Word to the Wise: Provost area overview

July 19, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like Wednesday Word to the Wise delivered directly to your inbox, subscribe here.

This week for our area overview, we’re covering one of Canada’s largest, historic conventional gas fields, the Provost. Discovered in 1946 and located in east-central Alberta, this once predominantly gas field is now producing 78% of its production as oil wells (largely horizontal drilled oil wells).

This long-standing field makes up a substantial chunk of several well-known companies’ production portfolios. Today, we’ll draw on XI Technologies’ enriched industry data to update a few perspectives as to what’s continuing in the Provost (for info on the area from a drilling perspective, read our post from last week).

Note: for the purposes of this article, we define the Provost field using the boundaries defined by the AER. This may differ from other internal company definitions.

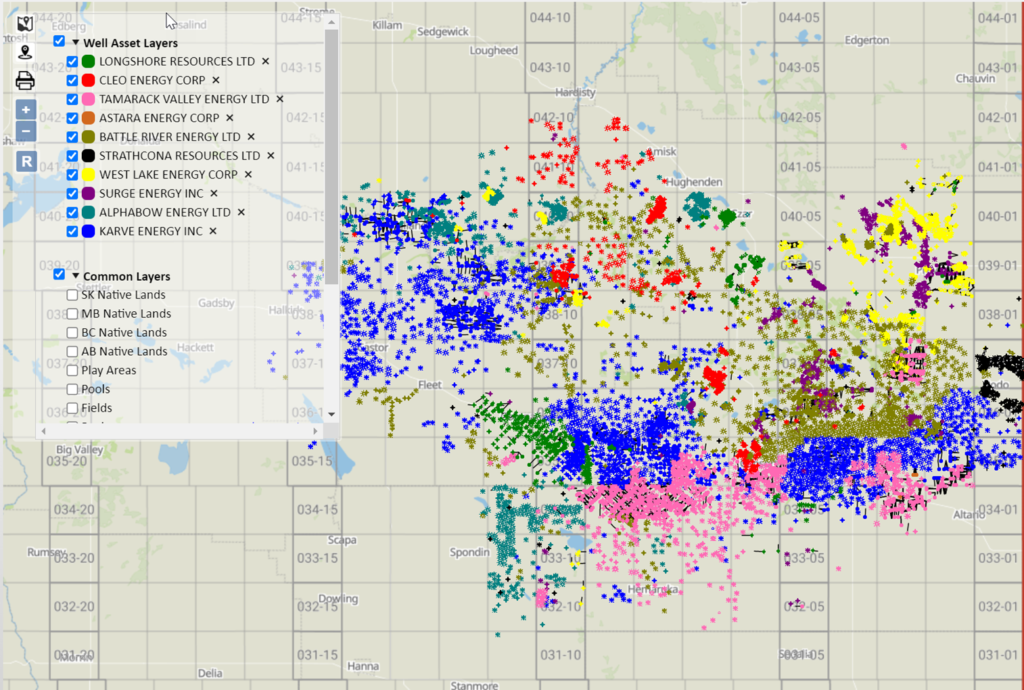

Ownership in Provost Assets

There are twenty-nine (29) companies with 50% or more of their production coming from the Provost. Seven (7) companies own 85% of Provost assets, but there are 75 companies that are active in this area.

Click here to download a report of all companies in the Provost.

Provost zones

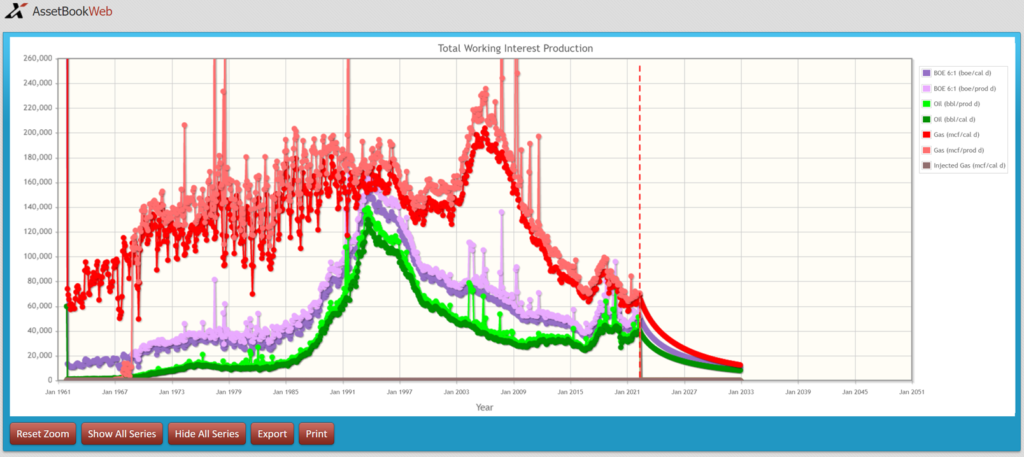

Heavy government comingling in the east central Alberta corridor has meant that it is hard to parse out the zones of this production. However, pulling further at the data you can see that the Viking and Sparky make up more than 51% of the field’s production. A graph of the production over time shows how the field has turned from predominately gas to oil in recent years.

