WTTW: Central Alberta – Black Gold Beneath the Prairies

April 23, 2024

In the dynamic landscape of oil and gas production, Central Alberta is commanding a significant portion of recent production. Looking at data current to Feb 2024, 31% of the production from wells spudded in the last three months are located within the Central Alberta Region.

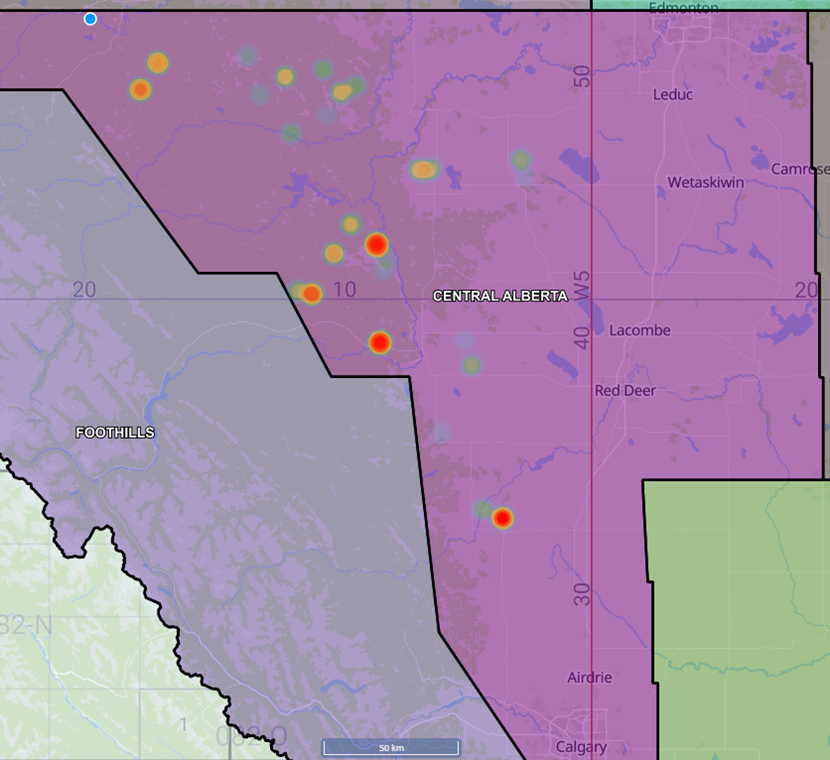

The image below illustrates the Central Alberta Region, highlighting the production hot spots.

This week, we delve into the southern portion of Central Alberta where we see some of the highest production and shed light on the key players, trends and potential for growth in that region.

