Blueberry River First Nations Update: Key Impacts for Oil and Gas Operators

August 14, 2024

***Update:

Blueberry River First Nations has taken legal action by filing a Notice of Civil Claim against the Province of British Columbia. This action challenges the Province’s approval of the Gundy Plan without adequate consultation or consent from the majority of Blueberry’s elected Chief and Council. The dispute stems from the Province’s decision to eliminate New Disturbance caps from the plan, which are essential for safeguarding Blueberry’s Treaty rights and effectively managing the cumulative impacts of oil and gas activities within their territory. Despite these disagreements, Blueberry remains steadfast in its commitment to collaborative efforts outlined in the 2023 Implementation Agreement. These efforts are aimed at achieving sustainable development while upholding their cultural and traditional values.

***

In June of 2021, a BC Supreme Court judgment agreed with the 2015 claim that years of industrial development in the region violated the Treaty 8 rights of the Blueberry River First Nations. As of this January, the BC government and the Blueberry River First Nation have come to a historic agreement. This agreement will have certain implications for all new projects in northeastern BC, where several First Nations are signatories to Treaty 8. Blueberry River’s traditional territory is in the upper Peace River region of northeastern BC, representing about 38,000 square kilometres.

Due to the increased interest in the area, both for precedent-setting significance as well as implications for future development in the area, XI Technologies takes a closer look using our enriched industry data to offer a few insights as to what’s happening in the area from an oil and gas perspective.

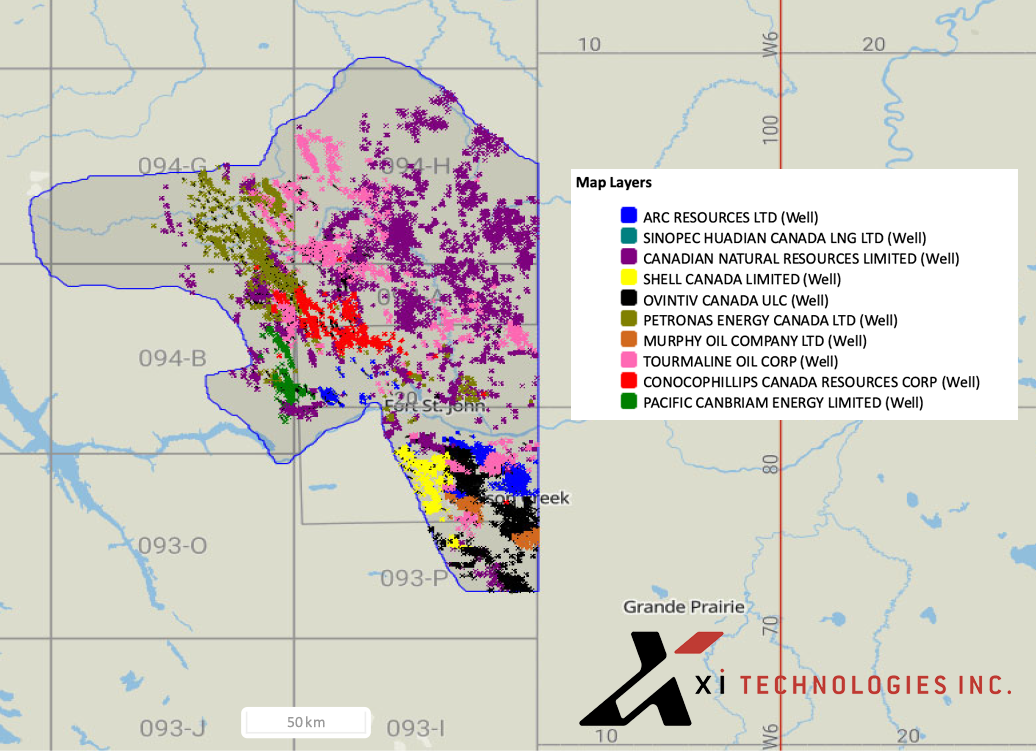

Ownership of Blueberry River Assets

In Figure 2, we show the top producing companies in the Blueberry River claim area, as captured by XI’s AssetBook. Ranked by BOE, the biggest players in the area today are still Ovintiv, Tourmaline, ARC Resources, Canadian Natural Resources and Petronas Energy. (You can load our globally available search of the Approximate Blueberry Claim Area polygon to run the same search).

