Word to the Wise: Post Acquisition Data Integration & ARO

November 13, 2023

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Word to the Wise in your inbox, subscribe here.

The end of 2023 is turning out to be highly active for mergers and acquisitions. But once a company has decided to merge with another (or purchase just some of their assets) – they have completed all the requisite paperwork, they have been approved by the Regulators, the banks, and the shareholders, and the purchase is complete – THEN what?

Shifting the assets from one company to another includes more than just submitting the paperwork to the appropriate governmental agencies, and then just sitting back and letting things happen. In this blog, we are going to focus on integrating the acquired assets into your ARO calculations.

Integrating the data into existing systems and processes often takes a back seat in priority, as operational integration tends to be the primary focus. After all, that’s where the money is going to be made. But integrating the data for ARO analysis and calculation should be just as important, as the overall company’s financial health can be adversely affected if bad information is passed on.

Corporations often manage their ARO calculations in complex spreadsheets, and while simply adding rows to an existing list doesn’t sound that difficult, it can cause real turmoil. Four questions we recommend you ask prior to starting your work:

- Does the information received include the data points needed in your spreadsheet?

- Is the information received full, accurate and complete? For example, working interest percentages may need to be cross-referenced with land documents to ensure accuracy, or statuses that have not been updated appropriately require a full check.

- How can you cross reference their spreadsheet with your work in a different format? UWI, License numbers and other data inputs are often changed on a company-by-company basis. Leading zeros missed in their spreadsheet can completely throw out information within yours.

- How can you easily identify missing pieces of information? While related to question number two, often what is important to your cost model or data set may not be to another company, so there could be significant gaps.

Duplicating efforts by maintaining legacy spreadsheets which are then brought into current processes wastes everyone’s time, and can lend itself to newly introduced errors, causing even more lost time searching for root causes.

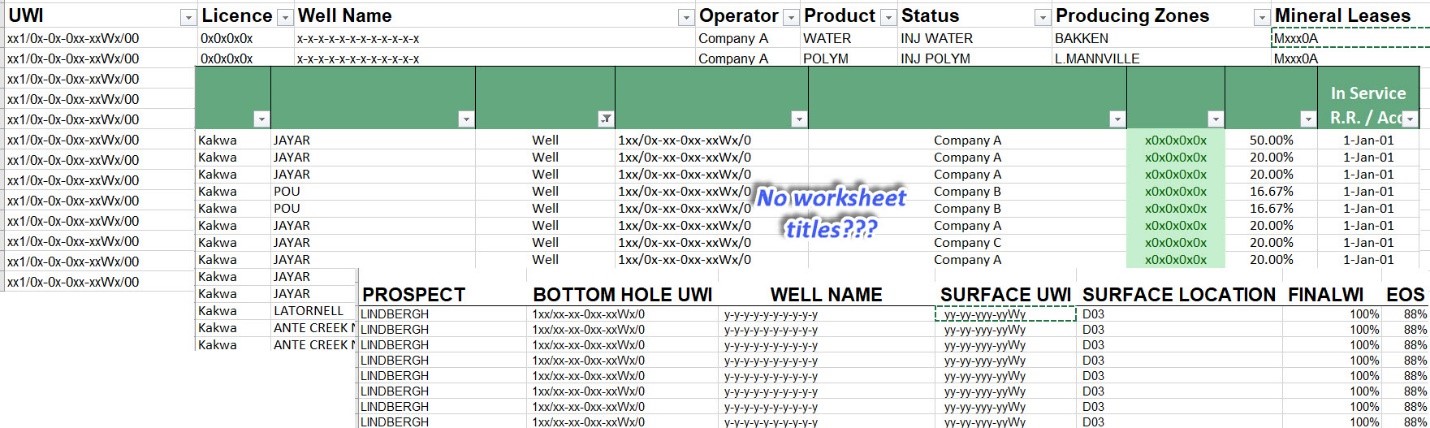

Figure 1: Example of multiple worksheets with varying data and formatting that need to be merged following an acquisition.

The solution, as we see it, seems simple, yet quite complex. Integration requires that you pull out the data you need and leave the data you don’t. There might be some validity to using that other data at some point, but initial integration should NOT include updating your current processes.

In our experience, those companies that proactively plan to integrate new acquisitions into their ARO projects have greater success immediately. The new data seamlessly flows throughout their finance and operations teams to allow for uninterrupted tracking and reporting.