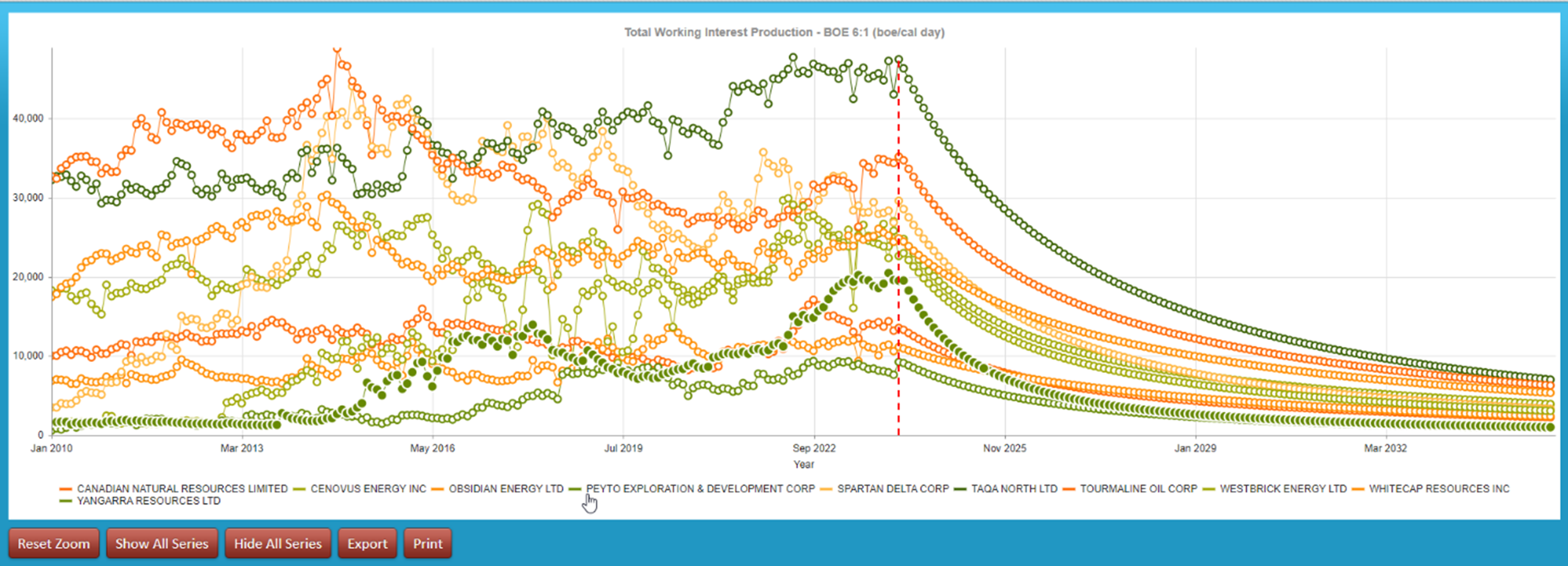

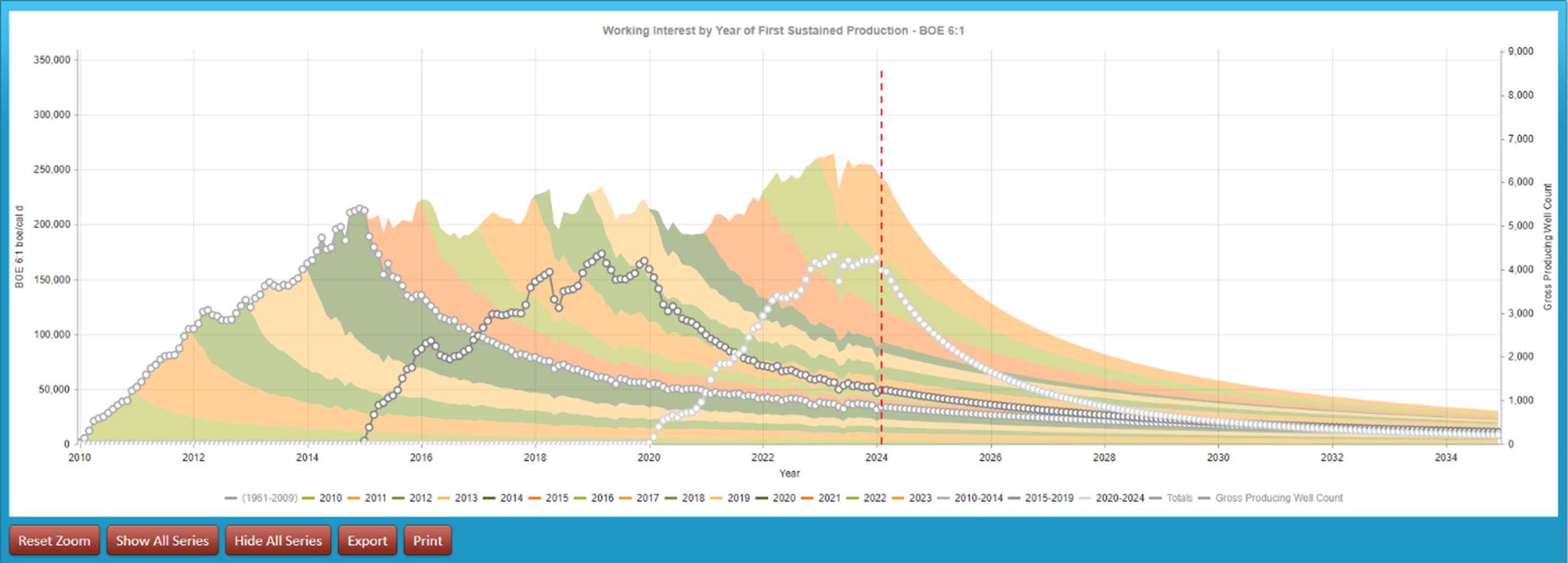

Since the start of 2024, an average of 337,500 boe/day is produced from this area, with a significant portion (over 60%) stemming from Mannville and equivalent zones.