Click here to download a report of all companies with working interest in the area.

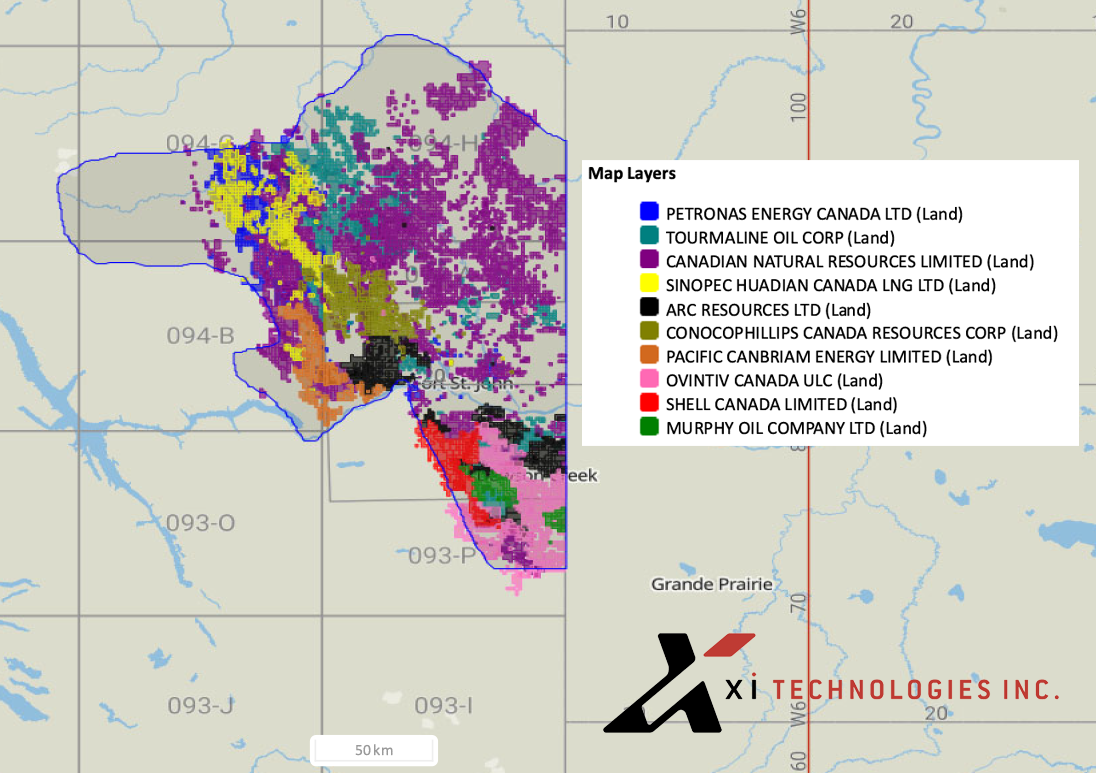

Expiring Lands

Looking ahead, here are the top companies with leases expiring in the upcoming year within the area and therefore those who will need to fully understand their ability to drill in this area to prove out those lands.

