Word to the Wise: Why ARO Reporting Has Become Too Big for Spreadsheets

September 5, 2023

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

“Why would I buy software to manage my ARO when I have a spreadsheet for that?”

We hear things like this a lot. And at first glance, it’s easy to understand why. Spreadsheets are easy-to-use, highly customizable, and come at no additional cost to most companies.

However, as end-of-life closure activities and obligations continue to balloon in importance and complexity, managing an Asset Retirement Obligations (ARO) program through spreadsheets comes at a hidden cost. The initial benefits of spreadsheets – flexibility, familiarity, and affordability – can’t overcome the challenges posed by utilizing a tool never made for this job.

Excel Wizards out there can create remarkable spreadsheets custom-tailored to meet their personal needs. The issue is that spreadsheets are designed to meet the needs of their creator and are not meant to be mission-critical applications used across multiple departments of a company. If a company intends to share these spreadsheets interdepartmentally, how do they then track changes for audit purposes? Do they know when a formula gets corrupted or broken? When does the sheet stop functioning as one person’s personal tracking system to a full corporate-wide report? More importantly, which version is updated and adjusted to meet changing regulations?

We frequently hear horror stories from companies who have outgrown their spreadsheets, for example:

- “Things got too complicated” – Simple worksheets originally built to manage at-the-time basic End of Life reporting needs grew into difficult, overblown monsters of dozens of tabs, and fragile nested formulas. Merged and acquired companies became impossible to fit into the legacy structure and had to be managed independently.

- “We had to call in IT” – As file sizes bloated, spreadsheets became more difficult to load, slow to respond, and more prone to crashes.

- “I lost my wizard” – Reliance on a single ARO Excel expert meant that when our Excel expert moved on from their role, we had to start from scratch getting someone else up to speed.

- “We wasted so much time on errors” – From simple data entry errors to broken formulas, we constantly had to do things over because something in the worksheet broke. Finding the formula break was always a long and painful process.

- “I’m always being asked for reports” – We usually sigh with relief when the task of year-end ARO reporting is done. But banks, investors, and executives are all insisting on more transparency, reporting, and planning when it comes to end-of-life obligations. This is not easy to do on the fly with our unwieldy spreadsheets.

- “I need a better audit trail” – Managing critical data within spreadsheets means not having an automated log of who made what changes to reports. Anyone who has access to the document can make changes without anyone else knowing.

- “Updating is so manual” – Every quarter the data needs to be refreshed with all changes to the licenses. Pulling this data is complex and time-consuming.

Not only do we think that moving from spreadsheets is important for ARO tracking and reporting, but other applications can benefit from this move as well. Read this Yogi Schulz article: “Engineers are World Leaders in Misusing Excel.”

When you factor in the time spent managing any of the issues noted above, spreadsheets start to become a lot less cost-effective than they initially appear. Companies need a more standardized approach that can be easily used to track, share, and report from by anyone throughout the organization. There is significant efficiency from a fully auditable, user-protected, trackable, and cloud-based solution.