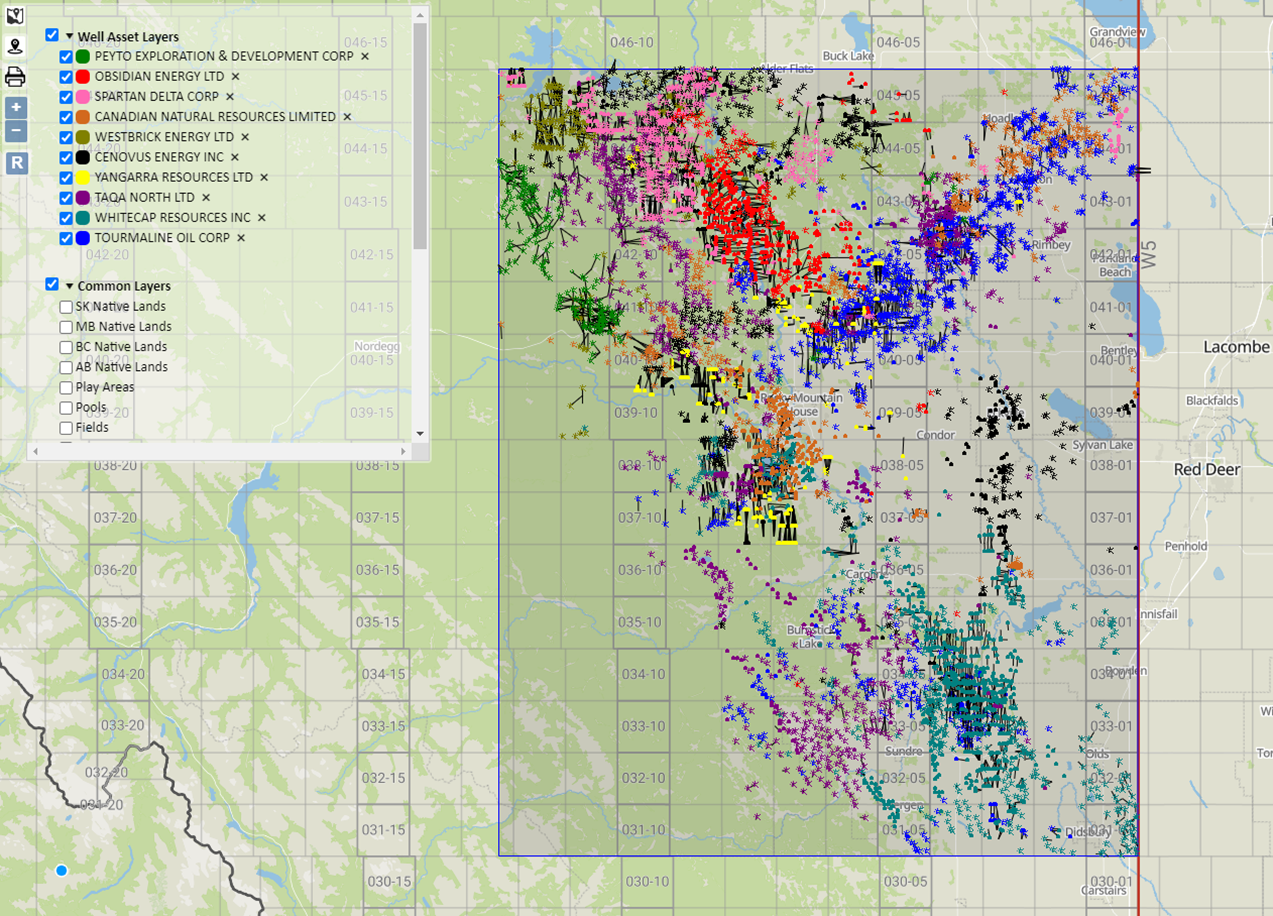

TAQA North Ltd is emerging as the dominant player, with a little over 14% ownership. There are a total of 180 companies that hold producing assets in this area, with the top 10 holding 72% of the production.

Noteworthy spikes in production have punctuated the years, particularly in 2014, 2016 and 2018, followed by overall steady increase in production since 2020.

