“Lease Limelight” – June 2024 Alberta Expiring Land Report

June 5, 2024

XI Technologies looks at expiring land to provide useful business development intel for both service companies and exploration and production (E&P) companies alike.

For service companies, expiring lands provide insight into where drilling activity is most likely to occur over the coming months, and who is behind it. For E&Ps, the expiring land report helps flag farm-in opportunities and/or land that may become available in your core area(s).

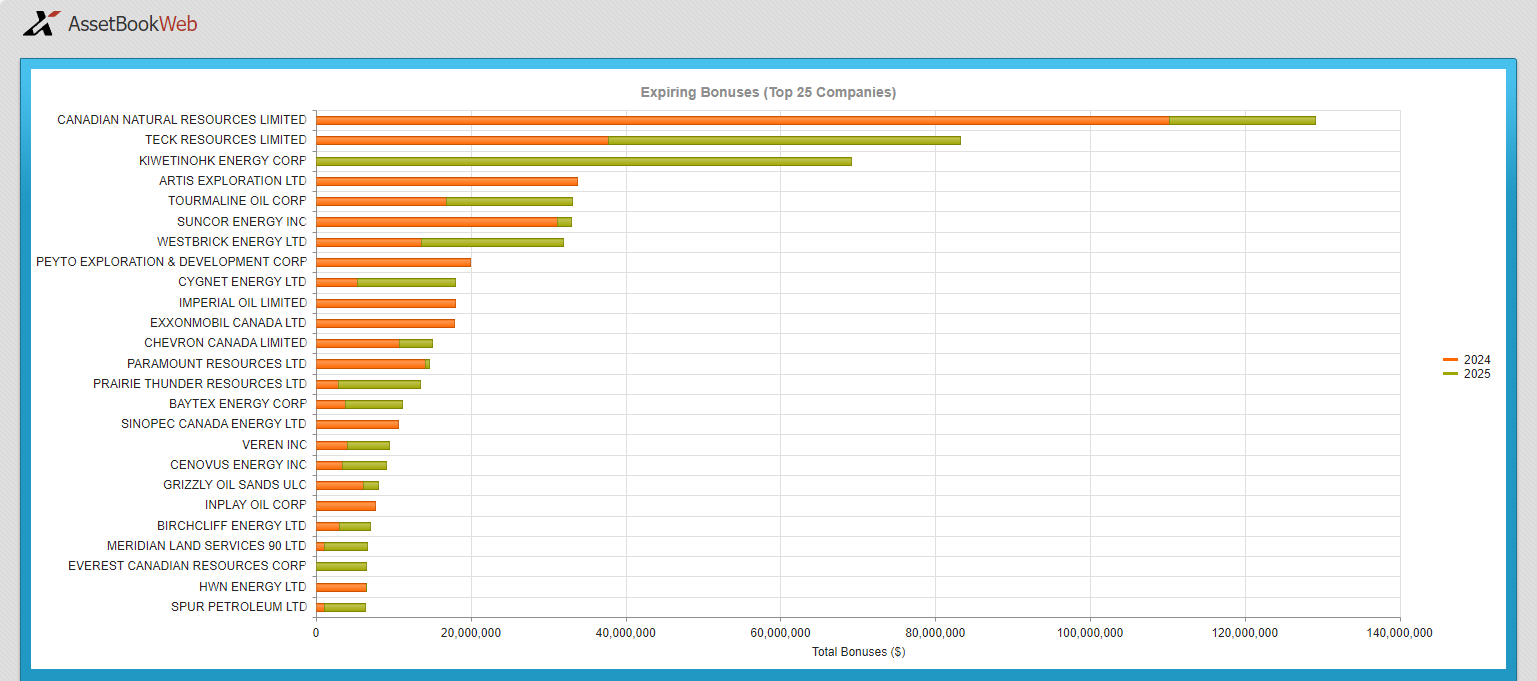

According to AssetBook data, these are the top 25 companies with expiring lands in Alberta over the next 12 months:

25 of 227 companies represent 66% of land expiring in the next 12 months.

When looking at the top 25 companies (Fig. 1), it is also useful to look at the land numbers in context to the overall total of expiring land. These 25 companies represent 66% of the total 1,117,253 hectares (ha) expiring in Alberta in the next 12 months. An additional 202 companies represent the remaining 34% of expiring land.

4% of the total land in Alberta is expiring in the next 12 months.

Comparing expiring land to total land by company for the top 25 companies listed above, we can see how the expiring land compares to their total land base. The percentage of total expiring land ranges from 1% to 73% with an average of 15%.

Collectively, the top 25 companies with expiring land represents 66% of total Alberta expiring land holdings.

The total percentage of the company’s land expiring might be a factor when looking at potential opportunities. This percentage, however, is only one piece of the puzzle when looking at opportunities.

In addition to knowing the top 25 companies with lands nearing expiry, it may be useful to know the bonus amounts that were paid on those lands. AssetBook allows you to easily identify and rank expiring lands based on the size of bonuses paid. This will help you prioritize companies that have the most money on the line and therefore may be more open to farm-in or partnership opportunities.

As with the total land, the top 25 companies, or 11% of the total companies, represent 85% of the total expiring bonuses.

When looking at potential opportunities, the total numbers are only a starting point. Looking at the totals in context of both overall company totals as well as the unique value of the land itself can give you a better picture of how valuable the land may be to each unique company.

Is there more you would like to see in the expiring land report? Contact us here.

AssetBook allows you to search for expiring lands by province, by company, or by any geographic area. The results can be viewed in tabular format or displayed on a map to help with visualization. To learn more about how the data in AssetBook can help you, contact XI Technologies.

—

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.