Word to the Wise: M&A Snapshot – Strathcona Resources Ltd. and Serafina Energy Ltd.

September 13, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Word to the Wise in your inbox, subscribe here.

Early in August, it was announced that private equity owned Strathcona Resources Ltd (“Strathcona”) was purchasing privately owned Serafina Energy Ltd. (“Serafina”) for C2.3 billion. Little has been reported on this acquisition other than the quality of the Serafina Assets. The deal closed on August 29, 2022.

What do the companies look like prior to completing the agreement? What do we know about each company’s assets, core areas, and recent activity? How might this combination affect others in the area? We’ve looked at both companies through a few different lenses using our AssetSuite software tools to allow you to compare the companies and gain some insight of your own.

Core Areas

This is an expansion into Strathcona’s Lloydminster heavy oil play. Strathcona covers all of the Western Canadian Sedimentary basin but is focused in Lloydminster and North Battleford heavy oil region and the Montney play in both Alberta and NE British Columbia. Serafina on the other hand is 100% concentrated in heavy oil above North Battleford Saskatchewan.

Click here to download the Company report from AssetBook.

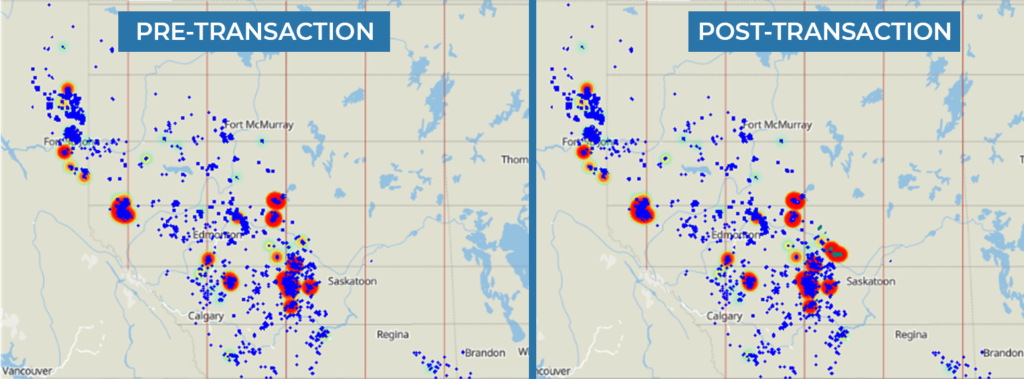

Looking at a production heat map of Strathcona pre and post transaction, you can see that this new Serafina significantly augments their northeast Saskatchewan assets.

If you investigate Serafina’s core area, it becomes apparent that Cenovus Energy Inc. is the dominant player with almost 16% of its production falling into this area and owning about 70% of the entire area. Serafina is a distant second with 100% of their company making up 20% of the production of the area.

Using XI’s LCA (Licensee Capability Assessment) report we can gain some insight into the operational history of licensees in the area. For instance, Serafina’s production has increased approximately 58% over the past 3 years, providing an indication of growth from this deal. As well, companies in this area hold on average 62% of their production from marginal wells (wells producing less than 10 boe/day), but Serafina’s marginal well license rate is only 1.18%, indicating that these assets come with very few near term liabilities, as reflected in the inactive well discussion below.

Click here to download the LCA report from AssetBook.

ESG Snapshot

As both companies are privately owned, any ESG reporting is likely only shared between investors, lenders, regulators, and other private stakeholders. Since there is no public ESG reporting, we are relying 100% on our Emissions Report to ascertain a high-level look at the scope 1 emissions impact of the deal.

Considering the nature of Serafina’s operations, it’s no surprise that their heavy oil thermal facility assets have high emissions from stationary combustion (fuel) use during the thermal recovery process. According to our Emissions Report, a high-level estimated corporate intensity is in the 0.07 range, with ~660K+ tonnes CO2 equivalent (trailing 12-month total) coming from fuel use. Associated flaring is minimal and makes up only 1% of their emissions portfolio.

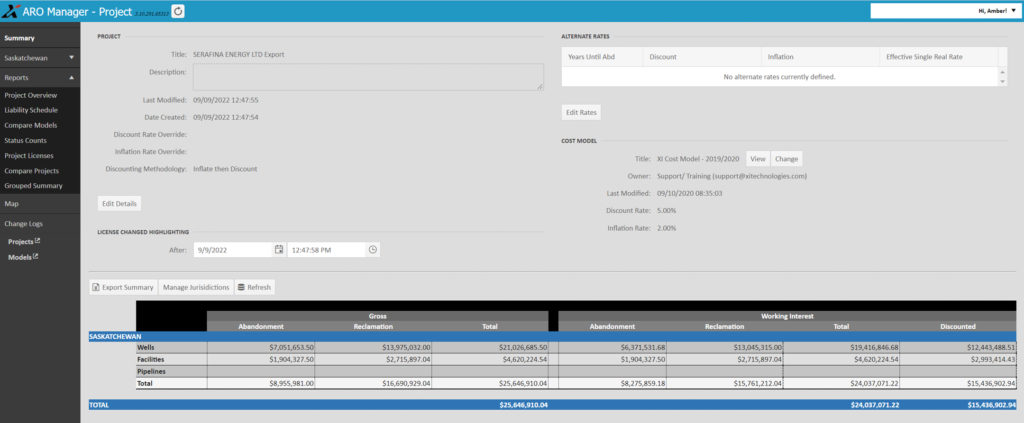

Serafina’s operated assets (using the Government LLR Cost Model values) have a liability of approximately $14 million and using AssetBook’s ARO module, a discounted net liability of approximately $15 million (excluding pipelines), with only an estimated $655,000 of which is from inactive wells.

Click here to download an ARO report from AssetBook.

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, including examining potential liabilities and emissions, contact XI Technologies. You can also attend our upcoming info session on Emissions Scoping for A&D on September 29th by registering through this link.