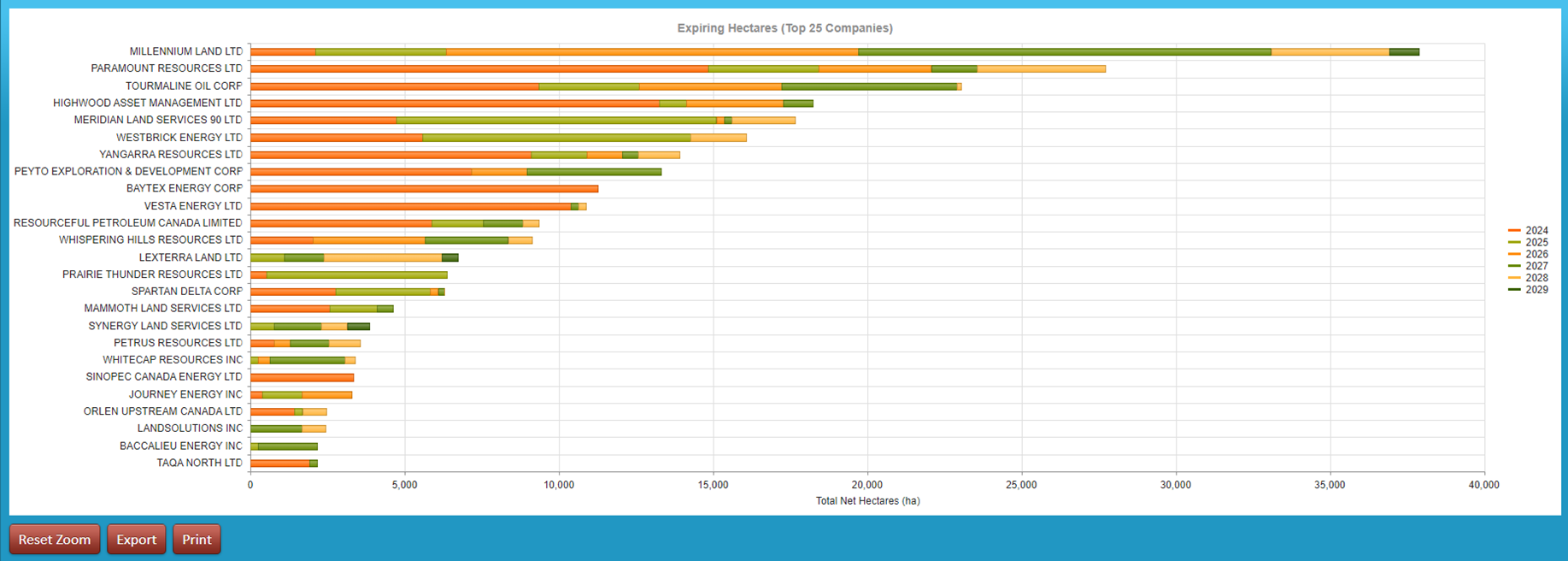

With over 787,784 ha of undeveloped land, there is still a lot of upside potential for future development. Opportunity is most obvious in the approximately 14% of undeveloped lands slated to expire in 2024.

Turning our attention to some of the existing infrastructure in the area, the top four companies with licensed Active Gas Plants – Keyera Corp, Cenovus Energy Inc, BTG Energy Corporation, and Canadian Natural Resources – make up 45% of the total Gas Plants in the area.

Utilizing XI’s cost model, the total wells and facilities in this area amass an undiscounted liability of approximately $2.7 Billion. Notably, 61% of this total is attributed to active licenses, with around 35% of active wells aged 21 years or older. Furthermore, the area has seen 1,260 spills, and 24% of well licenses and 20% of facilities are designated as inactive.

Central Alberta remains a constant of productivity in the realm of oil and gas extraction, boasting a substantial share of recent production. The region’s landscape is characterized by a diverse array of companies, infrastructure, and untapped potential. Despite challenges such as aging infrastructure and environmental concerns, Central Alberta remains poised for continued growth and innovation in the energy sector.

Upcoming Webinar:

Join us for a special presentation on ARO for Financial Tracking & Reporting.

When: April 25th 10:00am (MST)

Register Now!

Upcoming Certification Course:

ARO Manager For Financial Tracking and Reporting Certification Course provides practical, hands-on professional development for anyone interested in expanding their knowledge of Asset Retirement Obligation (ARO) tracking and reporting.

When: April 30 and May 2 at 9:00am

Space is limited so be sure to register now for the course. This is 2 x half- day course taking place in person at the XI office.

Register here.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.