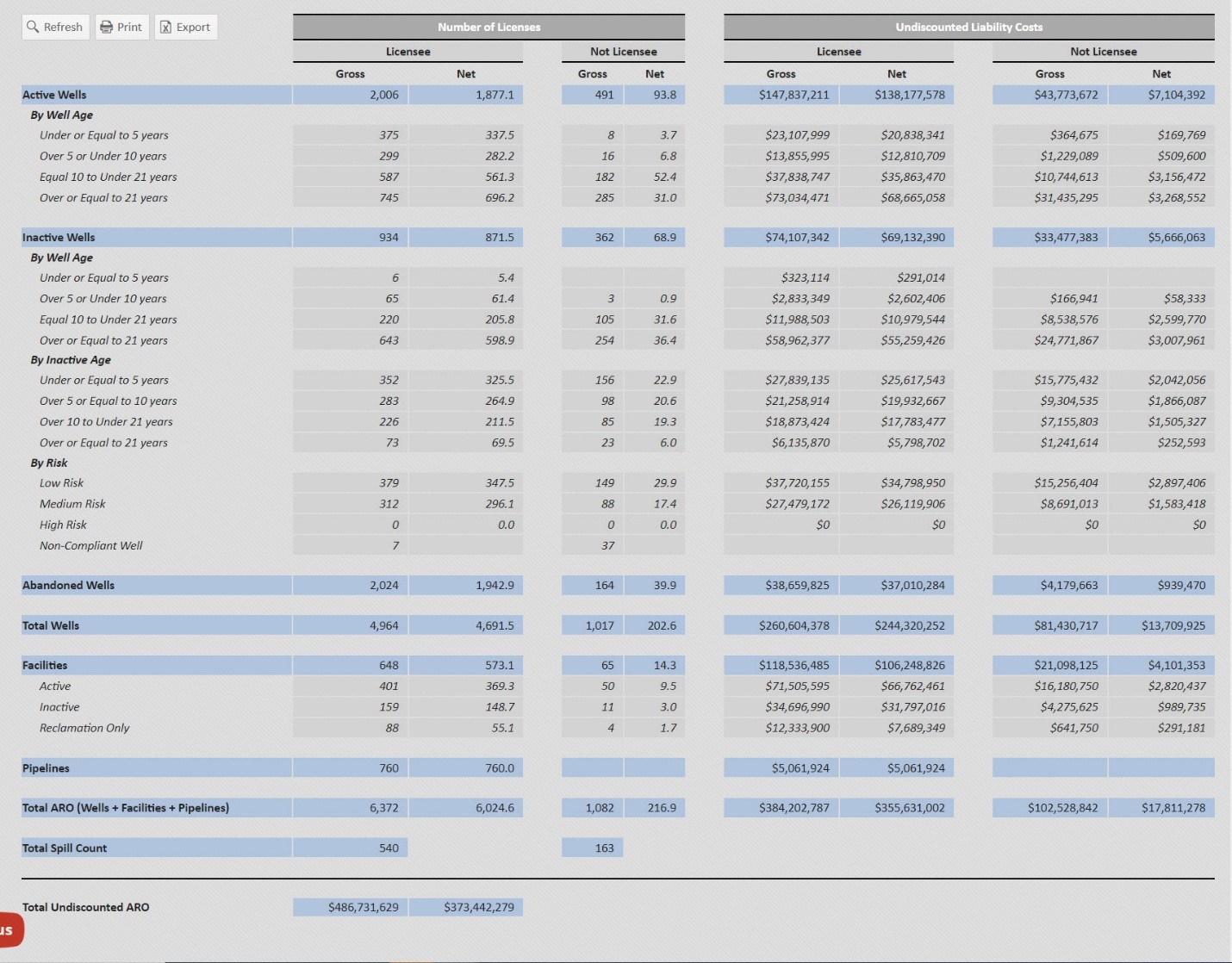

Figure 2: Project Overview from ARO Manager, the result of integration of all data into one master.

To ensure that no steps are missed during the integration, we’ve set up a checklist which we follow at XI with our clients. Using this system allows everyone to have a place to document the steps they are taking, what anomalies they’ve run into, any differences which are bound to appear, and any ideas for future investigation AFTER the initial integration is completed. In fact, if both companies have the same pro forma specifications, and better yet, access to the same specialized software – in our case, XI’s ARO Manager – then the integration is much simpler; the two most recent projects can be merged to create the new and complete master.

Click here to download the case study and discover how ARO Manager can be the tool you need to prepare for integrations.

AssetSuite’s ARO Manager is the only standardized tool for estimating and monitoring asset retirement obligations in Western Canada’s oil and gas sector. To learn how ARO Manager can help with your planning and reporting of liability management, join us for our virtual information session:

Webinar: ARO Manager for Financial Tracking & Reporting.

When: Tuesday, December 5, 2023 @ 9:30am MT

Register here, or visit XI’s website and contact XI for a demo.