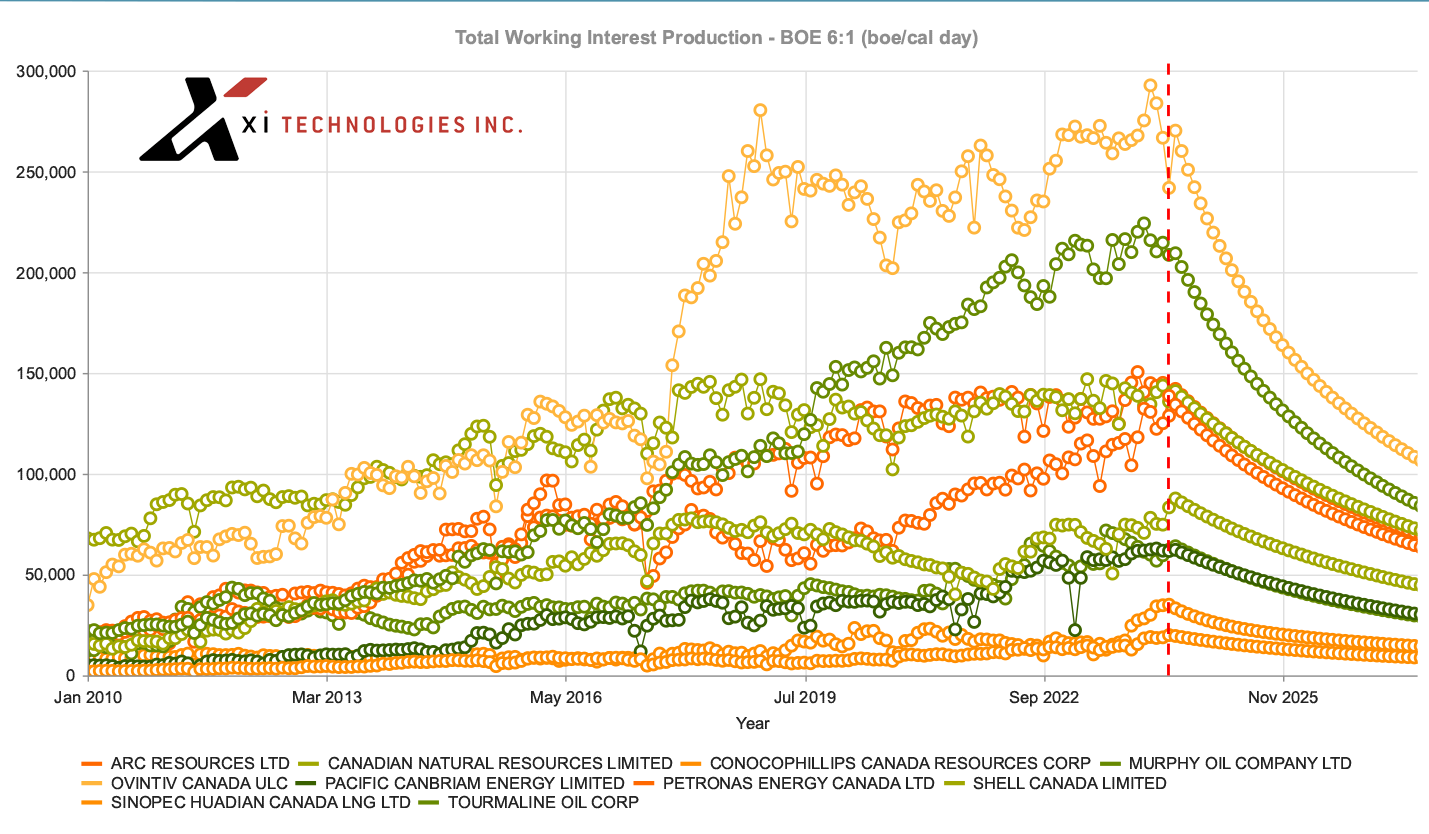

Production history of Blueberry River assets

Let’s investigate the area a little further by examining production levels over time.

As you can see, production has dramatically increased over the past few years, particularly for Ovintiv, and Tourmaline, as this area has become economically active.

