Word to the Wise: Licensee Capability Assessment

November 21, 2023

LCA and Transparency (Part 1)

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Word to the Wise in your inbox, subscribe here.

The Alberta Energy Regulator (AER) outlined a new framework in Directive 88 and the accompanying Manual 23 designed to incorporate a holistic approach to evaluating a licensee. It addresses five key areas; Licensee Assessment or Capability; License Transfers; Licensee Management Program; Inventory Reduction Program and Security Deposits. In this article, we will focus on the Licensee Assessment for License Transfers.

One of the repeated complaints we hear from stakeholders in the license transfer space (E&Ps, banking and investment, lawyers, shareholders) is the lack of transparency with pulling the data and recreating many of the metrics. In fact, accurate or not, banks and other lenders are currently still relying on the old LLR ratio methodology as it is much easier to base covenants on black and white, transparent numbers. The calculations behind the metrics, and available data are opaque, and most transactions trigger regulatory review, so why even try to figure it out? While much of this new Directive seems to fall into a “black box,” the AER has basically given an outline of what one should be evaluating when looking at a deal. During the transfer process once confidentiality agreements are in place the information the AER requires within this directive lines up with metrics used to properly evaluate a deal. These calculated values assist with enhancing your deal up front, exposing any potential cost obligations that may come up.

This November, our team was invited to host a talk in conjunction with Burnet, Duckworth & Palmer LLP (BD&P) at the PADA Society breakfast where we discussed this very topic. After an overview of Directive 88 from BD&P and an excellent discussion on how the directive was currently affecting the deal space, we presented ways to reverse-engineer the directive using public data to allow for a “peek beyond the black box” on the licensee capability assessment metrics.

The AER categorizes LCA into two groups: Risk and Performance. The Risk group includes evaluations for level of financial distress and magnitude of liability. The Performance category includes remaining lifespan of resources, operations, closure, and administration. The AER uses these factors to assign a company a licensee profile to group and prioritize producer licensees, as well as to identify regulatory and liability risks that will need to be mitigated by the licensee.

So how can you estimate each companies’ licensee profile and determine how long a deal may take to process? There is a wealth of public data available, and if you compile it in a specific way, you can calculate and estimate some of these factors, which can then help you adjust the structure your deal. For our purposes here, we’ll look at the Performance group, specifically, the “Remaining lifespan of mineral resources” factor, however if you would like to learn more about our take on the other factors and where to find the data, download our latest whitepaper here.

We have certainly seen a lot of M&A occurring within the Major/Intermediate Peer Groups, as categorized by the AER in Directive 88 (see Manual 23 – 2.1.2.1. Peer Group). The larger entities are likely at an advantage with more financing to back them – but what’s happening with the Juniors? Are they able to participate in any of these deals? Considering that a company’s mandatory spend (outlined in Manual 23, Section 4 – Inventory Reduction Program) is set around June, and doesn’t transfer with the licensees, they must somehow navigate through the perfect storm to fulfill their obligations and do the license transfer, all the while dealing with financing obligations and covenants with their lenders.

Let’s look at one area where companies can find information: the Remaining Lifespan of Resources. This includes the parameters of production trend, inactive well ratio, marginal well ratio, inactive facility ratio, and crossover timeline (Manual 23, Table 3). These categories will provide an insight into a company’s’ operational efficiency and will help you determine if the company is set up to fund its closure activities.

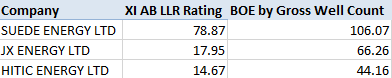

As an example of how to compare companies we look at three companies in the Junior Peer Group that have a high LLR Ratio based on the AER’s old calculation from Directive 11.

Figure: Three Junior Companies and XI Estimated LLR ratios.

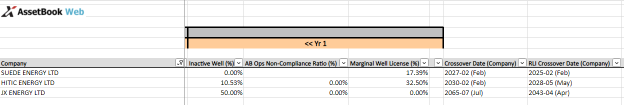

Suede and HITIC are both increasing production over the last three years, and both seem to be lowering their inactive well count. Suede stands out in the fact that their marginal well (10 boe/d or less) from three years ago went from 100% to 18% now. The company that stands out when looking at cross over dates is JX Energy, with an RLI crossover date in 2043.

Figure 6: A portion of the LCA Report showing some calculated parameters based on the remaining lifespan of resources factors

If you want to see the full comparison for these three companies, download the LCA report HERE. You can also expand this and look at the top ten that rank based on these factors and see how they compare against the companies identified in our recent Tax Pools article.

All factors outlined in the new directive are important to consider, but the Remaining Lifespan of Resources factor really allows you to easily benchmark companies against one another, to quickly identify ones that you may want to research further. Once that’s done, you can take the next step to look at the other factors outlined in Manual 23, especially the magnitude of liability, and an estimate of your potential security deposit for the deal.

Stay tuned for Part 2 on this topic, coming soon.

For a more thorough review of all factors involved in a more holistic approach to evaluations, download our whitepaper Licensee Capability Assessment here.

_______________________________

AssetSuite’s ARO Manager is the only standardized tool for estimating and monitoring asset retirement obligations in Western Canada’s oil and gas sector. To learn how ARO Manager can help with your planning and reporting of liability management, join us for our virtual information session.

Webinar: ARO Manager for Financial Tracking & Reporting.

When: Tuesday, December 5, 2023 @ 9:30am MT

Register here, or visit XI’s website and contact XI for a demo.