Word to the Wise: M&A Snapshot – Tamarack Valley Energy Ltd. and Rolling Hills Energy Ltd.

May 3, 2022

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

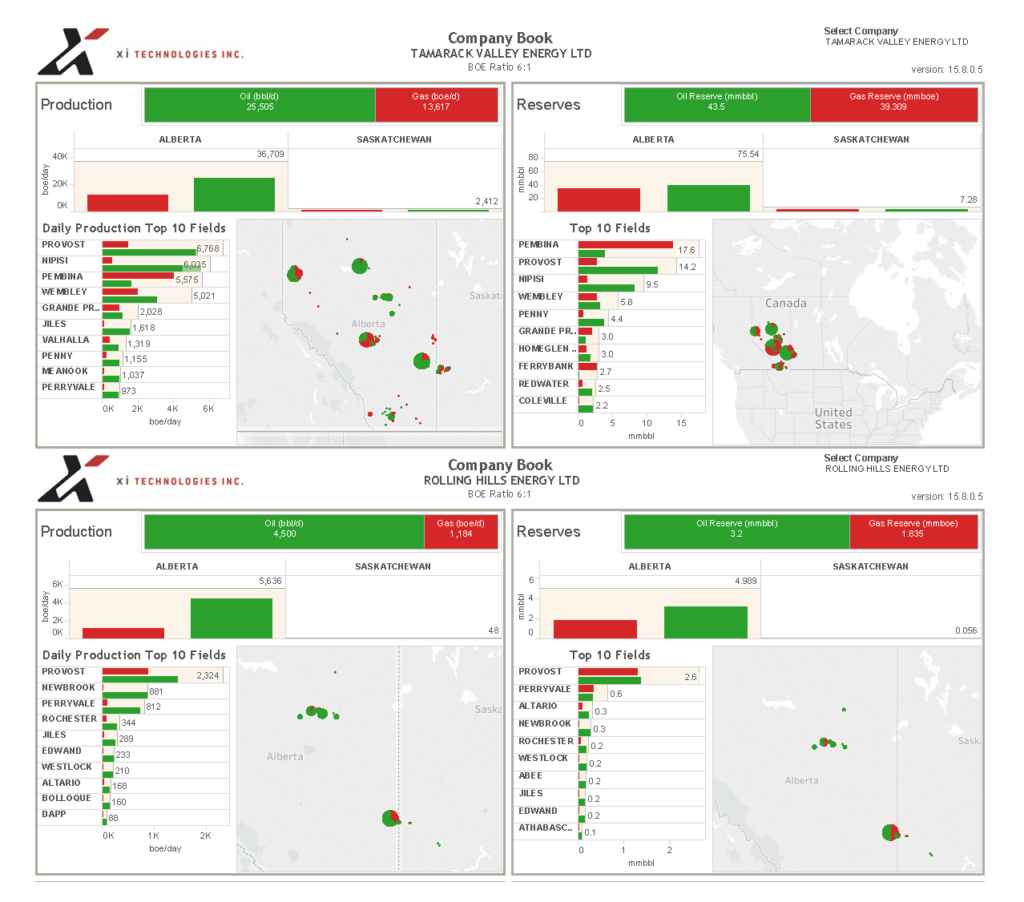

Merger and Acquisitions activity has continued to be active, particularly in strategic premier plays in Alberta. The Clearwater oil in Alberta is one such play and in this article we’ll explore Tamarack Valley Energy Ltd.’s (Tamarack) corporate acquisition of Rolling Hills Energy Ltd. (Rolling Hills), whose assets are clustered in two Clearwater fairways.

What do the companies look like prior to completing the agreement? What do we know about each company’s assets, core areas, and recent activity? How might this combination affect others in the area? We’ve looked at both companies through a few different lenses using our AssetSuite software tools to allow you to compare the companies and gain some insight of your own.

Click here to download a pdf report of the above data.