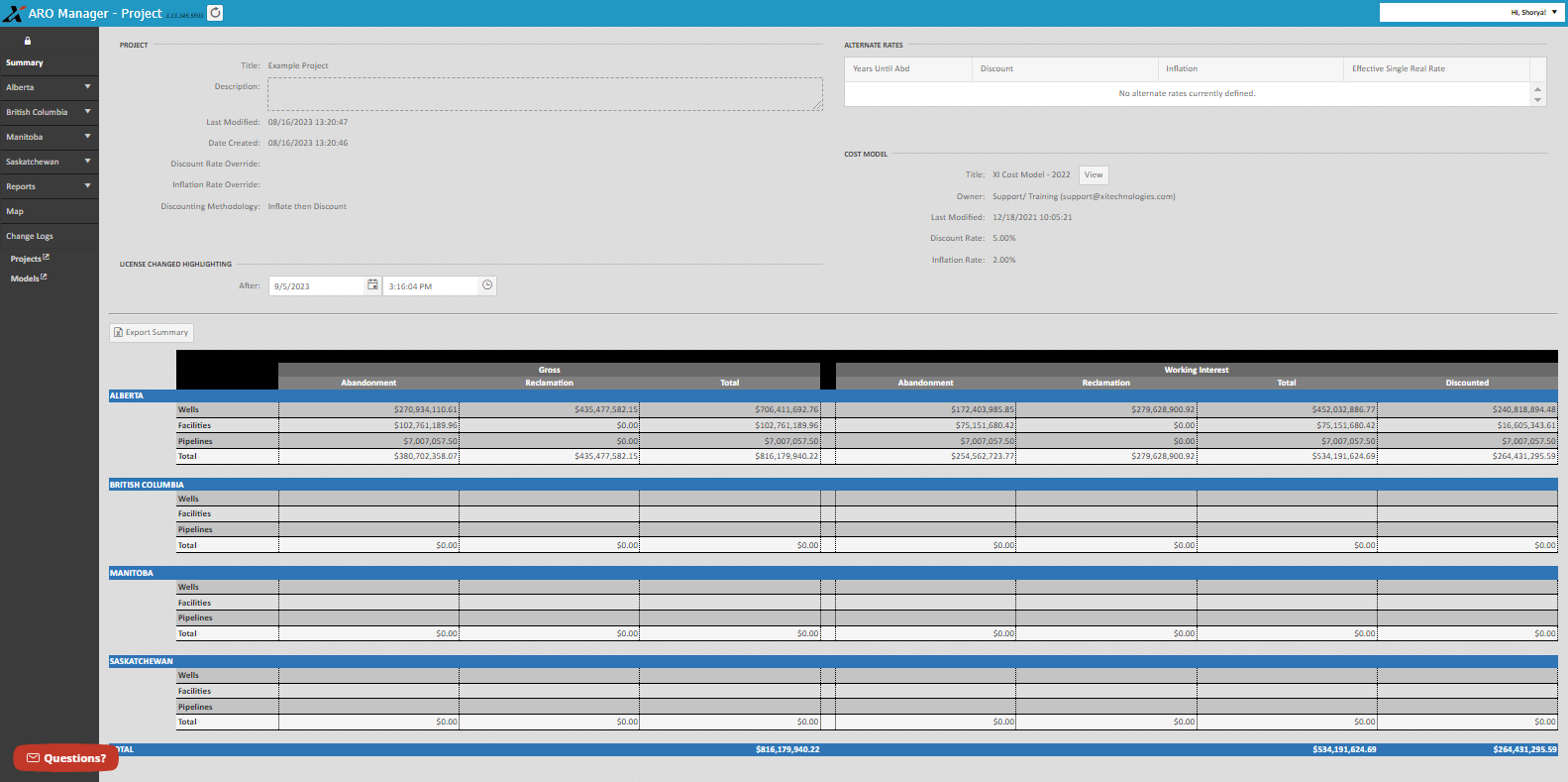

Moving away from spreadsheets to a software tool like AssetBook ARO Manager alleviates many of these problems. ARO Manager was purpose-built for the oil and gas industry, developed through a culmination of government resources, expert opinion, and industry data.

ARO Manager directly addresses the problems with spreadsheets by providing:

- Web-based platform that requires no IT intervention or database management.

- Simplified ARO processes – users get exactly the columns and data they need without having to be a spreadsheet wizard.

- Shared experience across departments, with everyone working from the same live file with real-time information for analysis and decision-making.

- Enhanced scenario analysis – easily substitute cost models, adjust inflation or discount rates, apply discounts for ABC programs, and more.

- Routine software updates to meet changing needs and regulations – eliminating the need for an Excel wizard to build new functionality into a spreadsheet.

- SOC compliant process that tracks all changes to satisfy auditors.

Join us for our webinar on “The Fundamentals of ARO Manager for Financial Tracking and Reporting” on September 14, 2023.

When: September 14, 2023

Time: 9:00-10:00 am MT

Where: Zoom. Register here