Word To The Wise: LCA and Transparency (Part 2) – Inventory Reduction Program and Security

January 30, 2024

In Mid-November last year, XI Technologies Inc. (XI) co-hosted a talk in conjunction with Burnet, Duckworth & Palmer LLP (BDP Law) at a Petroleum Acquisition & Divestment Association (PADA) breakfast about the AER’s new Directive 88. After an overview from BDP Law and an excellent discussion on how the directive was currently affecting the deal space, we presented ways to reverse-engineer the directive using public data to allow for a look behind the “black box” on the licensee capability assessment metrics.

Unveiling the Directive: A Look Behind the Black Box

Directive 88 offers a roadmap for assessing licensees during deals, outlining key metrics that should be considered. However, the lack of transparency has left many companies feeling uncertain about their transactions. The data required for Directive 88 aligns perfectly with the information needed for informed decision-making, but the opacity of the process raises concerns.

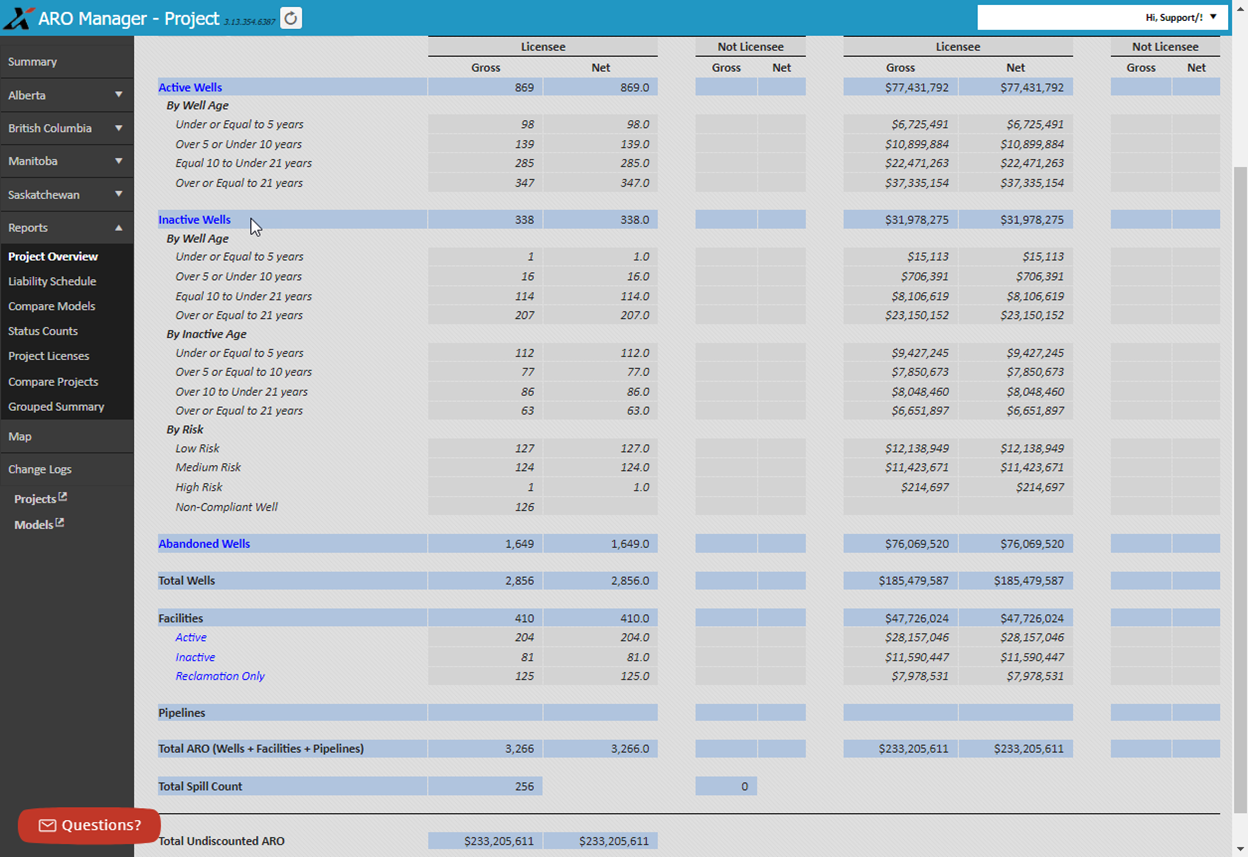

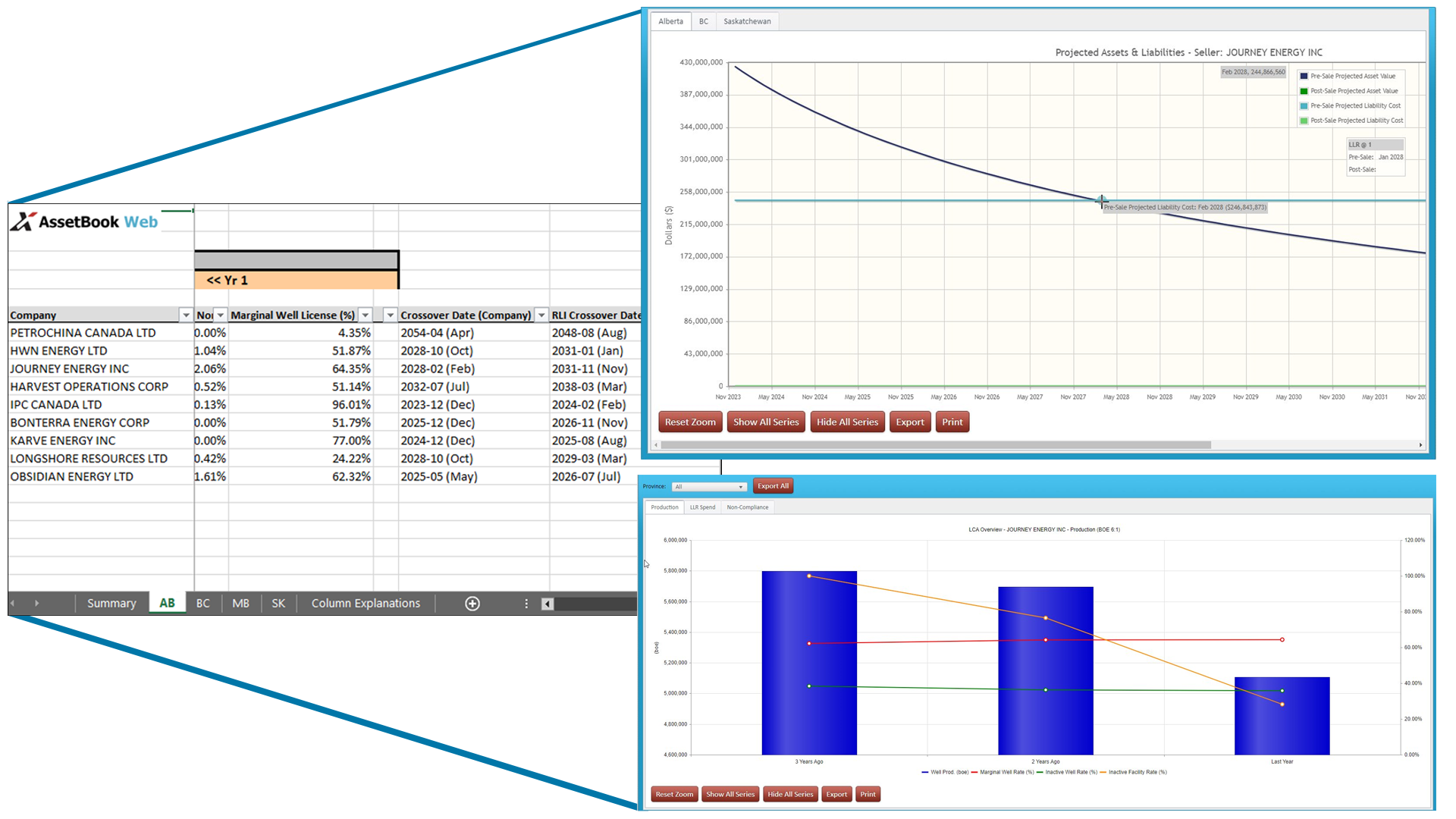

Publicly available data, when strategically compiled, can provide a workaround to this challenge. By reverse-engineering the directive using this data, companies can calculate and estimate factors, allowing for a clearer understanding of potential cost obligations and regulatory risks. One key aspect is determining the security deposit, a critical piece of information for risk mitigation and financial planning.

Holistic Licensee Assessment: A Deep Dive into Part 1

In our previous post, we delved into part 1 of our review of AER’s Directive 88. This comprehensive examination addressed transparency issues within the framework and provided insights into Licensee capability assessments, particularly focusing on the Remaining lifespan of resources. The associated whitepaper elaborated on these factors, offering valuable perspectives for industry stakeholders.

Inventory Reduction Program: Navigating Mandatory/Supplemental Spend and Closure Nomination

