WTTW: Abandonment & Reclamation Across WCSB in 2023

March 19, 2024

With an ever-growing focus on clean-up within the oil and gas sector, it’s time to take our annual look back on liabilities reduction work across the Western Canadian Sedimentary Basin (WCSB).

XI Technologies conducted an analysis of liability values and reclamation totals, comparing activity from 2022 to 2023, with the aim of obtaining a comprehensive overview of the status of oil and gas liabilities as of December 31, 2023.

Liabilities Value

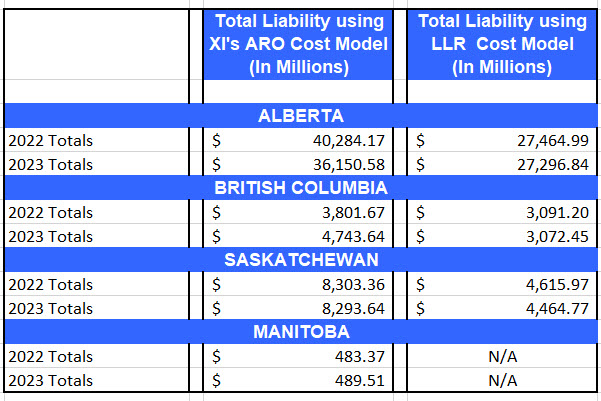

The following information was compiled using XI’s ARO Manager with XI’s 2023 Cost Model (plus AssetBook’s well and facility data) compared with AssetSuite’s LLR Module using the government Directive cost models. Pipeline information was specifically excluded for this compilation as provincial LLR calculations do not currently include those assets.

For a look at five major differences between XI’s proprietary third-party cost model and regulator LLR costs, download this case study.

In last year’s review, we noted that the calculated LLR liability was reduced by 2% across the WCSB (). The trend continues in 2023, with a reduction of 1% ($331.8m reduction) from the previous year’s calculated values. Keep in mind that reduction is after factoring in additional liability incurred due to 6,217 well licenses spudded in 2023 (calculating an additional $450.7m)

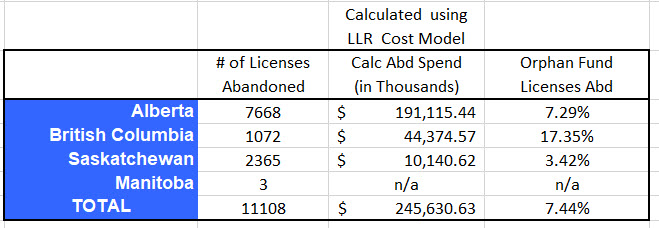

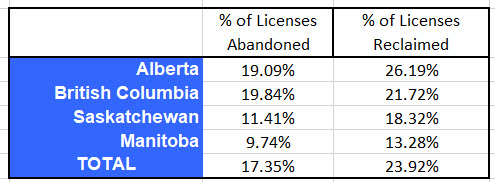

Abandonments in Western Canada

In the past 2 years, there have been over 26,000 licenses updated to an abandoned status. Several different federal and provincial programs have been available to assist companies in completing abandonment work in conjunction with the implementation of directives requiring companies to have a minimum spend on cleaning up their liabilities. The availability of these funds to operators is reflected in the number of sites where the license status changed to abandoned, and in many cases, are well on the path of being fully reclaimed.

The abandonment work continues across the Basin, with 11,108 well and facility licenses updated to an abandoned status in 2023. This abandonment work is spread across955 different fields.

