Word to the Wise: What Do Tax Pools Have To Do with M&A?

September 26, 2023

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

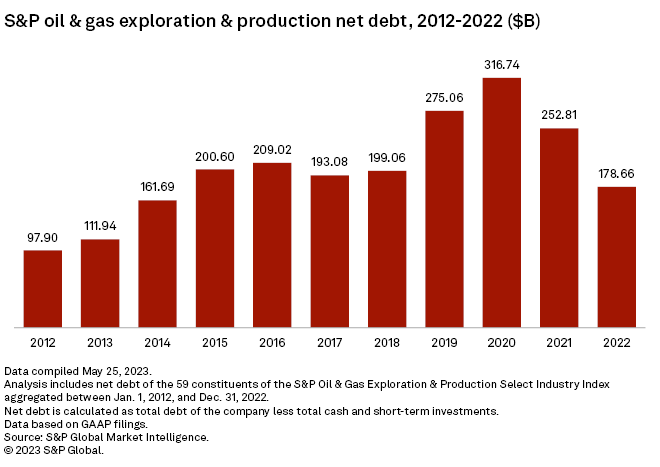

Over the past five years, the oil and gas industry experienced a (less than) perfect storm. Through the COVID-19 pandemic, the industry saw record oil price volatility and, for brief periods, negative pricing. As the world hunkered down to weather the storm, so did the industry. Survival became the playbook, and amid record debt levels, capital spending was slashed across the board to protect cash flow.

Emerging from the pandemic, oil prices rebounded substantially. With extreme caution, companies started to pivot back to shelved capital programs. However, with a pause in capital spending and record revenue, companies now face a different issue: taxes.

Capital spending equals tax credits. Companies that use tax pools to offset tax bills may now face near-term taxable horizons. Taxable income has outpaced the contribution of new credits to tax pools, which means less free cash flow to shareholders.

The debate continues over the best use of free cash flow: debt repayment, share buybacks, dividends, or development and growth. For those with looming tax horizons, acquiring tax pools can be a strategic growth opportunity. As history shows, acquiring a company only for the tax pools can be flawed if it is not synergistic or accretive overall. However, looking for synergistic and strategic opportunities that provide cash flow, development opportunities, and tax pools can be a solid option to pursue.

What are tax pools?

In Canada, all businesses can deduct capital costs from their total income to calculate their taxable income. In the energy industry, tax deductions or credits are generated when companies spend capital on tangible and intangible assets. Tangible assets, such as above ground or recoverable underground equipment, can be deducted over time, limited by capital cost allowances for specific categories. Unused balances can be deducted in future years.

Intangible capital expenses fall under four categories: Canadian Oil and Gas Property Expenses (“COGPE”), Canadian Development Expenses (“CDE”), Canadian Exploration Expenses (“CEE”), and Eligible Capital Expenditures (“ECE”). These expenses relate to acquiring properties or conducting activities leading to the exploitation of resources. Each category has a different deductible limit and is calculated on a declining balance. CEE, for example, is 100% deductible, while CDE is 30% deductible on a declining balance. Unused balances can also be carried forward and used in future tax years.

Most tax deductions generated in the Western Canadian Sedimentary Basin are from drilling, facility, and pipeline construction expenses. Tax pools are generated when a company does not use all its deductions in a tax year. These unused deductions are carried forward to a future tax year to reduce a company’s taxable income, often completely offsetting a company’s tax bill.

Under Canada’s Successor Corporation rules, tax pools can be transferred when all or substantially all resource properties are transferred to an acquirer. Tax Pools are often discussed in MD&A reports, but not every public company files them as it isn’t a requirement. As with most proprietary financial filings, private companies are a black box regarding tax pools unless they choose to disclose. Disclosure, when given, often includes the total only, without category breakdowns.

The Perfect Storm

In 2020 amid the COVID-19 pandemic, oil and gas companies held a record 316 billion dollars in debt.

To read the full whitepaper on how tax pools are a timely consideration in merger and acquisitions, including tangible strategies and real-world examples, download XI Technologies Whitepaper: The Tax Man Cometh – How Strategic Acquisitions Can Help Your Issue.

If you’d like to learn more about how XI’s AssetSuite software can analyze companies, packages, or regions throughout Western Canada, visit our website or contact XI Technologiesor join us for our upcoming webinars:

AssetBook 101

When: Tuesday, October 3

Time: 10:00 a.m. MT

Where: Zoom – Register here

Estimating ARO

When: Thursday, October 19

Time: 10:00 a.m. MT

Where: Zoom – Register here