Word to the Wise: Importance of Knowing Working Interest Partners in Merger, Acquisition or Divestiture Work

December 5, 2023

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

Merger and Acquisition (M&A) activity has been rekindled recently, drawing attention to the pivotal role of comprehending working interest partnerships (WIP’s) in evaluating acquisitions or divesting asset portfolios. Nevertheless, in the realm of asset management, with working interest partners, certain critical elements might slip under the radar of your current workflow. Overlooking nuances could be the difference between seizing an opportunity or facing a potential missed opportunity, making it imperative to delve deeper into the intricacies of the data.

Uncovering Hidden Realities Through WIP Investigation Investigations:

Conducting a comprehensive WIP investigation might unearth unexpected non-operating partners who hold a stake in the asset you plan to acquire. Such revelations could significantly alter your perspective:

- Alignment of Interests: The asset may not align with the core business area of your working interest partner; opening avenues for direct discussions on your purchase of the asset.

- Strategic Collaboration: Leveraging an existing working interest partner for the new asset could offer additional value, such as access to facilities and pipelines.

- Identifying Competing Interests: Some WIPs might aim to augment their share, potentially transforming into competing bidders against your acquisition.

- Risk Evaluation: Identification of a troublesome or non-compliant WIP might steer you away from potential collaboration due to associated risks.

Directive Impacts on Acquisition Strategies:

Governmental scrutiny via directives like AER’s Directive 88, BCER’s PCA program, and updates in SK’s PNG025 program has intensified the need to understand WIPs, their compliance history, financial standing, and prior licensee affiliations. The amalgamation of Company Operator codes within and across the different government regulatory bodies remains a laborious task, highlighting the challenge of tracking asset ownership history amidst legacy data and code updates. However, this work is critical to understanding timelines and potential security requirements. Our LCA blog from two weeks ago discusses this issue in more detail.

Navigating Financial Stability of Partners

The 2019 Redwater decision by the Supreme Court of Canada accentuated the necessity of assessing the financial health of operated and non-operated assets. Any closure orders issued against a company undergoing bankruptcy or facing closure repercussions significantly impacts all associated WIPs, directly influencing budgeting and overall performance.

Strategies for Identifying WIP’s:

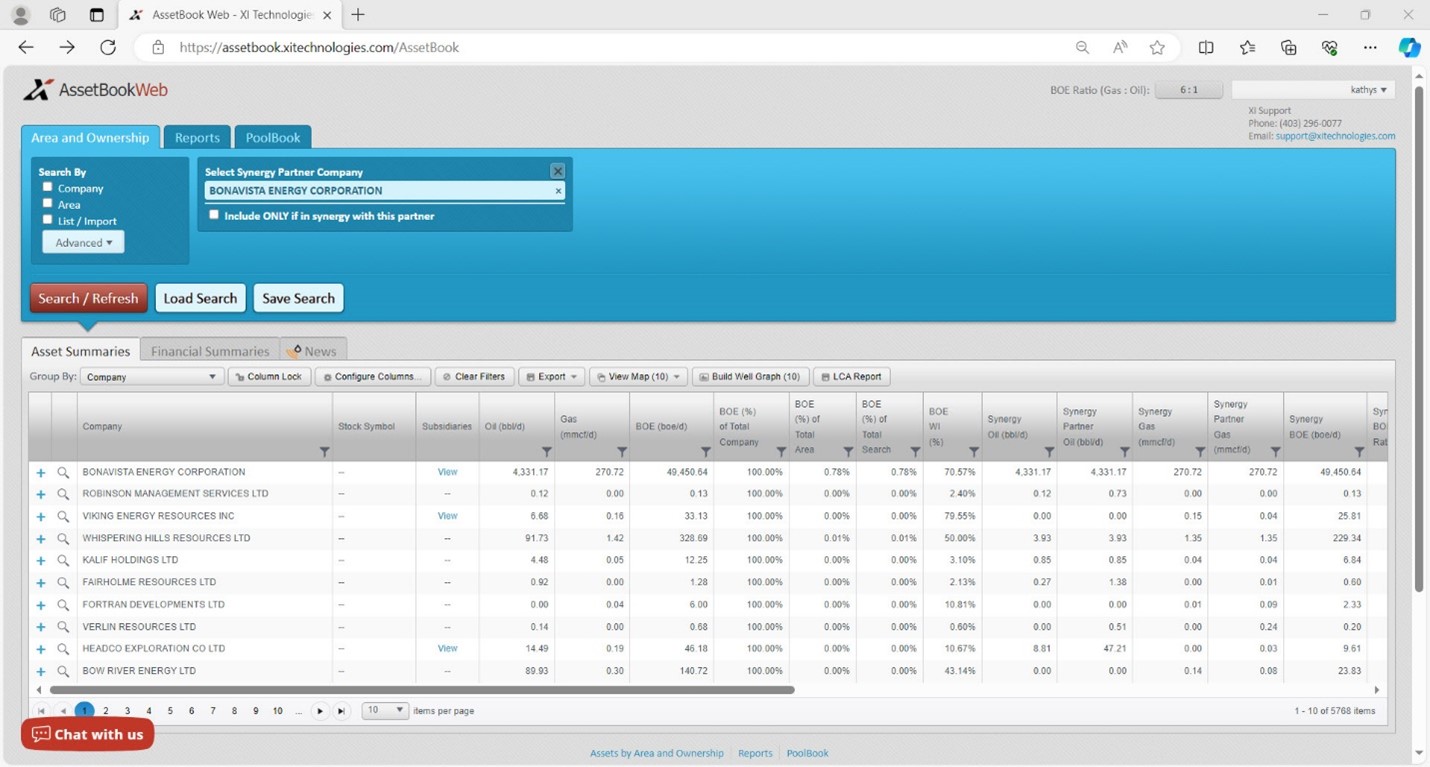

Efficiently identifying subsidiaries of a company, analyzing land ownership, and cross-referencing with well operatorship are crucial in unearthing potential working interest partners. Tools like the Synergy Report in AssetBook equip producers with a reliable means to assess working interest partnerships seamlessly, aiding in comprehensive evaluations.

Image: Sample Synergy Report generated by AssetBook

For a detailed demonstration on creating a Synergy Report akin to the one displayed above, refer to this video tutorial. To explore how XI can streamline your understanding and management of working interest partners, reach out to us at sales@xitechnologies.com for an in-depth discussion.