significant part of the picture.

- AssetBook ARO Manager is the first and only software application specifically designed for estimating and monitoring asset retirement obligations (ARO) in the Western Canada oil and gas sector. For exploration and production companies, ARO Manager provides transparency and SOC-compliant assurance when monitoring and tracking liabilities for financial reporting.

H2S Reporting – Why Accuracy, Efficiency, and Compliance Matters

Struggling to meet H2S reporting requirements with limited resources or time? We’ve got you covered.

In our latest webinar, we provided valuable insights on:

- Regulatory rules and expectations, including revisions to Directive 056.

- How to ensure compliance, find efficiencies, save costs, and work as a team for consistent and transparent APEGA-approved reporting.

- Manage mergers, acquisitions and divestitures with ease (no duplication of reports).

- Learn about H2SComplete as a full solution to help you quickly manage and mitigate risks associated with hydrogen sulfide (H2S) safety.

XI Technologies has moved to our NEW LOCATION:

XI Technologies Inc.

2400 – 500 4th Avenue SW (Altius Centre)

Calgary, Alberta T2P 2V6

Curious to learn more about XI’s product suites? Book a product demo today!

The number of users for XI Technologies modules is not limited to individual seats. The modules are accessible on a corporate wide subscription. Your company may have a XI Technologies AssetBook subscription. To register for access to your corporate account, click here.

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.