Core Areas

This Tamarack Valley acquisition was described as a consolidation and expansion of holdings in Clearwater. The acquisition follows two other high profile corporate roll ups, including Crestwynd Exploration (Clearwater), and Anegada Oil Corp (Charlie Lake). Rolling Hills was very concentrated in Provost/Veteran which is one of Tamarack’s core areas. The other synergistic core area is in the Redwater/Perryvale area. Mapping Rolling Hills core assets with Tamarack’s core Clearwater assets, the consolidation makes clear sense.

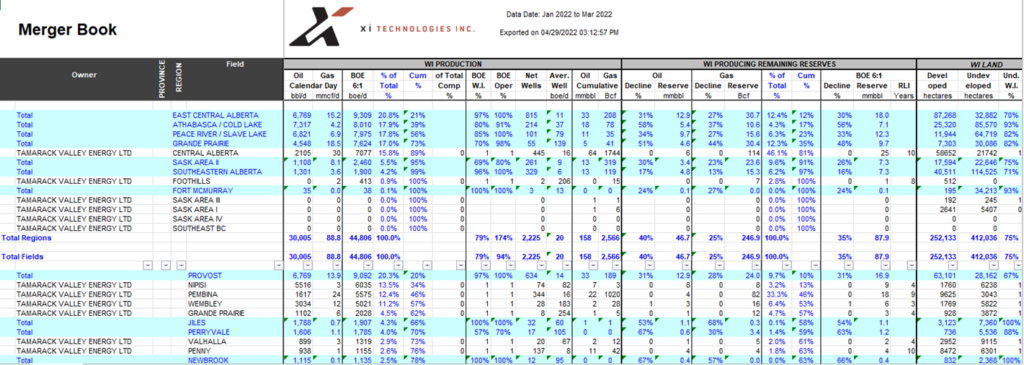

Click here to download the Merger Book report from AssetBook.

Looking at AssetBook’s synergy report that shows what assets companies own in common, we can see that Rolling Hills was second only to Ovintiv for oil production where both companies jointly own the license. Using synergies is an excellent way to find new opportunities as companies will already know the assets and have the infrastructure in place to produce them efficiently.

Click here to download the Synergy report from AssetBook.

Emissions summary

From an ESG perspective, the acquisition press release noted that the acquisition has minimal ARO obligations and limited freshwater requirements. From an emissions standpoint, it noted, “Tamarack expects to realize synergies in gas conservation and other infrastructure, lowering the GHG intensity of the assets, due to the strategic fit of the acquired assets in the Southern Clearwater.”

When taking a high-level over-the-fence look at acquired GHG, and in particular the two core areas of Redwater/Perryvale and Provost (Veteran), the acquired emissions of Rolling Hills are significantly higher in estimated intensity and lower in conservation than Tamarack Valley’s assets in the same areas.

Data from the AssetBook Emissions module tells us that:

- Overall, XI-estimated corporate operated intensity of Rolling Hills is roughly double that of Tamarack Valley.

- Rolling Hills emissions portfolio will add an ~87K tCO2e Scope 1 GHG (trailing 12-month total) to Tamarack Valley.

- For Redwater/Perryvale, Rolling Hills has very low conservation (approaching zero, with almost all of the gas being vented, flared, or used as fuel). Tamarack assets in the same area have an approximate conservation of 21% (including fuel use). Vent to flare ratios differ too, with Rolling Hills venting roughly 1.5x more than flaring, vs Tamarack Valley’s 0.4.

- In the Provost/Veteran area, both companies have significant conservation rates, both in the 93% range.

- High-level look at the GHG scope 1 emission suggests mitigating strategies focused on the highest venting Rolling Hills facilities can lower the entire corporate emissions portfolio significantly, up to an estimated quarter of emissions.

Tamarack Valley has a proven track record and innovative strategies to mitigate higher emissions, with recent actions including implementing flaring and incineration at higher venting properties and investing in gas conservation infrastructure. It’s clear that when looking at target acquisitions, both emissions scenarios and proforma analysis play a significant role in their M&A research, and mitigating strategies are considered a priority to align with Tamarack Valley’s corporate ESG goals.

If you’d like to learn more about how XI’s AssetSuite software can analyze potential mergers and acquisitions, including examining potential liabilities and emissions, contact XI Technologies.