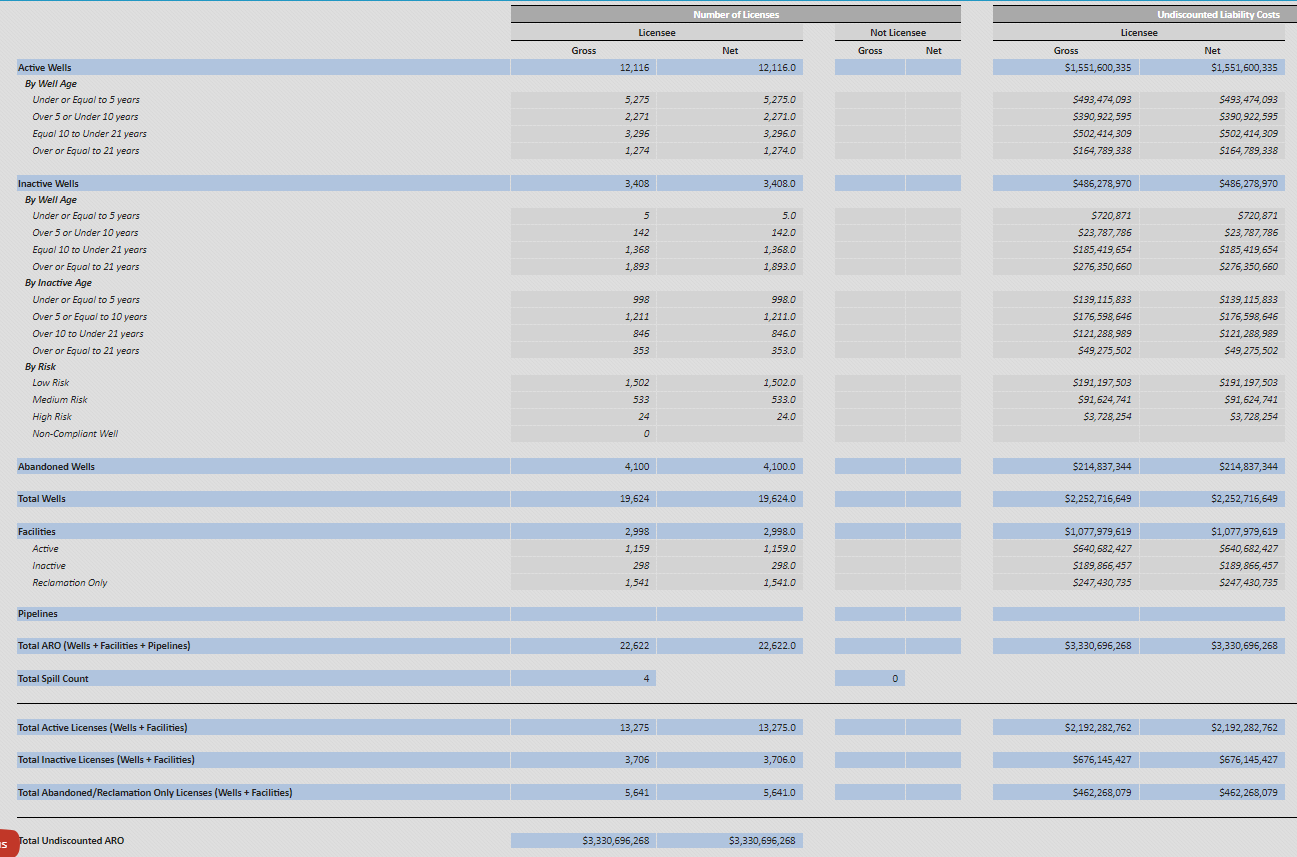

Liabilities

There is going to be a large focus on cleaning up liabilities. There are approximately 3,400 inactive licenses in this area, with an associated liability cost of around $485 million (based on XI’s 2022 Cost Model).