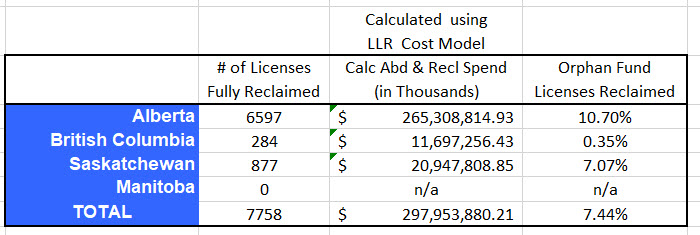

Reclamations in Western Canada

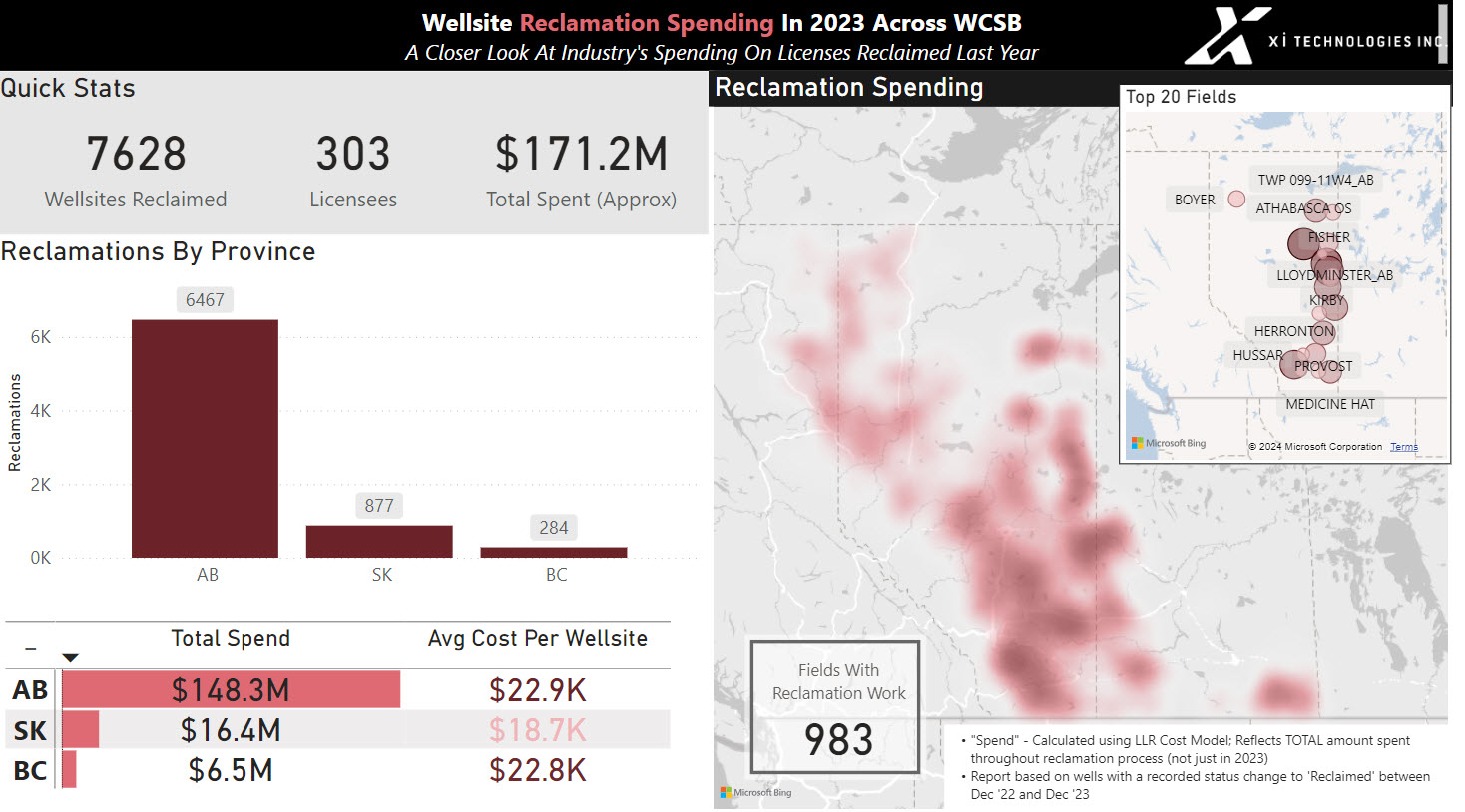

Dovetailing the abandonment work, the reclamation process often starts at the same time but takes a much longer time to complete, as it includes monitoring the site for compliance over time. During 2023, there were 7,758 licenses (wells and facilities combined) that were issued a Reclamation Certificate. This represents an approximate spend of nearly $298 million over the entire cycle of the abandonment and reclamation work completed if we use the Directive cost model values.

Reclamation work completed has been quite widespread across the Basin, including work completed in 983 fields.

Comprehensive efforts in abandonment and reclamation extend to licenses covered by the Orphan Well Fund, accounting for 7.44% of last year’s completed work. The OWA diligently utilizes levy funds to facilitate the cleanup of these licenses. Over the past year, producers within the WCSB have demonstrated proactive engagement, not only in drilling activities but also in the essential task of completing abandonment and reclamation work throughout the Basin. These endeavors signify a concerted commitment to environmental stewardship and the sustainable management of resources.

If you’d like to dig deeper into the two graphics, click here to access interactive dashboard versions.

Data within this article was calculated using XI’s liability software module called AssetBook ARO Manager. ARO Manager is the only standardized tool for estimating and monitoring asset retirement obligations in Western Canada’s oil and gas sector. Ideal for over-the-fence evaluations of potential acquisitions, it is also instrumental in ARO financial tracking and reporting, replacing cumbersome spreadsheets. To learn how XI’s ARO Manager can help with the planning, tracking, and reporting of liability management, visit our website or contact us for a demo.

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.