Word to The Wise: Expiring Lands vs Drilling Activity

February 21, 2023

XI Technologies: Expiring Land vs Drilling Activity

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Word to the Wise in your inbox, subscribe here.

Last week in our Word to The Wise Expiring Land Report, we took a deeper dive into the expiring lands and bonuses for the next twelve months.

By breaking down and assessing the potential value of the expiring lands to the complete company profile and the dollars per hectare ($/ha) value of those lands to each company, we can start to spot unique opportunities.

There are many reasons a company may have large blocks or high-value blocks of land expiring. The company may face capital constraints, or its focus may have switched to another play or region. The company may have these lands in drilling inventory but need access to the services required to drill. When looking for opportunities, following big-picture land and drilling trends can often provide patterns or insights worth further investigation.

What regions are more active than others? Where is drilling currently focused compared to any upcoming expiring land?

By overlapping the land expiring in the next twelve months with wells drilled in the past twelve months, we can see apparent clusters by region.

Figure 1 – Blocks of expiring land (green) and wells drilled (red) in Alberta

There are large blocks of expiring land in the Ft. McMurray region (Fig.1). The province’s southeastern portion has small blocks of land and clusters of recent drilling activity. The most significant overlap of expiring land and drilling activity is through the central part of Alberta and up into the Grande Prairie region.

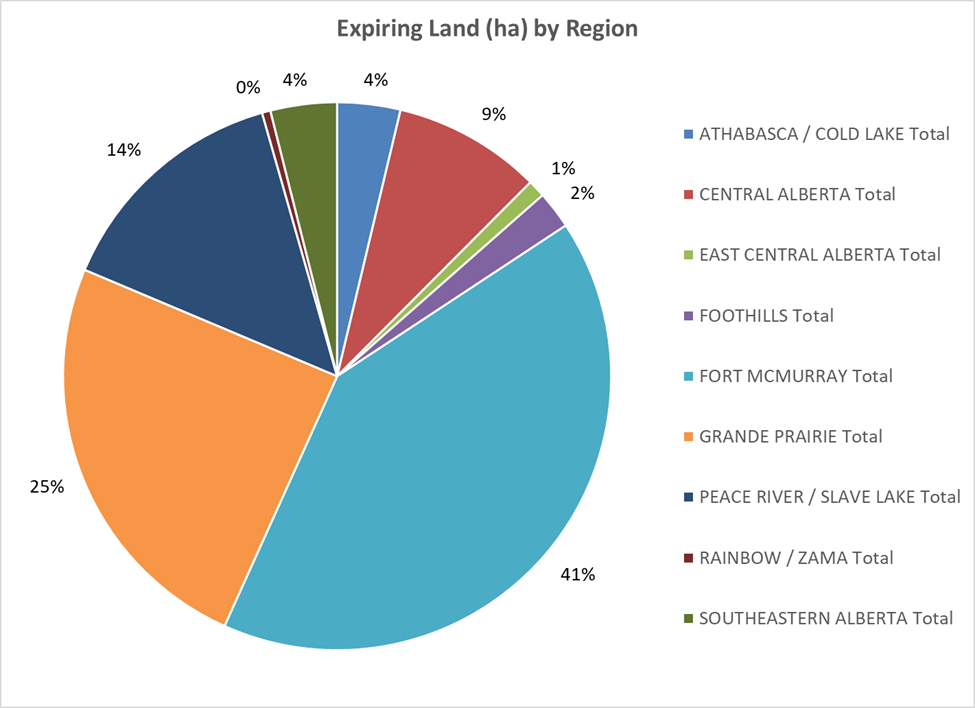

Last week we noted that from a total percentage expiring, the 3,077,198 hectares represents 10% of Alberta’s total 30.2 million crown hectares. The chart below breaks this total down by provincial region.

Figure 2 – Expiring Land in hectares (ha) by region

The Ft. McMurray, Grande Prairie, and Peace River regions collectively represent 80% of the expiring crown land in the province.

In the past twelve months, there have been close to 7,150 wells spud in Alberta. By breaking these down regionally, we can see that the most activity has been in the Athabasca/Cold Lake regions.

Figure 3- Total wells spud by region

42% of wells spud in Alberta in the past twelve months were in the Athabasca/Cold Lake regions.

The current month’s production on record (December 2022) from these wells is ~520,000 boe/d and is 43% oil. We can see a different trend emerging by breaking down production by region. While most activity was in the Athabasca/Cold Lake regions, it represents a small percentage (3%) of the total production. The most significant production addition came from the regions of Grande Prairie (37%) and Central Alberta (22%). Collectively these regions only represented 17% of the total wells, yet represents close to 60% of the current new production.

Figure 4 – Total new production by region

These numbers represent only a snapshot in time.

The total values themselves are not always indicative of the opportunity or success in these regions. For example, wells may have been drilled recently and still need to be completed or put on production. In addition, wells spud may be drainage wells, so they only contribute to the total well count but not production volumes.

Based on current production, the most impactful drilling additions in Alberta in the past twelve months have been in the Central Alberta and Grande Prairie regions.

Circling the activity and additions by region back around to the upcoming land expiries, by looking at the total expiring bonuses by region, we can see large collective bonuses expiring in the Ft. McMurray and Grande Prairie regions representing 81% of the total.

Figure 5 – Expiring bonuses by region

There is significant value in upcoming expiring bonuses in the Ft. McMurray and Grande Prairie regions.

Reviewing specific metrics in context to others, you can start to balance out activity and opportunity. Whether a company is active in an area and looking to grow its footprint or for entry into a new area or region, digging deeper into the trends can help spot opportunities. For example, what companies are in these areas, and who might be motivated to transact on high value expiring land? What plays are of greatest interest, and will there be available land soon?

By layering these four metrics together, are there anomalies that stand out? Opportunities?

What trends can be observed? How does this information correlate to the company’s strategy?

To learn more about this expiring land report, contact us here.

AssetBook allows you to search for expiring lands by province, by company, or by any geographic area. The results can be viewed in tabular format or displayed on a map to help with visualization. To learn more about how the data in AssetBook can help your company, contact XI Technologies.