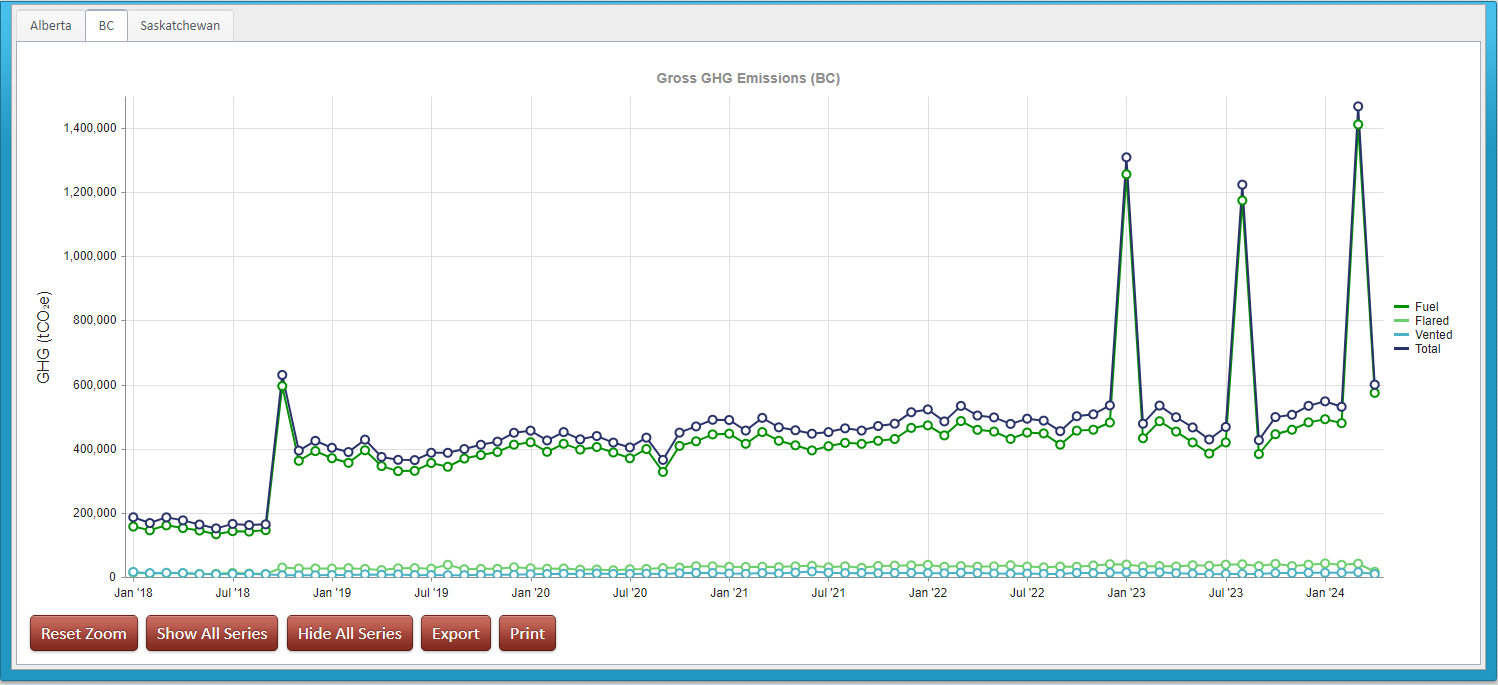

Emissions

With the increase in production in 2018, there has also been a rise in fuel emissions. Emissions from stationary combustion (fuel) outweighs venting and flaring at about 9:1. You can see from the below graph, that the venting and flaring have remained steady over the past few years. Being a gas play, it is no surprise the region has a high gas conservation ratio of almost 99%. About half of the GHG emissions come from the top 20 emitters, and predominantly from large gas processing plants.

The legal and regulatory developments surrounding the Blueberry River First Nations and their Treaty 8 rights continue to shape the landscape of oil and gas activities in northeastern British Columbia. As the BC Supreme Court’s judgment and the recent historic agreement mark significant milestones, the implications for industry stakeholders are profound.

XI Technologies remains committed to providing critical insights into these evolving dynamics through our comprehensive data solutions. Our AssetBook and ARO Manager tools offer valuable perspectives on asset ownership, production trends, and environmental considerations, helping stakeholders navigate the complexities of the region’s energy sector.

As the industry adjusts to new agreements and regulatory frameworks, staying informed and prepared is more important than ever. For ongoing updates and in-depth analysis, we encourage you to subscribe to our insights and explore how XI Technologies can support your strategic decision-making.

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.