Directive 88’s section on the Inventory Reduction Program emphasizes mandatory and supplemental spend, including closure nomination (Manual 23 – Section 4). Identifying potential closure-nominated sites becomes crucial, especially for municipalities, freeholds, or First Nations with inactive assets. A more comprehensive understanding is discussed in our Word To The Wise: Blueberry River First Nations Area Overview posting.

Security

Compounding the issue of lack of transparency, hard-to-reproduce crossover dates are also being used in conjunction with the level of financial distress to calculate the security deposits (see Manual 23, Table 9). Security is determined using magnitude of liability, site specific liability, and present value of future cash flows based on the reserves and economic analysis, and any other amount that the AER considers appropriate in the circumstance. Understanding the crossover dates, financial distress levels, and potential security deposit amounts becomes essential for proactive risk mitigation and financial planning, whether that is communicating transfer timelines to stakeholders, or preparing for lending rates from banks.

Conclusion: Navigating the Path Forward

In conclusion, as the industry adapts to the regulatory landscape defined by Directive 88, it’s crucial for companies to embrace transparency and demystify the calculations involved. Leveraging public data, understanding licensee assessments, and staying informed on mandatory spends and security calculations are vital steps in navigating the path forward.

As we collectively navigate these complexities, staying informed and fostering open dialogue with the AER will be key to achieving a balance between regulatory compliance and industry sustainability. The road ahead may be intricate, but with strategic insights and collaborative efforts, the oil and gas sector in Alberta can forge a path towards a resilient and responsible future.

Stay tuned for more insights, and don’t hesitate to reach out for a demo if you’re eager to explore the data further.

To get more info on LCA and the AER’s framework on Directive 88, download our whitepaper:

Licensee Capability Assessment: A Peek Into the Black Box

Each week, XI uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here. For more tips and to learn about how XI’s AssetSuite can help with your high-level analysis visit XI’s website or contact XI for a demo.