Production history of Provost assets

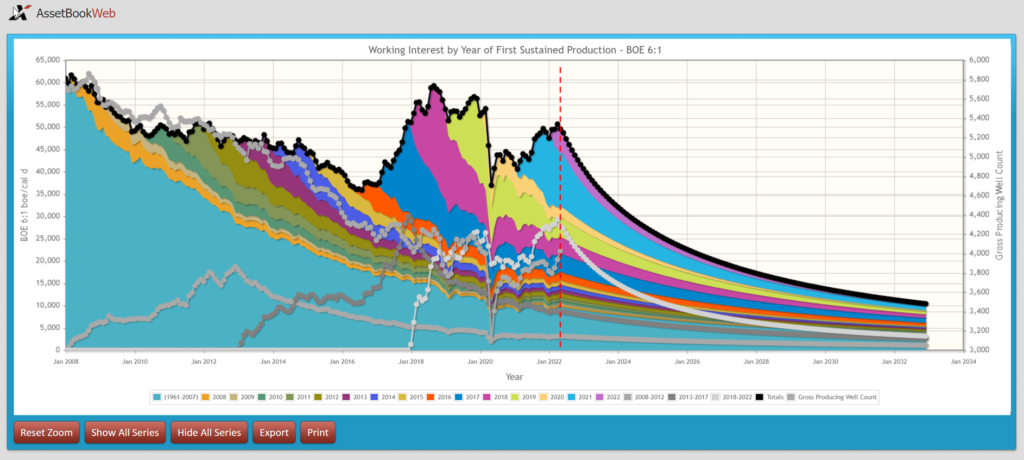

Let’s investigate the Provost field a little further. Looking at the vintage of this production, while there is a good chunk of production coming from pre-2007 wells, it is apparent that this area has had a renaissance in the past few years with a large increase in production from 2021. This area was also very sensitive to the oil crash that happened in May of 2020 as can be seen on the graph below.

