Word to the Wise: Why “more data” is key to managing company liabilities

July 25, 2023

Each week, XI Technologies uncovers trends and insights using our enhanced data and software focused on the WCSB. If you’d like Word to the Wise delivered directly to your inbox, subscribe here.

Oil & gas companies are renowned for using large amounts of data in their search for treasures below the surface. So why is liability tracking not receiving the same data-driven attention?

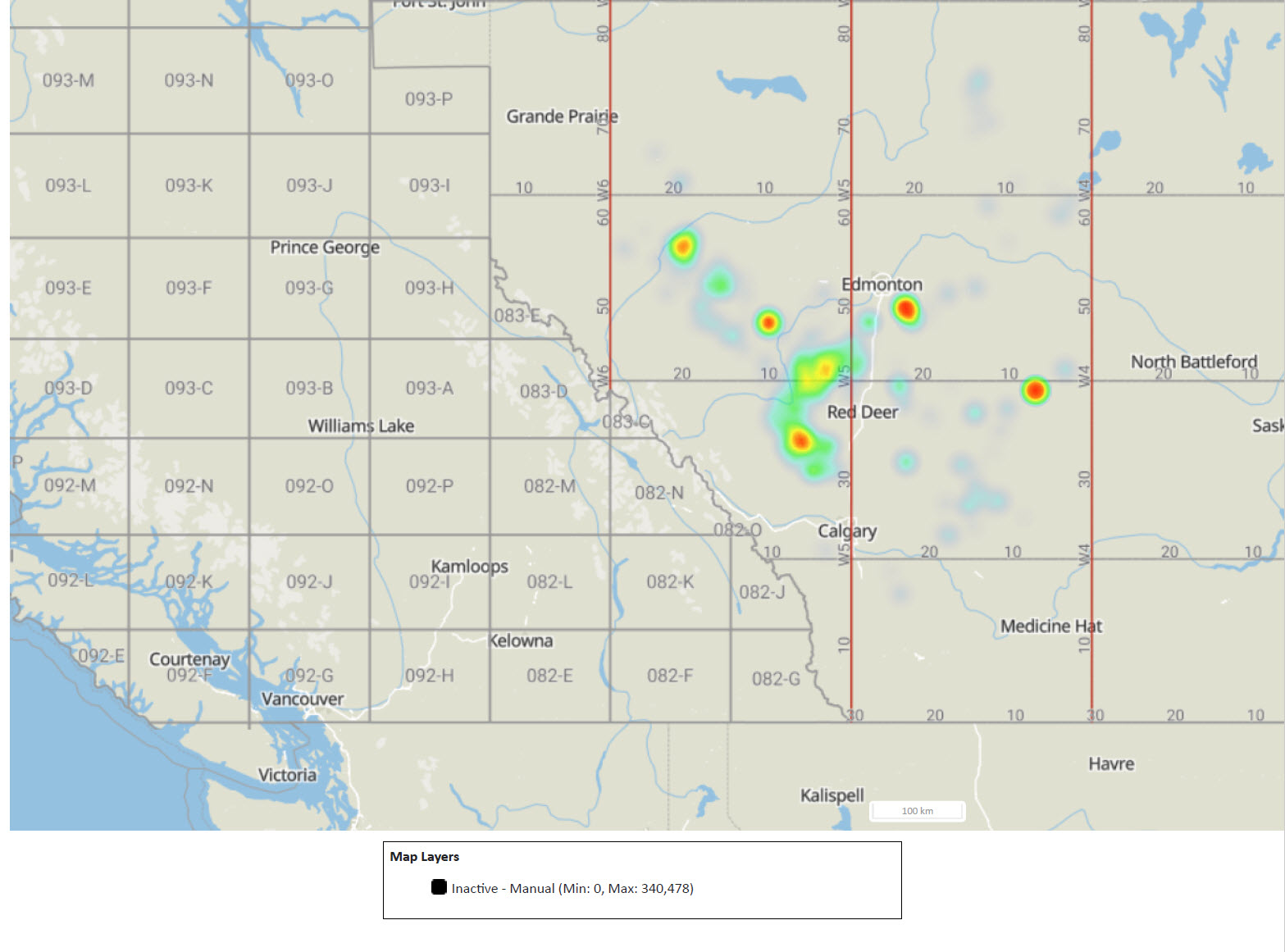

This became apparent in early 2020 when the federal and provincial governments announced available funding to encourage and accelerate site abandonment and reclamation work (as well as to get O&G specialists back to work). The program targeted over 137,000 inactive wells. Some of the 800+ companies who had inactive wells on that list scrambled to pull together the information that they had, with many receiving funding, but others were unable to take advantage of the opportunity as their data was too disparate, inaccurate, or sparse to qualify.

While the practice of gathering, normalizing, and analyzing data is slowly being applied in this new area, we regularly hear about the inability to pull together and maintain the information required to calculate those liability costs.

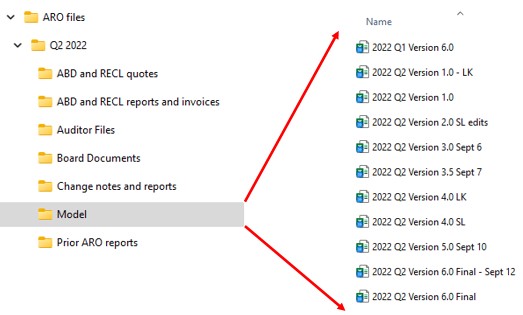

There are multiple sources for data on asset status and liabilities; some are publicly available such as LLR (used predominately by Operations groups), or Petrinex (used by Production Accounting), or the Inactive Well List (used within the Operations Team), while others are proprietary such as working interests (stored in the land system), lists of non-operated assets (tracked partially by the land team), or multiple ARO cost models (used by Finance departments for financial reporting). Each of these data points comes in its own format, is updated for different purposes, and in different time frames. Added to the challenge is that internal information is often maintained by different departments, resulting in numerous versions. Bringing together that information effectively takes a concerted amount of cooperation and effort on the part of multiple departments within a company.

Access to data is one thing – being sure everyone from Finance to Business Development, Operations, and Environmental teams wants quick and easy access to reliable data to inform their part of asset management. need to feel confident that they are seeing and using the most accurate data possible for their individual needs. But that highlights the most important issue: what is the assurance that what one team uses contains all the latest information that another team may have worked with, changed, or added? How can they feel confident that they are seeing and using the most accurate data possible for their individual needs?

A simple request can become a time sink for multiple teams. Innocent mistakes cost the company time and money. Moreover, being unable to quickly show transparency to stakeholders can have even more serious impacts down the road.

Having a single source of data that can be easily accessed, updated, or analyzed by any individuals who use the data to fill in their “piece of the puzzle” in the company workflow allows greater efficiencies across the board. Many times, pieces of data such as Directive 13 compliance, Inactive Well status, reported incidents, Site Specific Assessments, or LLR exemptions are only referenced during specific discussions directly involving those pieces of data.

By integrating all pieces of information which might affect a licensee’s liability cost or management into one single source of truth, confidence is restored, and data can be relied upon for making asset management decisions. The decisions are then made based on complete facts rather than partial information.

Above all, by including all relevant information within the single source, decisions can focus on working towards finding “the biggest bang for the buck,” easily including all factors involved.

ARO Manager is the only standardized tool for estimating and monitoring asset retirement obligations in Western Canada’s oil and gas sector. Learn how implementing AssetBook ARO Manager helped Operations, Finance, Business Development and Environmental teams’ function more efficiently by reading our case study on Bridging the Gap.

Discover how XI’s ARO Manager can help with the planning and reporting of liability management. Visit XI’s website or contact XI for a demo.