Liabilities in the Provost

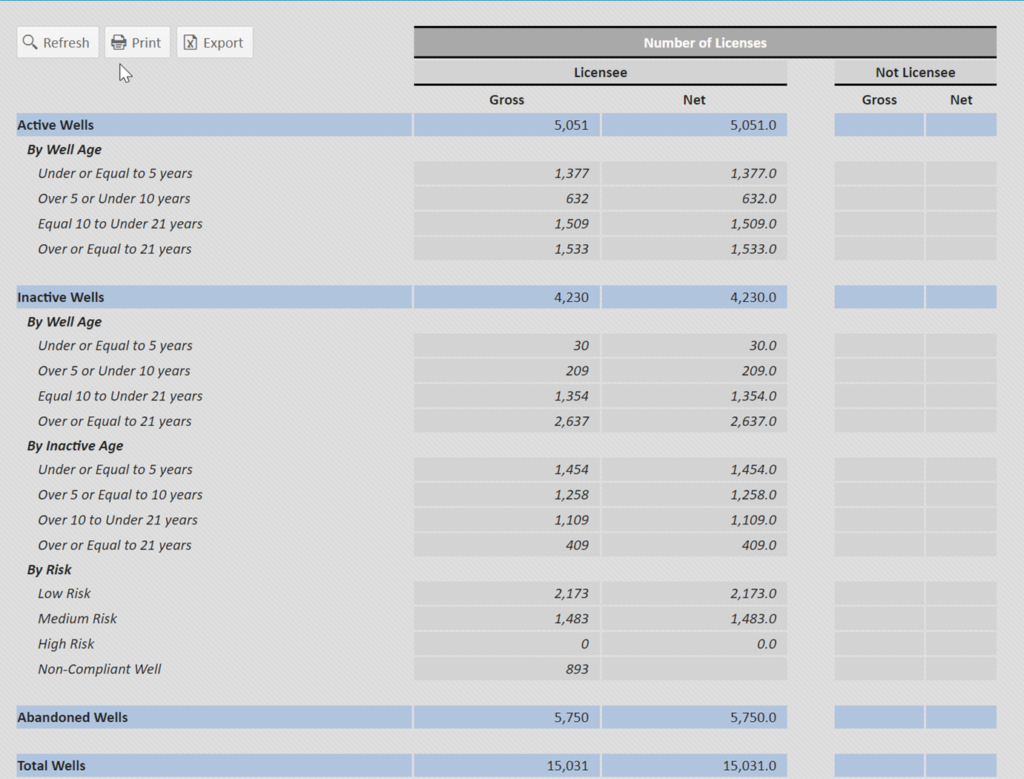

Because this area is older and now unconventional, the ARO obligations become extremely important. If companies are hoping to acquire rich and long-lived Provost assets, it is essential to look at liabilities among various acquisition opportunities to determine differences in future obligations.

Being one of the oldest fields in Alberta, it’s no surprise there are a significant number of inactive wells in the Provost, particularly ones over 21 years in age. There is over $289 million of liability on inactive wells in the Provost or 2637 total inactive wells identified by the government.

Note: Liability costs are based on XI’s ARO cost model.

Click here to download an ARO report on the Provost.

Emissions in the Provost

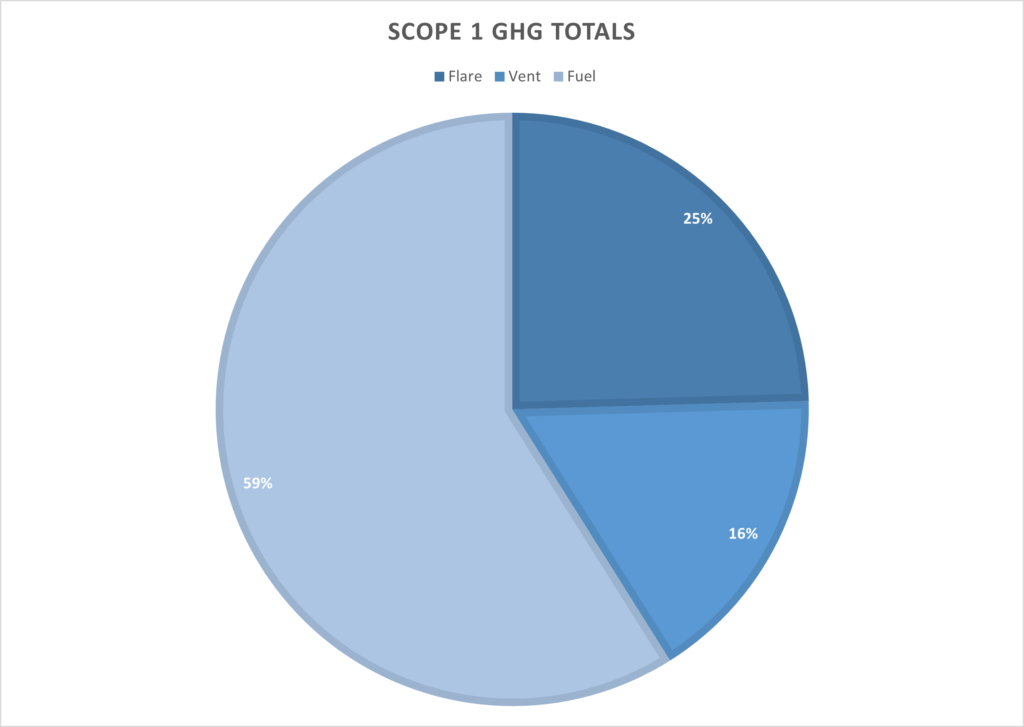

A high-level snapshot of Scope 1 GHG Emissions from the AssetBook Emissions Report for the total field shows the last 12 months have produced ~500K tonnes CO2e from roughly 700 reporting facilities. The mature field has an established gas production infrastructure, with an average gas conservation rate of 92%, with roughly 8% of produced gas ending up as emissions. The majority of emissions are from stationary combustion (59%) and flaring (25%), with ~16% of emissions coming from venting.

Note: An earlier version of this article posted incorrect data in the emissions section. We apologize for this error.

If you’d like to learn more about how XI’s AssetSuite software can analyze companies, packages, or regions throughout Western Canada, visit our website or contact XI Technologies. If you’d like more information on how to take an over-the-fence look at emissions when evaluating opportunities, register for our upcoming XI Chat: Emissions scoping for A&D on Thursday, July 21st. Click here for more details.